Cosigner For Car Lease Agreement

Description

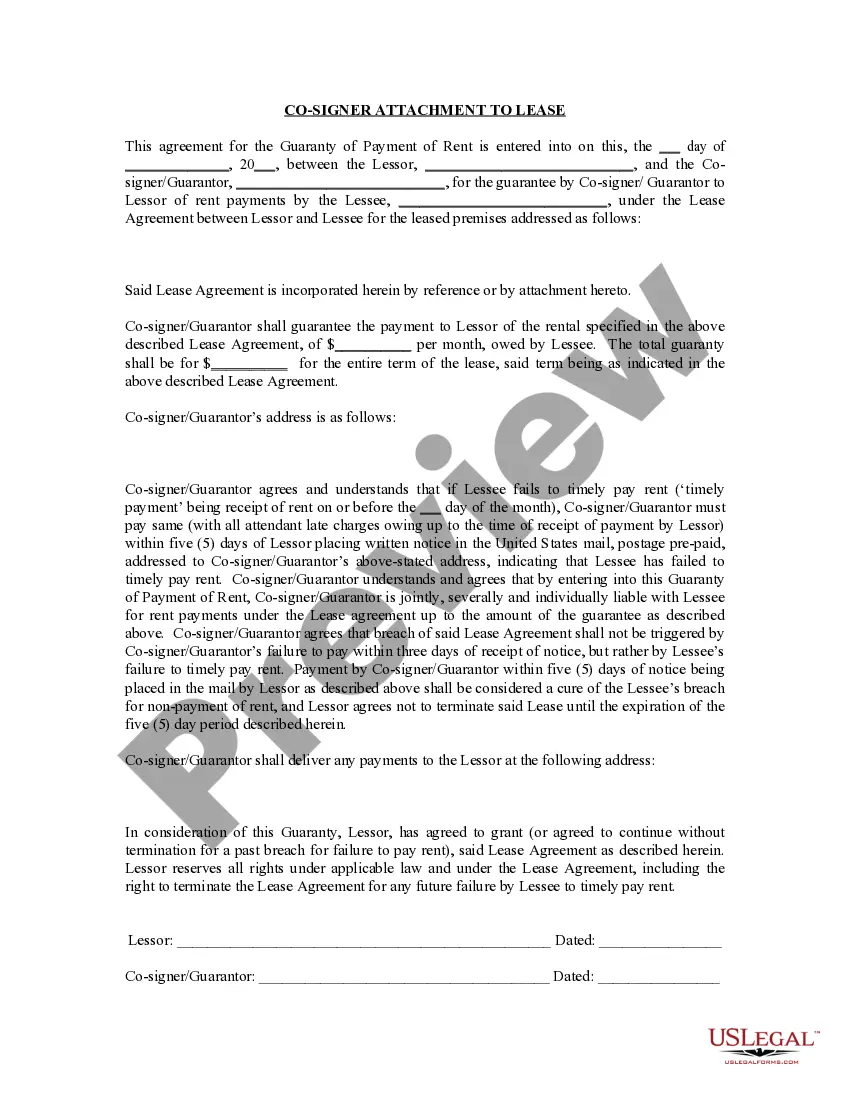

How to fill out Utah Landlord Tenant Lease Co-Signer Agreement?

Administrative systems require exactness and correctness.

If you do not engage with completing forms like Cosigner For Car Lease Agreement regularly, it may lead to some misunderstanding.

Selecting the appropriate example from the beginning will guarantee that your document submission proceeds smoothly and avert any hassles of re-submitting a document or replicating the same task entirely from the ground up.

Acquiring the correct and current examples for your documentation is just a matter of moments with an account at US Legal Forms. Eliminate the bureaucratic worries and simplify your dealings with forms.

- Locate the template using the search bar.

- Verify that the Cosigner For Car Lease Agreement you’ve discovered is suited for your state or locality.

- Open the preview or examine the details provided regarding the usage of the sample.

- If the outcome meets your criteria, click the Buy Now button.

- Choose the proper option among the recommended subscription packages.

- Log In to your account or create a new one.

- Finalize the transaction using a credit card or PayPal account.

- Receive the form in the file format of your preference.

Form popularity

FAQ

Can you have a cosigner on a car lease? Yes! Even with a bad credit score, you can still acquire a car through a lender with the help of a cosigner.

Having a Cosigner for a Car Lease Many lenders and lessors require bad credit borrowers to have a cosigner before they can approve you. If you have a credit score around 660 or lower, it isn't uncommon for a lessor to ask you to bring a cosigner to qualify for the lease.

The typical minimum for most dealerships is 620. A score between 620 and 679 is near ideal and a score between 680 and 739 is considered ideal by most automotive dealerships. If you have a score above 680, you are likely to receive appealing lease offers.

To add a co-borrower to your existing car loan, you have to refinance it in order to get their name on the loan. Refinancing is when you replace your existing loan with a new one, hopefully with better terms.

Answer provided by. It depends on your lender. Some lenders may allow him to sign digitally or through fax, while others will want him to be present for a witnessed or notarized document. Consult your lender beforehand to see if the cosigner needs to be present during closing.