Small Estate Affidavit Form For Florida

Description

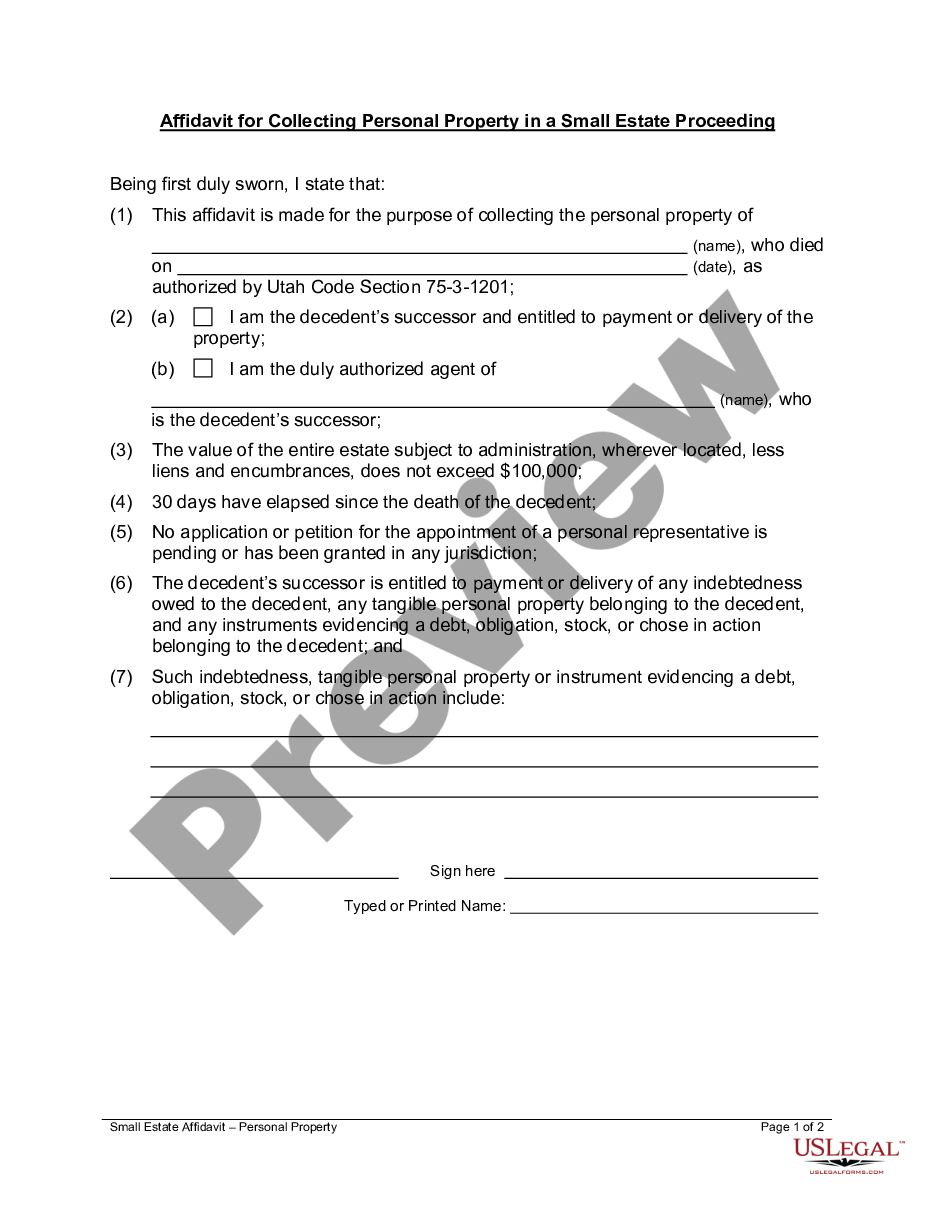

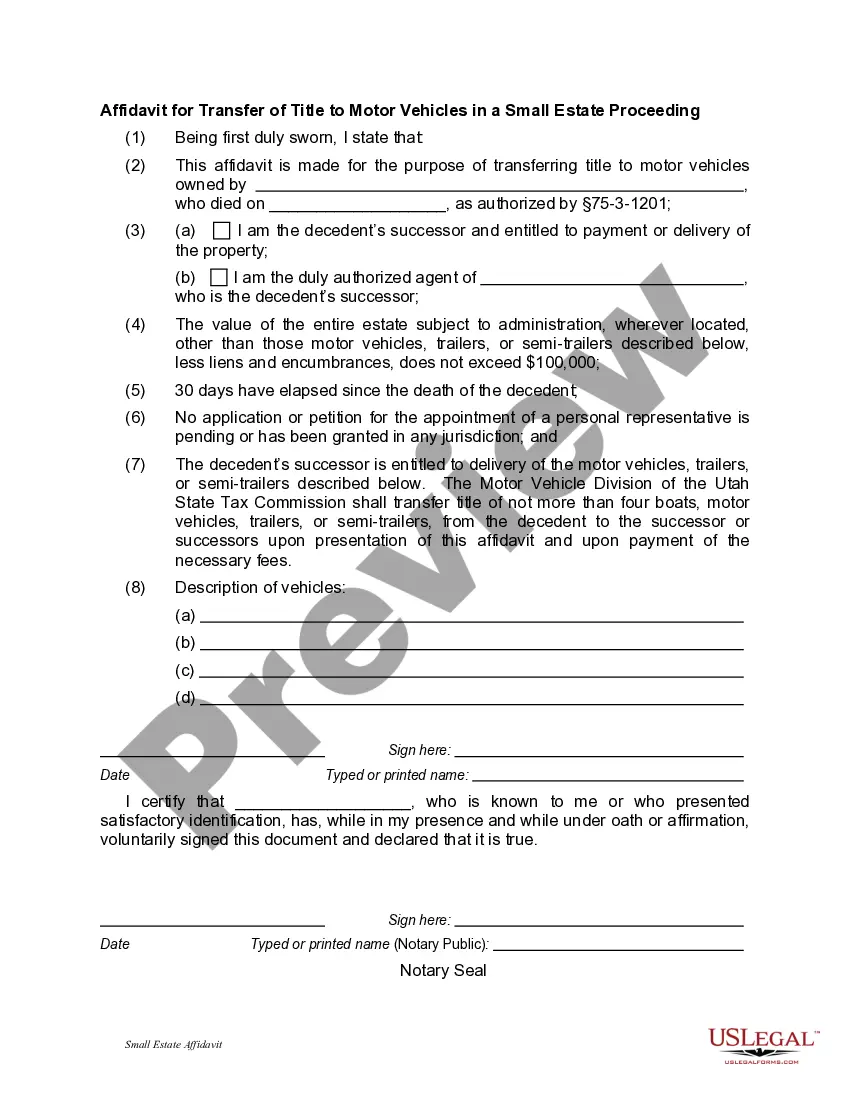

How to fill out Utah Small Estate Heirship Affidavit For Estates Under 100,000?

- If you're a returning user, log in to your account and locate the Small Estate Affidavit Form in your library. Ensure your subscription is current; if not, renew it as per your payment plan.

- For first-time users, start by exploring the Preview mode and form description. Confirm that the form suits your needs and adheres to your local legal requirements.

- Should you need a different template, utilize the Search tab above to find the accurate form for your situation.

- Once you find the correct document, click on the 'Buy Now' button and select your preferred subscription plan. You’ll need to register for an account to access the complete library.

- Proceed to checkout by entering your payment details, either through a credit card or PayPal account to secure your subscription.

- Finally, download the Small Estate Affidavit Form to your device from the My Forms section for future reference.

In conclusion, US Legal Forms provides a robust resource for individuals and attorneys alike, offering a comprehensive selection of legal documents to make the process efficient. By leveraging this service, you ensure your legal affairs are handled precisely and effectively.

Don't hesitate—start your journey to efficient legal documentation today!

Form popularity

FAQ

In Florida, certain assets are exempt from probate, including joint tenancy property, life insurance proceeds with named beneficiaries, and retirement accounts. Additionally, a small estate affidavit form for Florida can help you list exempt assets efficiently. Understanding what assets can avoid probate can save heirs significant time and costs.

Not all estates in Florida require probate. If the estate's value is below $75,000, you can use the small estate affidavit form for Florida to manage the assets without probate. This option simplifies the process, making it quicker and less expensive for the heirs.

Writing an affidavit in Florida involves drafting a document that clearly states facts related to your case. Start by identifying the parties involved, provide a detailed narrative of the relevant events, and conclude with a statement affirming the truthfulness of the content. Utilize the small estate affidavit form for Florida to ensure your document meets legal standards.

The minimum estate value for probate in Florida is generally $75,000. However, if the estate qualifies as a small estate, you can utilize the small estate affidavit form for Florida to bypass probate altogether. This option significantly simplifies the process and saves time for the heirs.

In Florida, the affidavit of heirs must be signed by the heirs of the deceased, usually identified through a family tree. Each heir should confirm their relationship to the deceased, ensuring all parties are aware of their rights. This document helps in clarifying the distribution of the estate without lengthy court proceedings.

In Florida, an estate typically must be worth more than $75,000 to go through probate, unless it falls under specific exemptions. For small estates, the small estate affidavit form for Florida provides a streamlined process if the estate value is below this threshold. Understanding the value of the assets can help you determine your next steps efficiently.

Filling out a small estate affidavit form for Florida involves providing essential information about the deceased and their assets. First, gather necessary documents, such as the death certificate and asset details. Then, complete the affidavit, ensuring each section is filled accurately. Lastly, have it signed in front of a notary to validate the document.

Yes, in Florida, you can settle an estate without probate by using a small estate affidavit form for Florida if the estate meets the state's criteria. This method allows heirs to claim assets directly without going through a lengthy probate process. The small estate affidavit typically applies to estates with limited value, making it a quicker solution for heirs. It is advisable to consult resources like USLegalForms to understand your options and ensure a smooth settlement.

Filing a small estate affidavit in Florida involves submitting the completed form to the probate court in the county where the deceased resided. After preparing the small estate affidavit form for Florida, make copies of all documents, including death certificates and asset listings. Make sure to check the court’s specific requirements, as they may vary by location, and consider utilizing USLegalForms for straightforward filing instructions and resources.

To fill out a small estate affidavit form for Florida, begin by gathering the necessary information about the deceased, including their name, date of death, and details about their assets. Ensure you include a list of all assets that fall under the small estate guidelines and their estimated values. You can find templates and guidance on platforms like USLegalForms, which can simplify the process and ensure you comply with Florida laws.