Living Trust Taxes

Description

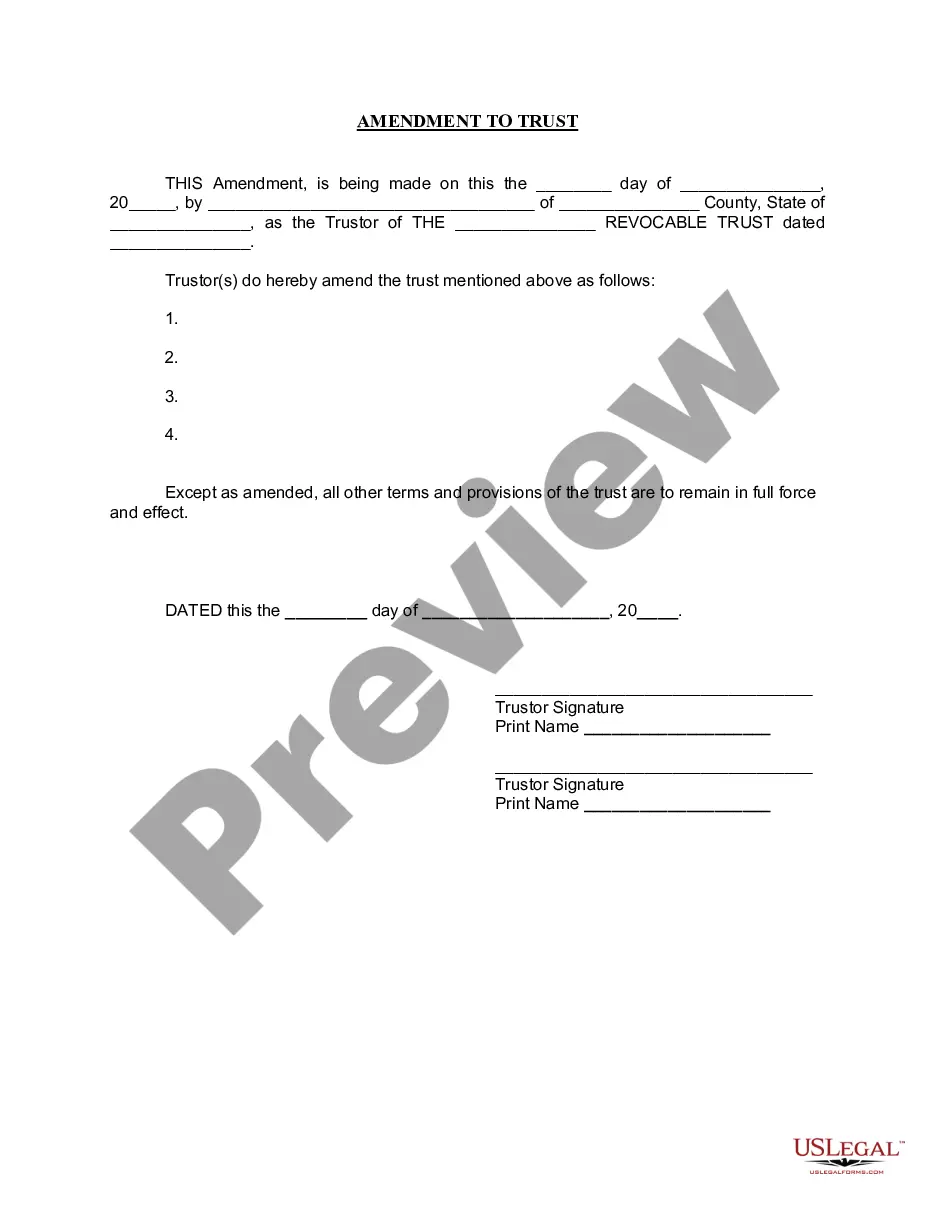

How to fill out Utah Amendment To Living Trust?

- If you're a returning user, log in to your account and select the necessary template to download by clicking the Download button. Ensure your subscription is active; renew it if necessary.

- For first-time users, first, check the Preview mode and description of the forms. Confirm that you've selected the template that meets your needs and is applicable to your jurisdiction.

- If you notice any discrepancies or need another template, utilize the Search tab to find the correct document tailored to your requirements.

- Once you've found the appropriate document, click on the Buy Now button and choose a suitable subscription plan. You'll need to create an account to access the full library.

- Complete your purchase by entering your credit card information or PayPal account details.

- Finally, download the form to your device and access it anytime from the My Forms section of your account.

By following these steps, you can manage your living trust taxes effectively and ensure your legal documentation is up-to-date. US Legal Forms not only streamlines this process but also provides users with access to premium experts for assistance in completing forms accurately.

Start today and safeguard your assets with the right legal forms—try US Legal Forms for an easier path to managing your living trust taxes.

Form popularity

FAQ

The new IRS $600 rule pertains to reporting thresholds for certain transactions involving trusts. If a trust's gross income exceeds $600, a tax return must be filed for that trust. This rule affects how individuals planning their estates manage and report living trust taxes. It's wise to consult a tax professional to ensure compliance with these recent updates.

A living trust itself does not count as income; however, income generated by trust assets may be subject to tax. This income is reported on the grantor’s tax return while they are alive. It is crucial to monitor how assets within the living trust generate income to manage living trust taxes efficiently. Your financial planner can help you understand these aspects in detail.

To avoid capital gains tax in an irrevocable trust, consider structuring the trust to minimize taxable events. Strategies include holding assets until a favorable market condition arises or utilizing strategies that pass along tax responsibilities to beneficiaries. A clear understanding of living trust taxes can guide you in effective tax planning. Explore options with a qualified advisor for personalized solutions.

The recent IRS ruling on irrevocable trusts underscores their separate tax implications. Unlike living trusts, irrevocable trusts must file their own tax returns and are taxed separately from the grantor. This distinction affects how individuals manage living trust taxes alongside their overall estate planning. Consulting with a professional can clarify these regulations for you.

Typically, a living trust does not file a separate tax return while the grantor is alive, as it is often treated as a disregarded entity. Instead, any income generated is reported on the grantor’s personal tax return. However, once the grantor passes away, the trust may need to file its own return. Managing living trust taxes correctly ensures you meet all requirements seamlessly.

The new IRS rule on trusts primarily focuses on income reporting. Trusts must now adhere to stricter guidelines regarding the disclosure of taxable income. This change impacts how living trust taxes are calculated and reported. Stay informed to ensure compliance with current regulations.

Yes, trust taxes are generally filed separately. A trust, such as a living trust, may have its own tax obligations, depending on its structure and income. Income generated by the trust is reported on its tax return. Understanding living trust taxes helps you navigate these requirements effectively.

A common mistake parents make regarding trust funds is not funding the trust properly. Simply establishing a trust is not enough; you must transfer assets into the trust to benefit from its features, including tax advantages related to living trust taxes. Without proper funding, your intended benefits may never materialize, leaving you and your family at a disadvantage.

Living trust taxes can create complexities for your estate plan. One disadvantage is that income generated by the assets in the trust may still be taxable, which means you must report this income on your personal tax return. Additionally, a living trust does not exempt your estate from estate taxes. Thus, it's essential to understand these nuances when considering a living trust.

Typically, a revocable living trust does not file its own tax return because its income is reported on the grantor's personal tax return. In contrast, an irrevocable trust is considered a separate entity and must file its own tax return. Understanding the distinction in living trust taxes can help you manage your finances effectively. Our platform can assist you in finding detailed guidance on forms and requirements.