Living Trust Instructions

Description

How to fill out Virginia Notice Of Assignment To Living Trust?

Locating a primary source for obtaining the most up-to-date and suitable legal documents is part of the challenge of navigating bureaucracy.

Identifying the correct legal papers requires precision and meticulousness, which is why it is vital to obtain samples of Living Trust Instructions only from trustworthy sources, such as US Legal Forms.

Remove the complications that come with your legal documentation. Browse the extensive US Legal Forms catalog to find legal templates, assess their applicability to your situation, and download them instantly.

- Utilize the library navigation or search bar to find your template.

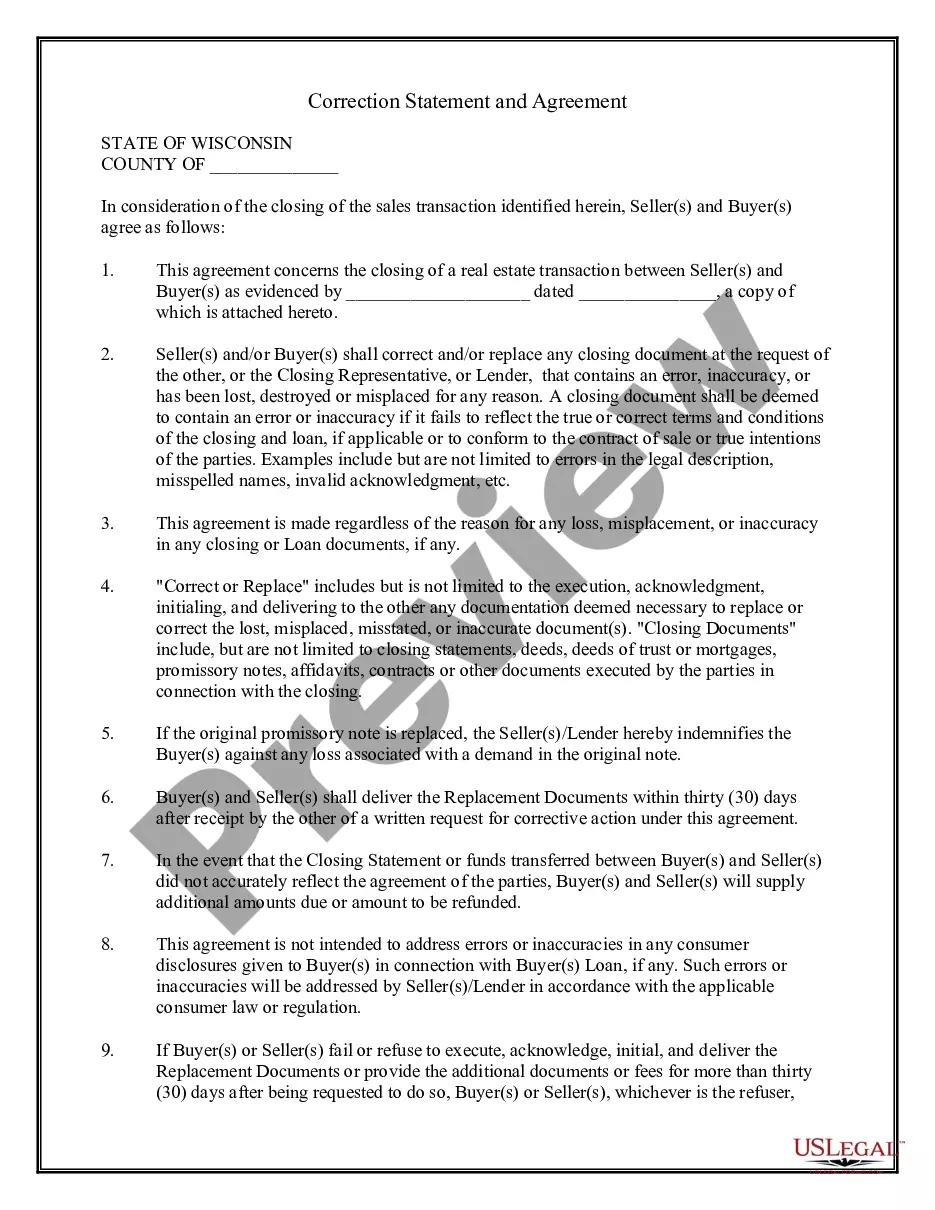

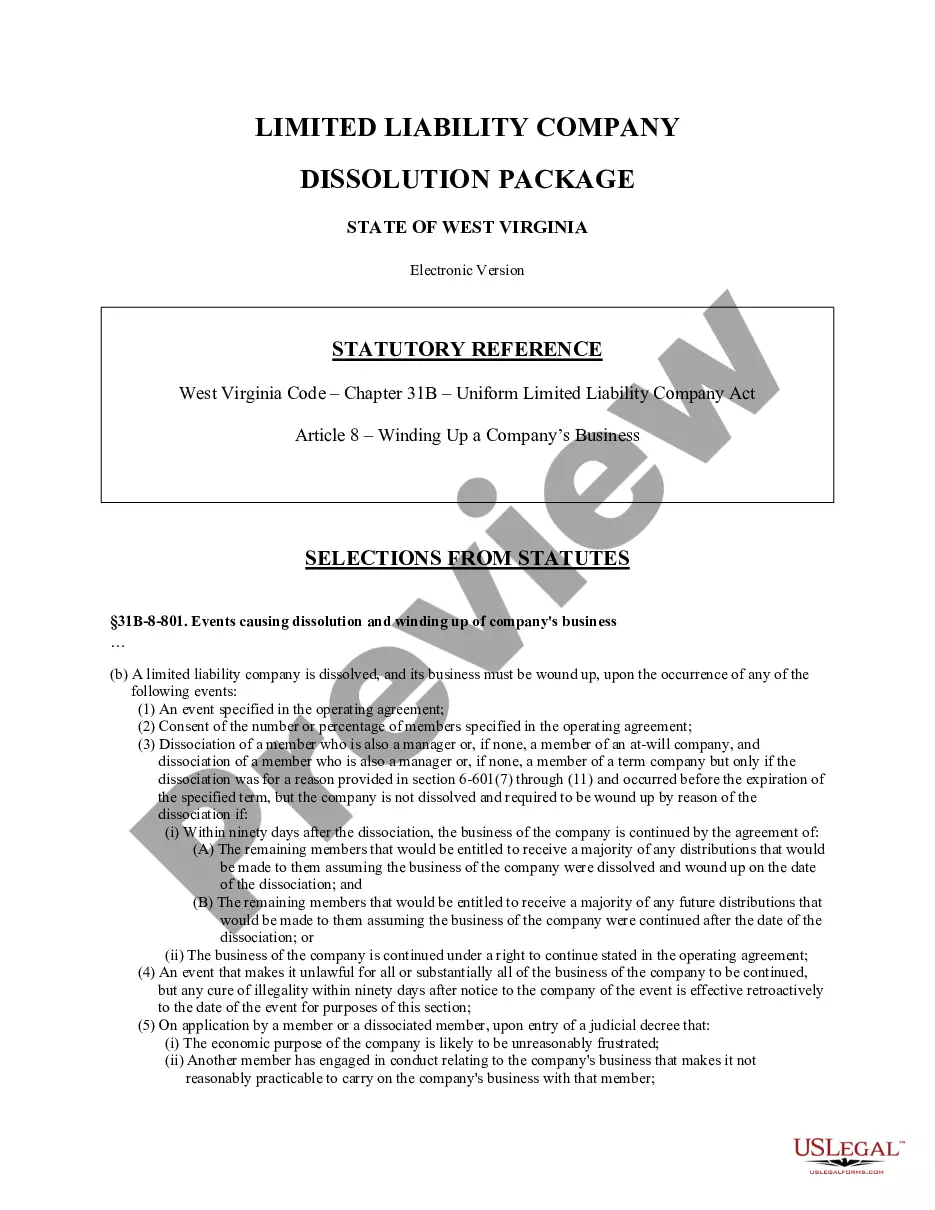

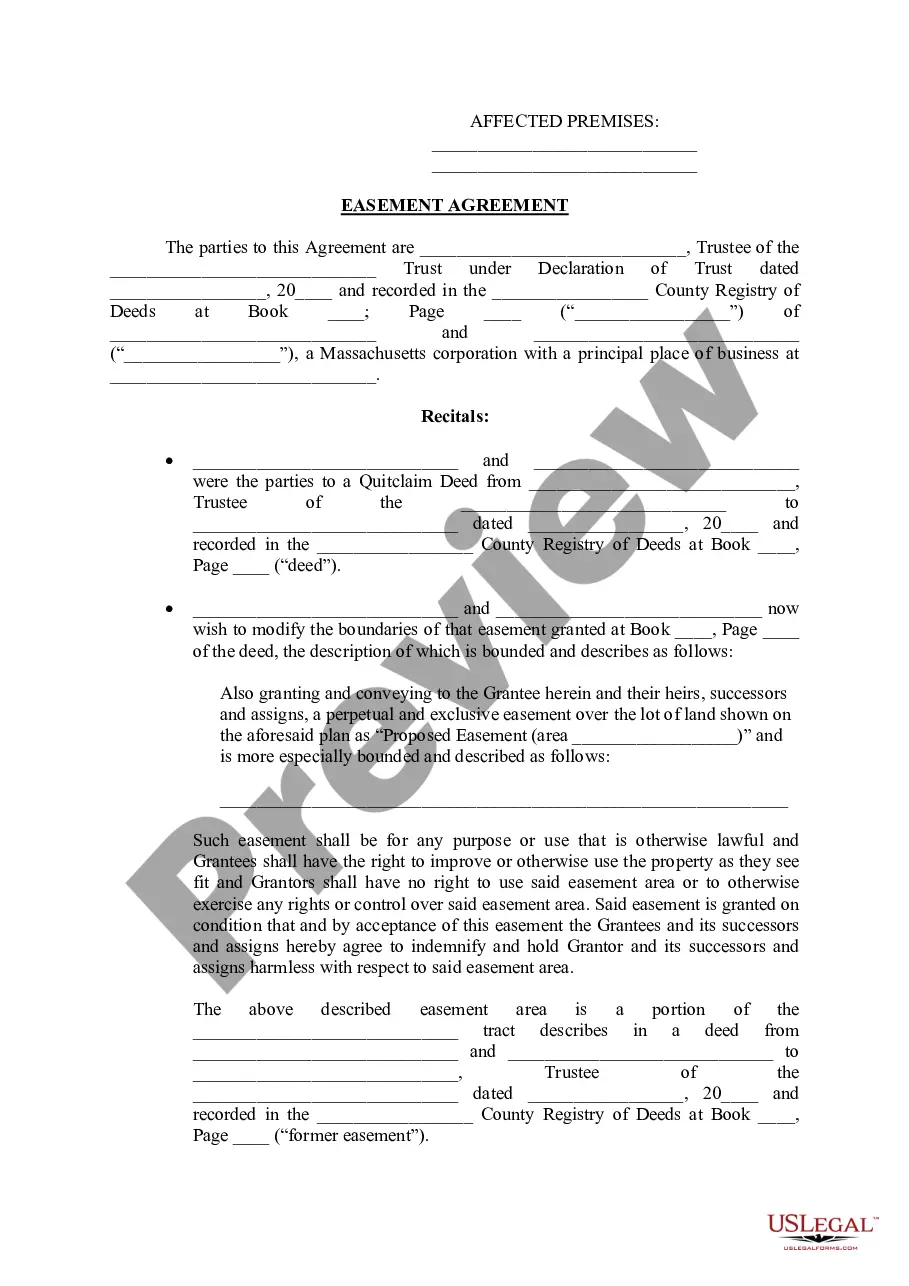

- Check the document's details to confirm it meets the criteria of your state and region.

- Look at the form preview, if provided, to ensure the template corresponds with your needs.

- Return to the search to find the appropriate template if the Living Trust Instructions do not satisfy your requirements.

- Once you are confident regarding the document's pertinence, download it.

- If you are an authorized user, click Log in to verify and access your chosen templates in My documents.

- If you do not yet have an account, click Buy now to obtain the form.

- Select the pricing option that meets your needs.

- Proceed with the registration to complete your acquisition.

- Finalise your transaction by choosing a payment method (credit card or PayPal).

- Choose the document format for downloading the Living Trust Instructions.

- After downloading the form to your device, you can modify it with an editor or print it and complete it by hand.

Form popularity

FAQ

Filing a living trust without a lawyer is indeed possible. You can follow straightforward living trust instructions to complete the process. With resources available on platforms like uslegalforms, you can effectively manage and file your trust documentation on your own. Just remember to ensure all necessary documents are completed correctly to validate your trust.

Yes, you can set up a living trust without an attorney if you feel comfortable doing so. Many people successfully create their trusts by following reliable living trust instructions available online. Platforms like uslegalforms provide step-by-step guides to help you navigate the process easily. However, if your estate is complex, seeking legal advice might be beneficial.

Typically, a living trust does not need to be filed with the IRS. Instead, the trust operates under the grantor's Social Security number, which simplifies your tax reporting. During your lifetime, as long as you follow proper living trust instructions, the trust assets stay separate from your personal filings. It’s always best to consult with a tax professional to ensure compliance.

Starting the process of a living trust begins with understanding your goals for asset distribution. Gather essential documents, such as property titles and bank information, as they are vital for the trust. Next, consult clear living trust instructions available on platforms like US Legal Forms, which simplify each step and guide you in creating a suitable trust for your needs.

Yes, you can create a living trust without a lawyer by using online resources and comprehensive living trust instructions. These instructions offer detailed guidance through each step, allowing you to complete the process independently. However, consider seeking professional advice if your situation involves complex assets or family dynamics.

To set up a living trust, begin by gathering your assets and deciding who will manage them. Next, choose beneficiaries, ensuring they align with your wishes. Then, create the trust document using reliable living trust instructions, which outline management details. Finally, fund the trust by transferring assets into it, completing the setup process.

The 5 by 5 rule for trusts refers to a provision allowing beneficiaries to withdraw up to $5,000 or 5% of the trust’s value each year, whichever is greater, without incurring penalties. This rule can provide beneficiaries with access to funds while still protecting the overall trust from rapid depletion. For those considering this, it's essential to review our living trust instructions to understand how to implement it correctly. This rule balances accessibility with long-term asset preservation.

To write your own living trust, begin by gathering important documents about your assets and beneficiaries. Next, outline the terms of the trust, including who will manage it and how assets will be distributed upon your passing. Utilizing our user-friendly living trust instructions can help simplify this process, ensuring that you include all necessary provisions. Finally, sign the document in front of witnesses to make it legally binding.

To establish a valid trust, you need a settlor, a trustee, and beneficiaries. The settlor creates the trust, while the trustee manages it according to the living trust instructions. Beneficiaries are individuals or entities that benefit from the trust. Ensuring you meet these requirements is crucial for the trust to function properly and meet your goals.

While living trusts offer many benefits, they also have downsides. One major concern is that they do not prevent estate taxes. Additionally, creating a living trust requires effort and time to fill it out correctly. It's essential to follow the living trust instructions meticulously to avoid complications in the future.