Memorandum Of Lien Virginia Withholding Tax

Description

Form popularity

FAQ

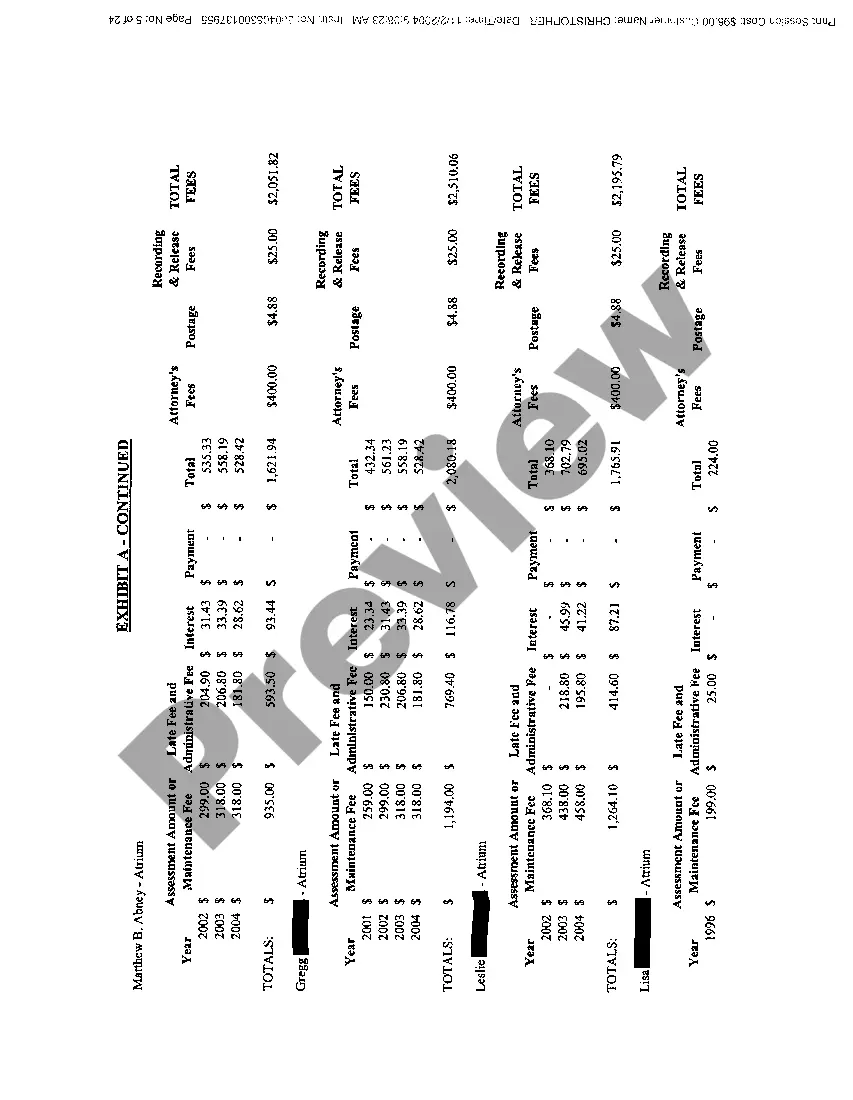

To determine if you are subject to Virginia withholding, you need to review your income sources and residency status. If you earn income in Virginia, the state often requires withholding. Additionally, understanding the memorandum of lien Virginia withholding tax can provide insights into specific deductions and obligations related to your income, ensuring you stay compliant with state laws.

Yes, Virginia does sell tax lien certificates, which can be a valuable investment opportunity. These certificates are typically sold at public auctions, and you can acquire them by bidding. Familiarize yourself with the specific details governing the process, including the memorandum of lien Virginia withholding tax, as it directly impacts your investment strategy and potential returns.

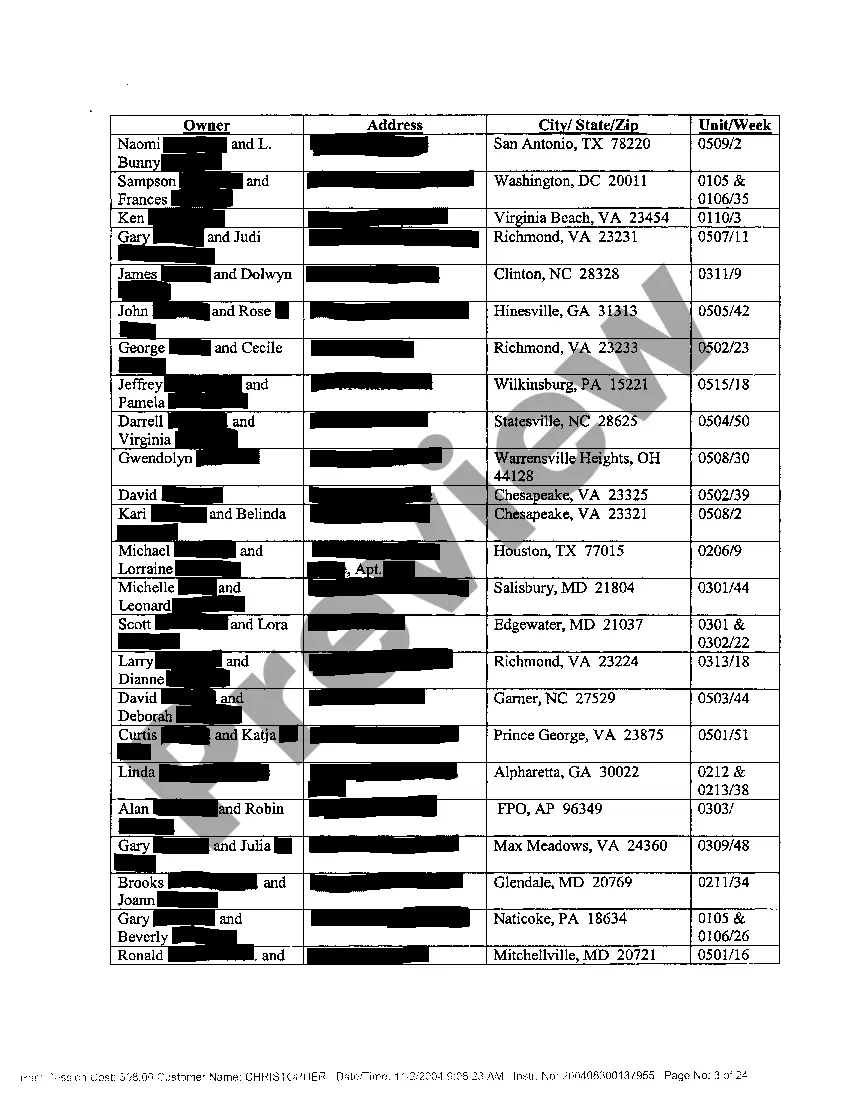

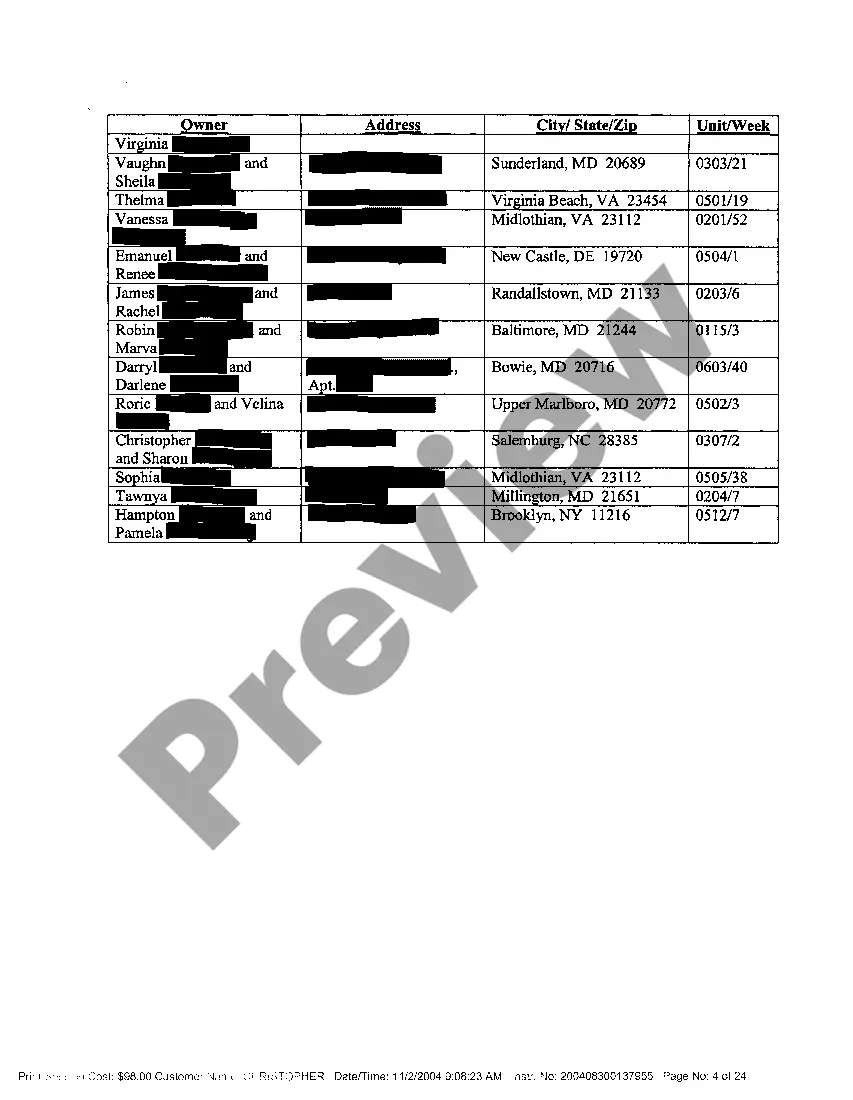

To look up a tax lien in Virginia, you can visit your local county or city tax office's website or office. Many jurisdictions provide online databases where you can search using the property address or parcel number. Furthermore, consider checking the memorandum of lien Virginia withholding tax to get detailed information on any outstanding liens against the property, as this may affect your investment decisions.

The best state for purchasing tax lien certificates often depends on your investment goals. In Virginia, investors can find potential opportunities, but it is essential to understand the local rules and market conditions. Some states provide higher returns, while others may have a more straightforward buying process. Regardless, understanding the memorandum of lien Virginia withholding tax is crucial for making informed decisions.

Yes, Virginia does issue tax lien certificates, which are used to recover unpaid taxes. These certificates represent a lien on a property and provide local governments a way to collect back taxes. If you are dealing with matters related to the memorandum of lien Virginia withholding tax and tax liens, platforms like US Legal Forms can provide helpful resources and documents to navigate these legal requirements efficiently.

To know if you are subject to Virginia withholding, you must review your employment status and the nature of your payments. If you work for an employer in Virginia, they are likely withholding taxes from your earnings. Additionally, understanding the impacts of the memorandum of lien Virginia withholding tax can help you navigate your financial responsibilities effectively.

Yes, Virginia does impose withholding tax on wages and certain types of payments. Employers in Virginia are required to withhold a specific percentage of an employee's wages for state income tax. Understanding the memorandum of lien Virginia withholding tax is essential for both employers and employees to ensure compliance with state tax laws and to avoid unexpected tax liabilities.

The amount you should withhold for taxes in Virginia depends on your total income, filing status, and the number of exemptions you claim on your VA 4 form. Generally, state guidelines outline the appropriate withholding amounts based on income brackets. For personalized advice, consider consulting with a tax professional to ensure compliance with Virginia withholding tax regulations.

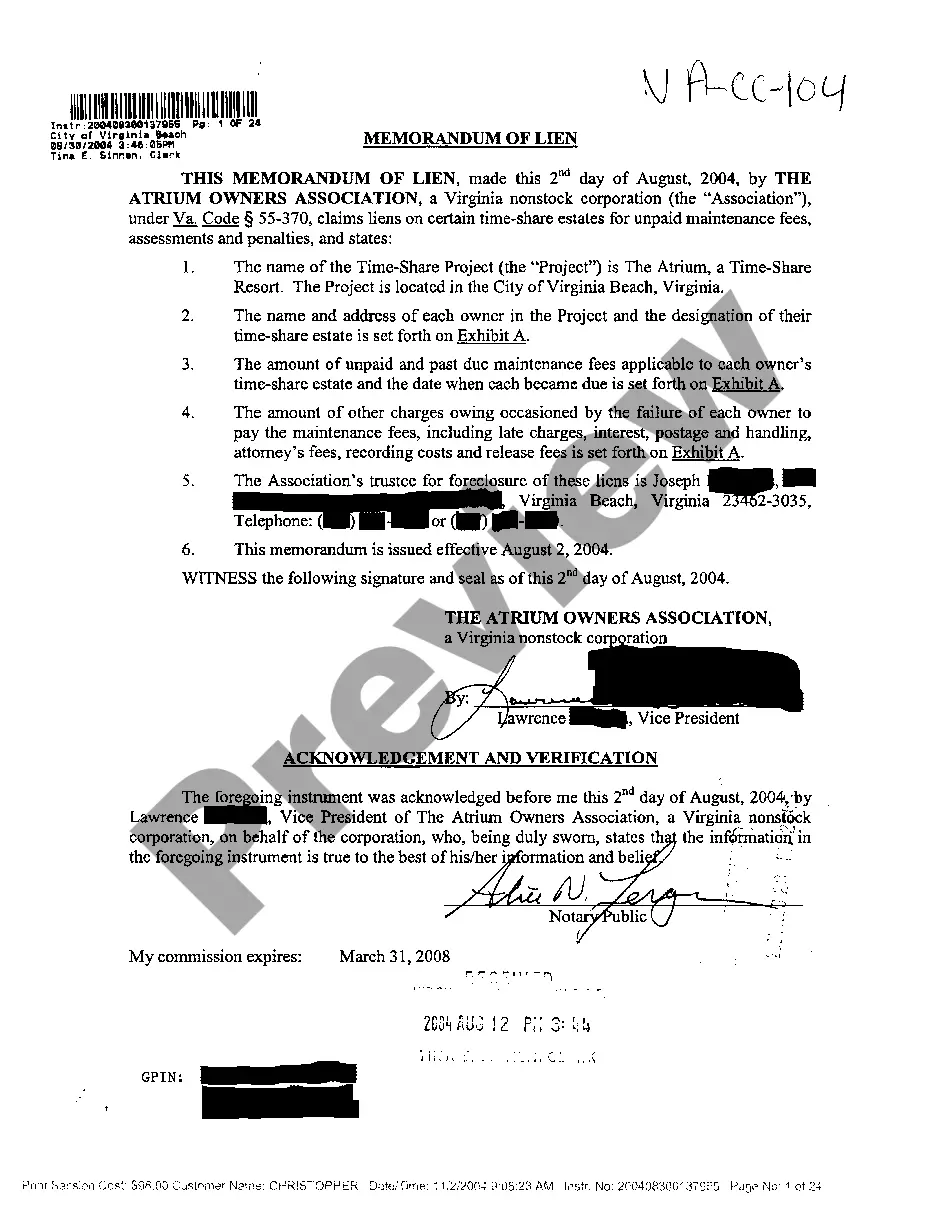

A memorandum of lien in Virginia symbolizes a creditor's claim against property without establishing the lien itself. It serves as public notification to other creditors and potential buyers about existing claims. If you are navigating issues related to debts on property, understanding this document is crucial for protecting your financial interests.

You can sell a house with a lien on it in Virginia, but the lien must typically be addressed before the sale is complete. Most buyers will require that any liens be resolved to obtain clear title to the property. This process can include negotiating with the lien holder or paying off the debt at the closing.