Trustee Trust

Description

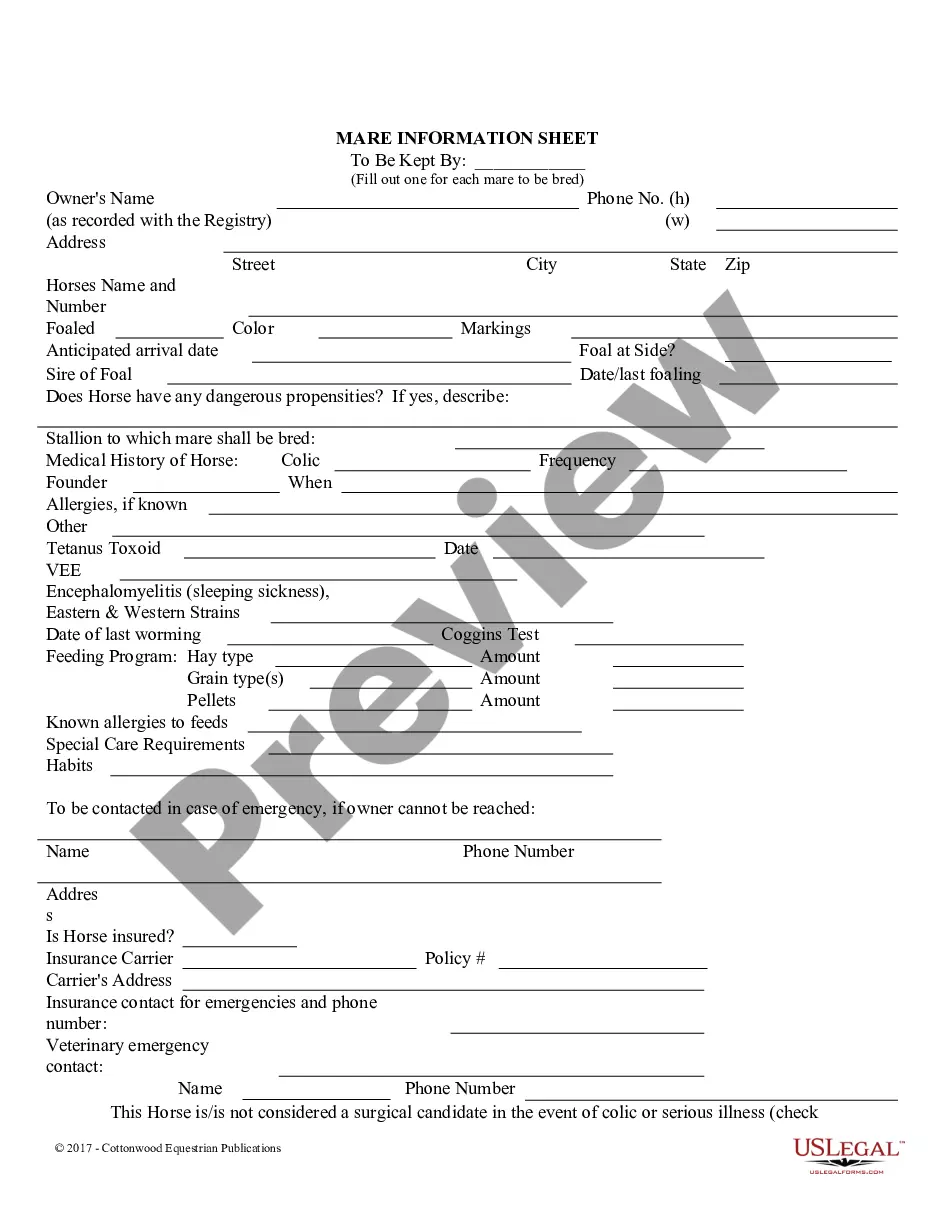

How to fill out Virginia Amendment To Living Trust?

- Log into your US Legal Forms account if you're a returning user. Verify your subscription is active before proceeding to download your required document.

- If you're new to the service, start by reviewing the form descriptions and Preview mode to identify the trustee trust template that aligns with your needs.

- Utilize the Search tab to explore additional templates if you don't find what you're looking for. This ensures you select a form that complies with your local jurisdiction.

- Click on the Buy Now button for your chosen document and select your preferred subscription plan. You will need to create an account to gain access to the library.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Download the completed form to your device, and remember that you can access it anytime through the My Forms section of your profile.

In conclusion, US Legal Forms simplifies the process of acquiring crucial legal documents like a trustee trust. With a robust library of over 85,000 forms, you can be confident in securing precisely what you need.

Start your journey towards hassle-free legal paperwork today!

Form popularity

FAQ

When naming a trustee for your trust, consider someone who is responsible, trustworthy, and understands your wishes. This person will manage your assets according to your trustee trust, so choose someone with good financial judgment. Often, people select a family member, close friend, or a professional with experience in trust management. US Legal Forms can assist you with the necessary documents to formalize this important decision.

Yes, you can set up a trust fund by yourself, but it requires careful planning and knowledge of legal requirements. Using resources from US Legal Forms can empower you to create a trustee trust without professional help. However, consulting with a legal expert may be beneficial to ensure compliance with state laws. This approach helps you feel more confident about the integrity of your trust.

To fill out a trust fund, you begin by gathering essential information, including the names of beneficiaries and assets you wish to include. Next, ensure that you clearly define the terms of your trustee trust, detailing how the assets should be managed and distributed. Utilizing platforms like US Legal Forms can significantly simplify this process, offering templates that guide you step by step. This way, you can avoid common pitfalls and create a solid trust.

There are several disadvantages to being a trustee that you should consider. The role can be demanding, requiring careful attention to detail and extensive documentation to manage a trustee trust effectively. Additionally, trustees might face conflicts of interest or emotional strain, especially in family situations. Engaging with resources like US Legal Forms can help you mitigate these challenges by providing the necessary legal support and guidance.

While anyone can be a trustee of a trust, certain legal qualifications may apply depending on your state. Generally, the trustee should be a legal adult and capable of managing the responsibilities that come with a trustee trust. It's a good idea to research specific requirements or consult with professionals, such as those available through US Legal Forms, to ensure you comply with all regulations while making your selection.

The best person to appoint as a trustee is someone who is trustworthy, reliable, and has a good understanding of financial matters. It's also beneficial to choose someone who can remain objective and impartial, especially when managing family dynamics. Utilizing tools and guidance from US Legal Forms can help you identify the right candidate and create a solid trustee trust tailored to your needs.

Yes, there can be downsides to being a trustee. Serving as a trustee often involves significant time and effort, especially when it comes to managing a trustee trust and ensuring compliance with legal requirements. Additionally, trustees may face potential liability if they fail to fulfill their duties properly, making it crucial to stay informed and seek help from resources like US Legal Forms when needed.

To become a trustee, you need a clear understanding of your responsibilities and the legal obligations that come with managing a trustee trust. Typically, trustees should be trustworthy individuals, often with financial acumen or experience in managing assets. It is also important to have access to legal resources or guidance, such as those from US Legal Forms, to help navigate the complexities of trust administration.

Setting up a trustee trust involves several key steps, starting with defining your goals for the trust. Then, you need to choose a trustworthy individual as a trustee, one who can manage the trust effectively. Afterward, you'll prepare the necessary documents, which can be efficiently completed with the help of US Legal Forms, providing templates and guidance tailored to your needs. Finally, review your trust periodically to ensure it meets your evolving requirements.

Yes, a trustee typically must file a tax return for the trust, especially if the trust generates income. The specific filing requirements can vary based on the type of trustee trust established. Understanding these tax obligations is crucial for the proper management of the trust. Consulting a tax professional can offer clarity on this matter, ensuring that you fulfill all required tax duties.