Trustee For Trust Fund Responsibilities

Description

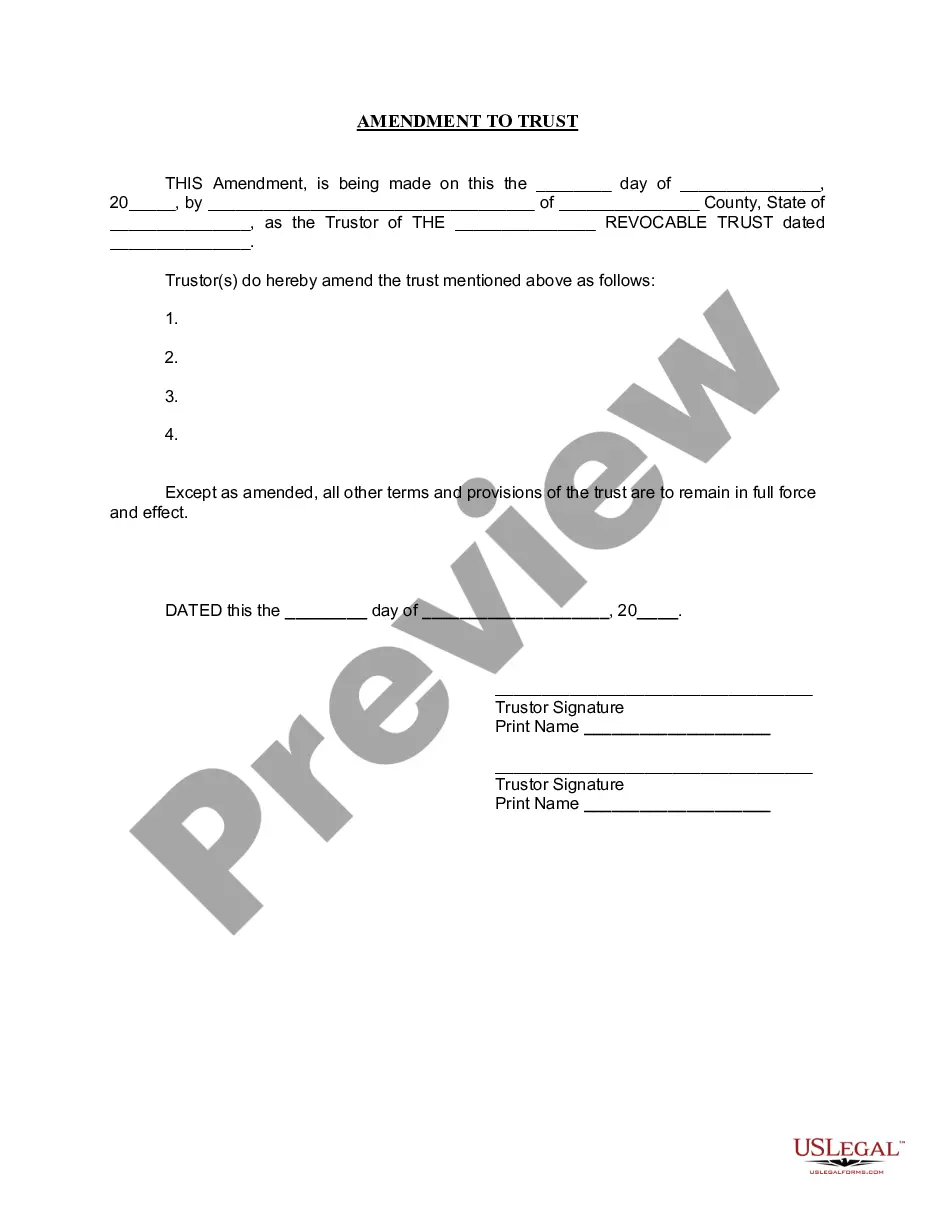

How to fill out Virginia Amendment To Living Trust?

- If you're an existing user, log in to your account and download the necessary form by clicking the Download button. Ensure your subscription is active; renew if necessary.

- For new users, start by browsing the extensive online library that features over 85,000 legal forms. Check the Preview mode and form description to find the document that meets your needs and local jurisdiction requirements.

- In case you need additional forms, utilize the Search tab to find the right templates quickly. If you discover any inconsistencies, be sure to seek alternatives before proceeding.

- Purchase your selected document by clicking on the Buy Now button. Choose the subscription plan that best suits your needs and register for account access.

- Complete your transaction by entering your payment information, either using a credit card or your PayPal account.

- Finally, download your form to your device for completion. Access it anytime via the My Forms section in your profile.

US Legal Forms empowers both individuals and attorneys to easily navigate the often overwhelming landscape of legal documents. With a robust collection of forms available at competitive prices, trustees can efficiently manage their obligations.

Start simplifying your trust fund management today! Visit US Legal Forms to explore our extensive library and ensure compliance with all legal requirements.

Form popularity

FAQ

Selecting a trustee for trust fund responsibilities is a critical decision that impacts the management of your trust. First, consider individuals who understand financial matters and can act in the best interest of the beneficiaries. You may also evaluate professional trustees, such as bank and trust companies, which offer expertise in trust management. The US Legal platform can assist you in drafting the necessary documents and provide resources to help you navigate this decision effectively.

A trustee has several key obligations that revolve around the effective administration of a trust. You are required to adhere to the terms outlined in the trust document, act in the best interests of the beneficiaries, and maintain accurate records of all transactions. Additionally, you must communicate effectively with beneficiaries, keeping them informed about distributions and changes. Utilizing a platform like USLegalForms can assist you in understanding and fulfilling your trustee for trust fund responsibilities.

The power of a trustee in managing a trust fund is significant but is also regulated by the trust document and state law. You have the authority to make investment decisions, disburse funds, and manage assets within the trust. However, with this power comes the responsibility to act in the best interest of the beneficiaries at all times. Understanding these dynamics helps you navigate your trustee for trust fund responsibilities effectively.

As a trustee responsible for managing a trust fund, you have several mandatory duties. Firstly, you must manage the assets prudently, which involves making sound investment decisions and protecting the trust's property. Secondly, you must provide regular accounting to beneficiaries, ensuring they are aware of the trust’s financial status. These responsibilities ensure transparency and adherence to your obligations as a trustee.

Yes, a trustee can be held personally liable if they fail to fulfill their fiduciary duties or violate the terms of the trust. This includes acts of negligence, misconduct, or self-dealing that harm the beneficiaries. It is important for trustees to understand their trust fund responsibilities to avoid personal liability. If beneficiaries believe a trustee has acted irresponsibly, legal action may be necessary to protect their interests.

To hold a trustee accountable, beneficiaries should review trust documents and monitor trustee actions closely. Open communication can often resolve concerns, but if problems persist, seeking legal advice might be necessary. Documenting any violations of fiduciary duties is crucial for potential legal action. Utilizing platforms like US Legal Forms can help you navigate these processes effectively.

Trustees are held accountable through a combination of legal requirements and fiduciary obligations. They must act in the best interest of the beneficiaries and adhere to the terms of the trust. Regular reporting, transparency in transactions, and documentation are essential to ensure they fulfill their trust fund responsibilities. If mismanagement occurs, beneficiaries can take action to seek redress.

Deciding whether your parents should place their assets in a trust depends on their specific financial and personal situation. Establishing a trust can provide benefits like asset protection and streamlined inheritance, but it's important to evaluate those benefits against the costs. Consulting a legal expert can help your parents understand their options and fulfillment of trustee for trust fund responsibilities.

A potential downfall of having a trust is that it may complicate the estate settlement process. If not properly structured, disputes can arise among beneficiaries or with the trustee, leading to delays. Moreover, administering a trust can require significant time and effort, especially if there are complex assets involved.

One significant mistake parents often make is failing to update the trust as circumstances change. Whether it’s changes in family dynamics, such as births or deaths, or shifts in financial status, regular updates to the trust are essential. Neglecting this can lead to unintended consequences for beneficiaries and complications in fulfilling trustee for trust fund responsibilities.