Va Law Codes For 401k

Description

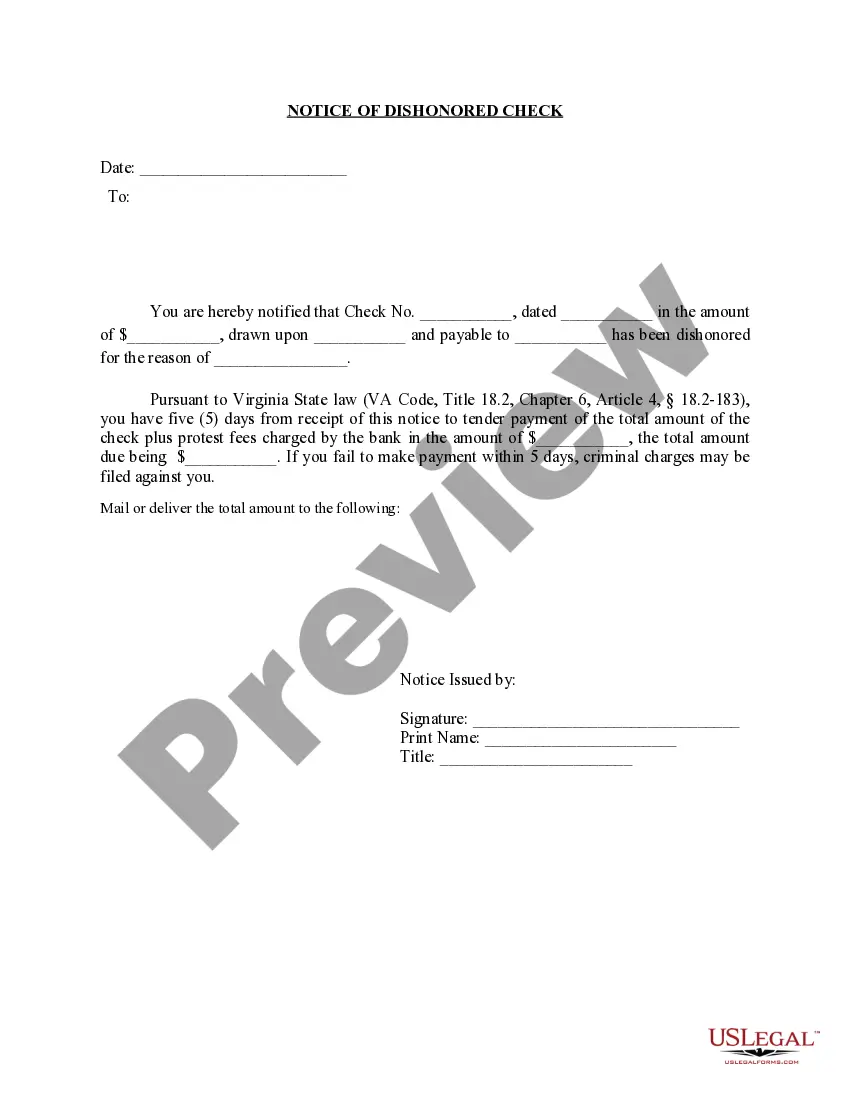

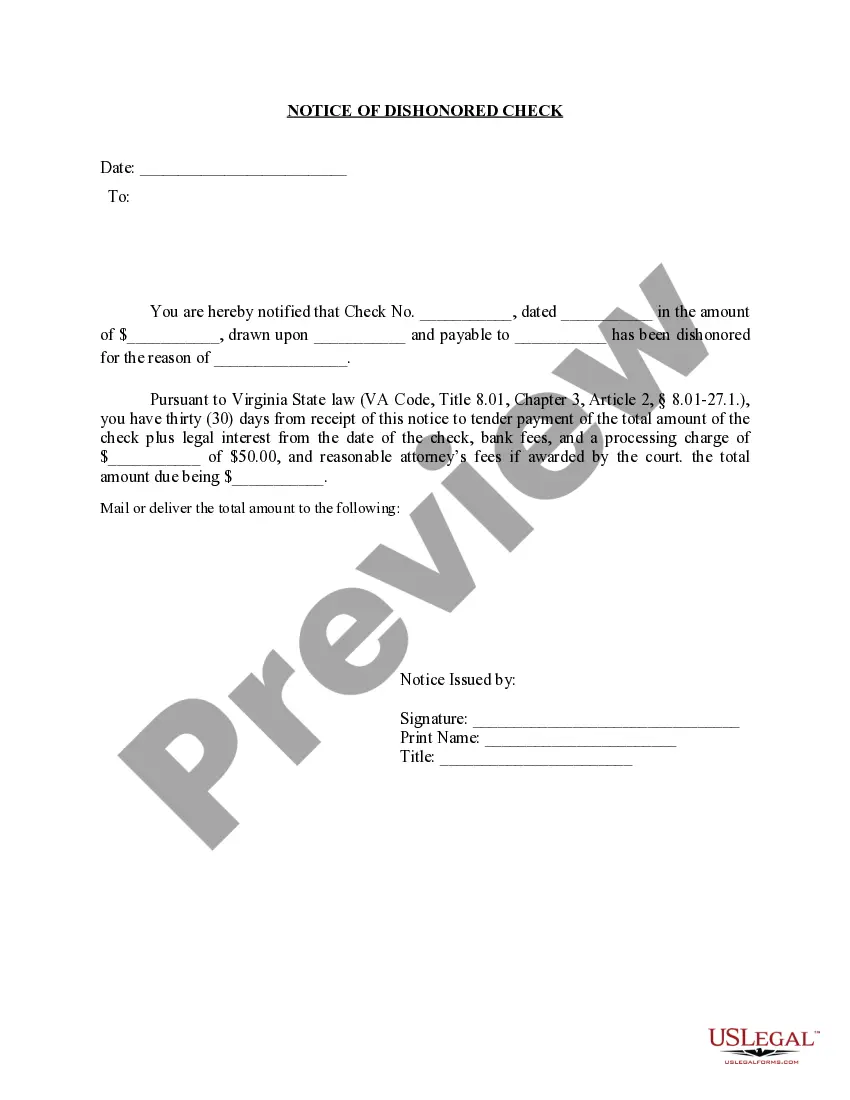

How to fill out Virginia Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

It’s clear that you cannot become a legal expert instantly, nor can you learn how to swiftly draft Va Law Codes For 401k without having a specialized skill set.

Compiling legal documents is a labor-intensive task that necessitates particular training and expertise. So why not entrust the formulation of the Va Law Codes For 401k to the experts.

With US Legal Forms, one of the most comprehensive legal document collections, you can find everything from court documents to templates for in-office correspondence.

You can regain access to your documents from the My documents section at any time.

If you’re a current client, you can simply Log In, and find and download the template from the same section. Regardless of the reason for your forms—be it financial, legal, or personal—our website has everything you need. Try US Legal Forms today!

- Find the form you need using the search bar at the top of the page.

- Examine it (if this choice is available) and read the accompanying description to determine if Va Law Codes For 401k is what you’re looking for.

- Begin your search anew if you require a different template.

- Create a complimentary account and select a subscription plan to purchase the template.

- Select Buy now. Once the purchase is finished, you can access the Va Law Codes For 401k, complete it, print it, and send or mail it to the necessary individuals or organizations.

Form popularity

FAQ

A traditional section 401(k) plan allows employees to make pre-tax contributions without an employer requirement for matching contributions. In contrast, a section 401(k) plan as part of a savings incentive match plan for employees simple plan requires employers to match employee contributions, providing an added incentive for savings. Both options have distinct benefits, so it's essential to review Va law codes for 401k for detailed compliance. Understanding these differences can help you choose the plan that best suits your retirement goals.

Rule . ? All final judgments, orders, and decrees, irrespective of terms of court, remain under the control of the trial court and may be modified, vacated, or suspended for twenty-one days after the date of entry, and no longer.

Five days' notice is required to the opposing party and the court. Motions may be typed by either party, may be filed on the General Notice and Motion Form or may be filed on one of the appropriate forms provided by the Supreme Court of Virginia (located here).

Motions may be filed for the same purposes recognized by the courts of record in the Commonwealth. Unless otherwise ordered by the commission, any response to a motion must be filed within 14 days of the filing of the motion, and any reply by the moving party must be filed within 10 days of the filing of the response.

A hearing shall be held by the court, as provided herein, and the court shall rule on any such motions not later than forty-five days after the date of judgment, not including the date of entry of such judgment.

Upon a properly filed petition, the court will usually issue the ?Rule to Show Cause? commanding the defaulting party to appear at a scheduled court hearing and demonstrate why he or she should not adjudged to be in contempt and then compelled to comply to take or not take certain action.