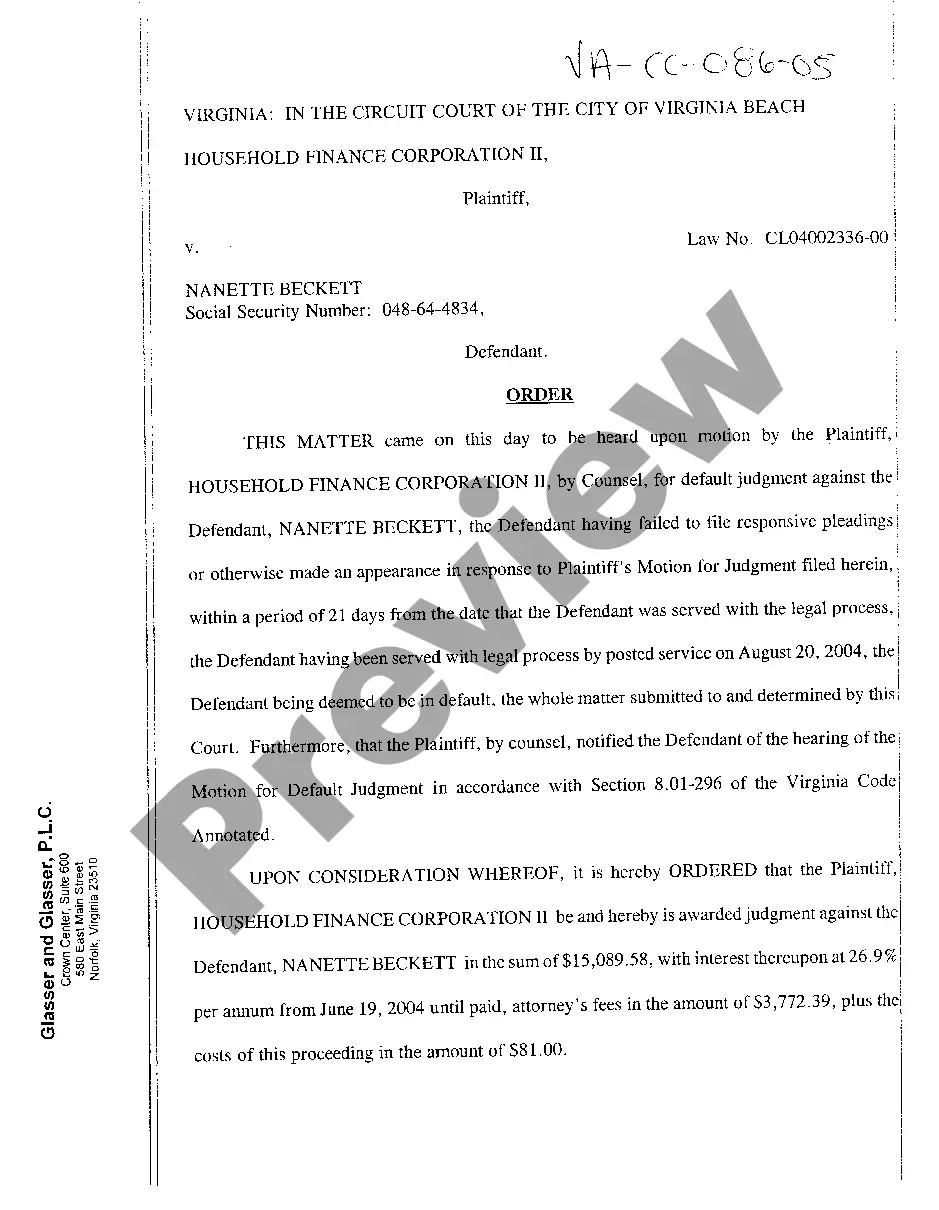

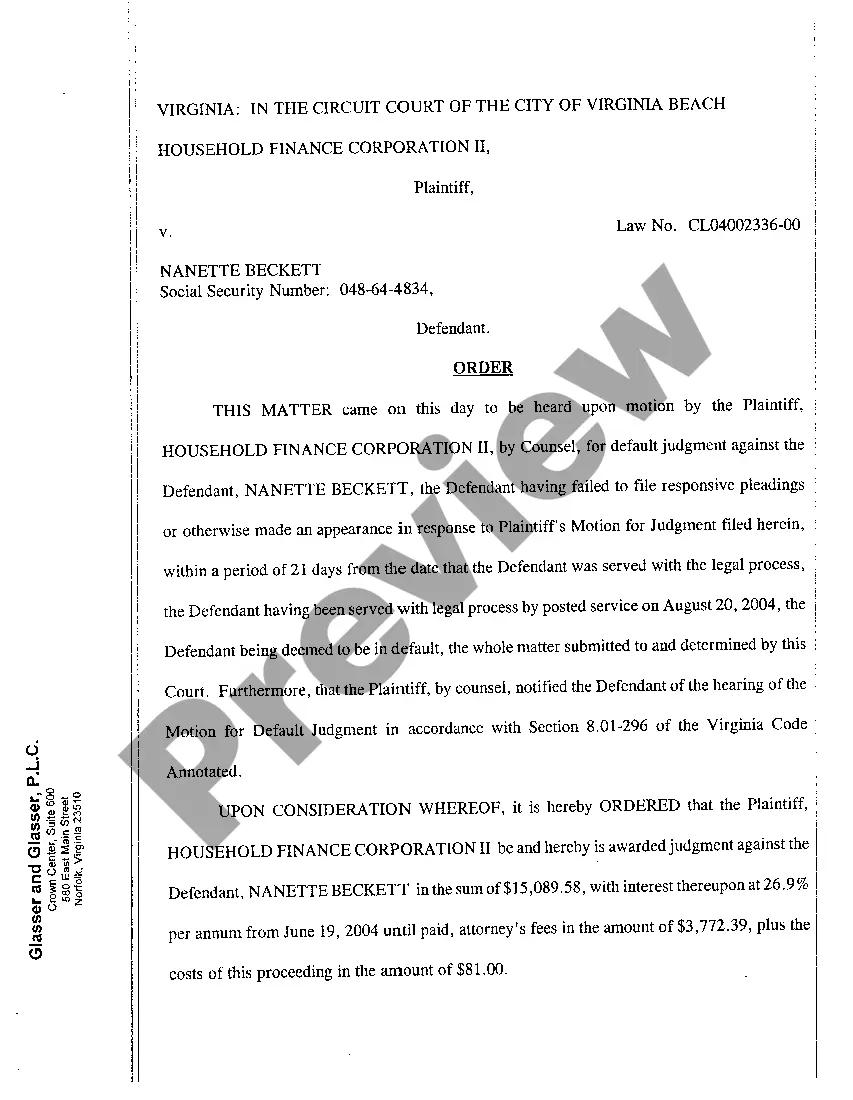

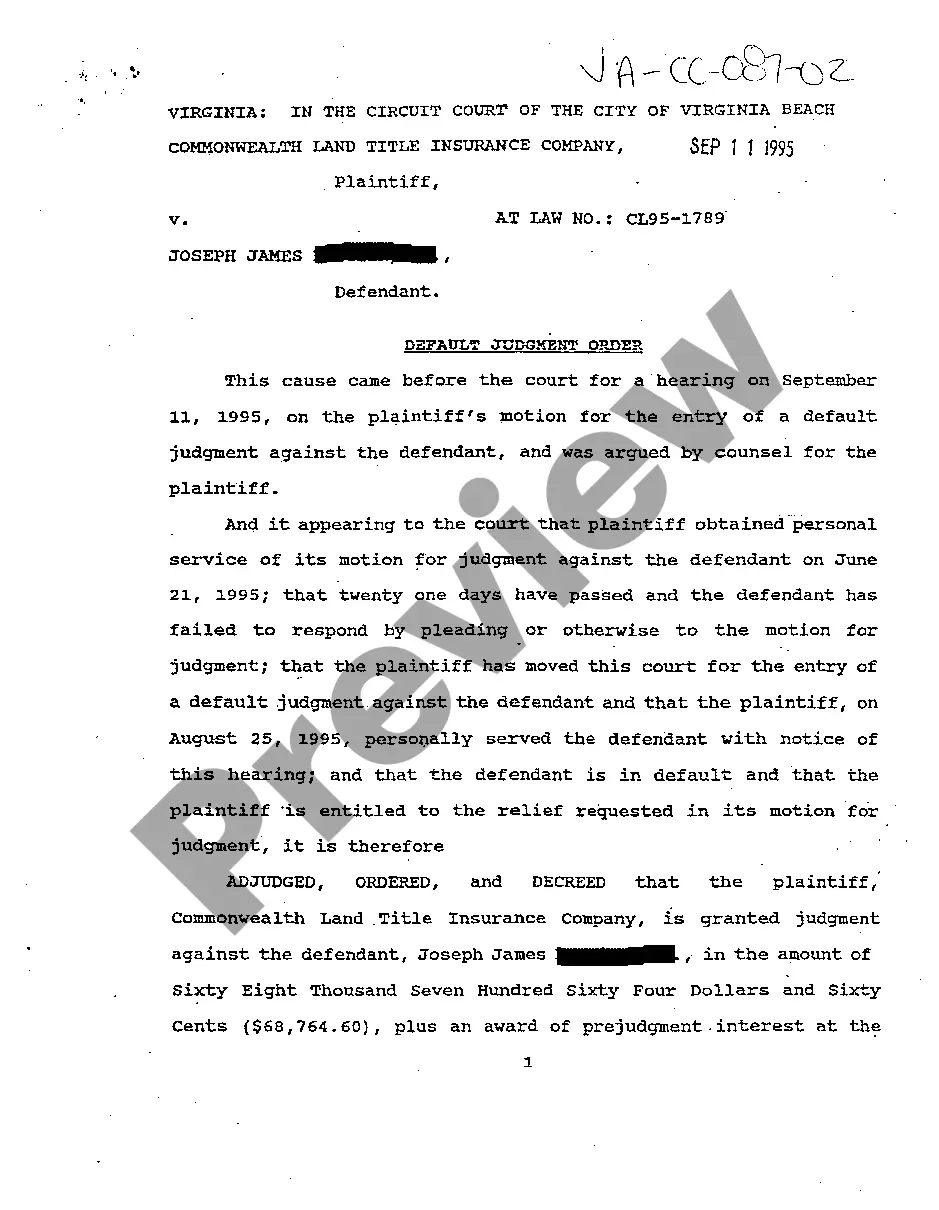

Sample Court Orders Virginia Judgement For Credit Card Debt

Description

How to fill out Virginia Order For Default Judgment?

Well-formulated official documents serve as critical protections against issues and legal disputes, yet securing them without legal assistance might require some time.

Whether you seek to promptly acquire an updated Example Court Orders Virginia Judgment For Credit Card Debt or various other forms for work, family, or business purposes, US Legal Forms is consistently available to assist.

The process is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you just need to Log In to your account and click the Download button next to the selected file. Additionally, you can retrieve the Example Court Orders Virginia Judgment For Credit Card Debt at any point, as all documents previously obtained on the platform remain accessible within the My documents tab of your profile. Save time and funds on preparing official documents. Experience US Legal Forms right away!

- Confirm that the form fits your case and jurisdiction by reviewing the description and preview.

- Search for an additional sample (if necessary) using the Search bar located in the page header.

- Click Buy Now when you find the appropriate template.

- Choose the pricing plan, Log In to your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (credit card or PayPal).

- Choose PDF or DOCX file format for your Example Court Orders Virginia Judgment For Credit Card Debt.

- Click Download, then print the template to complete it or add it to an online editor.

Form popularity

FAQ

In Virginia, a judgment generally lasts for 10 years from the date it is signed by the judge. After this period, it can potentially be renewed if the creditor acts before the expiration time. Understanding this duration is vital for those dealing with financial constraints. Using sample court orders Virginia judgment for credit card debt can provide a clear framework for managing these legal documents.

In Virginia, while judgments do not technically expire after the 10-year mark, they can be renewed. This means creditors may extend the judgment for another 10 years if they take appropriate legal steps. Being aware of this can help you manage debt effectively. Reviewing sample court orders Virginia judgment for credit card debt may clarify the renewal process.

To find out if you have a judgment against you in Virginia, you can check the circuit court's online database. Additionally, obtaining credit reports can help you identify active judgments. Staying informed about your financial obligations is essential, and using tools such as sample court orders Virginia judgment for credit card debt can aid in understanding your situation better.

Once a default judgment is issued in Virginia, the creditor can take steps to collect the debt. This might include wage garnishment, bank account levies, or liens on property. Understanding the implications of a default judgment is crucial, especially if you're navigating payment issues. Resources like sample court orders Virginia judgment for credit card debt can offer guidance on how to address these situations.

In Virginia, a judgment stays on your credit record for a period of 10 years. This time begins from the date the judgment is entered by the court. It's essential to understand this timeline, especially if you are dealing with credit card debt. For those looking to settle their debts, utilizing sample court orders Virginia judgment for credit card debt can provide helpful insights.

In Virginia, the maximum amount you can sue for in small claims court is generally $5,000, while circuit court can handle larger amounts, often starting at over $25,000. It is important to know your limits when considering legal action. Consulting sample court orders in Virginia for judgments related to credit card debt can provide valuable insight into your claims.

To file a motion in Virginia court, you must prepare a written document that details your request and submit it to the court along with any necessary fees. Ensure that your motion includes relevant arguments and evidence to support your case. For specific instances related to sample court orders in Virginia for judgment about credit card debt, consider seeking legal guidance to strengthen your motion.

In Virginia, a creditor can collect on a judgment for up to 20 years. This means that the creditor has a lengthy period to enforce the judgment, which may include wage garnishment or bank levies. Knowing the timeframe can help you take appropriate actions or consult resources such as sample court orders in Virginia regarding judgment for credit card debt.

Another common term for judgement proof is 'asset protection.' This term refers to having little to no non-exempt assets, which makes it difficult for creditors to collect. If you find yourself in this situation, exploring sample court orders in Virginia for judgment regarding credit card debt can provide clarity on your legal standing.

In Virginia, the statute of limitations for collecting a debt is generally five to six years, depending on the type of debt. Therefore, if a debt collector tries to take you to court after seven years, they may face legal challenges. Keep track of your debts and remember, you can find helpful sample court orders in Virginia for judgment on credit card debt to guide you.