First Preferred Ship Mortgage With Credit Card

Description

How to fill out Virginia First Preferred Ship Mortgage?

Managing legal documents can be daunting, even for seasoned experts.

When you are interested in a First Preferred Ship Mortgage With Credit Card and lack the time to search for the suitable and current version, the process may be stressful.

With US Legal Forms, you can.

Access a valuable collection of articles, guides, and references related to your situation and needs.

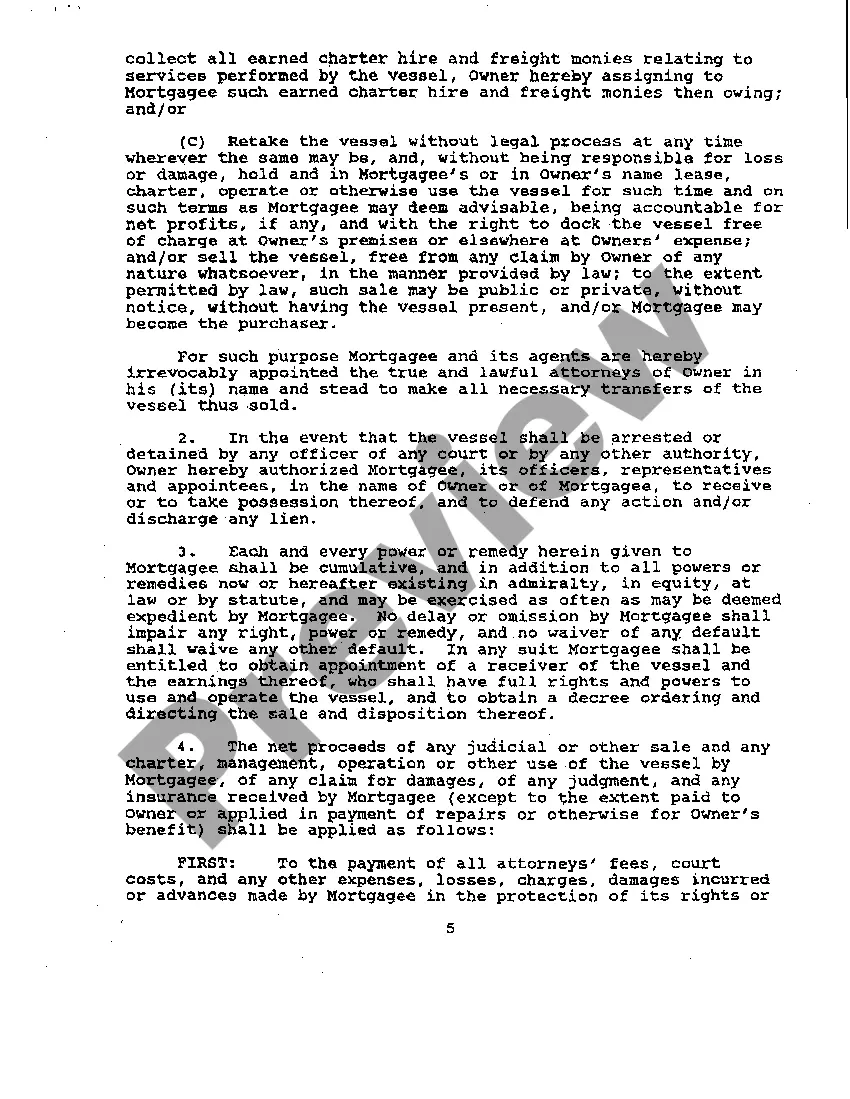

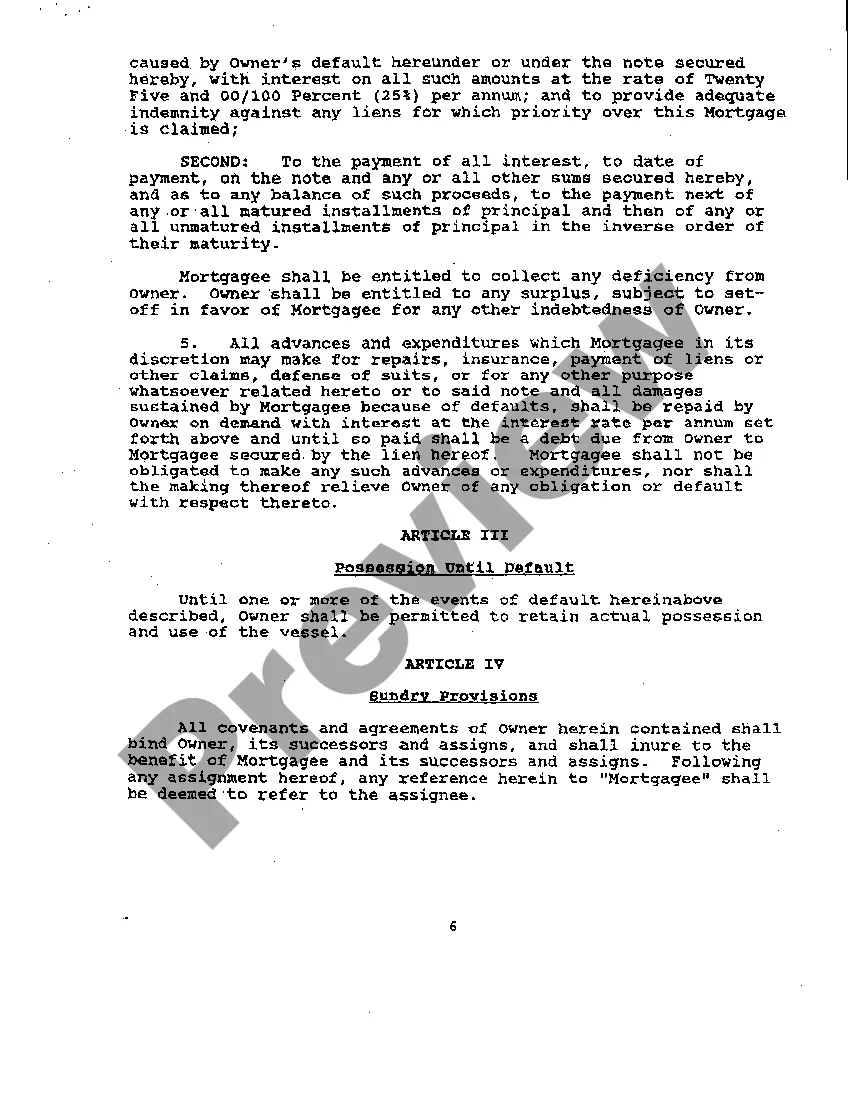

Ensure it is the correct form by previewing it and reviewing its description.

- Save time and energy searching for the documents you need, and utilize US Legal Forms’ advanced search and Review feature to locate the First Preferred Ship Mortgage With Credit Card and obtain it.

- If you possess a membership, Log In to your US Legal Forms account, search for the form, and acquire it.

- Check the My documents tab to view the documents you have previously saved and manage your files as desired.

- If this is your initial experience with US Legal Forms, create a free account and gain unlimited access to all the benefits of the library.

- Follow these steps after obtaining the desired form.

- A comprehensive online form collection could revolutionize how individuals navigate these matters effectively.

- US Legal Forms stands as a frontrunner in online legal documents, offering over 85,000 state-specific legal forms accessible at any time.

- Utilize cutting-edge tools to prepare and manage your First Preferred Ship Mortgage With Credit Card.

Form popularity

FAQ

A first preferred ship mortgage is the highest-ranking claim a lender can have over a vessel, giving them priority in case of default. This type of mortgage provides lenders with increased protection and makes it easier for borrowers to secure financing. When you opt for a first preferred ship mortgage with credit card, you can ensure that your investment is safeguarded, allowing you to focus on enjoying your vessel.

Generally, a boat that is 5 net tons or larger may require a ship mortgage to secure financing. However, the specific size and regulations can vary based on the lender's policies and the intended use of the vessel. If you're considering a first preferred ship mortgage with credit card, reviewing these details with a lender can help you choose the best fit for your financing needs.

A preferred mortgage is a type of security interest that a lender holds over a vessel. This mortgage takes priority over other claims against the vessel, ensuring that lenders have a better chance of recovering their funds if the borrower defaults. When seeking a first preferred ship mortgage with credit card, it is crucial to recognize the benefits this type of financing offers in terms of security and priority.

The Preferred Ship Mortgage Act is a federal law that allows vessel owners to secure financing through preferred ship mortgages. This act provides a legal framework that protects the lender's interest in the vessel, making it easier for them to recover their investment. Understanding this act is essential for anyone considering a first preferred ship mortgage with credit card as it outlines the rights and responsibilities of both parties involved.

To document your vessel under a first preferred ship mortgage with credit card, you need to gather several essential documents. First, ensure you have the vessel's hull identification number, proof of ownership, and any previous documentation. Then, complete the required application forms and submit them to the appropriate maritime authority. Using USLegalForms can simplify this process, as it provides templates and guidance tailored for first preferred ship mortgages.

After acquiring a new credit card, it's wise to wait at least six months before applying for a first preferred ship mortgage with credit card. This waiting period allows your credit score to stabilize and improve, which can enhance your chances of securing favorable mortgage terms. Additionally, it gives you time to build a positive payment history on the new credit card. To simplify the mortgage application process, consider utilizing the resources available on uslegalforms, which can guide you through the necessary paperwork.

You typically cannot add your credit card balance directly to your mortgage. However, refinancing your First preferred ship mortgage with credit card may allow you to consolidate your debts. This approach can simplify your payments and reduce your overall interest. To navigate this process smoothly, consider seeking assistance from uslegalforms to ensure you understand your options.

Linking your mortgage to a credit card is not a standard practice. However, some financial institutions might offer products that allow you to use a credit card to make mortgage payments or manage expenses related to your First preferred ship mortgage with credit card. It is essential to explore these options through your lender or consider platforms like uslegalforms that can provide guidance on managing your finances effectively.

You cannot directly add your credit card to your mortgage. However, you can explore options like consolidating your debts, which may involve refinancing your First preferred ship mortgage with credit card. This process allows you to manage your credit card balance more effectively and potentially lower your interest rates. Consider consulting with a financial expert to find the best solution for your situation.