This is an official form from the Utah State Courts, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Utah statutes and law.

Utah Child Support Table For Alberta

Description

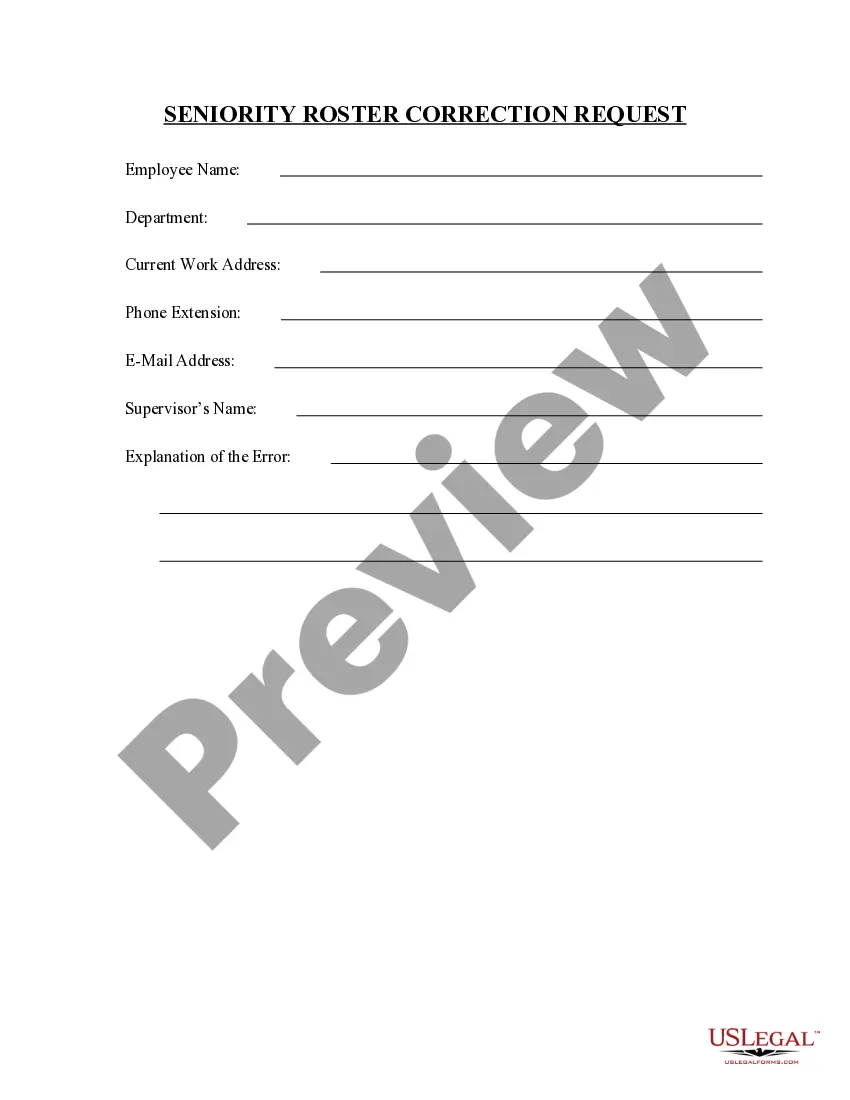

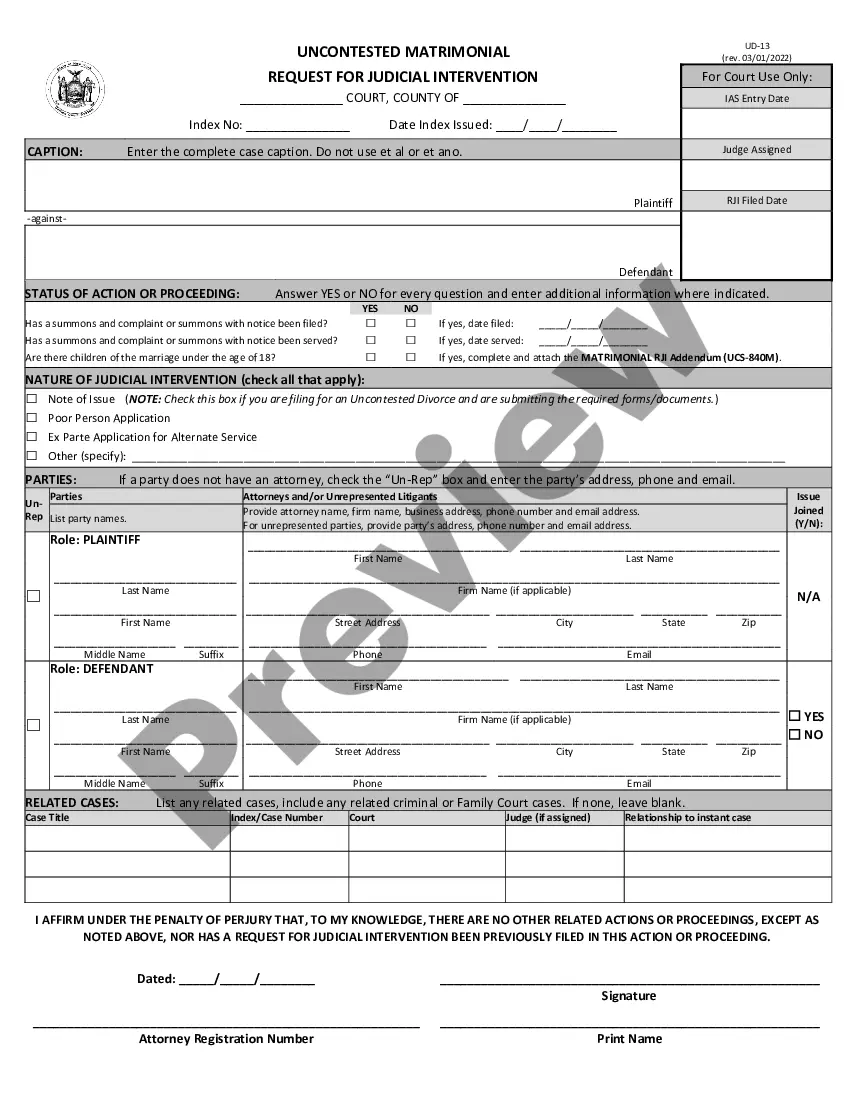

How to fill out Utah Base Combined Child Support Obligation Table And Low Income Table 78 - 45 - 7 . 14 For Reference?

Regardless of whether for commercial reasons or personal matters, everyone must confront legal scenarios eventually in their lifetime. Completing legal documents requires meticulous focus, beginning with selecting the correct form template. For instance, if you choose an incorrect version of a Utah Child Support Table For Alberta, it will be declined upon submission. Thus, it is crucial to obtain a trustworthy source of legal documents like US Legal Forms.

If you need to acquire a Utah Child Support Table For Alberta template, adhere to these straightforward steps.

With an extensive US Legal Forms catalog available, you will never have to waste time searching for the suitable sample across the web. Take advantage of the library’s straightforward navigation to locate the right form for any situation.

- Obtain the sample you require using the search field or catalog navigation.

- Review the form’s description to verify it corresponds with your situation, state, and locality.

- Click on the form’s preview to examine it.

- If it is the wrong document, return to the search function to find the Utah Child Support Table For Alberta sample you need.

- Acquire the template if it satisfies your criteria.

- If you possess a US Legal Forms account, click Log in to access previously stored templates in My documents.

- If you do not have an account yet, you may download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the document format you desire and download the Utah Child Support Table For Alberta.

- Once it is saved, you can complete the form using editing software or print it and finish it manually.

Form popularity

FAQ

(1) As used in the guidelines, "gross income" includes prospective income from any source, including earned and nonearned income sources which may include salaries, wages, commissions, royalties, bonuses, rents, gifts from anyone, prizes, dividends, severance pay, pensions, interest, trust income, alimony from previous ...

Alberta child support is calculated using the Federal Child Support Guidelines and gross parental income. If children live with only one of their parents, only the income of the paying parent is taken into consideration.

Child support is calculated using the gross monthly income of both parents and the number of overnights the child spends in each household.

A new spouse's income isn't included in the child support calculations. But if the new marriage results in a substantial change in the parents' relative wealth or assets, a judge might modify child support based on that change.

Child support is the money paid by one spouse to the other to assist with the care and upbringing of a child after a divorce. In general, it includes fixed monthly amounts for basic daily support, plus coverage for other important expenses such as educational or healthcare costs.