Revocation Living Trust With A Beneficiary

Description

How to fill out Virginia Revocation Of Living Trust?

- If you are an existing user, log in to your account on the US Legal Forms website and access the necessary form template by clicking the Download button. Confirm that your subscription is valid; otherwise, renew it.

- For first-time users, start by reviewing the available templates in Preview mode. Make sure to select a form that aligns with your needs and adheres to local jurisdiction regulations.

- If you need a different template, utilize the search feature at the top of the page to find the appropriate document tailored to your requirements.

- Once you have selected the correct document, click the Buy Now button and choose your desired subscription plan. Create an account to access US Legal Forms' extensive library.

- Proceed to complete your purchase using either a credit card or your PayPal account to finalize your subscription.

- Download your document to your device. You can manage and retrieve it anytime from the My Forms section of your user profile.

Utilizing US Legal Forms not only grants access to an extensive collection of legal documents but also allows you to benefit from expert guidance, ensuring your trust is legally sound.

Don't wait; start your estate planning today by accessing US Legal Forms and ensure your legal documents are both efficient and effective.

Form popularity

FAQ

To revoke a revocable living trust with a beneficiary, you need to follow a few straightforward steps. First, you must create a formal document that states your intent to revoke the trust. Next, gather all original copies of the trust documents and any related amendments. Finally, you should destroy those documents or clearly mark them as revoked, ensuring that your intention is clear for all parties involved.

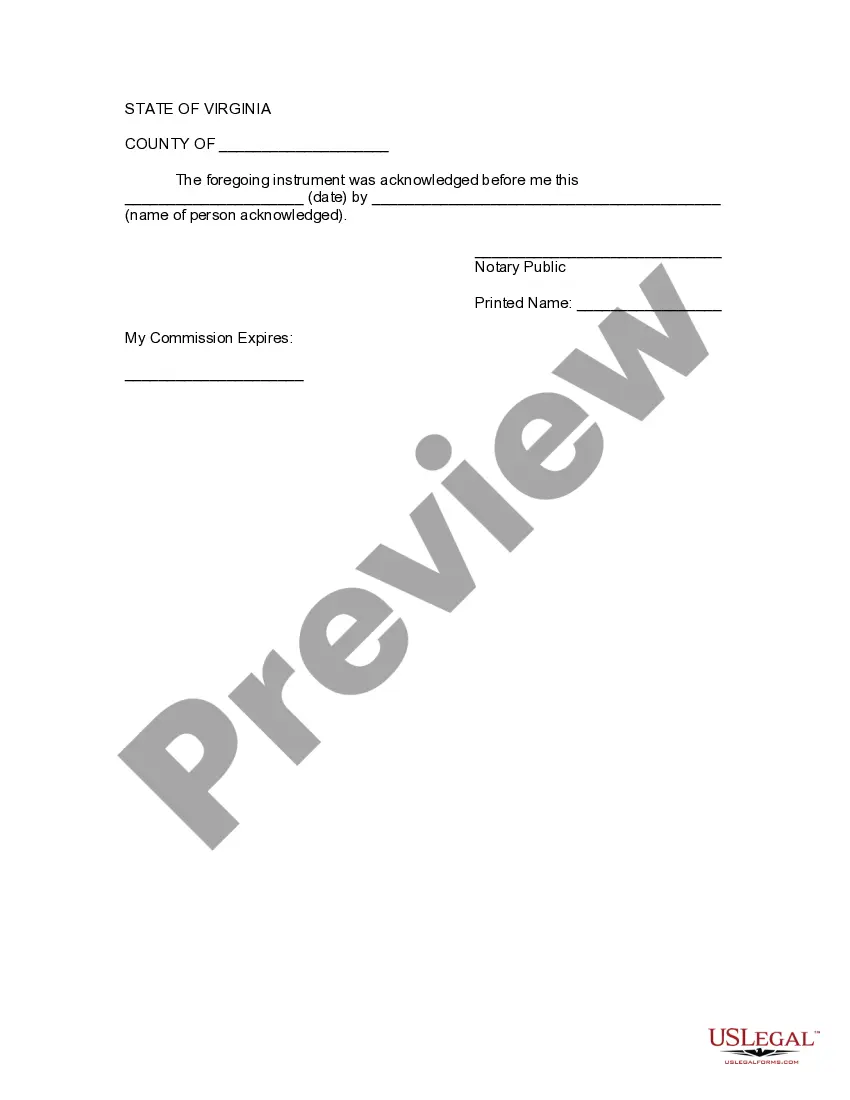

A sample revocation of a living trust is often a brief document stating the trust's name, the grantor's details, and a clear declaration of revocation. The grantor should sign and date this document, and it's advisable to have it witnessed or notarized for extra verification. By creating a revocation living trust with a beneficiary, you help clarify your intentions and make the transition smooth for those involved.

An example of trust revocation occurs when a grantor decides to dissolve an existing trust and redistributes its assets directly to themselves or another account. This decision is typically documented in writing, often in the form of a revocation letter, which clearly states the grantor’s intention. Understanding the process involved in a revocation living trust with a beneficiary is vital to ensure that the changes are legally binding and properly honored.

One of the most significant mistakes parents make is failing to properly designate their beneficiaries. Parents may create a trust but overlook the need for regular updates, especially as family dynamics change over time. This can lead to confusion and unintended consequences regarding asset distribution. It's essential to focus on revocation living trust with a beneficiary to ensure everything aligns with your family's current needs and intentions.

A revocable trust is terminated when the grantor decides to revoke it, indicating a clear intent to dissolve the trust. Often, beneficiaries and trustees need to be notified in writing to ensure proper documentation. Additionally, any assets held in the trust must be redistributed according to the grantor's wishes or transferred into their name. Consider using resources like USLegalForms to navigate the revocation living trust with a beneficiary effectively.

A revocation of living trust is the process of canceling a living trust, rendering it void. This action allows you to reclaim your assets and reallocate them as you see fit. When you execute a revocation living trust with a beneficiary, it is essential to follow legal procedures to ensure your intentions are legally binding. For guidance, US Legal Forms offers resources to assist you in this process effectively.

A living trust with a beneficiary does not override the beneficiary's rights. In fact, a living trust defines how your assets are distributed, including to beneficiaries. However, in some cases, specific provisions in the trust may influence how funds are distributed. It’s crucial to understand the terms of your revocation living trust with a beneficiary to ensure your wishes are honored.

A trust can be considered null and void for several reasons, including lack of capacity of the grantor, improper execution, or impossibility of the trust purpose. If you have a revocation living trust with a beneficiary that does not meet state requirements or is not legally binding, it may be invalid. Administrative oversights can also lead to a trust’s invalidation. To ensure your trust remains valid, resources from US Legal Forms can be invaluable.

Yes, a beneficiary of a trust can often be removed, particularly if the trust is revocable. With a revocation living trust with a beneficiary, the grantor holds the power to change or remove beneficiaries at their discretion. It is important to make these changes in compliance with the trust's original terms and state law. Enlisting help from US Legal Forms can simplify this process by providing necessary documentation.

An example of revocation of a trust can be seen when a grantor decides to dissolve a revocable trust. This may occur if the grantor wishes to create a new trust or change the beneficiaries involved. In cases of a revocation living trust with a beneficiary, the grantor would file a formal revocation document to nullify the existing terms. US Legal Forms provides templates that illustrate this process for clarity and ease.