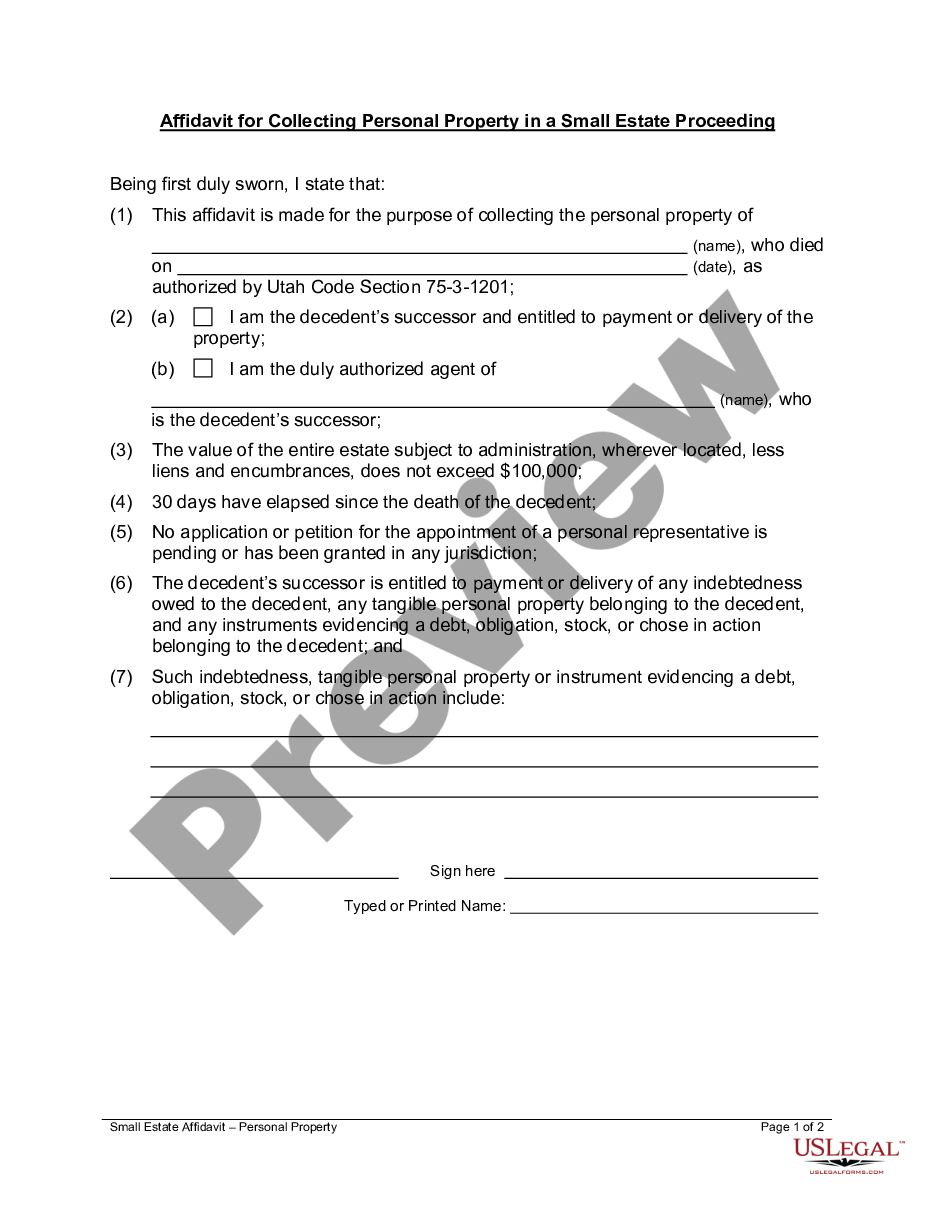

Under Utah statutes, where an estate is valued at less than $100,000, an interested party may, thirty (30) days after the death of the decedent, issue a small estate affidavit to collect any debts owed to the decedent.

Small Estate Estates Without Probate

Description

Form popularity

FAQ

The size of an estate is determined by calculating the total value of all assets owned by an individual, minus any debts owed. This includes real estate, personal property, and financial accounts. Knowing the size of your estate is crucial for proper estate planning and tax implications. It also helps in determining if an estate qualifies for small estate estates without probate, thus streamlining the transfer process.

In California, small estate estates without probate can be achieved if the total value of the assets does not exceed a designated figure set by law. This allows heirs to transfer property more easily and directly, bypassing the probate court. However, it's essential to follow specific legal procedures to ensure compliance with state regulations. Understanding these rules can empower individuals to manage their estate planning more effectively.

The small estate value in the UK refers to the total monetary worth of assets that can be handled outside of formal probate proceedings. The threshold is typically lower than in many US states, making it easier for beneficiaries to access their inheritance. When an estate qualifies as a small estate, loved ones can often avoid the lengthy and costly probate process. This can significantly ease the financial and emotional burdens during a difficult time.

An estate consists of all the assets and liabilities owned by an individual at the time of their death. It includes properties, bank accounts, investments, and debts. The management of an estate after a person passes away can greatly differ based on the complexity and the total value. Knowing what constitutes an estate helps in identifying whether one qualifies for small estate estates without probate.

A small estate is generally defined as an estate with a total value that falls below a specific statutory limit. This designation allows for the assets to be transferred without the need for probate court involvement. Small estate estates without probate streamline the distribution process, making it easier and faster for heirs. Thus, understanding this definition can help in proper estate planning.

In Maryland, the distinction between a small estate and a regular estate primarily lies in the total value of the assets. Small estate estates without probate can simplify the transfer of assets if they fall under a certain monetary threshold set by the state. Typically, if the estate's value is under this limit, heirs may avoid the lengthy probate process. This can lead to quicker access to assets for beneficiaries.

Before probate, you can remove assets that you want to pass directly to heirs, such as joint accounts or accounts with payable-on-death designations. Additionally, consider giving away personal items, gifts, or smaller possessions while you are still alive to simplify the distribution process. This strategy can ease the burden on your family and help create small estate estates without probate.

A revocable living trust is often considered the best trust to avoid probate. This type of trust allows you to retain control over your assets while designating beneficiaries to receive them after your passing. Since the assets are held in the trust, they can bypass the probate process entirely, making it an ideal solution for small estate estates without probate.

The best way to avoid probate is to utilize strategies such as establishing a living trust, naming beneficiaries on accounts, or transferring ownership of property during your lifetime. These approaches ensure that your assets pass directly to your intended heirs without the delays and costs of probate. By planning ahead, you can effectively manage small estate estates without probate and provide a smoother experience for your loved ones.

To leave your house to your heirs effectively, consider using a revocable living trust. This option allows you to transfer your property ownership while maintaining control during your lifetime. When you pass away, your heirs receive the house without going through probate. Using a trust can simplify the process and help manage small estate estates without probate.