Notice Assignment Trust With The Following Information

Description

How to fill out Virginia Notice Of Assignment To Living Trust?

- Begin by logging into your US Legal Forms account if you're a returning user. If your subscription is inactive, renew it according to your chosen payment plan to access the forms.

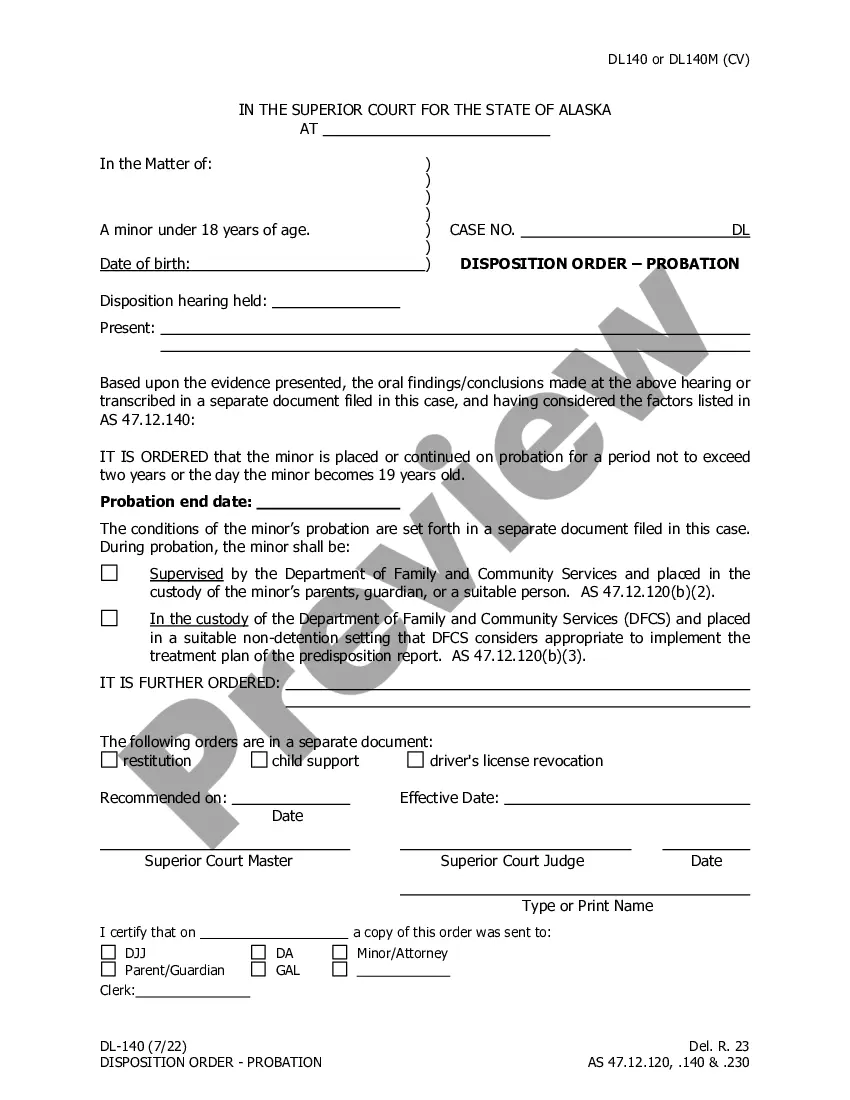

- For new users, start by reviewing the documents in the Preview mode. Confirm that you've selected a form that meets your needs and complies with local jurisdiction requirements.

- If necessary, utilize the Search feature to find alternative templates. Make sure you find the right form before proceeding.

- Proceed to purchase the selected document by clicking on the Buy Now button. Choose a subscription plan that fits your needs.

- Complete the transaction by entering your payment information, either using a credit card or your PayPal account.

- Finally, download the completed form to your device. You can also access it later from the My Forms section in your account.

In conclusion, US Legal Forms equips users with a comprehensive library of over 85,000 legal documents, ensuring you have access to precisely what you need. With a step-by-step approach, creating legally sound forms becomes quick and efficient.

Don’t wait—start streamlining your legal document preparation today with US Legal Forms!

Form popularity

FAQ

To settle an estate with a trust, begin by identifying and gathering the trust assets, then follow the terms outlined in the trust document. It is crucial to communicate with the beneficiaries and keep accurate records of all transactions. You may also consider using services from US Legal Forms to help navigate the complexities of a notice assignment trust and ensure smooth execution.

A key step in the settling of an estate involves gathering all relevant documents, including the will, death certificate, and any trust agreements. This step helps in clarifying the instructions for the distribution of assets. Engaging with platforms like US Legal Forms allows you to efficiently manage the paperwork and understanding required for settling a notice assignment trust.

In Florida, a notice of trust is an official document that informs interested parties about the existence of a trust and its details. This notice helps to clarify the rights and responsibilities of the trustee and the beneficiaries. Implementing a notice assignment trust can streamline the management of property and ensure that relevant parties are aware of their interests.

The 3-year rule for a deceased estate allows the IRS to assess tax liabilities based on the deceased individual’s final income tax return for three years after they pass away. If certain conditions are met, you may have additional time to settle a notice assignment trust or handle other estate matters. Be sure to consult with a tax professional to understand your obligations.

An assignment to a trust refers to the process of transferring ownership of assets into a trust. This legal action enables the trust to hold and manage the assets for the benefit of the beneficiaries. The assignment ensures that the assets are governed by the terms set forth in the trust document, allowing for effective estate planning.

To notify the IRS of a trust termination, you need to file Form 1041, U.S. Income Tax Return for Estates and Trusts. Make sure to report the final income and any distributions made from the trust. It's also important to send a copy of the notice assignment trust if applicable, along with any needed documentation, to confirm the termination of the trust.

The IRS may take action if they suspect non-compliance related to your Notice assignment trust or tax returns. This could happen if returns are not filed, income is underreported, or payments are missed. It’s essential to address all tax obligations promptly. Consultation with a tax advisor can be beneficial in avoiding potential IRS issues.

The trustee of a Notice assignment trust has a duty to provide relevant information to beneficiaries upon request. This includes details about trust assets, income, and distributions. Transparency is vital in maintaining trust and fulfilling fiduciary responsibilities. If there are concerns about the trustee's communication, beneficiaries can seek legal advice.

To submit Form 2848, Power of Attorney and Declaration of Representative, to the IRS, you must complete the form with relevant details regarding the Notice assignment trust. After filling it out, you can mail it directly to the appropriate IRS office or submit it electronically if applicable. Ensure all required signatures are included to avoid delays in processing.

Filling out IRS Form 1041 for a Notice assignment trust starts with entering the trust’s basic information, such as name and identification number. Next, you’ll report income, deductions, and credits that the trust has incurred during the tax year. Follow the instructions provided by the IRS carefully. If you're unsure, using platforms like UsLegalForms can simplify this process.