Utah Deed Of Trust Form

Description

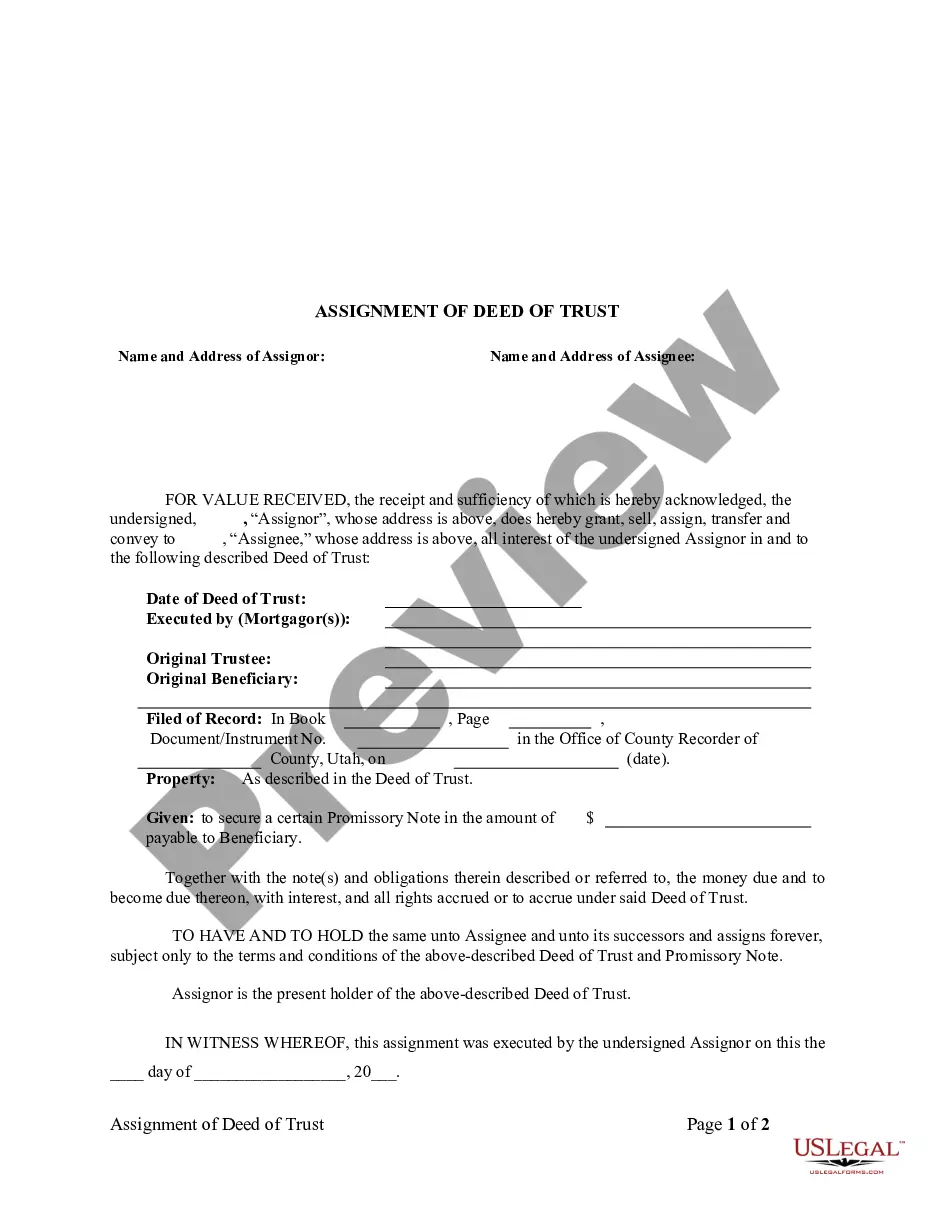

How to fill out Utah Assignment Of Deed Of Trust By Corporate Mortgage Holder?

Individuals typically link legal documents with a complicated process that only an expert can handle.

In a sense, this is accurate, as creating the Utah Deed Of Trust Form demands considerable expertise in the area, encompassing both state and local laws.

Nevertheless, with US Legal Forms, everything has been simplified: pre-prepared legal templates for any personal and business situation tailored to state regulations are compiled in one online repository and are now accessible to all.

You can print your document or upload it to an online editor for quicker completion. All templates in our library are reusable: once purchased, they remain stored in your profile. You can access them any time via the My documents tab. Explore all the advantages of utilizing the US Legal Forms platform. Subscribe now!

- US Legal Forms offers over 85,000 current forms categorized by state and usage area, making it quick to find the Utah Deed Of Trust Form or any specific template.

- Returning users with an active subscription must Log In to their account and click Download to access the form.

- New users on the platform are required to create an account and subscribe before they can download any legal documents.

- Follow these step-by-step instructions to obtain the Utah Deed Of Trust Form.

- Review the content on the page closely to make sure it meets your requirements.

- Examine the form description or confirm it through the Preview feature.

- If the previous sample does not fit your needs, search for another one using the Search field above.

- Once you find the appropriate Utah Deed Of Trust Form, click Buy Now.

- Select a subscription plan that aligns with your needs and financial plan.

- Create an account or Log In to continue to the payment section.

- Pay for your subscription using PayPal or with a credit card.

- Choose the format for your document and click Download.

Form popularity

FAQ

Forming a trust in Utah involves several essential steps, starting with defining your objectives for creating the trust. You will need to draft a trust document, which outlines the terms of the trust and identifies the trustee and beneficiaries. It’s advisable to consult with a legal expert to ensure the document meets state laws and your specific needs. Utilizing a Utah deed of trust form can provide a reliable framework for establishing the financial aspects of your trust.

To transfer property title in Utah, you typically need to complete a deed form, such as a quitclaim deed or warranty deed. You should ensure the form is filled out accurately and contains all necessary information, including the legal description of the property. Once completed, you must have the deed notarized, then record it with your county clerk's office. Using a Utah deed of trust form can help clarify any financial agreements associated with the property transfer.

Transferring items into a trust generally involves changing the title of the items to reflect the trust as the new owner. This may include signing documents that explicitly show the transfer, especially for significant assets like real estate or business interests. Using a Utah deed of trust form can simplify the process for real estate transactions, ensuring clarity and legal compliance.

Filing a quit claim deed in Utah requires you to complete the deed form, detailing the property and parties involved. After signing, the deed must be submitted to the county recorder's office where the property exists. This action effectively transfers any interest you have in the property, and it is advisable to consult resources or platforms like USLegalForms for guidance.

To transfer property into a trust in Utah, you must execute a deed that transfers your property from your name to the trust's name. A Utah deed of trust form should be used for real estate transactions, ensuring proper documentation. This step legally places your property under the management of the trust.

Filing a trust in Utah involves drafting the trust document and signing it in the presence of a notary. Unlike other legal documents, you do not need to file the trust with a court. However, if your trust holds real estate, you may need to record the deed that transfers property into the trust by using a Utah deed of trust form.

The best trust for your house often depends on your specific needs and goals. Generally, a revocable living trust is recommended for its flexibility and ease of management. This allows you to retain control over your property while also simplifying the transfer process in the event of your passing.

While many types of assets can be placed in a trust, certain items are typically excluded. For instance, retirement accounts that have specific beneficiary designations often cannot be transferred. Additionally, some assets may require special considerations, like life insurance policies, which might not be directly transferable into a trust.

To transfer ownership of a property in Utah, you will typically need to complete a deed, such as a warranty deed or a Utah deed of trust form for secured transactions. After filling out the appropriate form, you must sign it in front of a notary and file it with the county recorder. Using resources from platforms like USLegalForms can simplify this process and ensure you have the necessary documents and guidance for a smooth transaction.