Gift Real Grantor Blank With A Certificate

Description

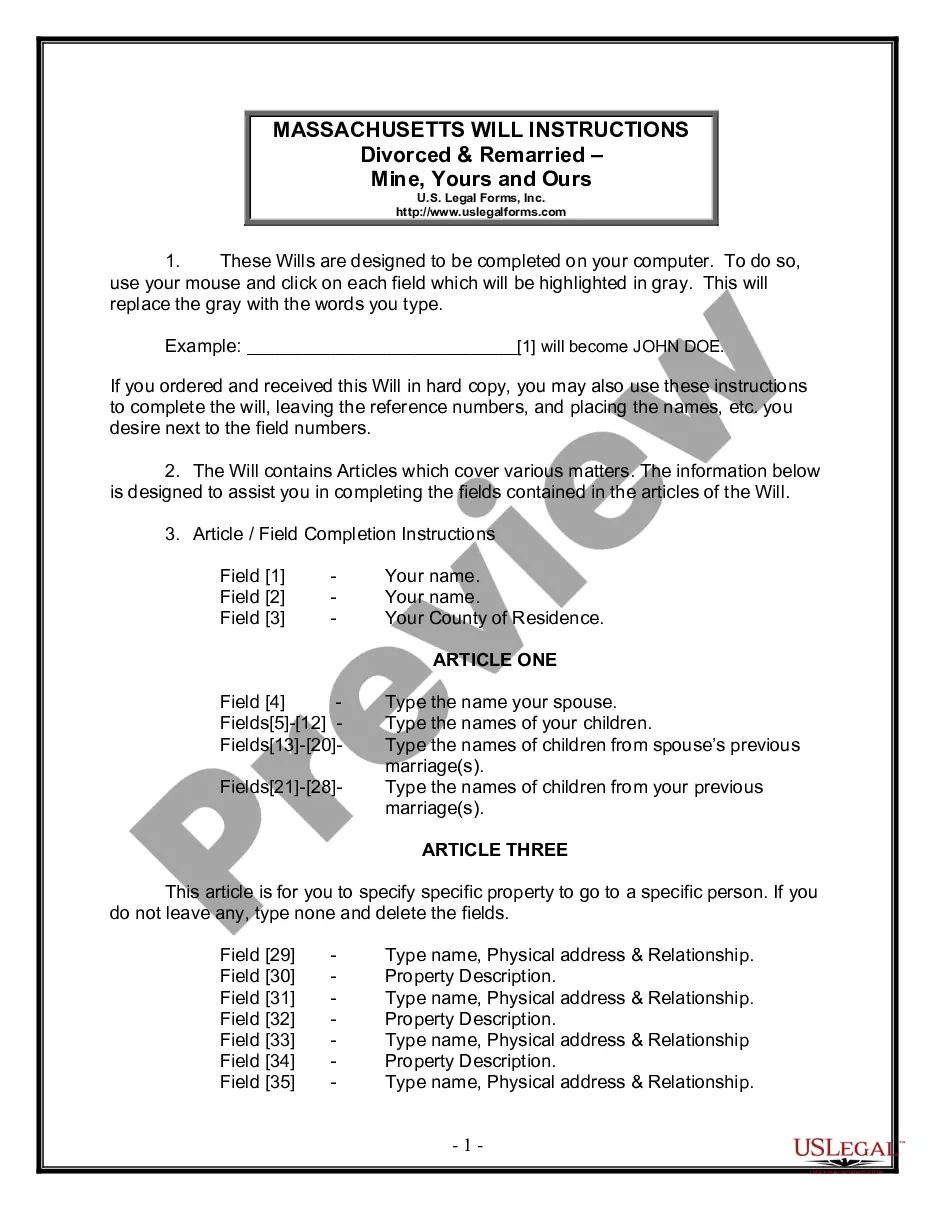

How to fill out Virginia Deed Of Gift?

- If you are an existing user, log in to your account and locate the required template. Ensure your subscription is active; if not, renew it as per your plan.

- If this is your first time using US Legal Forms, start by reviewing the Preview mode and form descriptions to select the appropriate document that aligns with your needs and local legal requirements.

- Should you encounter any inconsistencies, utilize the Search tab to find a suitable alternative template. Once you find the right one, proceed to purchase.

- Initiate the purchase by clicking on the Buy Now button and selecting a subscription plan that fits your preferences. An account registration will grant you access to the document library.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Once the transaction is confirmed, download the form directly to your device. You can always revisit and access it later via the My Forms section of your profile.

By following these steps, you will successfully gift a real grantor blank with a certificate. US Legal Forms ensures you have access to over 85,000 vetted and easily adjustable legal forms, empowering you to handle your legal documents without hassle.

Start exploring the US Legal Forms library today and make your legal document processes seamless!

Form popularity

FAQ

Yes, you can create a quitclaim deed yourself, but it requires attention to detail. Using a template from a reliable platform like uslegalforms can simplify this process and ensure you include all necessary information. A Gift real grantor blank with a certificate is often recommended for clarity and can aid in the successful execution of your deed.

To prove funds gifted, you should maintain a clear paper trail that includes the gift letter and bank statements reflecting the transfer. The gift letter is essential, as it verifies the relationship between the donor and the recipient. Also, consider recording the transaction details using a Gift real grantor blank with a certificate, which adds a level of official documentation to your claim.

To document gift funds, you will need a gift letter that outlines the amount and the intent of the gift. This letter should also include the donor's name, relationship to you, and their contact information. Additionally, you may need to provide bank statements showing the transfer of funds. Using a Gift real grantor blank with a certificate can help formalize this process and ensure all necessary details are captured.

To document a gift for the IRS, include necessary details such as the recipient's name, the date of the gift, and the value of the gift. Utilizing a gift real grantor blank with a certificate provides an official record, which should help you through any potential audits or inquiries from the IRS.

You cannot write off a gift certificate as a tax deduction if it is given as a personal gift. However, if the gift serves a business purpose, it may qualify for a deduction. Always keep documentation, like a gift real grantor blank with a certificate, to support your claims.

As of now, IRS Form 709 cannot be filed electronically. You will need to print the form and send it by mail to the IRS. To make the process smoother, using a gift real grantor blank with a certificate is advisable, as it can facilitate accurate reporting.

Yes, you can file Form 709 separately from your tax return. The IRS allows this form to be submitted independently, which can be beneficial for tracking substantial gifts. A gift real grantor blank with a certificate can help ensure that your filing is accurate and up to date.

Generally, the recipient of a gift does not have to report it to the IRS unless the gift is above a certain threshold. However, staying informed about the gift's value is important in case taxes are applicable. Using a gift real grantor blank with a certificate can simplify this process for both parties involved.

To document gifts out of income, keep a detailed record of the amounts given and the dates they were handed over. It's important to create a paper trail that includes any relevant forms or certificates, such as a gift real grantor blank with a certificate. This documentation ensures transparency and compliance with tax regulations.

Documenting a gift for tax purposes involves making records of the gift's value and the recipient's information. You should retain copies of any paperwork, especially if you are using a gift real grantor blank with a certificate. This way, both you and the IRS have clear documentation if questions arise.