Trust Deed Form Without Consideration

Description

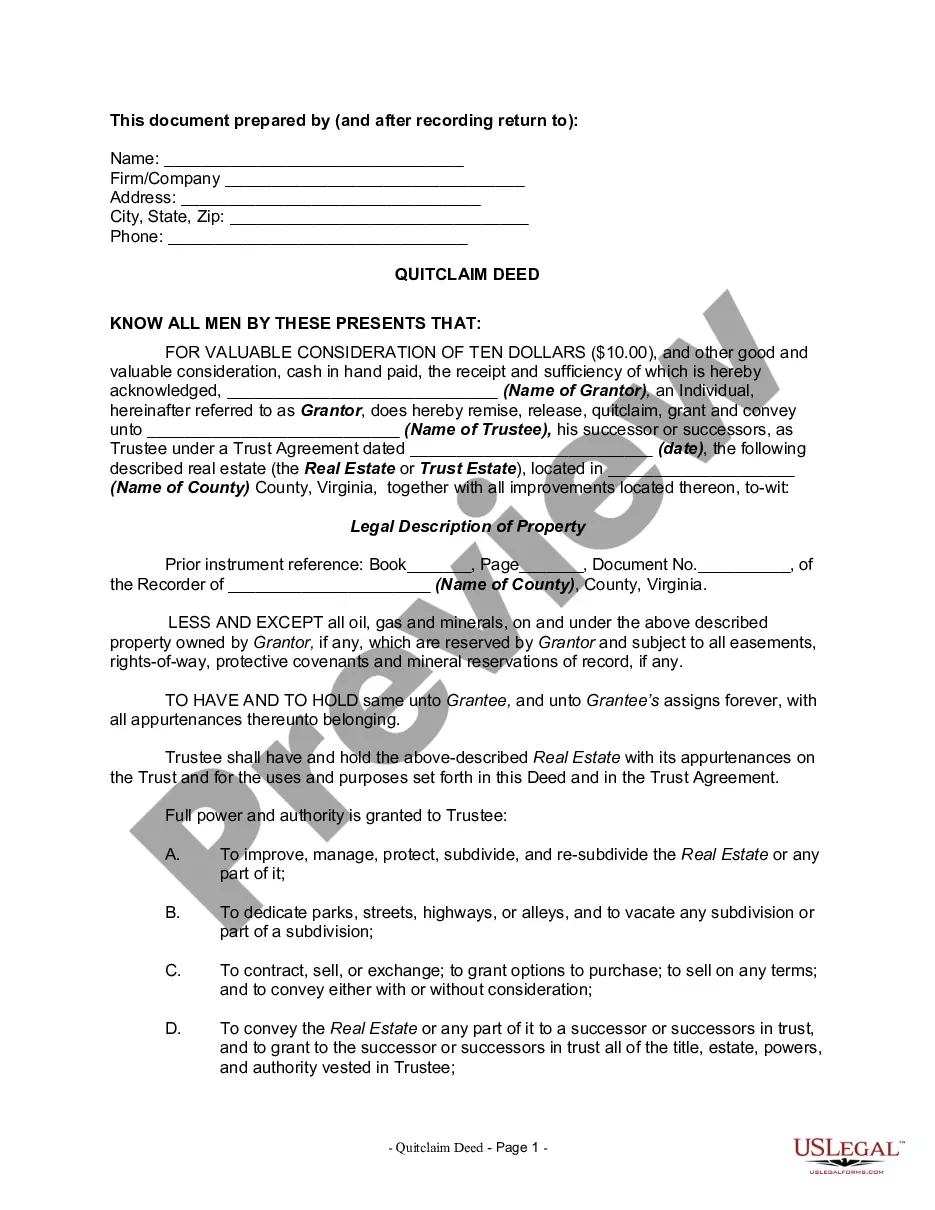

How to fill out Virginia Land Trust - Quitclaim Deed?

Administrative systems require meticulousness and exactness.

If you do not handle the completion of documents like Trust Deed Form Without Consideration regularly, it may lead to some confusions.

Choosing the correct example from the outset will guarantee that your document entry proceeds smoothly and avert any troubles of resending a file or repeating the same task from the start.

Obtaining the correct and current examples for your documentation is a matter of moments with an account at US Legal Forms. Eliminate the administrative uncertainties and simplify your form-related tasks.

- Acquire the required template using the search box.

- Verify that the Trust Deed Form Without Consideration you’ve found is pertinent to your state or area.

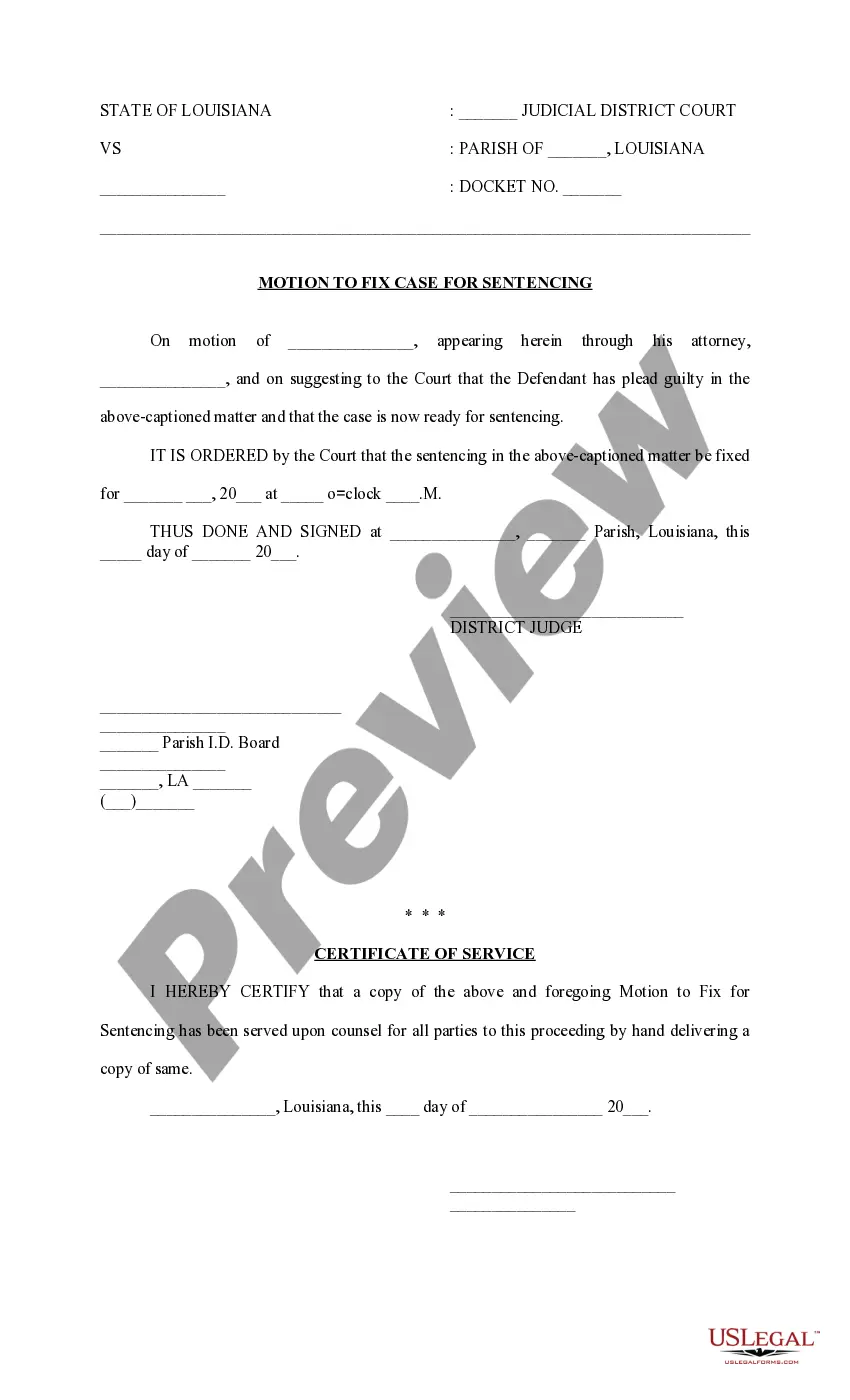

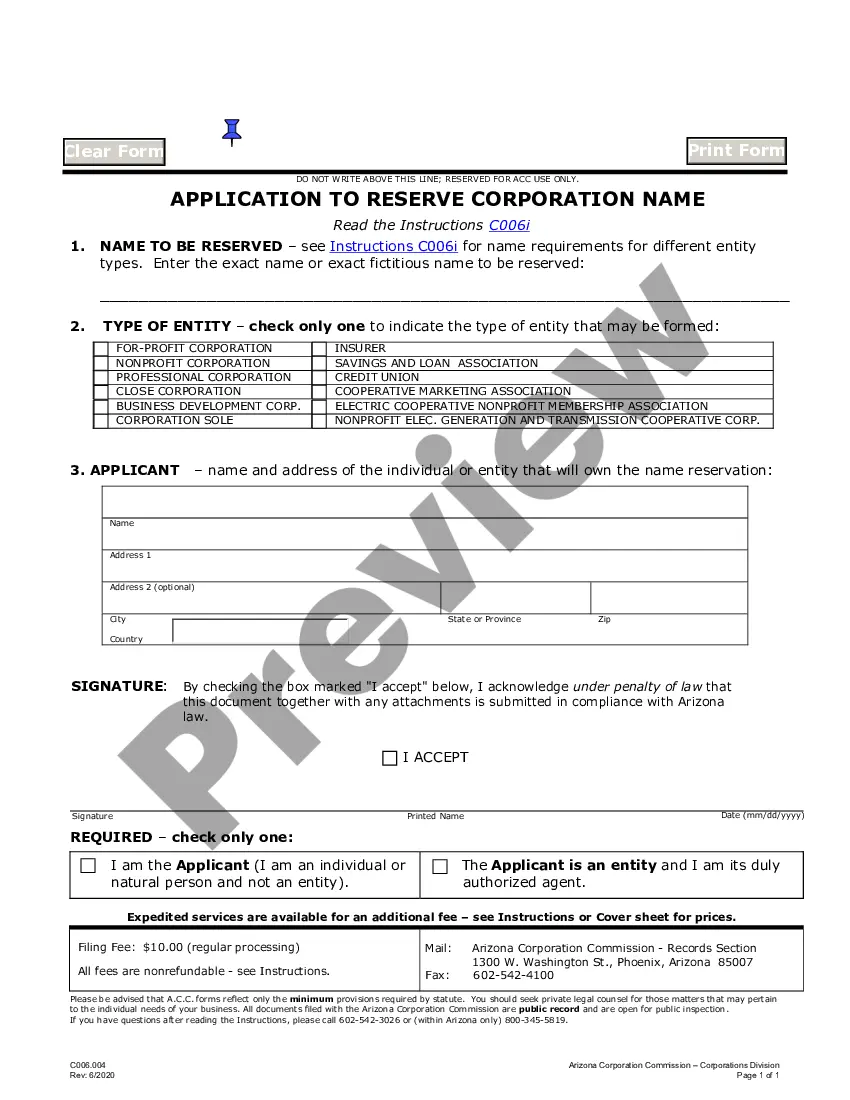

- Review the preview or examine the description that includes the specifics on how to utilize the template.

- When the result aligns with your search, click the Buy Now button.

- Select the suitable choice from the available pricing options.

- Log In to your account or create a new one.

- Finalize the purchase using a credit card or PayPal payment method.

- Download the form in the desired format.

Form popularity

FAQ

An invalid deed means it does not meet the legal requirements necessary to convey property rights. Common causes include lack of proper signatures, failure to properly notarize, or ambiguously stated terms. To avoid these pitfalls, using a reliable trust deed form without consideration is crucial, ensuring all legal requirements are met.

In California, the statute of limitations for enforcing a deed of trust is generally four years from the date of breach or default. Once this period lapses, the lender may lose the right to foreclose on the property. To maintain your rights, it is advisable to use a trust deed form without consideration to ensure proper execution and record-keeping.

A trust in California can be invalidated for various reasons, including lack of capacity, improper execution, or failure to meet legal requirements. If the terms of the trust are not clear or the intent of the creator is ambiguous, it may also lead to challenges. Utilizing a trust deed form without consideration can help ensure clarity and reduce potential disputes.

To create a valid deed of trust in California, you need the following elements: a clear description of the property, identification of the borrower and lender, and the required signatures of both parties. It's essential that the deed is notarized to ensure its authenticity. Additionally, using a trust deed form without consideration can streamline the process, making it more efficient and straightforward.

A deed without consideration may still hold legal validity, but it could be subject to challenges in court. Typically, such a deed is treated as a gift, which often requires specific formalities to be enforceable. Consulting with legal professionals or using the correct trust deed form without consideration from platforms like US Legal Forms is advisable to navigate this effectively.

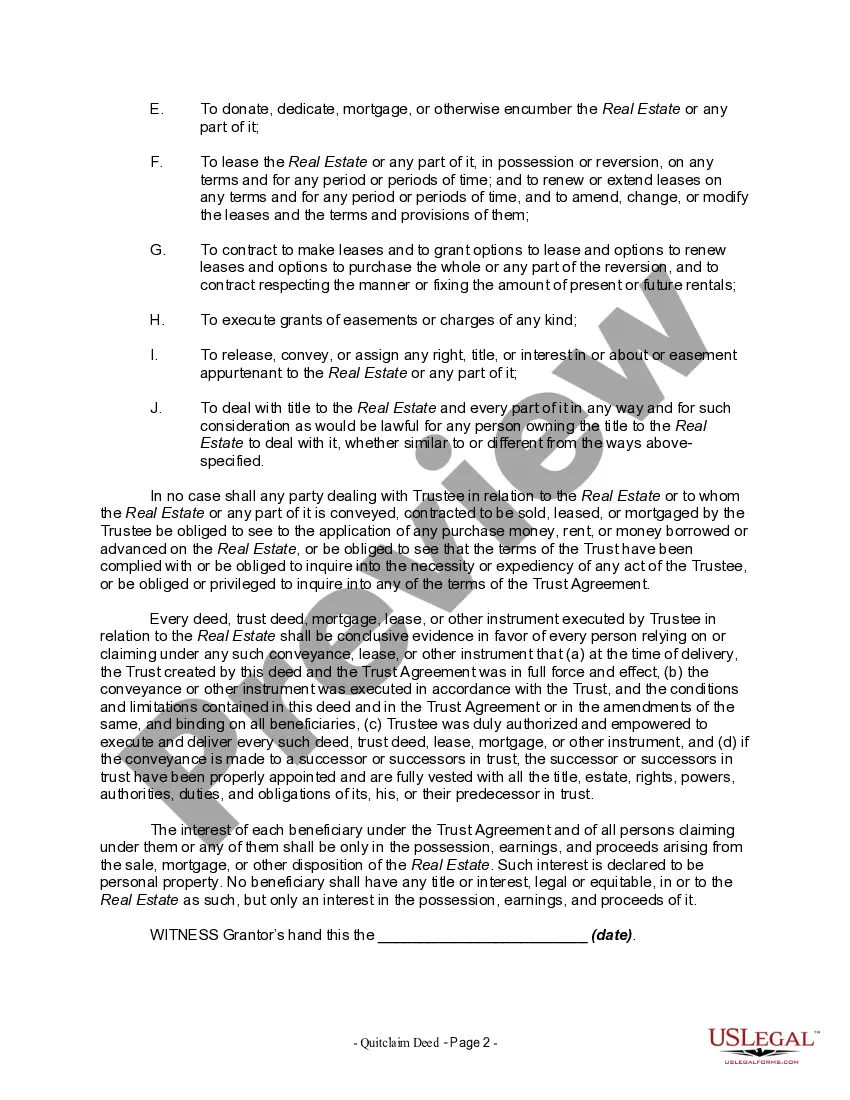

A trust is a fiduciary relationship where one party holds property for the benefit of another, while a trust deed is the legal document that establishes that trust. To clarify, the trust deed form without consideration serves as the blueprint that defines the arrangement and its terms. Understanding this distinction can help you manage your assets more effectively.

A trust deed form without consideration generally includes details such as the names of the trustor and trustee, the purpose of the trust, and the description of the property. Additionally, it should outline the powers and responsibilities of the trustee. Ensuring clarity in these sections helps prevent disputes later on.

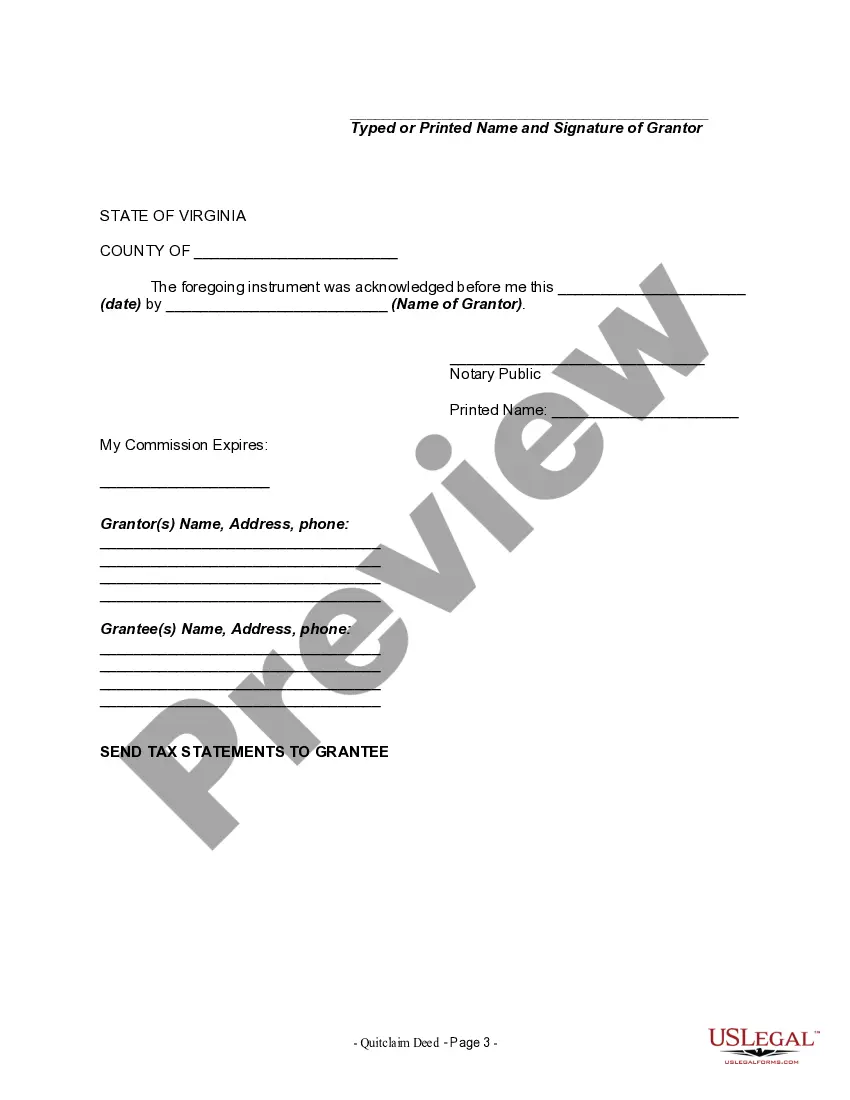

The main requirements for a trust deed form without consideration typically include the identification of the parties involved, a clear property description, and signatures of all relevant parties. Some states may also require notarization or witnesses to validate the deed. Always check your local regulations to ensure compliance.

To obtain a trust deed form without consideration, you can start by visiting reputable legal document platforms like US Legal Forms. These platforms often provide templates that are customizable according to your specific needs. After selecting the appropriate template, you can fill it out accordingly and ensure you include the necessary details that comply with your state laws.

A deed must meet several essential conditions to be valid. First, it must include the names of the grantor and grantee, describe the property, and be signed by the grantor. Additionally, the deed should be delivered to the grantee to demonstrate the grantor's intent to transfer ownership. When using a Trust deed form without consideration, be sure to follow these conditions to ensure your transaction is binding and legally sound.