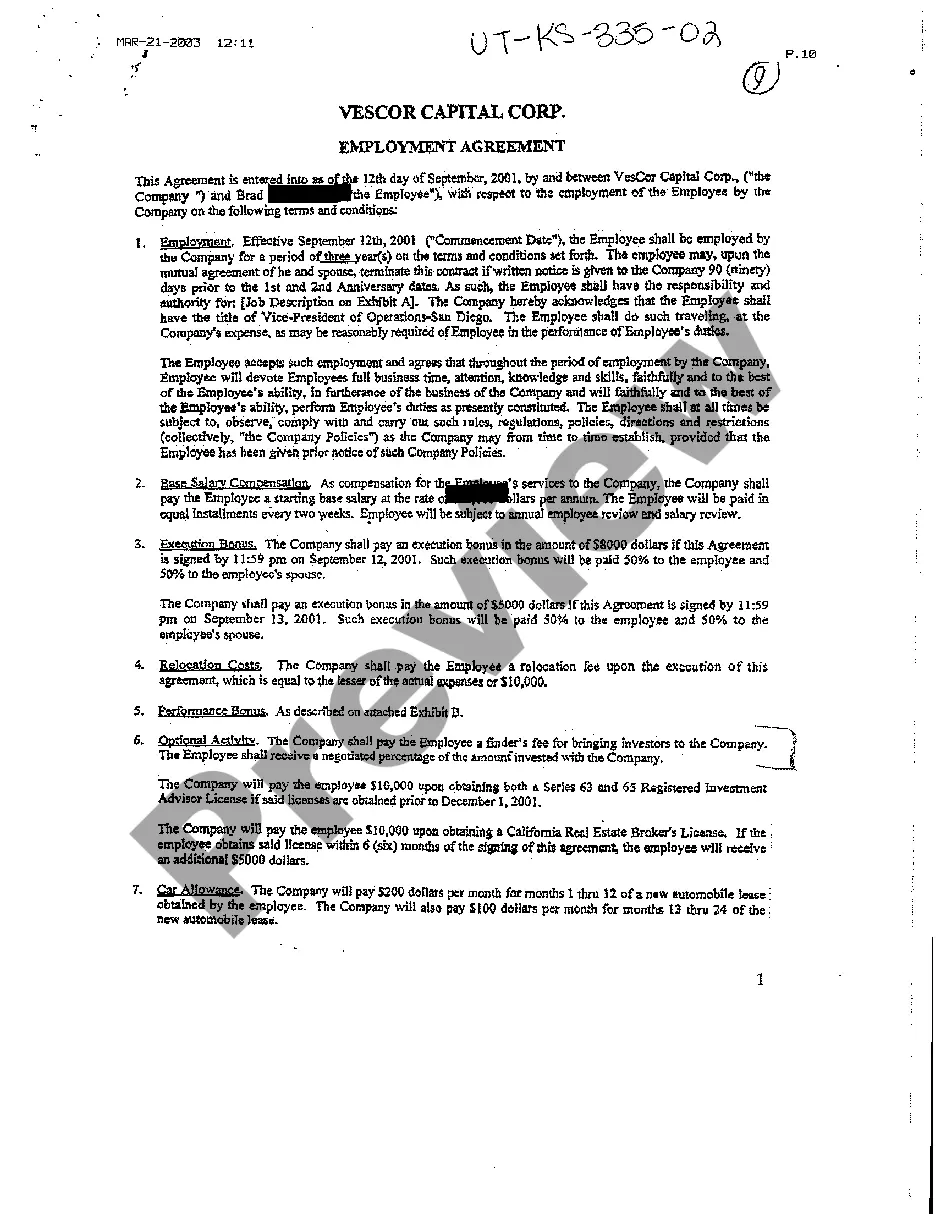

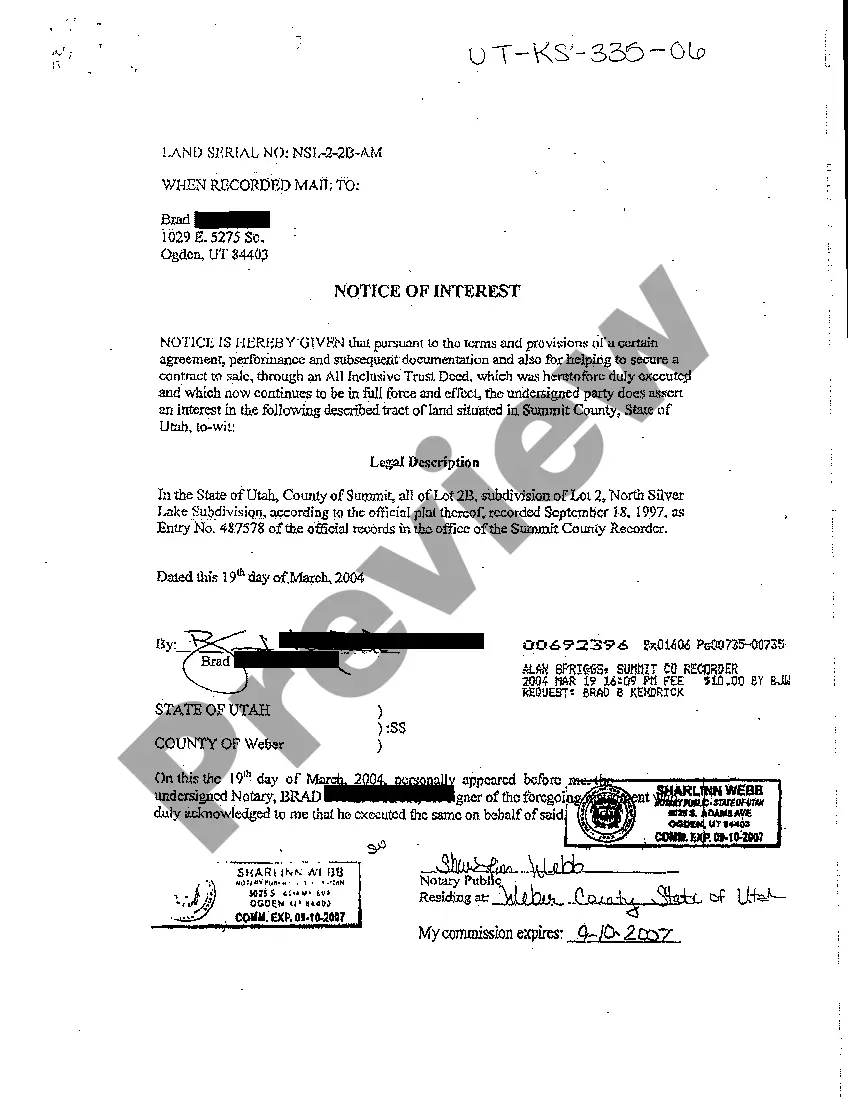

Notice Of Interest Real Estate Withholding

Description

How to fill out Utah Notice Of Interest In Property By Respondent?

It’s well-known that you cannot transform into a legal authority instantly, nor can you comprehend how to swiftly formulate a Notice Of Interest Real Estate Withholding without possessing a specific set of competencies.

Assembling legal documents is a labor-intensive task that necessitates particular training and expertise. So, why not entrust the drafting of the Notice Of Interest Real Estate Withholding to the professionals.

With US Legal Forms, one of the most extensive collections of legal templates, you can uncover everything from courtroom paperwork to templates for internal workplace communication. We understand how vital conformity and compliance with federal and state regulations are. That’s why, on our platform, all templates are tailored to specific locations and remain current.

You can revisit your forms from the My documents tab at any moment. If you’re a current client, simply Log In, and locate and download the template from the same tab.

Regardless of the intent behind your documents—whether they are financial, legal, or personal—our platform supports you. Explore US Legal Forms today!

- Begin by locating the form you require using the search bar located at the top of the page.

- Preview it (if this feature is available) and review the accompanying description to ascertain if the Notice Of Interest Real Estate Withholding is what you need.

- Initiate a new search if you require an alternative template.

- Create a free account and select a subscription plan to purchase the form.

- Click Buy now. Once the payment is finalized, you can access the Notice Of Interest Real Estate Withholding, fill it out, print it, and send or forward it by mail to the specified recipients or organizations.

Form popularity

FAQ

Every LLC or foreign LLC registered in Maine is required to submit an annual report that lists important information about the company, such as the following: Business name. Business address. Type of business.

Online: Go to their website under online services and follow the instructions provided on the interactive corporate services page to search and print a certified copy. A list of all filings for the Maine Corporation is provided. If the document is older it may not be available for online printing.

An annual report is required to be filed every year in order to maintain a good standing status. The legal filing deadline is June 1st.

Maine's state fee to start an LLC is $175. Every year you own your Maine LLC, you'll also have to pay $85 to file an annual report. Beyond those two unavoidable fees, there are other expenses that could come up, like local business license fees and the cost of hiring a registered agent.

The articles of incorporation may be amended by written consent of all members entitled to vote on such amendment, as provided by section 606. If such unanimous written consent is given, no resolution of the board of directors proposing the amendment is necessary. [PL 1977, c. 525, §13 (NEW).]

You need to file an Annual Report in order to keep your LLC in compliance and in good standing with the state. You can file your LLC's Annual Report by mail or online. We recommend filing online since it's easier and the processing time is quicker. You will find instructions below for filing by mail and filing online.

LLC ? The filing fee for reinstating an administratively dissolved LLC in Maine is $85. You also need to pay $150 as a penalty for every annual report you did not file. The limit for the penalty is $600. If you choose 24-hour processing, you need to pay another $50.