Deed Of Gift Form For Vehicle

Description

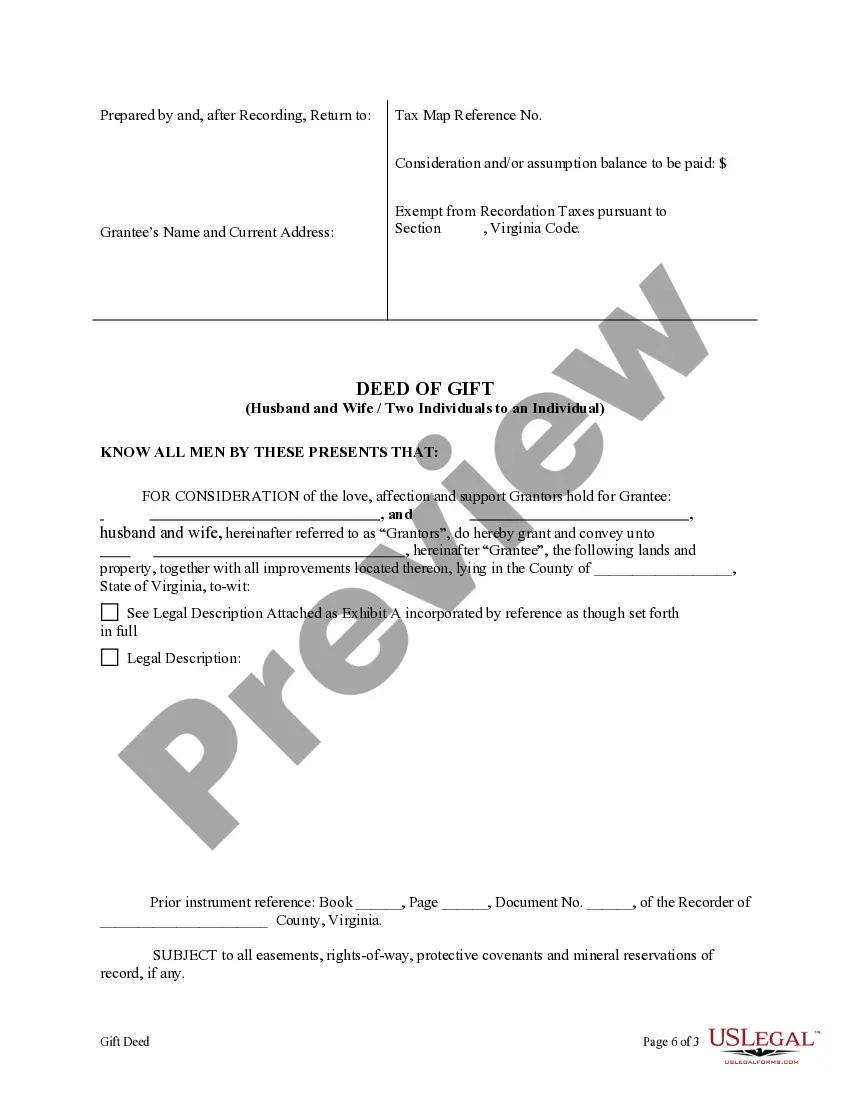

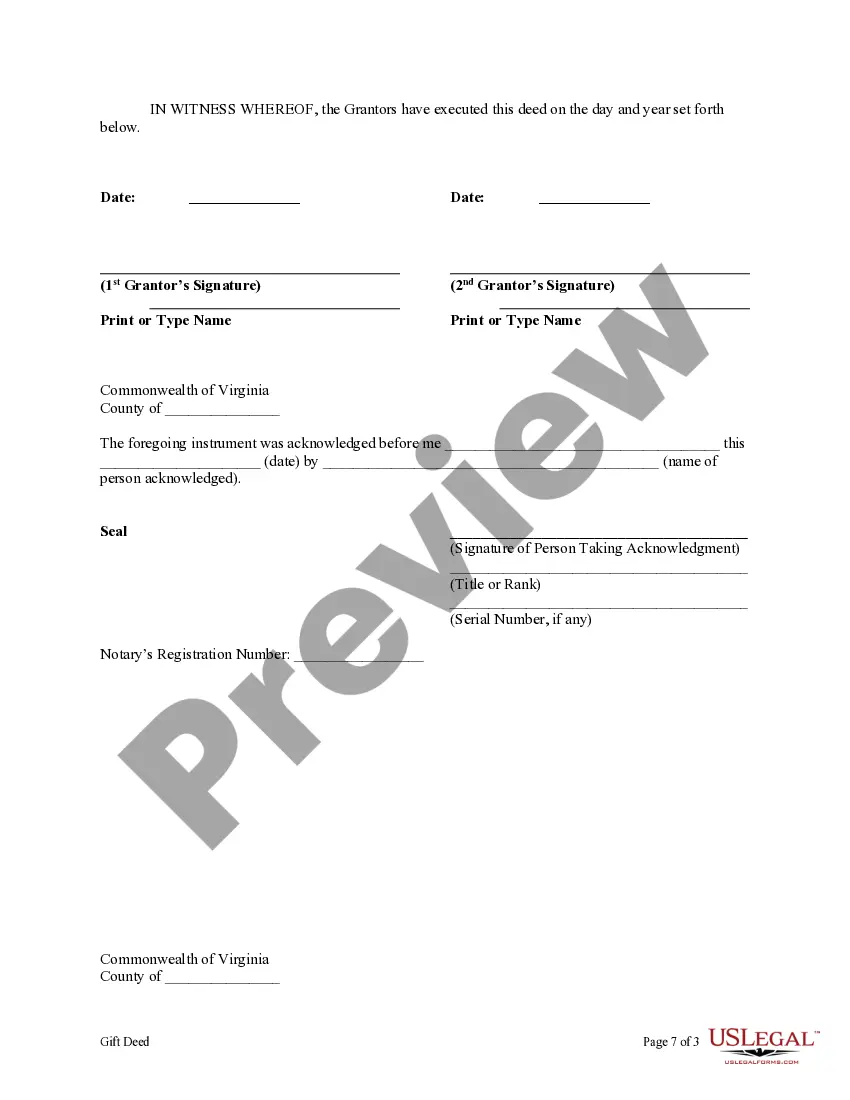

How to fill out Virginia Deed Of Gift - Husband And Wife Or Two Individuals To Indvidual?

Regardless of whether it is for corporate reasons or personal issues, everyone must handle legal matters at some stage in their life.

Filling out legal documents requires meticulous care, starting with choosing the appropriate form template. For example, if you select an incorrect version of the Deed Of Gift Form For Vehicle, it will be rejected upon submission. Thus, it is essential to find a reliable source of legal documents such as US Legal Forms.

With an extensive US Legal Forms directory available, you never have to waste time searching for the appropriate template online. Utilize the library’s straightforward navigation to find the correct form for any circumstance.

- Acquire the form you require using the search box or catalog browsing.

- Review the form’s description to confirm it suits your situation, state, and county.

- Click on the form’s preview to examine it.

- If it is not the correct form, return to the search feature to locate the Deed Of Gift Form For Vehicle template you need.

- Download the template if it aligns with your requirements.

- If you already possess a US Legal Forms account, click Log in to access previously saved templates in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the document format you prefer and download the Deed Of Gift Form For Vehicle.

- Once downloaded, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

Gifting Your Vehicle General Affidavit (Form 768) or a written statement indicating the vehicle was given as a gift. NOTE: The General Affidavit or statement does not have to be notarized. Lien Release (Form 4809), notarized, if applicable.

Any applicant for a vehicle title who claims that the vehicle was received by gift must submit a notarized Affidavit of Gift of Motor Vehicle or Boat (MVD-10018) in which both donor and recipient affirm under oath and under penalty of perjury that the vehicle was in fact transferred as a gift.

In addition to completing Form 130-U, Application for Texas Title and/or Registration (PDF), both the donor and person receiving the motor vehicle must complete a required joint notarized Form 14-317, Affidavit of Motor Vehicle Gift Transfer, describing the transaction and the relationship between the donor and ...

Use form DTF-802 (Statement of Transaction for Sales Tax) to show the purchase price of the vehicle or that the vehicle is a gift. The seller or donor completes the affidavit on page two of the form and gives the form to the new owner.

The donor and recipient must complete a joint notarized Affidavit of Motor Vehicle Gift Transfer (form 14-317) and must be filed in person by either the donor or recipient.