Utah Certificate Of Authority Form Tc-721

Description

How to fill out Utah Certificate Of Authority Form Tc-721?

Individuals typically link legal documents with something intricate that only an expert can handle.

In a way, this is accurate, as creating the Utah Certificate Of Authority Form Tc-721 requires considerable understanding of topic specifications, including state and county laws.

However, with US Legal Forms, everything has become simpler: pre-made legal documents for any personal and business circumstance tailored to state regulations are gathered in a single online repository and are now accessible to everyone.

You can print your document or upload it to an online editor for quicker completion. All templates in our library are reusable: once purchased, they remain saved in your profile. You can access them anytime via the My documents section. Discover all the advantages of using the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current templates categorized by state and purpose, making the search for the Utah Certificate Of Authority Form Tc-721 or any other specific document quick and efficient.

- Previously registered users with an active subscription must Log In to their account and select Download to get the form.

- New users will first need to create an account and subscribe before they can save any documents.

- Here’s how to obtain the Utah Certificate Of Authority Form Tc-721 step-by-step.

- Carefully review the page content to ensure it meets your needs.

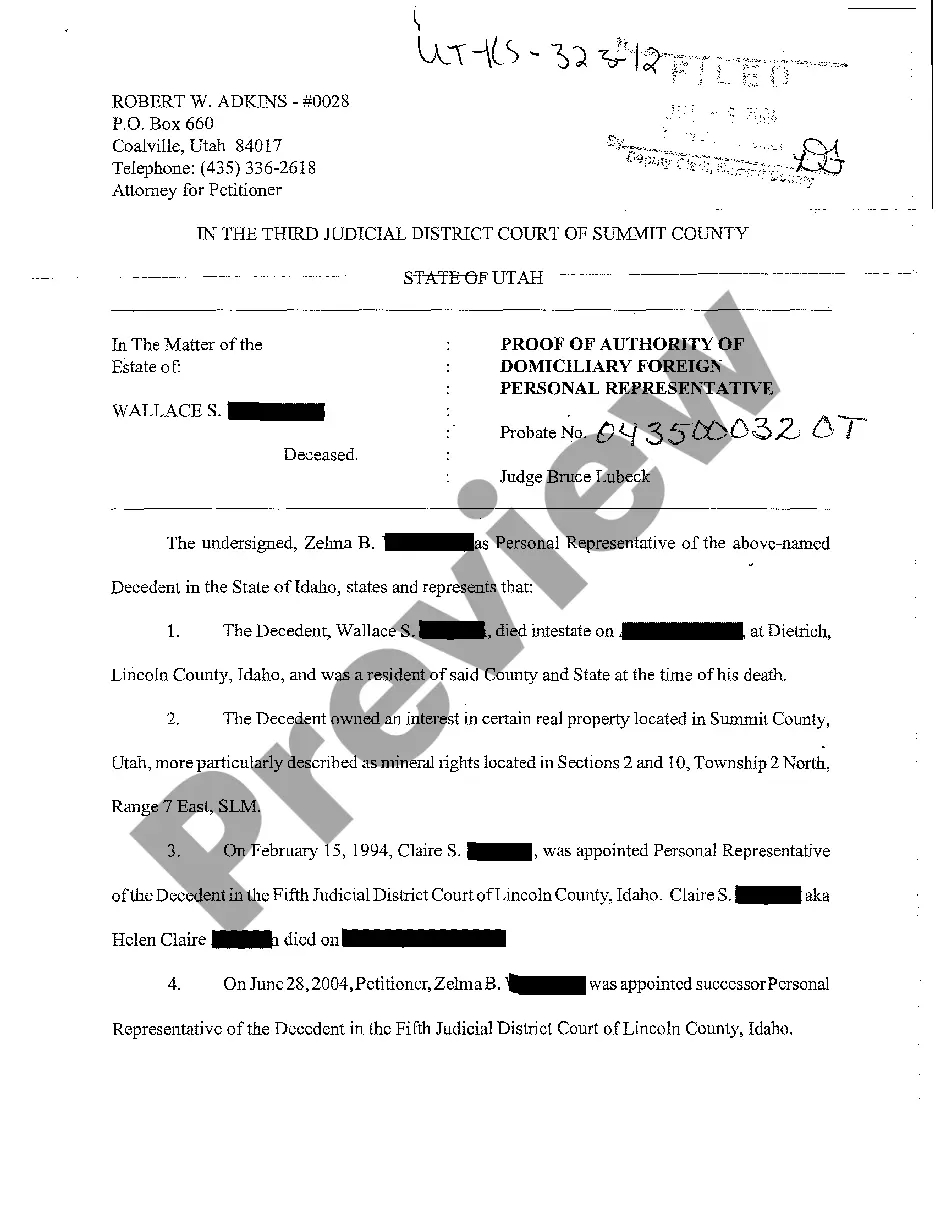

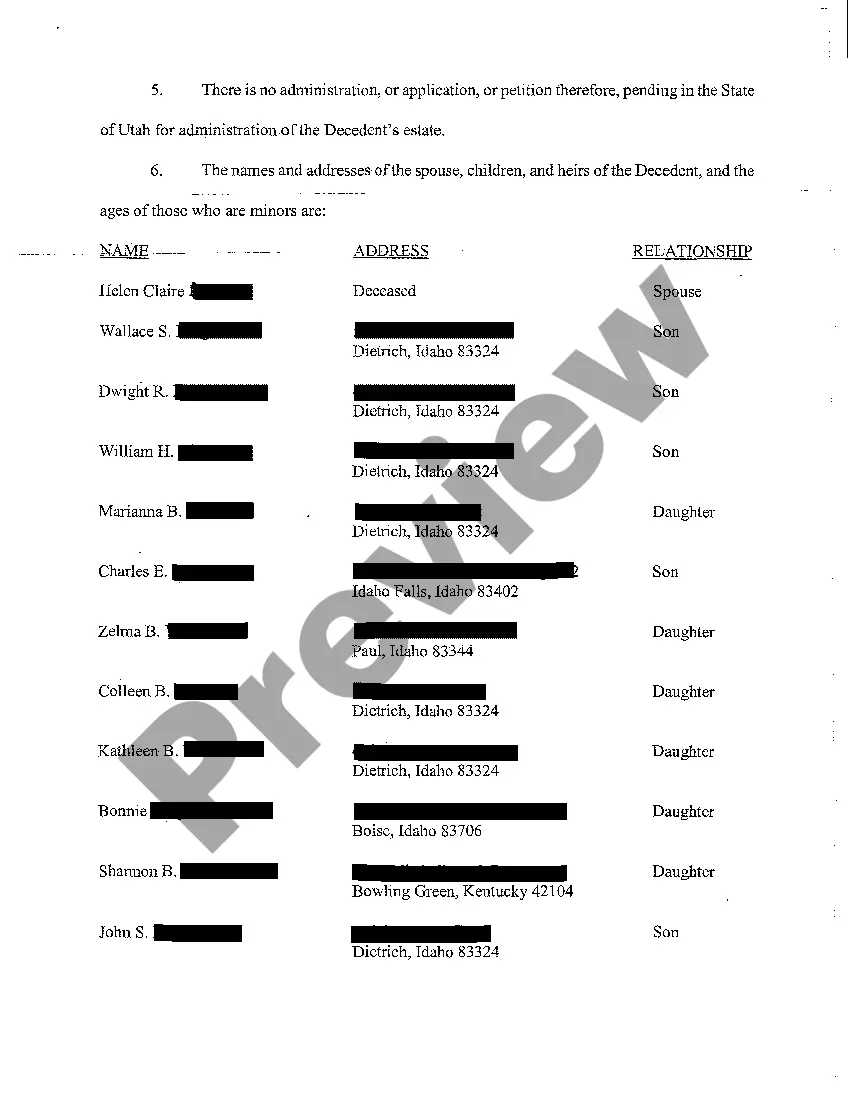

- Read the form description or view it through the Preview feature.

- If the previous option isn’t suitable, search for another template using the Search bar above.

- When you find the correct Utah Certificate Of Authority Form Tc-721, click Buy Now.

- Choose a subscription plan that aligns with your needs and budget.

- Create an account or Log In to advance to the payment page.

- Complete your payment with PayPal or a credit card.

- Choose the format for your document and click Download.

Form popularity

FAQ

Filling out a Utah certificate of title requires gathering vital information about your vehicle, such as the Vehicle Identification Number (VIN), your name, and your address. Begin by clearly entering this information on the Utah certificate of authority form tc-721, following the instructions precisely. It's crucial to double-check for any errors to avoid delays in processing. For convenience, U.S. Legal Forms offers easy-to-understand resources and templates to support you throughout this process.

To fill out a certificate of exemption, first, ensure you have the correct form, which may vary by state. Gather the necessary information, such as your business details and the specific exemption reason. Clearly complete each section of the Utah certificate of authority form tc-721, ensuring accuracy and compliance with state regulations. If you need assistance, consider using U.S. Legal Forms, which provides comprehensive guidance and templates for accurate submission.

The Utah TC 721 is the official form known as the 'Application for Utah Certificate of Authority.' This form is essential for businesses looking to operate within the state while ensuring compliance with Utah’s tax laws. By utilizing the Utah certificate of authority form TC-721, businesses can effectively manage their tax obligations and maintain legitimacy.

Seniors do not stop paying property taxes in Utah solely based on age. Yet, those aged 65 and older can access various relief programs that lessen their tax obligations. Completing the Utah certificate of authority form TC-721 is crucial for seniors looking to take advantage of these available benefits.

To fill out the Utah resale certificate, first gather all necessary business information, such as your name, address, and sales tax identification number. Follow the guidelines carefully on the form, ensuring accuracy in each section. Using the Utah certificate of authority form TC-721 can provide you with structured content and necessary details to complete the resale certificate effectively.

Property taxes do not automatically decrease when a property owner turns 65 in Utah. However, eligible seniors can apply for property tax exemptions through specific programs. The Utah certificate of authority form TC-721 can assist in navigating the application and potentially lowering property taxes.

In Utah, residents do not automatically stop paying property taxes at any specific age. However, seniors aged 65 and older may qualify for property tax relief programs that reduce their tax burden. Utilizing forms like the Utah certificate of authority form TC-721 can simplify the application process for these benefits.

To verify a Utah resale certificate, you need to check the certificate's information against the Utah State Tax Commission's records. You can visit the official website, enter the details, and confirm its validity. Additionally, using the Utah certificate of authority form TC-721 helps ensure compliance with state regulations while streamlining your verification process.

The time it takes to get a sales tax license in Utah typically ranges from a few days to several weeks, depending on the submission method and completeness of your application. If you complete the Utah certificate of authority form TC-721 accurately and submit it properly, you may receive your license more quickly. Ensure you follow all guidelines to avoid delays.

Obtaining a seller's permit in Utah involves filling out the appropriate registration form with the Utah State Tax Commission. You'll typically need to provide your business information and may also submit the Utah certificate of authority form TC-721. Once processed, you'll receive your permit, allowing you to legally collect sales tax.