Gift Deed Format For Movable Property

Description

How to fill out Virginia Deed Of Gift - Husband And Wife Or Two Individuals To Indvidual?

Acquiring legal templates that comply with federal and state laws is crucial, and the web provides numerous choices to select from.

However, what is the use of spending time searching for the appropriate Gift Deed Format For Movable Property example online when the US Legal Forms digital library already has such templates gathered in one location.

US Legal Forms is the largest online legal repository with over 85,000 fillable templates created by lawyers for any business and personal situation. They are easy to navigate with all documents categorized by state and purpose of use.

Search for another example using the search tool at the top of the page if needed. Click Buy Now when you have found the right form and choose a subscription plan. Create an account or Log In and process a payment via PayPal or a credit card. Select the format for your Gift Deed Format For Movable Property and download it. All documents you discover through US Legal Forms are reusable. To re-download and complete previously obtained forms, access the My documents tab in your account. Take advantage of the most comprehensive and user-friendly legal document service!

- Our specialists keep up with legal updates, ensuring your documents are always current and compliant when obtaining a Gift Deed Format For Movable Property from our site.

- Acquiring a Gift Deed Format For Movable Property is simple and quick for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document sample you require in the appropriate format.

- If you are new to our site, follow the steps outlined below.

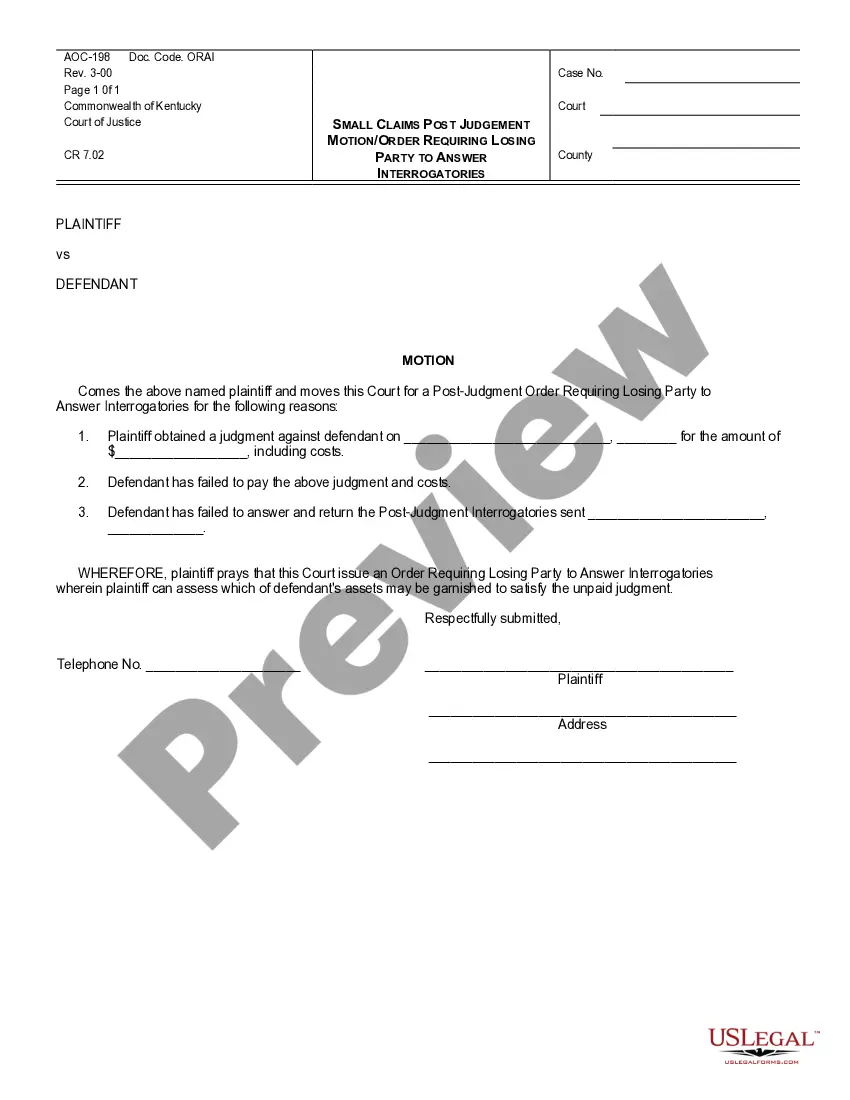

- Review the template using the Preview feature or through the text description to ensure it fulfills your requirements.

Form popularity

FAQ

The three requirements for a gift are the donor's intention to give, the delivery of the gift, and the recipient's acceptance. Each of these elements must be present for the gift to be legally valid. By utilizing a reliable gift deed format for movable property, you can effectively incorporate these requirements into your documentation.

Using a gift deed carries several risks, such as potential tax liabilities and challenges from other interested parties. There is also a risk of misunderstanding the terms of the gift if the deed is not correctly formatted. To reduce these risks, consider using a proper gift deed format for movable property, which can ensure clarity and legal protection.

The three main elements needed for a gift include intent, delivery, and acceptance. First, the giver must intend to make a gift. Next, the gift must be delivered to the recipient, and finally, the recipient must accept it. When using a gift deed format for movable property, ensure each of these elements is documented to avoid confusion.

Anyone with a legal interest in the property can challenge a gift deed. This includes previous owners, creditors, or family members who believe they have a claim on the movable property. Using an accurate gift deed format for movable property can help mitigate disputes by clearly outlining the terms of the gift.

To avoid tax on a gift deed, make sure the value of the gift falls under the annual exclusion limit set by the IRS. Additionally, using the correct gift deed format for movable property can help document the intent clearly, which may support tax exemptions. It is wise to consult a tax professional to navigate any potential tax implications effectively.

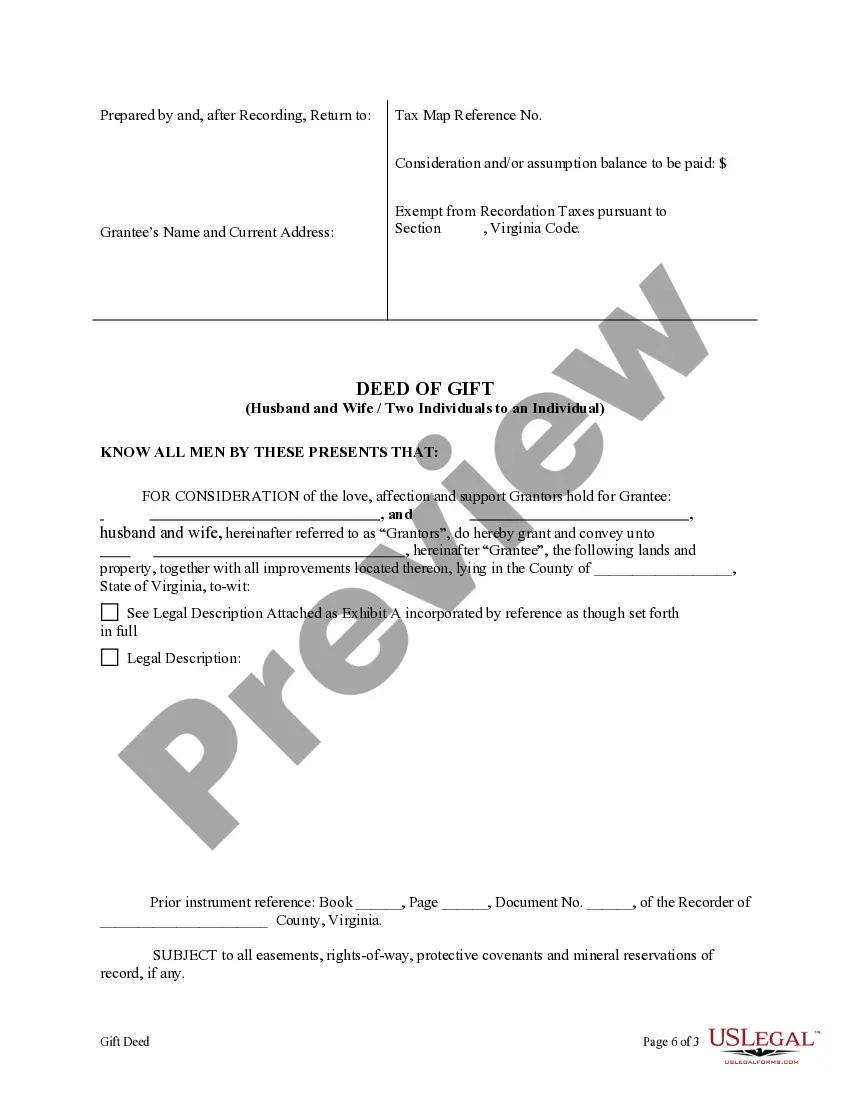

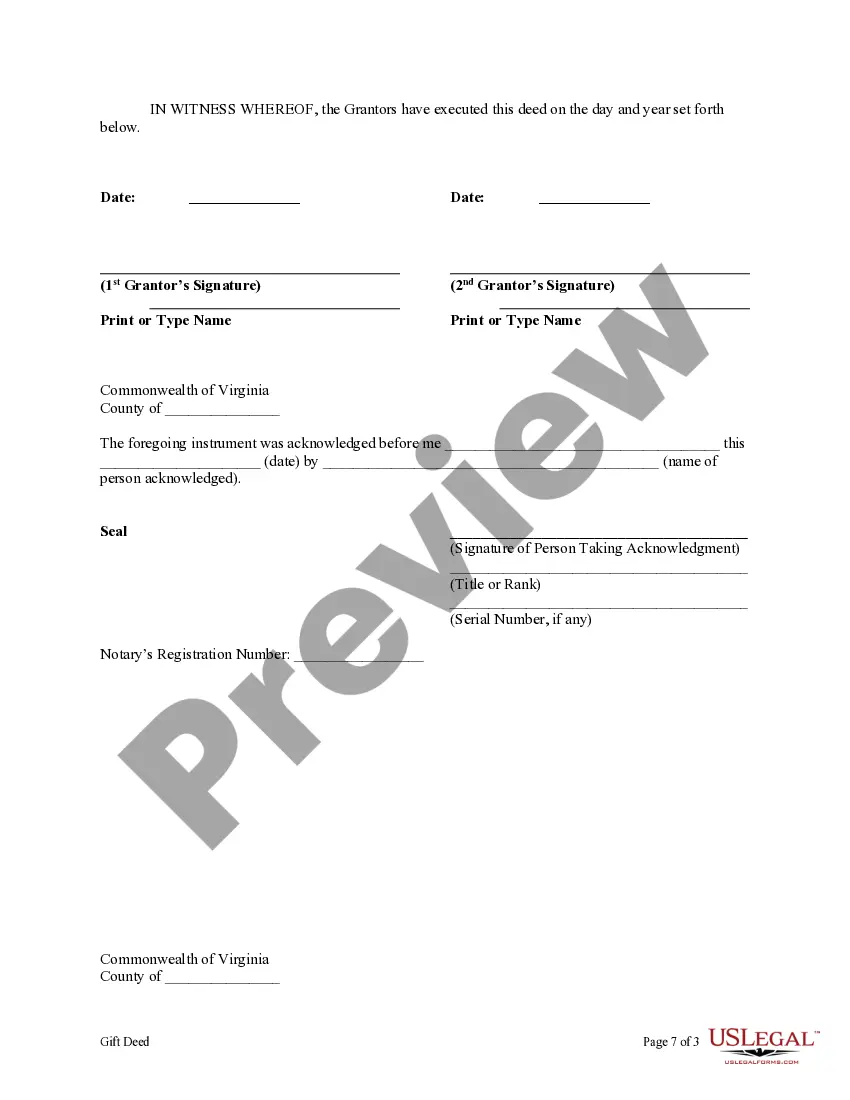

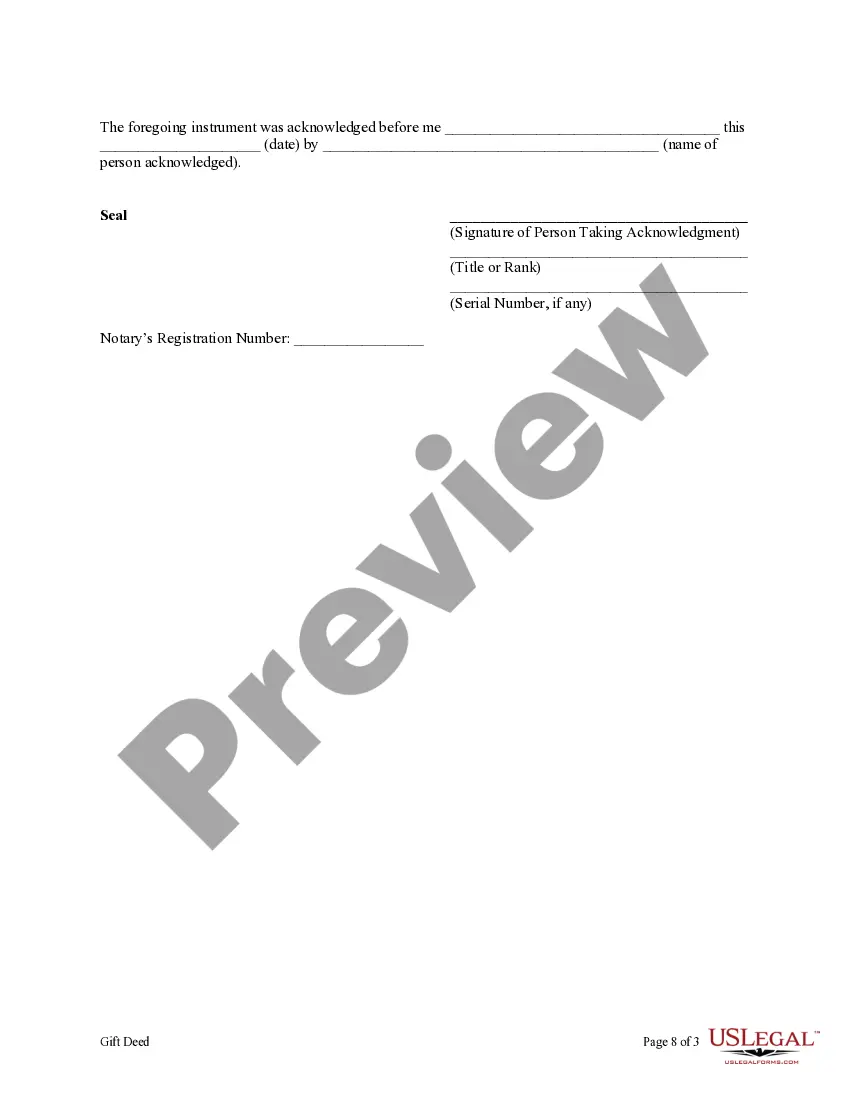

The gift deed format for movable property typically includes key components such as the names of the donor and recipient, a clear description of the property, and the intention to transfer ownership. It is important to include provisions for any conditions, if applicable, along with signature lines for witnesses. By using a standardized template, you can ensure that all necessary information is included, minimizing the risk of errors. US Legal Forms provides easy-to-use templates that simplify this process and ensure your gift deed meets all legal requirements.

Yes, a gift of immovable property can be given, but the process and documentation differ from movable property. It is essential to follow specific legal requirements, such as registration of the gift deed to make it valid. While this FAQ focuses on gift deed format for movable property, understanding the nuances of immovable property is crucial. For comprehensive guidance, US Legal Forms offers various templates and resources that can assist you in both scenarios.

When creating a gift deed format for movable property, many people overlook essential legal requirements. Common mistakes include failing to properly identify the donor and recipient, omitting necessary witness signatures, or not clearly describing the property being gifted. Additionally, neglecting to include terms regarding the transfer of ownership can lead to disputes later. To avoid these issues, consider using a reliable platform like US Legal Forms, which provides templates that ensure compliance with legal standards.

A letter of gift for personal property serves as a formal document that outlines the transfer of ownership from one individual to another. This letter typically includes important details such as the description of the movable property, the names of the donor and recipient, and the date of the transfer. By using an appropriate gift deed format for movable property, you can ensure that the transaction is legally recognized and clear to all parties involved. For those seeking assistance, USLegalForms offers a variety of templates that simplify the process of creating a gift deed.