Credit Line Deed Of Trust Form

Description

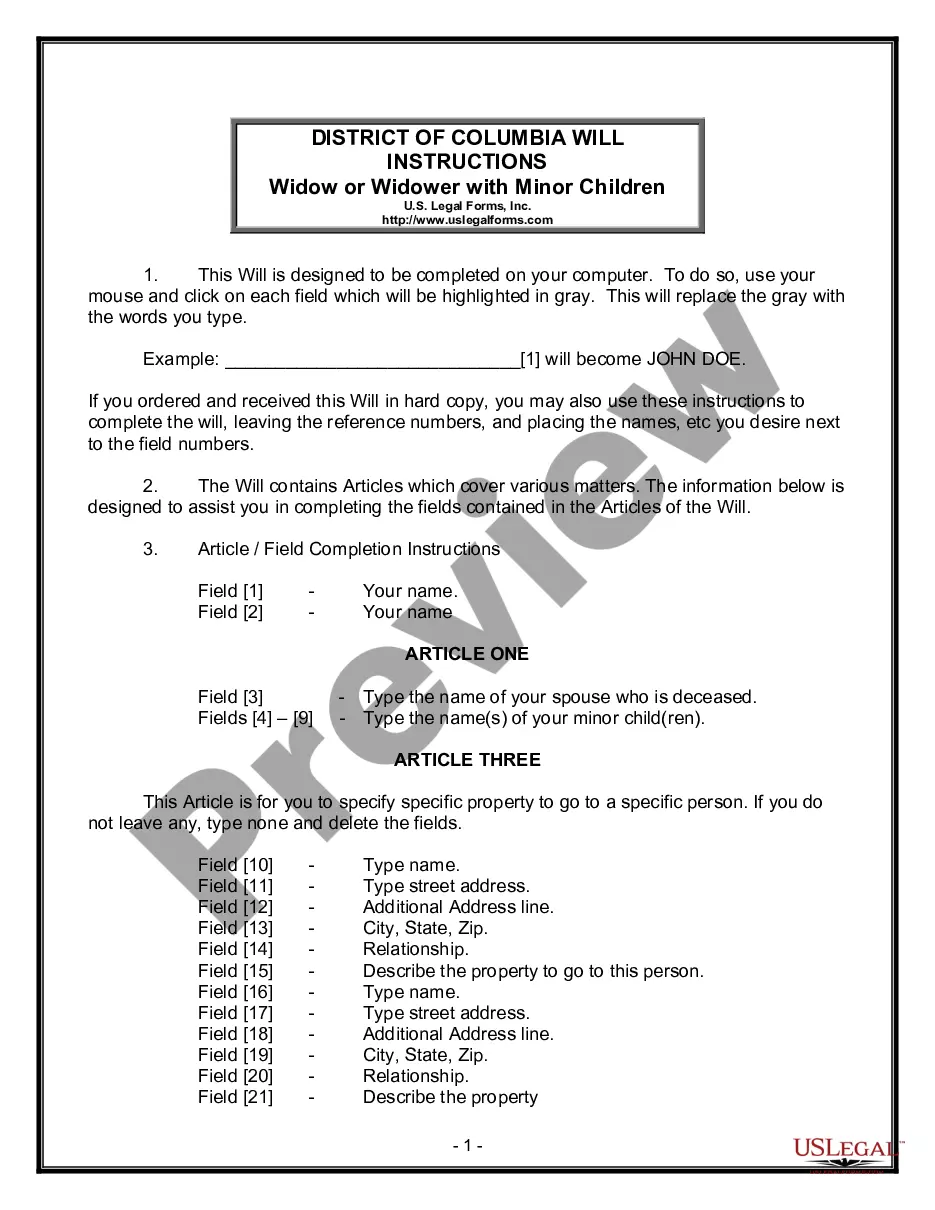

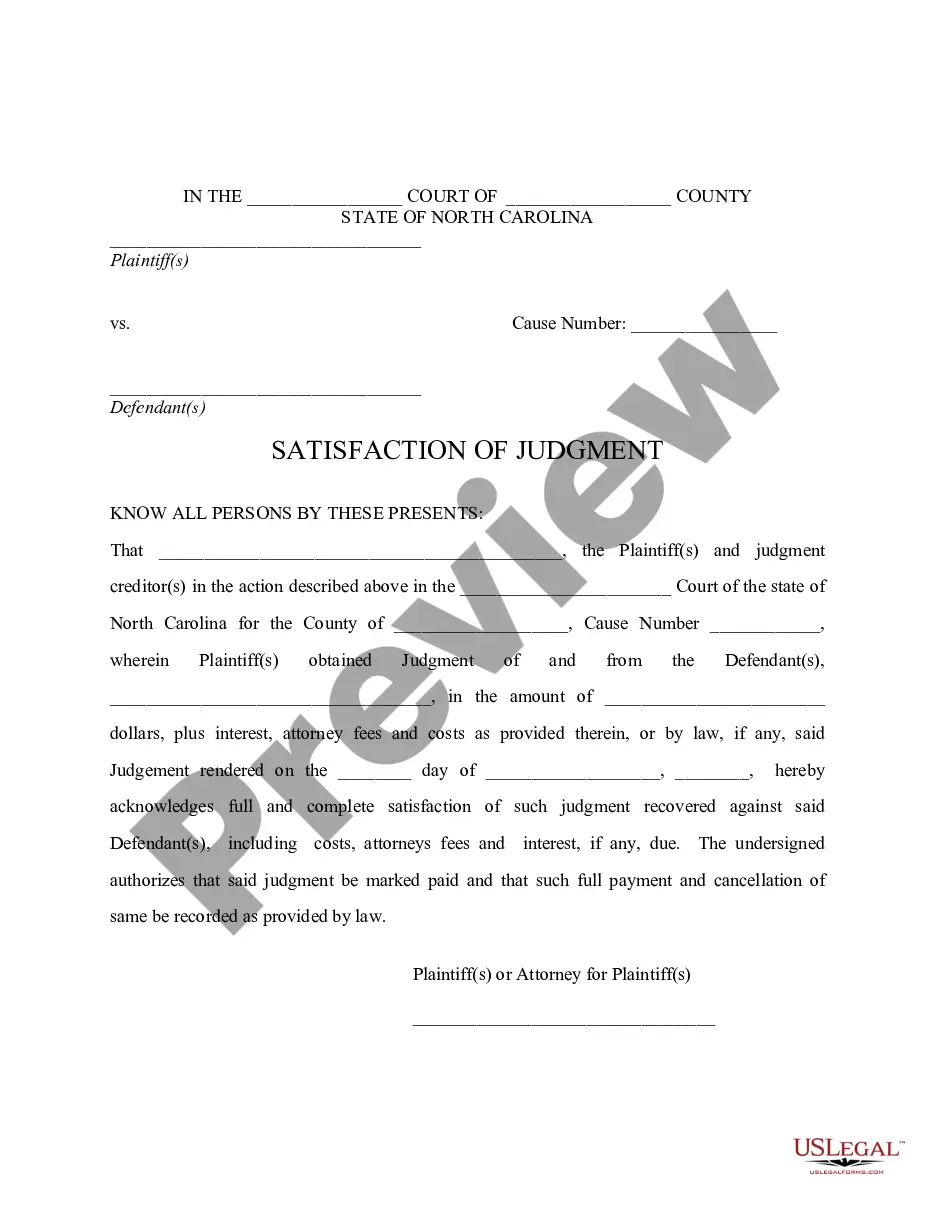

How to fill out Virginia First Change Or Modification To Credit Line Deed Of Trust And Assignment Of Rents And Leases?

There’s no further justification to spend time searching for legal documents to adhere to your local state statutes.

US Legal Forms has compiled all of them in a single location and enhanced their accessibility.

Our website provides over 85k templates for any business and personal legal circumstances organized by state and area of application.

Click Buy Now beside the template title when you identify the suitable one.

- All forms are properly drafted and verified for authenticity, ensuring that you receive a current Credit Line Deed Of Trust Form.

- If you are acquainted with our platform and already possess an account, ensure that your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also retrieve all saved documents whenever necessary by accessing the My documents tab in your profile.

- If you have not engaged with our platform before, the process will require a few additional steps to finish.

- Here’s how new users can locate the Credit Line Deed Of Trust Form in our library.

- Review the page content thoroughly to confirm it contains the sample you need.

- If the previous one didn’t meet your needs, utilize the Search bar above to find another sample.

Form popularity

FAQ

To build credit after a Trust Deed, consistently practice good financial habits. Begin with secured credit cards or loans that report to credit bureaus. Additionally, obtaining a credit line deed of trust form can help you set a solid foundation for your credit growth. Make timely payments, and gradually elevate your credit score as you demonstrate responsible credit behavior.

When your Trust Deed completes, your debt obligations are fulfilled, and you regain your financial independence. This completion signifies a fresh start, allowing you to rebuild your credit. Afterward, you can consider establishing a new credit line deed of trust form to ensure a smooth transition into positive credit habits. It's crucial to keep track of your credit score as you move forward.

Obtaining credit while under a Trust Deed can be challenging, but it is not impossible. Some lenders may offer credit options designed for individuals with Trust Deeds, although they generally come with higher interest rates. Utilizing a credit line deed of trust form can help you navigate this process by providing clarity on your financial situation and securing better terms. Always explore your options wisely.

One significant disadvantage of a Trust Deed is that it can negatively affect your credit score for several years. When you enter into a Trust Deed, it may limit your ability to access new credit and restrict your financial freedom. Additionally, potential lenders might view this as a red flag, affecting your future credit applications. Understanding the implications of a credit line deed of trust form can help you make informed decisions.

Building credit after a Trust Deed involves several steps. Start by paying all your bills on time, since timely payments contribute positively to your credit score. Consider obtaining a secured credit card or a credit line deed of trust form to establish a new credit history. Each small, consistent action can lead to improved credit over time.

A line of credit deed of trust is a type of deed that secures a line of credit, allowing homeowners to borrow against the equity built up in their property. This aligns with the borrower's need for flexible access to funds, whether for home improvements or unexpected expenses. Using a credit line deed of trust form helps ensure that the transaction is properly documented, providing peace of mind to both the borrower and lender.

At the end of a trust deed, the borrower typically receives a discharge, clearing them from obligations tied to the trust deed. The lender then removes their claim on the property, and the borrower regains full ownership rights. If you've followed the terms outlined in your credit line deed of trust form, you can move forward confidently. This conclusion can lead to opportunities for new financial ventures and better credit options.

Yes, you can often obtain credit after completing a trust deed. Once the trust deed process concludes, you may see improvements in your credit rating. Starting fresh with a credit line deed of trust form shows potential lenders that you have taken steps toward financial stability. Many individuals successfully rebuild their credit scores by managing new credit responsibly after the trust deed.

Obtaining a credit card while under a trust deed can be challenging. Lenders often view a trust deed as a sign of financial distress, which may affect your creditworthiness. However, completing a credit line deed of trust form does not prevent you from applying for new credit. It is essential to check with individual lenders on their specific requirements and guidelines.

The most commonly used deed is the warranty deed, which guarantees that the seller has clear ownership of the property and the right to sell it. However, for securing loans, the deed of trust is frequently preferred. This document provides a secure method for lenders to ensure repayment, and utilizing a credit line deed of trust form can simplify that process.