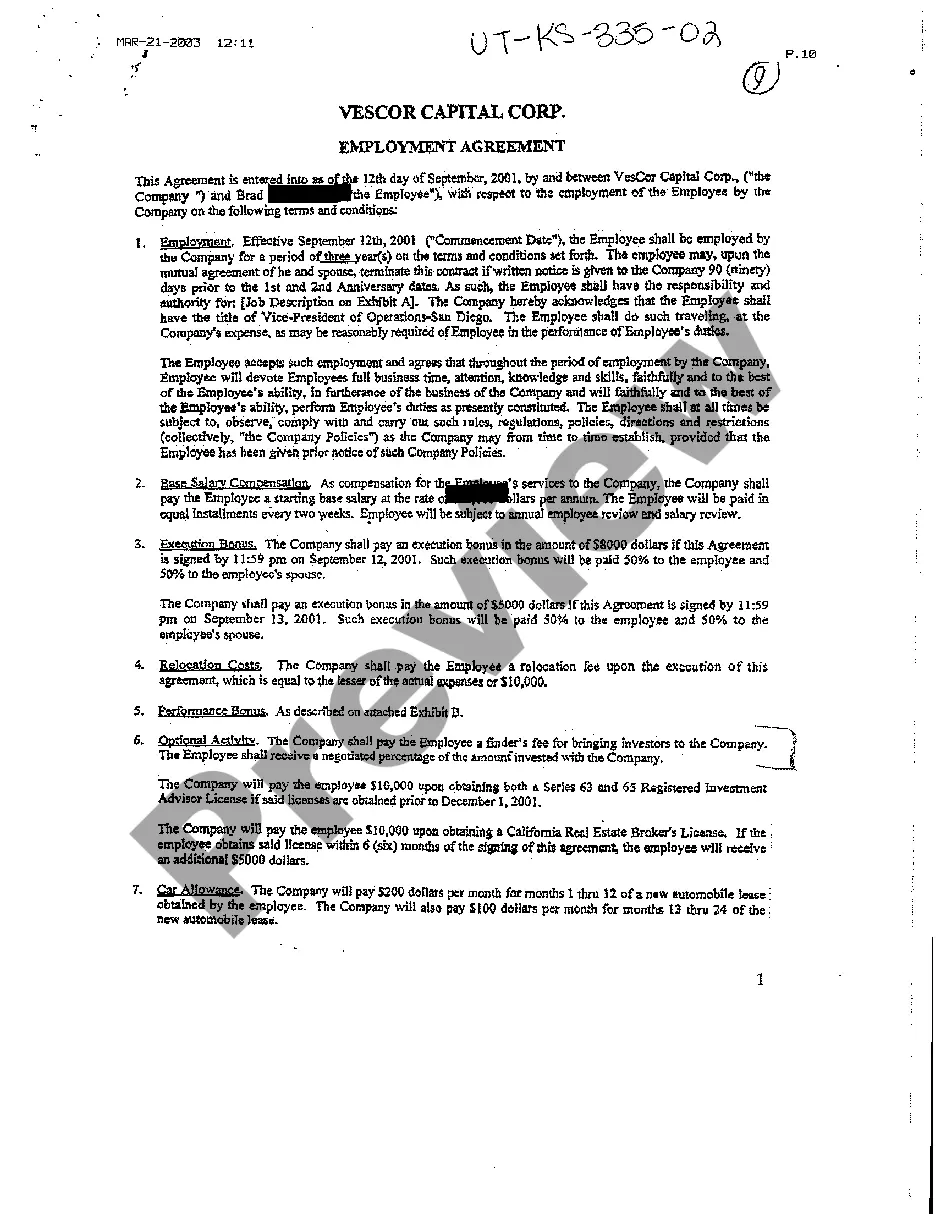

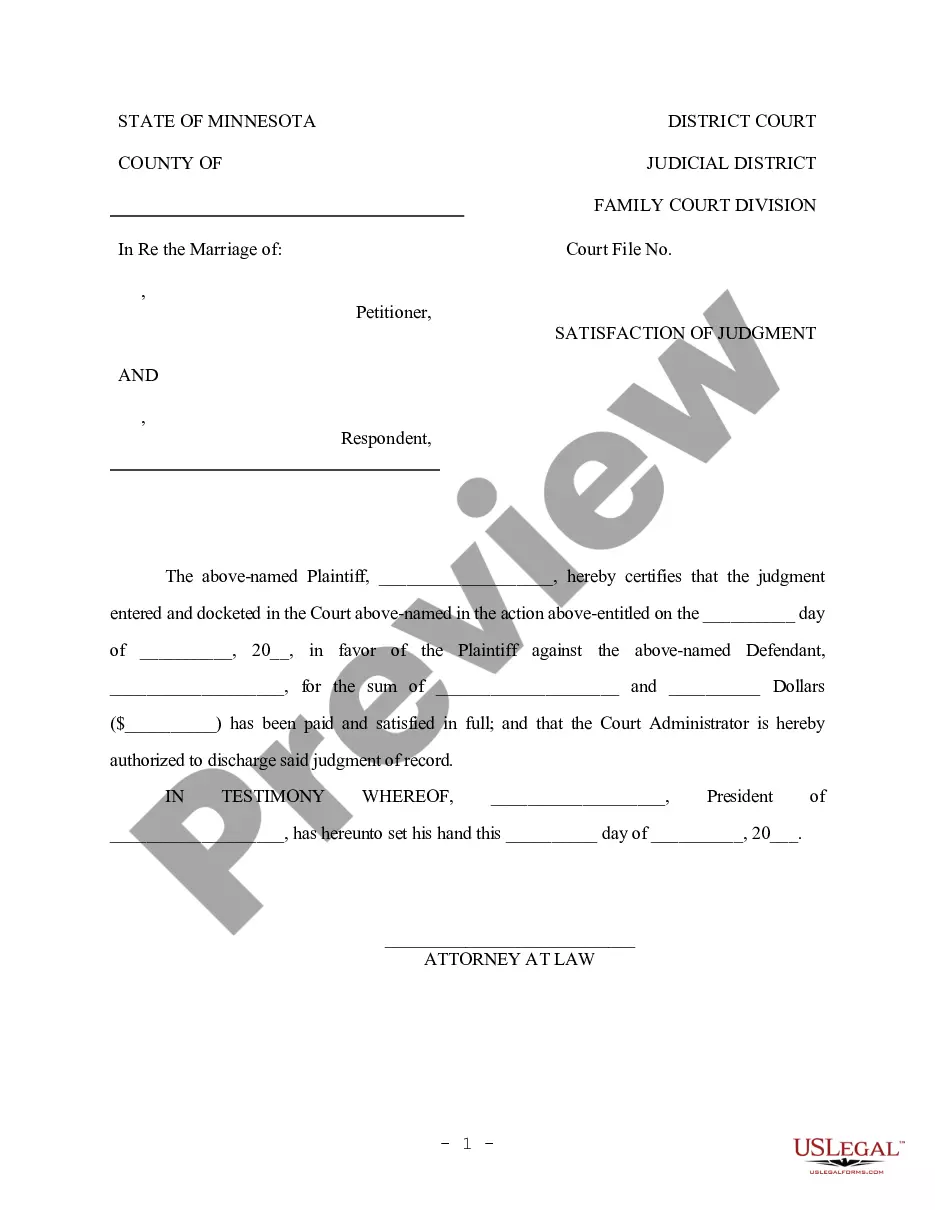

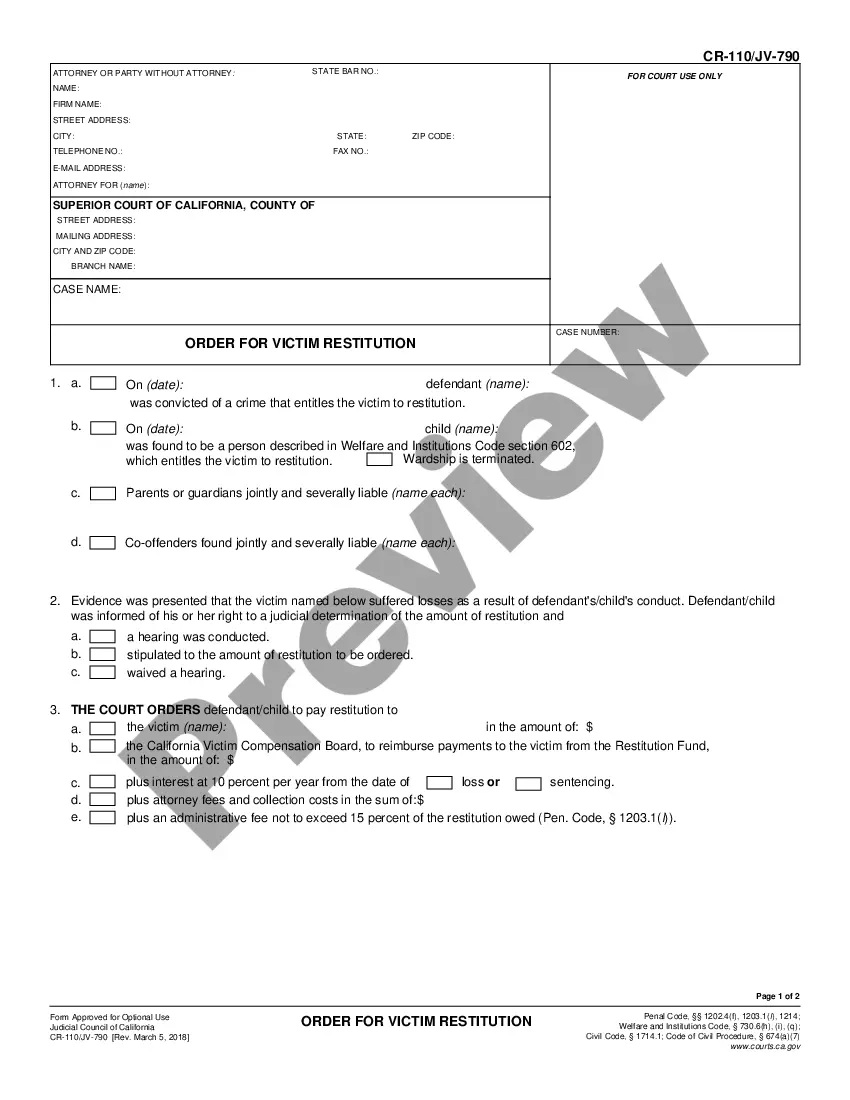

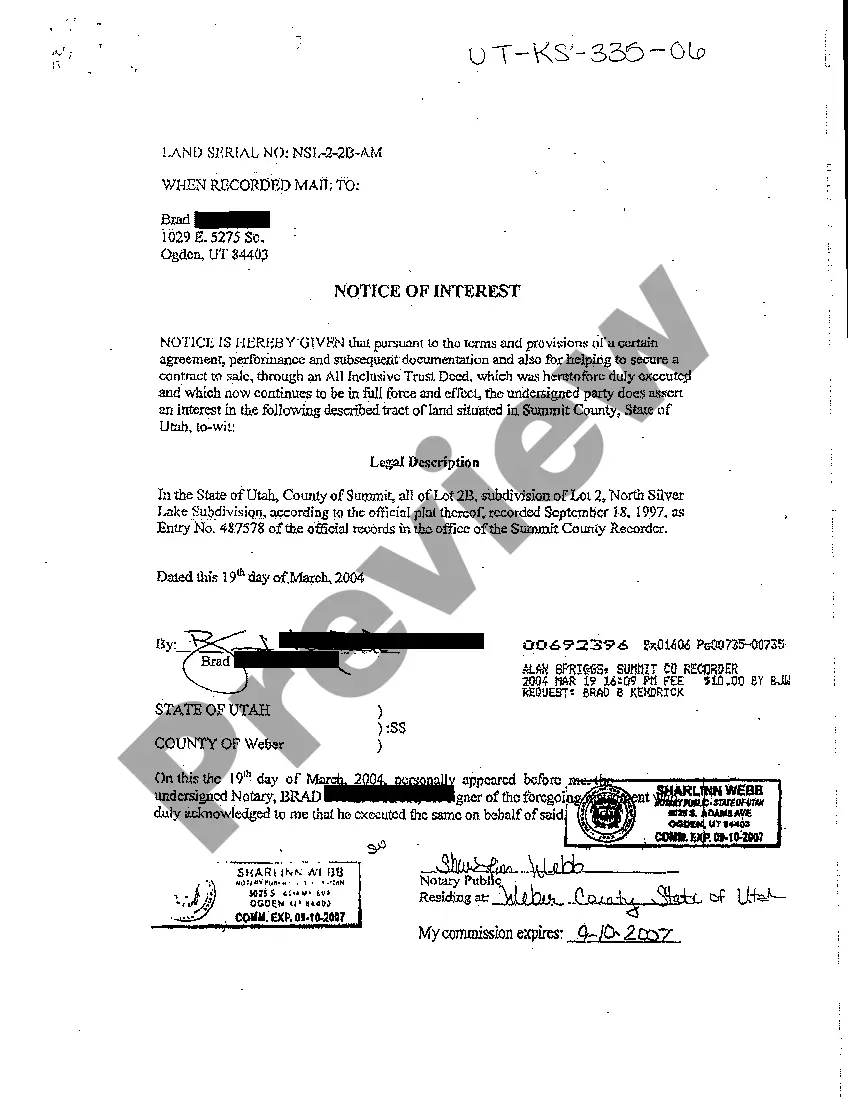

Notice Of Interest Within 10 Days

Description

How to fill out Utah Notice Of Interest In Property By Respondent?

Whether for business purposes or for individual affairs, everybody has to manage legal situations sooner or later in their life. Filling out legal papers needs careful attention, beginning from choosing the proper form sample. For example, when you select a wrong version of a Notice Of Interest Within 10 Days, it will be rejected once you submit it. It is therefore crucial to have a reliable source of legal documents like US Legal Forms.

If you have to get a Notice Of Interest Within 10 Days sample, stick to these simple steps:

- Get the template you need by using the search field or catalog navigation.

- Look through the form’s information to ensure it fits your situation, state, and county.

- Click on the form’s preview to view it.

- If it is the wrong form, get back to the search function to find the Notice Of Interest Within 10 Days sample you require.

- Get the file when it meets your requirements.

- If you already have a US Legal Forms profile, click Log in to gain access to previously saved templates in My Forms.

- If you don’t have an account yet, you may download the form by clicking Buy now.

- Pick the correct pricing option.

- Complete the profile registration form.

- Choose your payment method: you can use a credit card or PayPal account.

- Pick the document format you want and download the Notice Of Interest Within 10 Days.

- When it is downloaded, you can complete the form by using editing applications or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you don’t have to spend time looking for the right template across the web. Make use of the library’s straightforward navigation to find the right template for any occasion.

Form popularity

FAQ

2% if you're one to five days late. 5% if you're six to 15 days late. 10% if you're 16 days late or if you pay within 10 days after the IRS's first notice for late a deposit has been issued. 15% if you pay 10 days or more after the IRS notice has been issued.

The interest rate is determined quarterly and is the federal short-term rate plus 3 percent. Interest compounds daily.

The late payment penalty is 0.5% of the tax owed after the due date, for each month or part of a month the tax remains unpaid, up to 25%. You won't have to pay the penalty if you can show reasonable cause for the failure to pay on time.

How We Calculate the Penalty Number of Days Your Deposit is LateAmount of the Penalty1-5 calendar days2% of your unpaid deposit6-15 calendar days5% of your unpaid depositMore than 15 calendar days10% of the unpaid deposit1 more row ?

As of Nov. 18, there were 3.4 million unprocessed individual returns received in 2022, including filings for previous tax years, the agency reported. Adjusted quarterly and tied to the federal short-term rate, the 7% interest applies to pending refunds and unpaid tax balances.