Non Affidavit Estate With Will

Description

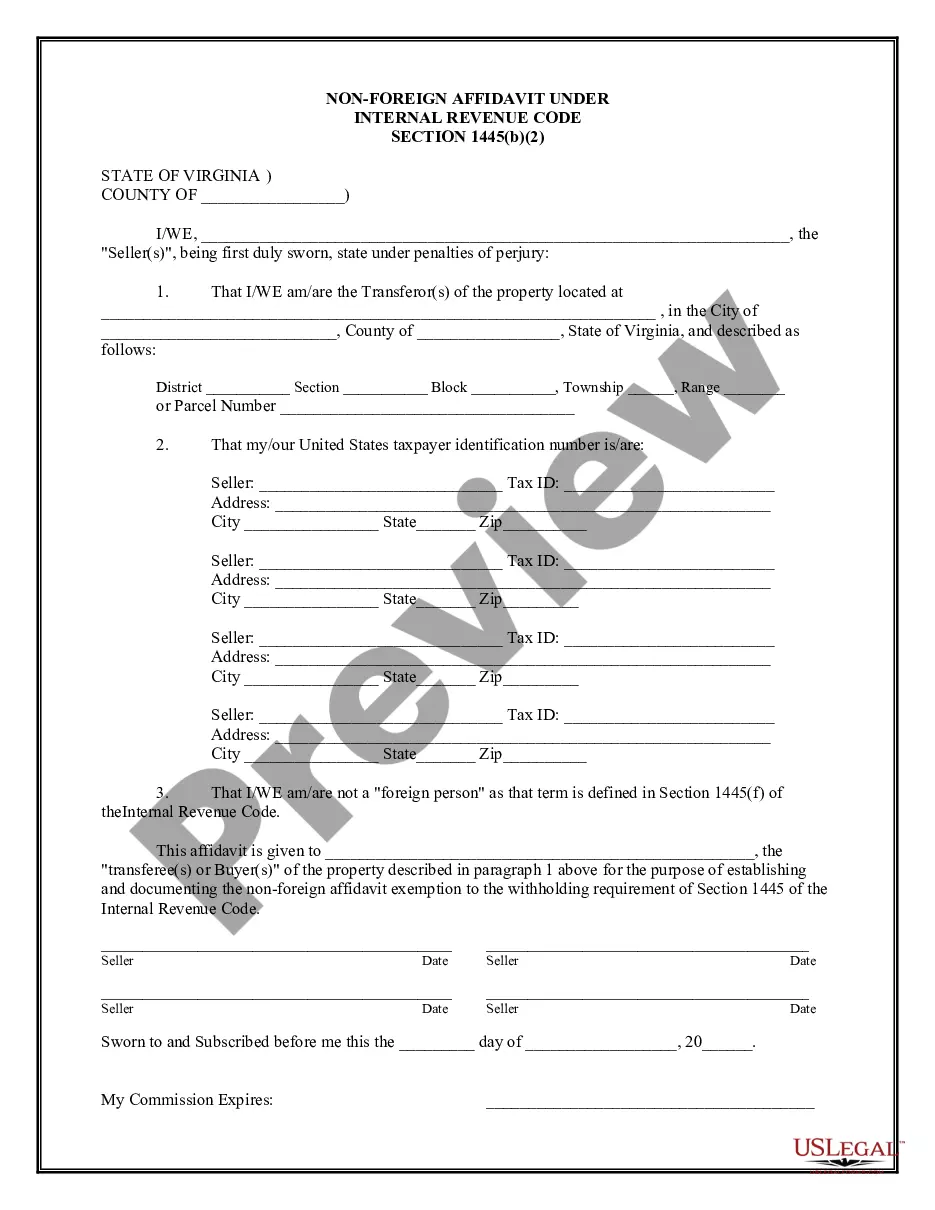

How to fill out Virginia Non-Foreign Affidavit Under IRC 1445?

Regardless of whether you handle documents frequently or you occasionally need to submit a legal report, it is essential to have a reliable source of information where all samples are pertinent and current.

The first task you should undertake with a Non Affidavit Estate With Will is to confirm that it is indeed the most recent version, as it determines whether it can be submitted.

If you prefer to streamline your search for the most recent document examples, look for them on US Legal Forms.

Eliminate the uncertainty of handling legal documents; all your templates will be organized and validated with a US Legal Forms account.

- US Legal Forms is a repository of legal documents that includes nearly every template you might seek.

- Locate the forms you require, assess their relevance immediately, and understand their application better.

- With US Legal Forms, you gain access to over 85,000 document templates across various fields.

- Retrieve the Non Affidavit Estate With Will samples in just a few clicks and save them in your account at any time.

- A US Legal Forms account facilitates your access to all the samples you need with added ease and minimal hassle.

- Simply click Log In in the site header and navigate to the My documents section, where all the forms you require are readily accessible.

Form popularity

FAQ

I explained that California law requires filing the original will in the probate court. However, if a will is lost we can file a petition for admittance of a lost will. I assured her I do this all the time. I explained that I would send her an email with the initial probate documents and a FedEx return label.

A California small estate affidavit, or Petition to Determine Succession to Real Property, is used by the rightful heirs to an estate of a person who died (the decedent). The total net value of the estate cannot be more than $184,500 for it to qualify under this process and bypass probate.

An affidavit or declaration signed under penalty of perjury at least 40 days after the death can be used to collect the assets for the beneficiaries or heirs of the estate. No documents are required to be filed with the Superior Court if the small estates law (California Probate Code Sections 13100 to 13116) is used.

The small estate affidavit can be used only if ALL of the following conditions apply: 1 The deceased person died WITHOUT A WILL. If there is a will, a small estate affidavit CANNOT be used whether the will has been offered for probate or not. 2 More than thirty (30) days must have passed since the date of death.

To prepare a small estate for an administrative hearing, the executor of the estate will need to file the will,a copy of the death certificate, and a small estate affidavit petition for the hearing with the Surrogate Court where the deceased lived.