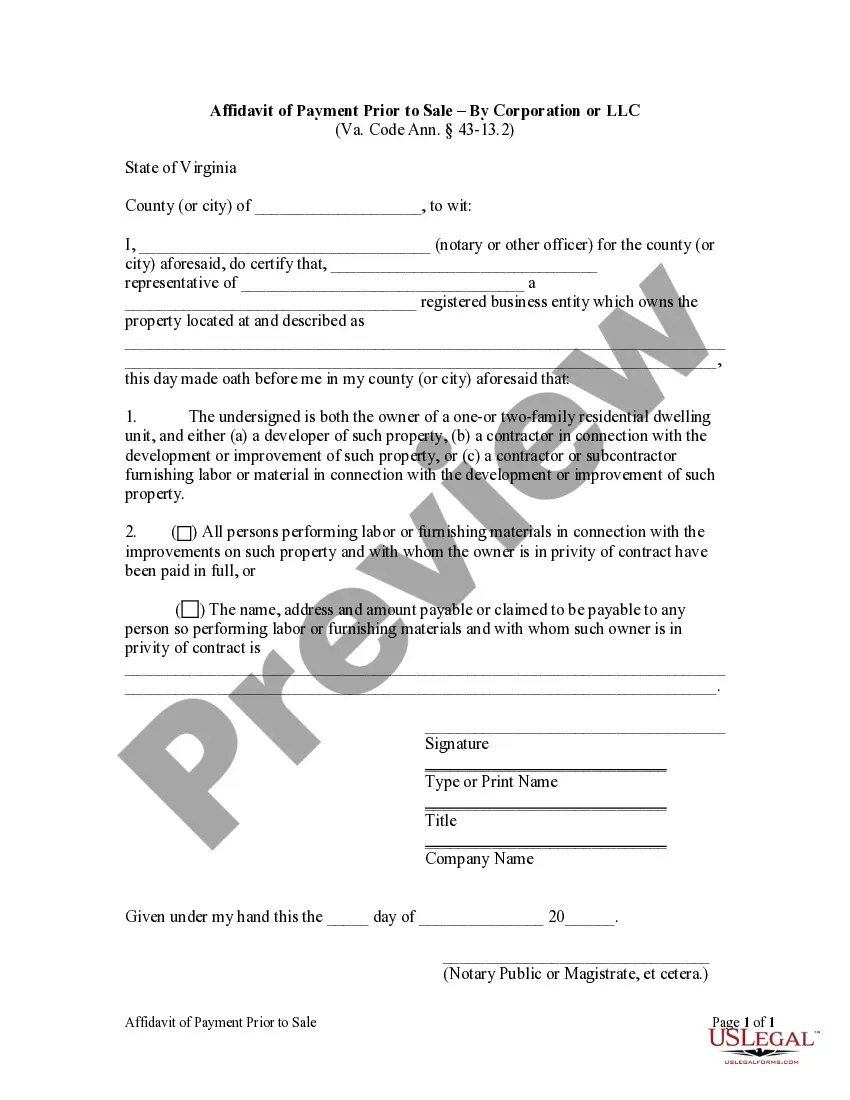

A person who is both the owner of a one- or two-family residential dwelling unit and either a developer of such property, a contractor in connection with the development or improvement of such property or a contractor or subcontractor furnishing labor or material in connection with the development or improvement of such property shall, at the time of settlement on the sale of such property, provide the purchaser with an affidavit stating either (i) that all persons performing labor or furnishing materials in connection with the improvements on such property and with whom such owner is in privity of contract have been paid in full or (ii) the name, address and amount payable or claimed to be payable to any person so performing labor or furnishing materials and with whom such owner is in privity of contract.

Virginia Payment Corporation Form 500

Description

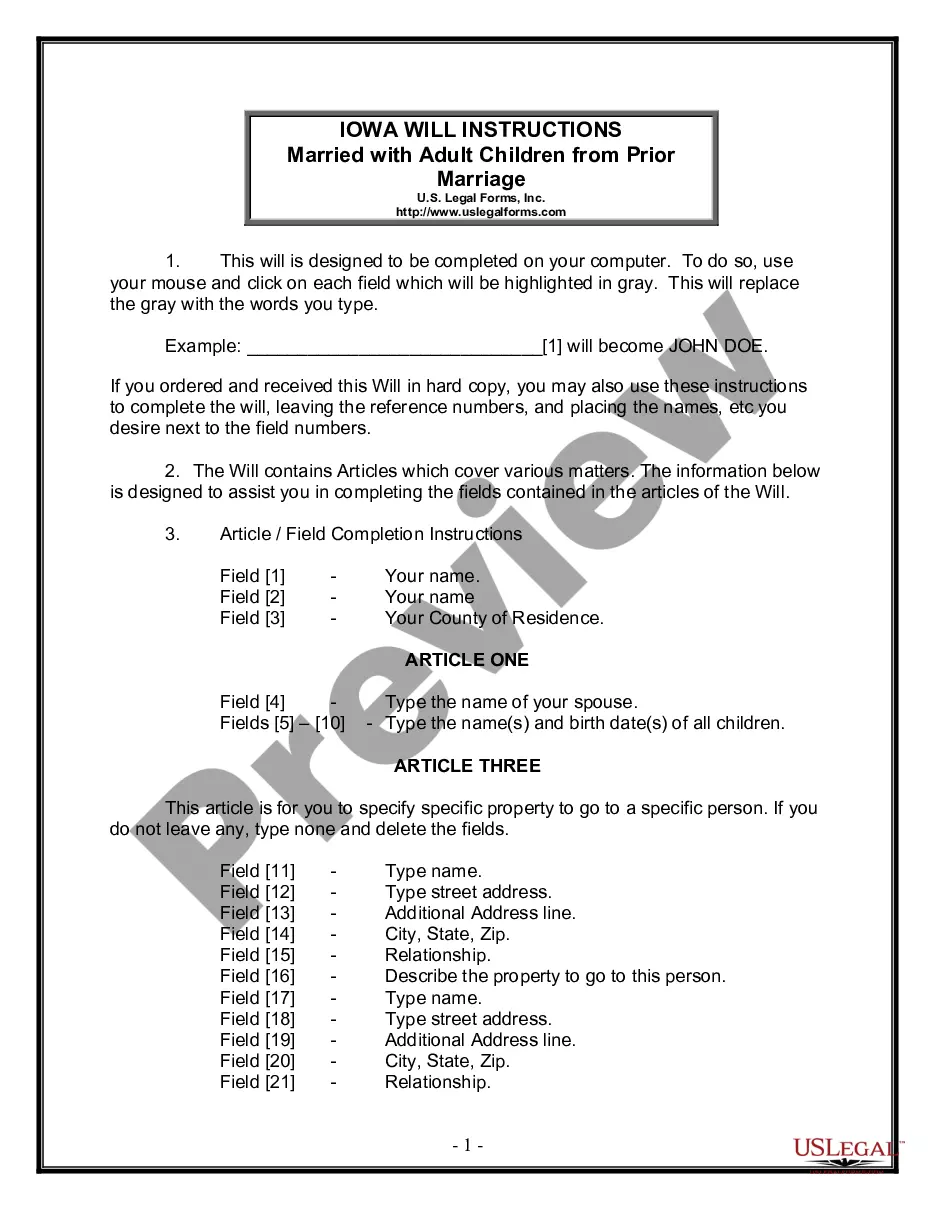

How to fill out Virginia Payment Corporation Form 500?

How to locate professional legal documents that adhere to your state regulations and create the Virginia Payment Corporation Form 500 without seeking an attorney's help.

Numerous online services provide templates for diverse legal scenarios and formal processes. However, it may require time to determine which of the provided samples fulfill both your use case and legal criteria.

US Legal Forms is a reliable platform that assists you in finding official documents crafted in accordance with the latest updates to state laws, helping you save on legal fees.

If you do not possess an account with US Legal Forms, follow the steps below: Browse the webpage you've accessed and review if the form meets your requirements. To achieve this, use the form description and preview options if available. Look for another template in the header specifying your state if necessary. Press the Buy Now button once you locate the correct document. Select the most suitable pricing plan, then Log In or establish an account. Choose the payment method (by credit card or through PayPal). Adjust the file format for your Virginia Payment Corporation Form 500 and click Download. The acquired documents remain yours: you can always revisit them in the My documents section of your profile. Subscribe to our platform and prepare legal papers independently like a seasoned legal professional!

- US Legal Forms is not just an ordinary online directory.

- It is an assembly of over 85k authenticated templates for a variety of business and personal situations.

- All documents are categorized by sector and state to streamline your search experience.

- Moreover, it connects with advanced solutions for PDF modification and electronic signatures, allowing Premium subscribers to effortlessly finalize their paperwork online.

- Acquiring the necessary documentation requires minimal time and effort.

- If you have an existing account, sign in and verify that your subscription is active.

- Download the Virginia Payment Corporation Form 500 using the relevant button next to the file title.

Form popularity

FAQ

You can obtain Virginia state tax forms directly from the Virginia Department of Taxation’s official website. The website provides access to all necessary forms, including the Virginia payment corporation form 500, which is essential for various filings. Additionally, you can check local government offices for physical copies if you prefer to fill them out by hand. Having the correct forms readily available simplifies the filing process.

Individuals who earn income from Virginia sources, whether they reside in the state or are non-residents, must file a Virginia income tax return. This filing requirement also applies if you receive income from a partnership or a business operating in Virginia. Make sure to consult the Virginia payment corporation form 500 as it can provide significant insights regarding your tax obligations. Understanding your filing needs can help you prepare more effectively.

If you're looking to file GA form 500, it’s crucial to know your filing location. For Virginia, you can submit this form through the Virginia Department of Taxation’s website or by mail to the designated address. Ensure that you have the Virginia payment corporation form 500 ready, as it is fundamental for smooth processing. Following the correct procedures is vital to avoid delays.

A Virginia fiduciary tax return must be filed by estates or trusts that generate income taxable in Virginia. This requirement applies if the estate or trust has its residency in Virginia or realizes income sourced from Virginia. To fulfill this obligation, you may need to complete the Virginia payment corporation form 500. Proper filing helps in managing your tax responsibilities effectively.

In Virginia, any partnership doing business within the state must file a Virginia partnership return. This includes partnerships that have income from Virginia sources or those that operate in Virginia. It’s essential to complete the Virginia payment corporation form 500 as part of your filing process. Using the appropriate forms ensures compliance with state tax regulations.

In Virginia, LLCs may elect to be taxed as S Corporations if they meet specific criteria set forth by the IRS. This election allows LLC owners to benefit from pass-through taxation, avoiding double taxation on income. However, filing requirements will change based on this selection, which includes filing Form 500 for Virginia. For expert guidance on this process and the Virginia payment corporation form 500, consider utilizing US Legal Forms for a smoother experience.

Corporations that meet specific qualifications may be exempt from Virginia income tax. Primarily, these include non-profits that operate exclusively for educational, religious, or charitable purposes. Furthermore, mutual insurance companies and certain government entities may also claim exemption. For help determining your eligibility and understanding the qualifications relating to the Virginia payment corporation form 500, US Legal Forms is a valuable tool.

Schedule 500ADJ is used to report adjustments to income, deductions, and credits for corporations filing Virginia Form 500. This schedule helps corporations reconcile differences between federal and state tax calculations. By providing accurate information on this schedule, corporations can ensure they are reporting correctly to avoid penalties. If you are navigating these forms, check out US Legal Forms for detailed assistance with the Virginia payment corporation form 500.

Virginia Form 500 is required to be filed by corporations that conduct business in the state or generate income sourced from Virginia. This includes domestic corporations, foreign corporations, and those that have a physical presence in the state. Even if a corporation is exempt from income tax, it may still need to file this form for compliance. For clear guidance on completing the Virginia payment corporation form 500, US Legal Forms can be an excellent resource.

In Virginia, corporations that engage in activities directly related to their exempt purpose may be exempt from income tax. This typically includes charities and entities that provide social services. Additionally, if a corporation operates exclusively for exempt purposes, it may be eligible for exemption as well. You can find more details about these exemptions and filing the Virginia payment corporation form 500 through US Legal Forms.