Virginia Transfer On Death Deed Form For Trust

Description

How to fill out Virginia Revocable Transfer On Death Deed From Individual To Individual?

Legal management can be frustrating, even for knowledgeable professionals. When you are interested in a Virginia Transfer On Death Deed Form For Trust and don’t get the a chance to devote looking for the right and up-to-date version, the procedures might be stress filled. A robust online form library could be a gamechanger for anybody who wants to deal with these situations effectively. US Legal Forms is a market leader in online legal forms, with more than 85,000 state-specific legal forms available at any time.

With US Legal Forms, you are able to:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any requirements you might have, from individual to enterprise documents, in one location.

- Utilize advanced resources to accomplish and handle your Virginia Transfer On Death Deed Form For Trust

- Access a useful resource base of articles, guides and handbooks and resources related to your situation and requirements

Help save time and effort looking for the documents you need, and make use of US Legal Forms’ advanced search and Preview tool to get Virginia Transfer On Death Deed Form For Trust and acquire it. If you have a subscription, log in to your US Legal Forms profile, search for the form, and acquire it. Take a look at My Forms tab to find out the documents you previously saved and to handle your folders as you see fit.

Should it be the first time with US Legal Forms, create a free account and obtain unlimited access to all benefits of the library. Listed below are the steps for taking after downloading the form you need:

- Confirm it is the proper form by previewing it and reading its description.

- Be sure that the sample is acknowledged in your state or county.

- Choose Buy Now when you are all set.

- Choose a monthly subscription plan.

- Find the format you need, and Download, complete, sign, print and send your document.

Enjoy the US Legal Forms online library, backed with 25 years of experience and trustworthiness. Enhance your everyday document managing into a smooth and easy-to-use process today.

Form popularity

FAQ

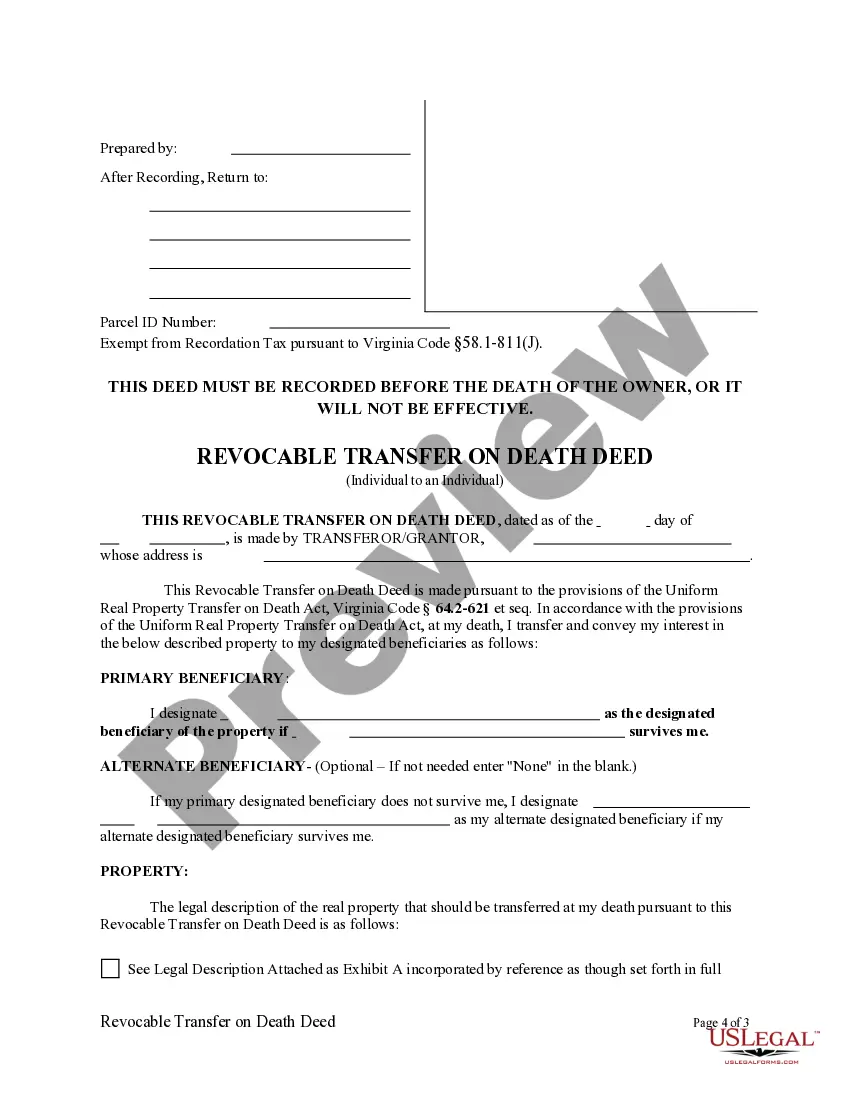

In Virginia, an owner of real property can transfer their ownership interest to one or more beneficiaries, effective upon their death, through a Transfer on Death Deed (?TOD Deed?). TOD Deeds automatically transfer ownership of the subject property directly to the designated beneficiaries upon the owner's death.

Invalidation and Probate The transfer on the death deed is rendered ineffective if the designated recipient passes away before the property owner. This could cause the property to enter probate without adequate planning or execution, negating the goal of using a transfer on the death deed to avoid probate.

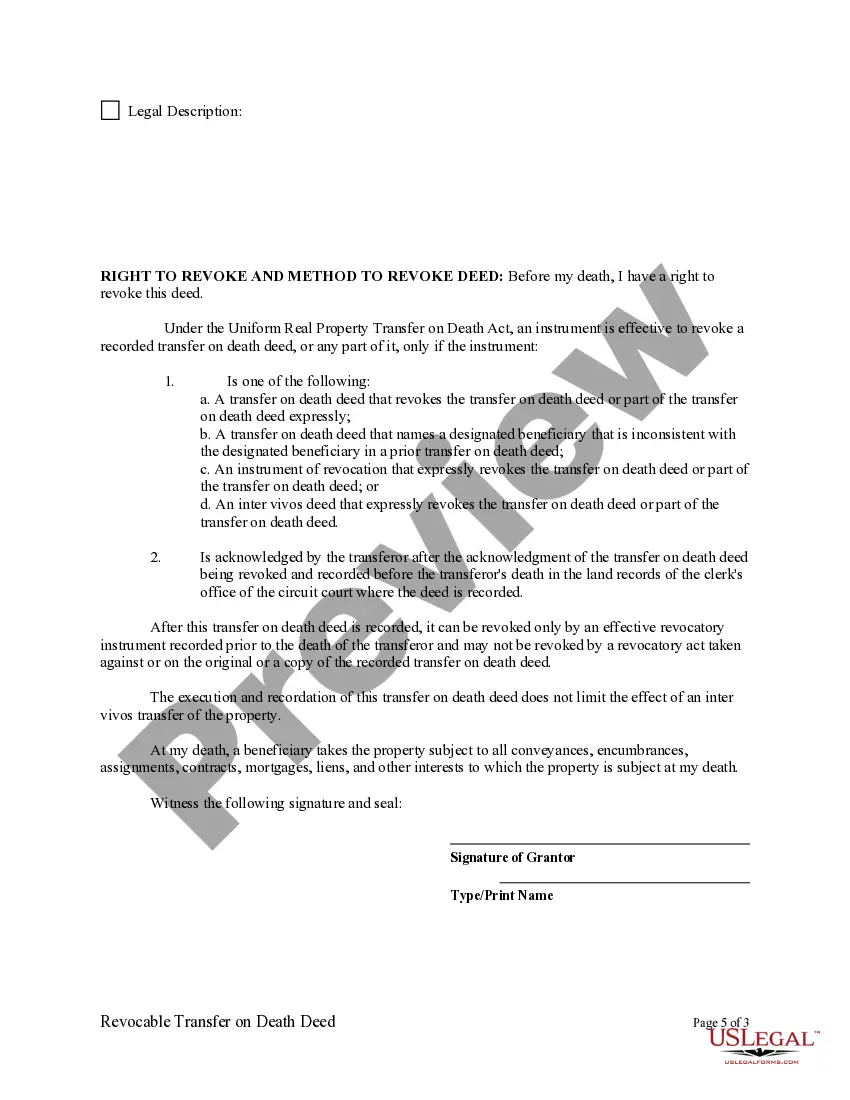

You must sign the deed and get your signature notarized, and then record (file) the deed with the circuit court clerk's office before your death. Otherwise, it won't be valid.

The most important benefit of a TOD account is simplicity. Estate planning can help minimize the legal mess left after you die. Without it, the probate system can take over the distribution of your assets. It can also name an executor of your estate and pay off your remaining debts with your assets.

The way it differs from a TOD deed is that a living trust can be used for any type of asset, not just real estate. So if you have stocks, savings accounts, valuable belongings, or other assets that you want to transfer to someone after your death, a living trust is a way to do it.