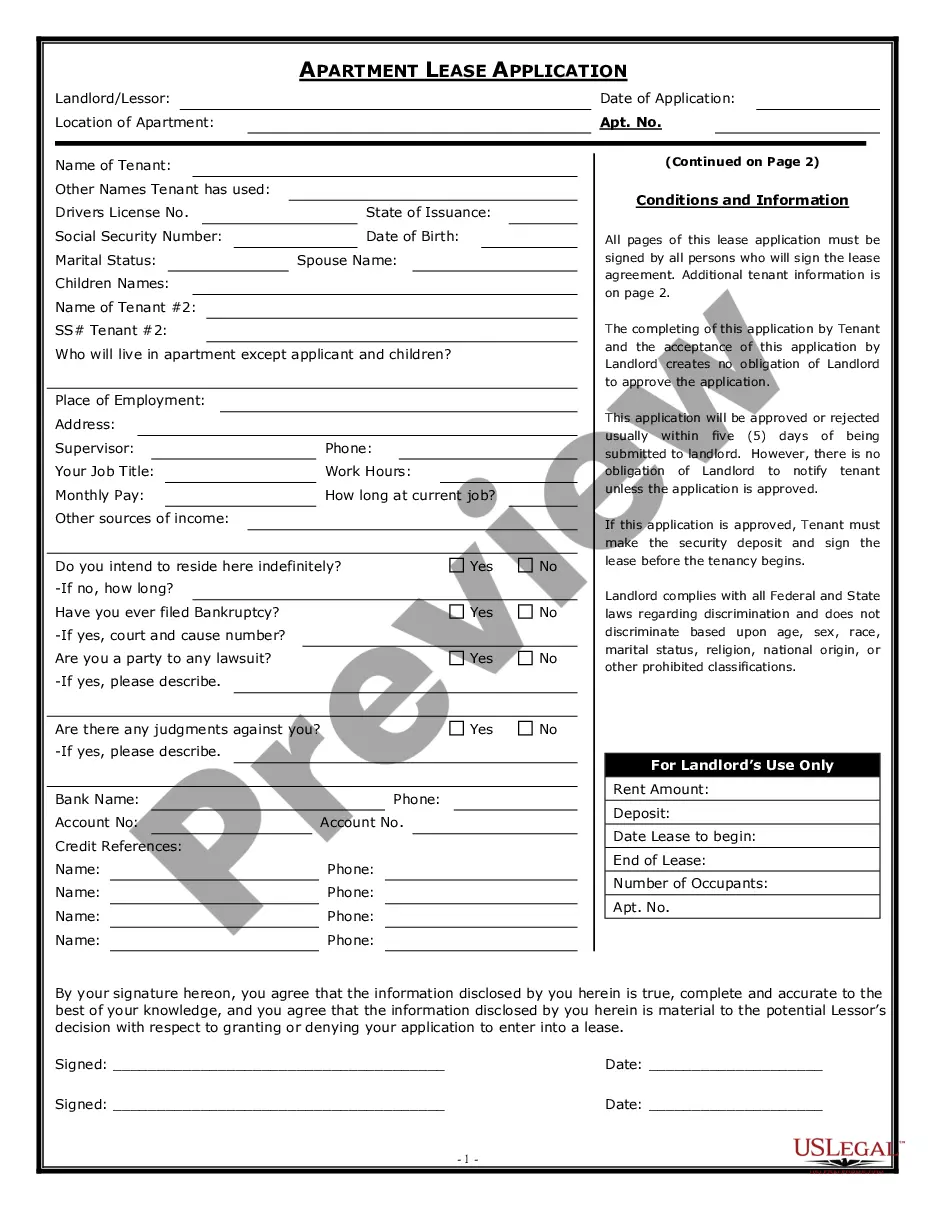

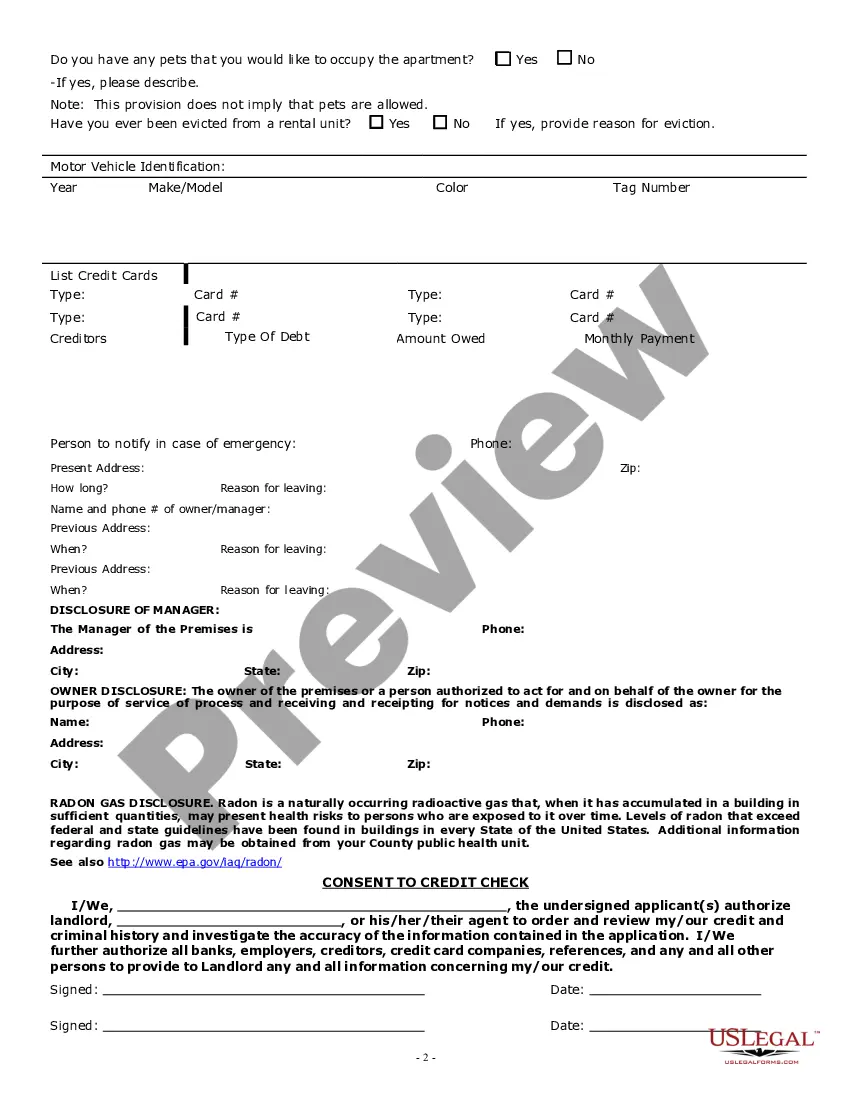

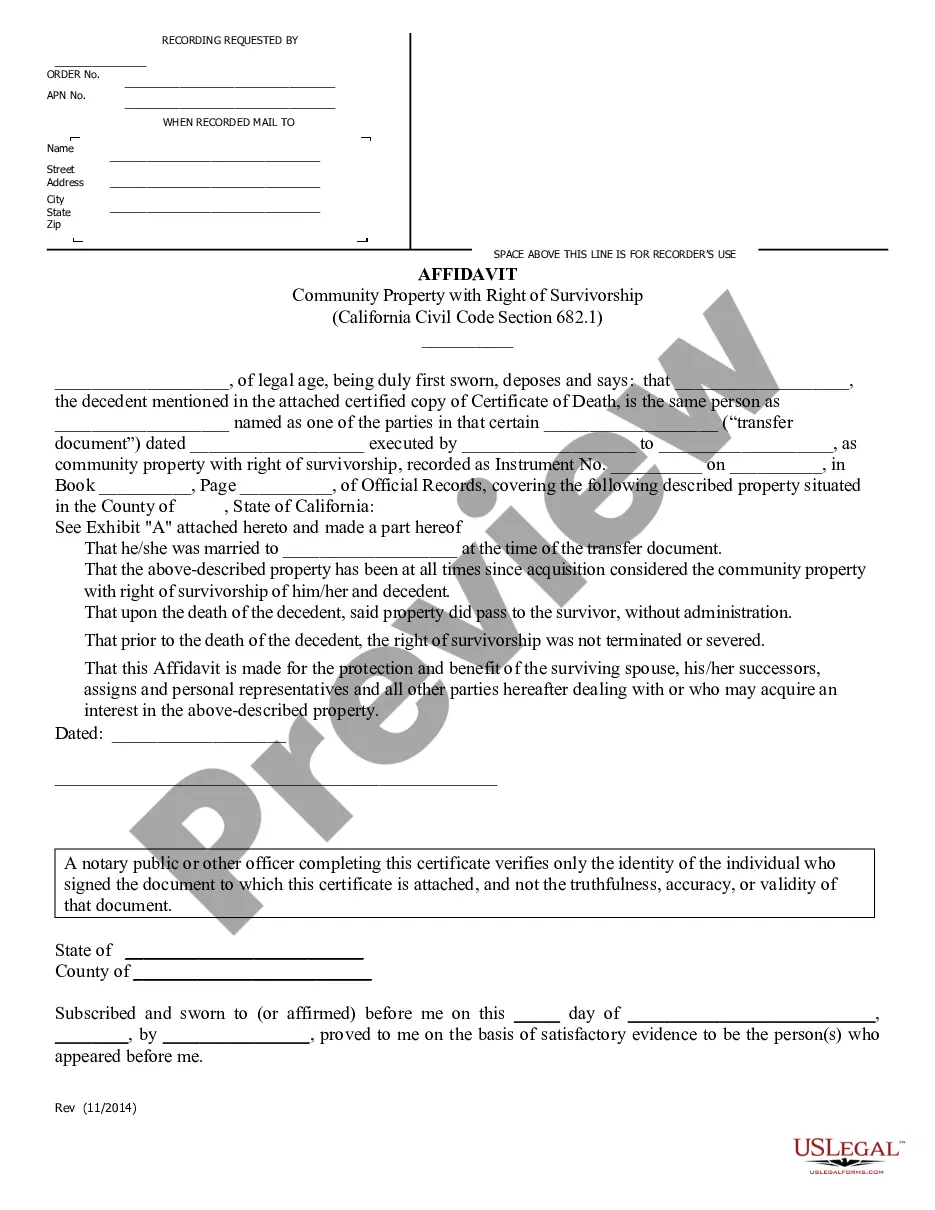

This Apartment Lease Rental Application Questionnaire form is an Apartment Lease Application for the Landlord to have the proposed Tenant complete and submit to the Landlord for the Landlord to evaluate. It contains the required disclosures and an authorization for release of information.

Rental Application Form Virginia Withholding

Description

How to fill out Rental Application Form Virginia Withholding?

How to obtain professional legal documents that adhere to your state's regulations and prepare the Rental Application Form Virginia Withholding without consulting a lawyer.

Numerous online services provide templates to address various legal scenarios and formal requirements. However, it may require some time to assess which of the accessible samples meet both your use case and legal standards.

US Legal Forms is a dependable service that assists you in locating formal paperwork created according to the latest state law amendments and helps you save on legal fees.

If you do not possess an account with US Legal Forms, follow the instructions below: Review the webpage you have opened and ascertain if the form meets your requirements. To do so, utilize the form description and preview options if available. Search for another template using the header pertaining to your state if necessary. Click the Buy Now button upon finding the relevant document. Choose the most appropriate pricing plan, then either sign in or register for an account. Select the payment option (by credit card or via PayPal). Change the file format for your Rental Application Form Virginia Withholding and click Download. The obtained documents are yours to keep: you can always revisit them in the My documents section of your profile. Subscribe to our library and create legal documents independently like a seasoned legal professional!

- US Legal Forms is not just an ordinary online library.

- It is a repository of over 85,000 validated templates for various business and personal contexts.

- All documents are categorized by field and state to expedite your search process.

- Moreover, it integrates with robust solutions for PDF editing and eSignature, enabling users with a Premium subscription to conveniently complete their documentation online.

- It requires minimal time and effort to acquire the needed paperwork.

- If you already have an account, Log In and verify that your subscription is active.

- Download the Rental Application Form Virginia Withholding using the appropriate button next to the file name.

Form popularity

FAQ

What Pay is Subject to Withholding. Your regular pay, commissions and vacation pay. Reimbursements and other expense allowances paid under a non-accountable plan. Pensions, bonuses, commissions, gambling winnings and certain other income.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2.

Virginia law conforms to the federal definition of income subject to withholding. Virginia withholding is generally required on any payment for which federal withholding is required. This includes most wages, pensions and annuities, gambling winnings, vacation pay, bonuses, and certain expense reimbursements.

Change Your WithholdingComplete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer.Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer.Make an additional or estimated tax payment to the IRS before the end of the year.

In general, an employer who pays wages to one or more employees in Virginia is required to deduct and withhold state income tax from those wages. Since Virginia law substantially conforms to federal law, if federal law requires an employer to withhold tax from any payment, we also require Virginia withholding.