Small Estate Heirship Affidavit for Estates under 100,000

Small Estates General Summary: Small Estate laws were enacted in order to enable heirs to obtain property of the deceased without probate, or with shortened probate proceedings, provided certain conditions are met. Small estates can be administered with less time and cost. If the deceased had conveyed most property to a trust but there remains some property, small estate laws may also be available. Small Estate procedures may generally be used regardless of whether there was a Will. In general, the two forms of small estate procedures are recognized:

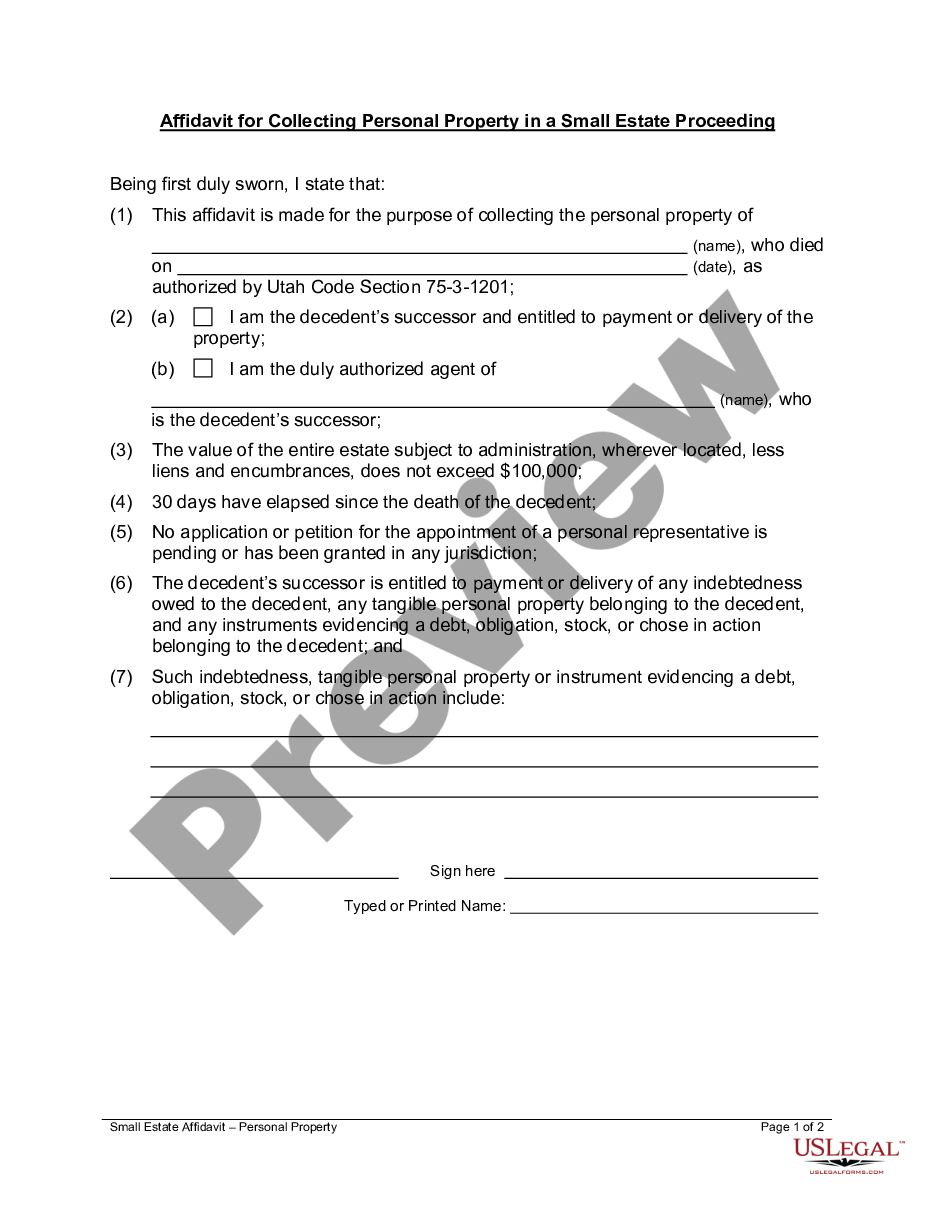

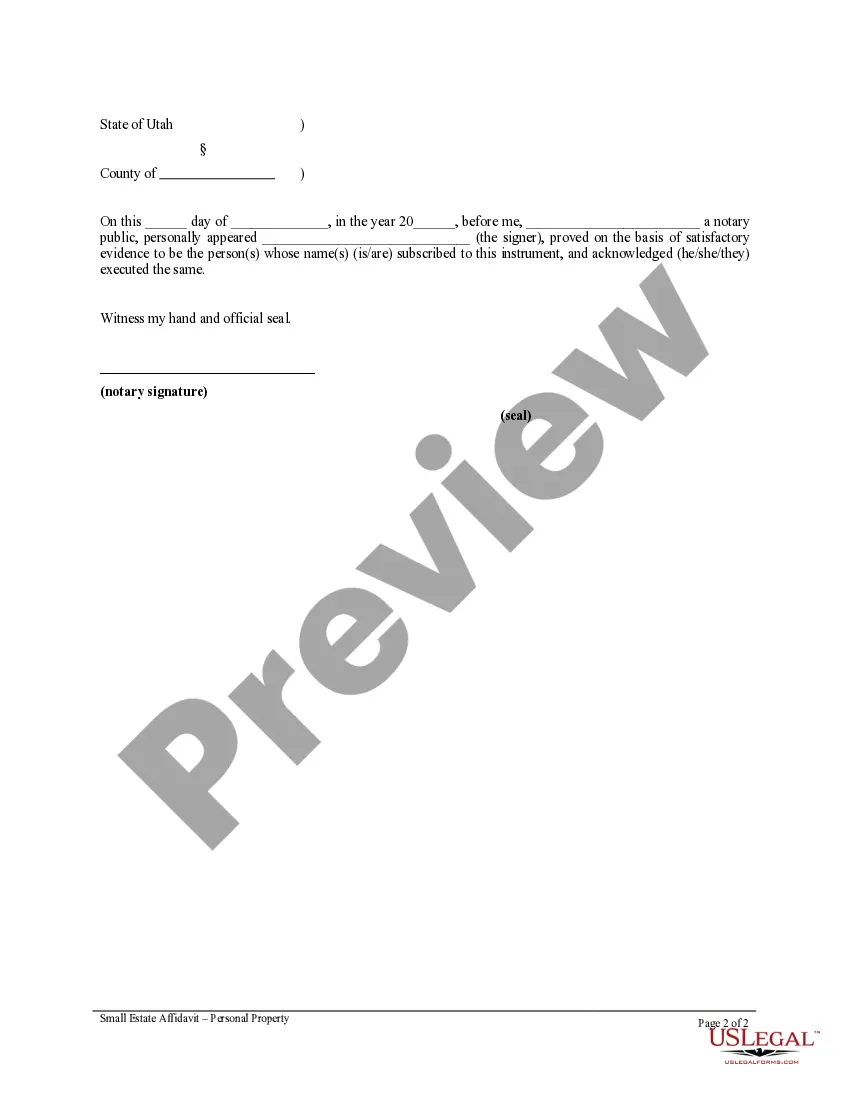

1.   Small Estate Affidavit -Some States allow an affidavit to be executed by the spouse and/or heirs of the deceased and present the affidavit to the holder of property such as a bank to obtain property of  the deceased. Other states require that the affidavit be filed with the Court. The main requirement before you may use an affidavit is that the value of the personal and/or real property of the estate not exceed a certain value.

2.   Summary Administration -Some states allow a Summary administration. Some States recognize both the Small Estate affidavit and Summary Administration, basing the requirement of which one to use on the value of the estate. Example: If the estate value is 10,000 or less an affidavit is allowed but if the value is between 10,000 to 20,000 a summary administration is allowed.

Utah Summary:

Under Utah statute, where the value of the entire estate subject to administration, less liens and encumbrances does not exceed $100,000, an interested party may, thirty (30) days after the death of the decedent, issue a small estate affidavit to collect any debts owed to the decedent.

Utah Requirements:

Utah requirements are set forth in the statutes below.

75-3-1201.  Collection of personal property by affidavit.

(1) Thirty days after the death of a decedent, any person indebted to the decedent or having possession of tangible personal property or an instrument evidencing a debt, obligation, stock, or chose in action belonging to the decedent shall pay the indebtedness or deliver the tangible personal property or an instrument evidencing a debt, obligation, stock, or chose in action to a person claiming to be the successor of the decedent upon being presented an affidavit made by or on behalf of the successor stating that:

(a) the value of the entire estate subject to administration, wherever located, less liens and encumbrances, does not exceed $100,000;

(b) 30 days have elapsed since the death of the decedent;

(c) no application or petition for the appointment of a personal representative is pending or has been granted in any jurisdiction; and

(d) the claiming successor is entitled to payment or delivery of the property.

(2) A transfer agent of any security shall change the registered ownership on the books of a corporation from the decedent to the successor or successors upon the presentation of an affidavit and the security as provided in Subsection (1).

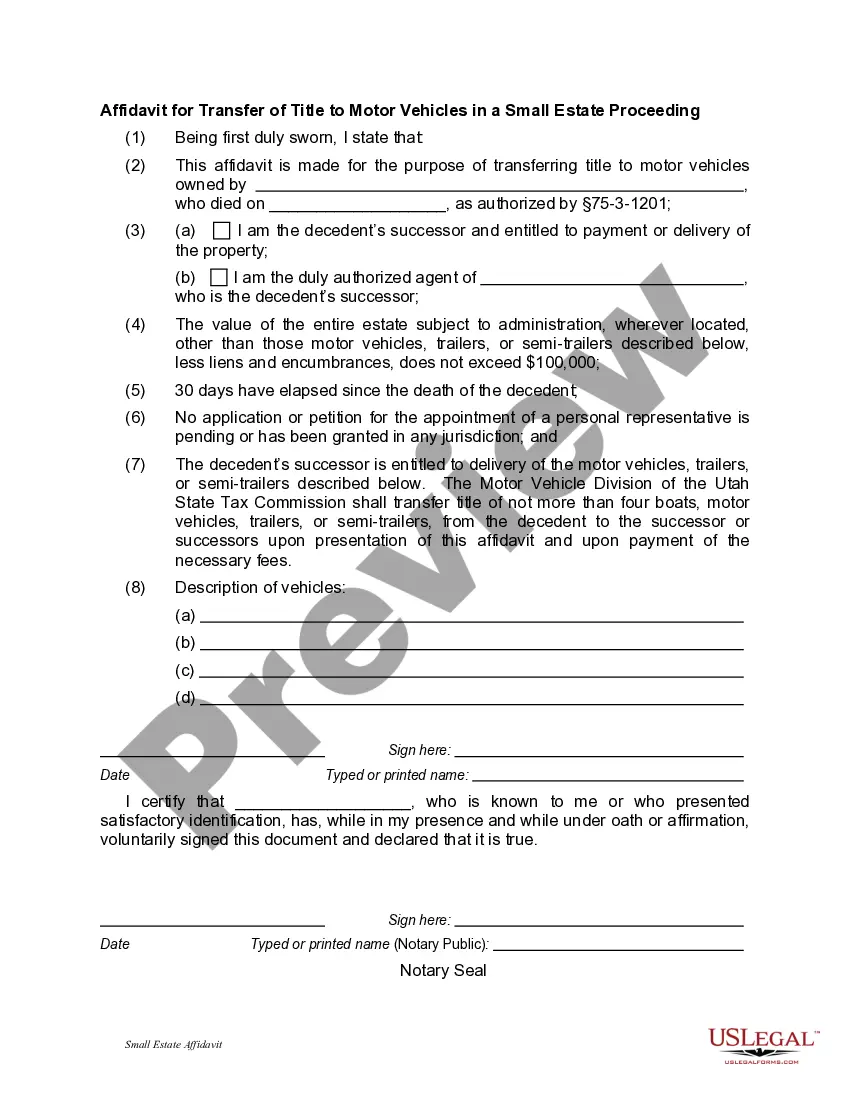

(3) The Motor Vehicle Division of the State Tax Commission shall transfer title of not more than four boats, motor vehicles, trailers, or semitrailers, registered under Title 41, Motor Vehicles, or Title 73, Water and Irrigation, from the decedent to the successor or successors upon presentation of an affidavit as provided in Subsection (1) and upon payment of the necessary fees, except that in lieu of that language in Subsection (1)(a) the affidavit shall state that the value of the entire estate subject to administration, wherever located, other than those motor vehicles, trailers, or semitrailers, less liens and encumbrances, does not exceed $100,000.

Amended by Chapter 316, 2007 General Session

75-3-1202.  Effect of affidavit.

The person paying, delivering, transferring, or issuing personal property or the evidence thereof pursuant to affidavit is discharged and released to the same extent as if he dealt with a personal representative of the decedent. He is not required to see to the application of the personal property or evidence thereof or to inquire into the truth of any statement in the affidavit. If any person to whom an affidavit is delivered refuses to pay, deliver, transfer, or issue any personal property or evidence thereof, it may be recovered or its payment, delivery, transfer, or issuance compelled upon proof of their right in a proceeding brought for the purpose by or on behalf of the persons entitled to it. In such event, in addition to recovering the property, the person to whom an affidavit is delivered shall, in the discretion of the court, be liable for damages to the claimant for an amount up to three times the value of the personal property plus costs of suit and reasonable attorneys' fees. Any person to whom payment, delivery, transfer, or issuance is made is answerable and accountable therefor to any personal representative of the estate or to any other person having a superior right.

Amended by Chapter 226, 1983 General Session

75-3-1203.  Small estates -- Summary administrative procedure.

If it appears from the inventory and appraisal that the value of the entire estate, less liens and encumbrances, does not exceed homestead allowance, exempt property, family allowance, costs and expenses of administration, reasonable funeral expenses, and reasonable and necessary medical and hospital expenses of the last illness of the decedent, the personal representative, without giving notice to creditors, may immediately disburse and distribute the estate to the persons entitled thereto and file a closing statement as provided in Section 75-3-1204.

75-3-1204.  Small estates -- Closing by sworn statement of personal representative.

(1) Unless prohibited by order of the court and except for estates being administered by supervised personal representatives, a personal representative may close an estate administered under the summary procedures of Section 75-3-1203 by filing with the court, at any time after disbursement and distribution of the estate, a verified statement stating:

(a) the nature and value of the estate's assets at the time of distribution;

(b) that to the best knowledge of the personal representative, the value of the entire estate, less liens and encumbrances, did not exceed homestead allowance, exempt property, family allowance, costs and expenses of administration, reasonable funeral expenses, and reasonable, necessary medical and hospital expenses of the last illness of the decedent;

(c) that the personal representative has fully administered the estate by disbursing and distributing it to the persons entitled thereto; and

(d) that the personal representative has sent a copy of the closing statement to all distributees of the estate and to all creditors or other claimants of whom the personal representative is aware whose claims are neither paid nor barred and hasfurnished a full account in writing of administration to the distributees whose interests are affected.

(2) If no actions or proceedings involving the personal representative are pending in the court one year after the closing statement is filed, the appointment of the personal representative terminates.

(3) A closing statement filed under this section has the same effect as one filed under Section 75-3-1003.