Limited Limited

Description

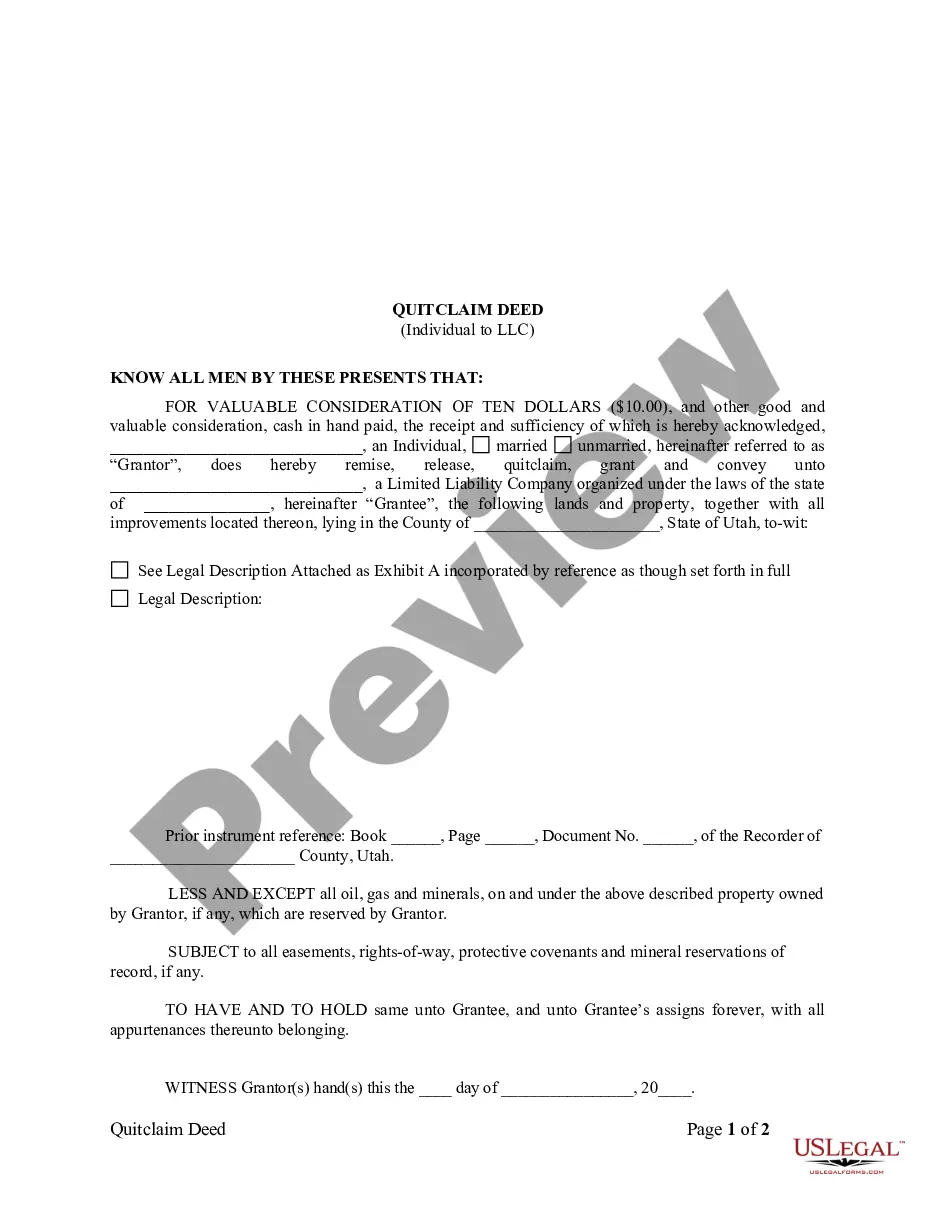

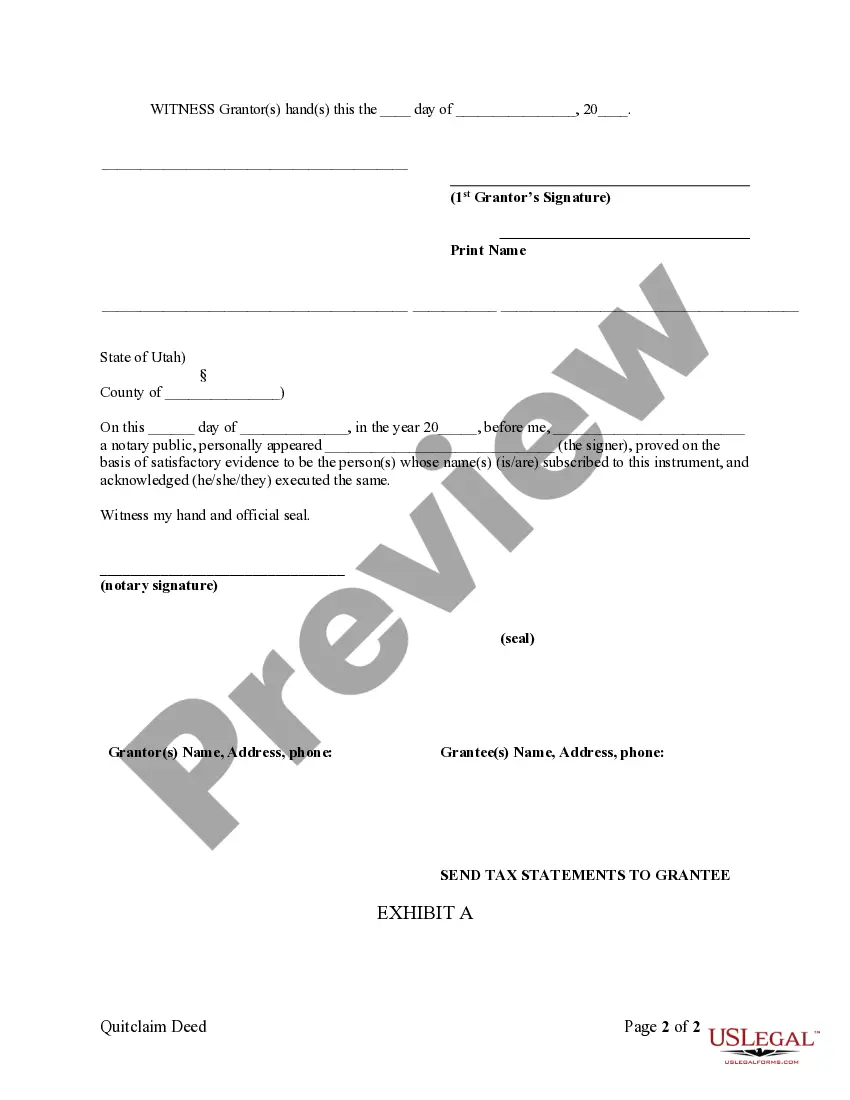

How to fill out Utah Quitclaim Deed From Individual To LLC?

- If you're an existing user, simply log in and download the required form by pressing the Download button. Confirm the validity of your subscription; renew it if needed.

- For first-time users, start by reviewing the form descriptions and utilize the Preview mode. Verify that your selection matches your local jurisdiction's requirements.

- If you need a different template, leverage the search functionality to identify a suitable form. Ensure it meets your specifications before proceeding.

- Click on the Buy Now button to purchase the document and select your preferred subscription plan while ensuring you register for full access.

- Complete your transaction by entering your payment details or using PayPal to secure your subscription.

- Finally, download your selected form and save it to your device. You can also find it again later in the My Forms section.

By following these steps, you can efficiently acquire and manage your legal documents with ease, reinforcing the user-friendly experience that US Legal Forms provides.

Ready to streamline your legal documentation? Start today with US Legal Forms for a hassle-free experience!

Form popularity

FAQ

In slang, 'limit' can imply reaching the maximum of something, often used to describe situations where someone feels overwhelmed or pushed to their boundaries. This informal use conveys a sense of exhaustion or frustration. It's important to recognize this slang, as it reflects cultural discussions around stress and limits in daily life. Communicating within these contexts helps build connection.

In Roblox, 'limited' refers to items that are available in restricted quantities, making them desirable to players. The 'limited u' tag indicates that an item can be traded or sold among users, adding a layer of value. These limited items enhance gameplay and provide a sense of exclusivity. Players often strive to obtain these items to elevate their gaming experience.

The term 'limit limited' suggests specific constraints on both action and potential. It can be used to discuss constraints in various scenarios, including legal and business environments. For businesses, having a clear understanding of these limitations lets owners navigate complex regulations. This understanding helps you avoid pitfalls and make informed choices.

The phrase 'limit limit' can be somewhat confusing, as it usually refers to a stricter or further restricted boundary. It conveys a sense of two layers of limitation, perhaps in a specific context. It's important to clarify what those boundaries entail for effective decision-making. When it comes to business regulations, knowing your limits is key.

Ltd. is an abbreviation for 'limited', which designates a limited company. However, when you see Ltd. Ltd., it might be a playful or erroneous repetition, as the term is already denoted by the first 'Ltd.'. Such companies enjoy certain legal protections, particularly around personal liability for debts. It's essential to understand this designation when interpreting business structures.

The full meaning of limited often relates to the limitations placed on owners' liabilities. In business terminology, it signifies a structure that protects personal assets. For example, a limited company allows for the separation of personal and business finances. This separation is vital for safeguarding individual wealth.

When something is described as limited, it indicates that there are restrictions or boundaries. In a legal context, 'limited' often refers to a type of company that has liability protections. This means that the owners are not personally responsible for the company's debts. Understanding this term is crucial for anyone considering starting a business.

Using the term 'limited' instead of LLC is generally not permissible when referring to a Limited Limited Company in most states. LLC stands for Limited Liability Company and offers specific legal protections. Therefore, it is essential to use the correct terminology to comply with state business naming regulations. USLegalForms can assist you in understanding the nuances of naming your business correctly.

Not filing taxes for your LLC can lead to severe consequences, such as penalties, interest on unpaid amounts, and even potential loss of good standing in your state. The IRS may issue notices for non-compliance, which can accumulate over time. It's crucial to address any tax obligations promptly. Consider using services like USLegalForms to navigate your filing correctly.

Yes, you can have an LLC and keep it inactive, but it’s still recommended to file annual reports or maintain compliance as required by your state. Failing to do so may result in penalties or even dissolution of your Limited Limited Company. It's wise to understand your obligations even if you're not using the LLC. USLegalForms provides resources to guide you through compliance requirements.