Limited Liability Company For Dummies

Description

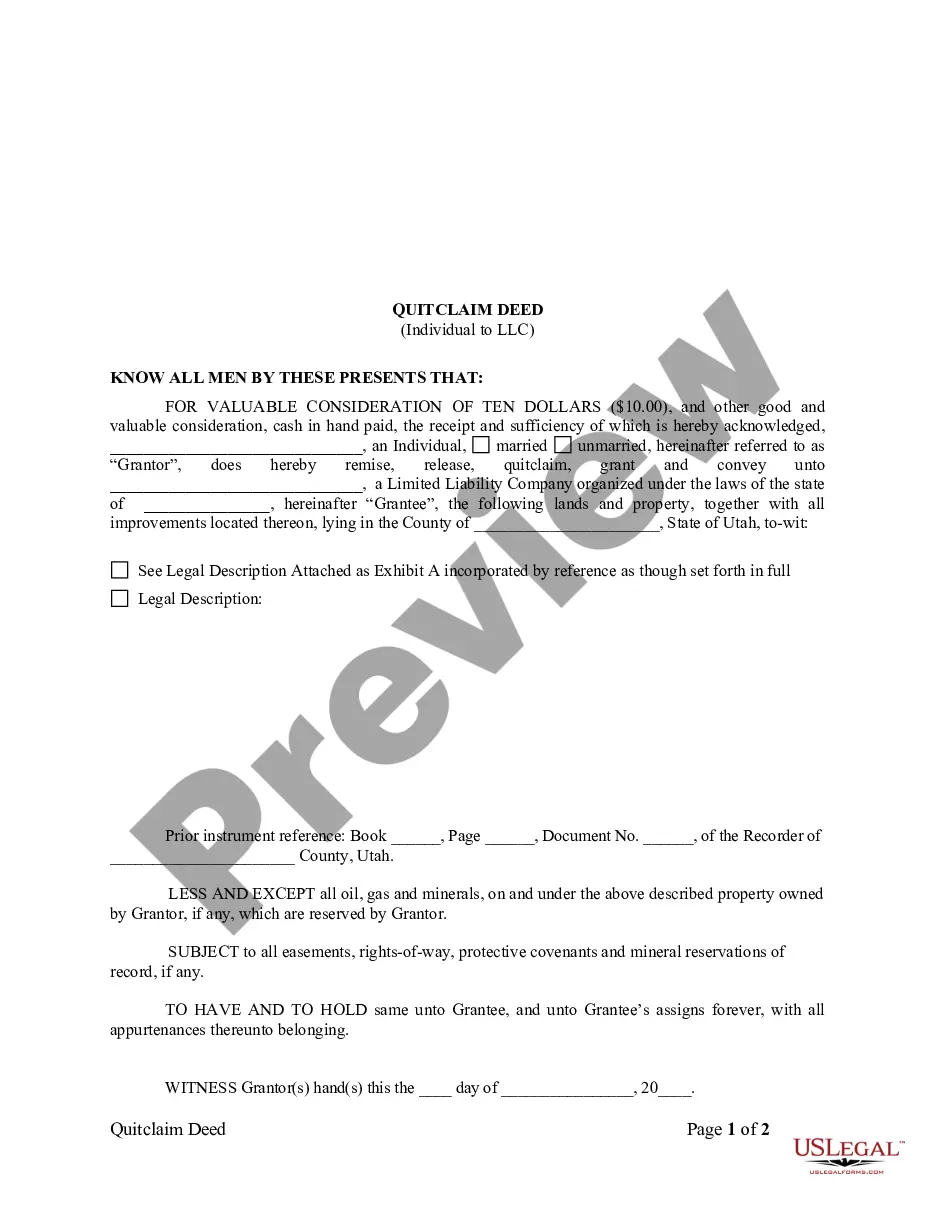

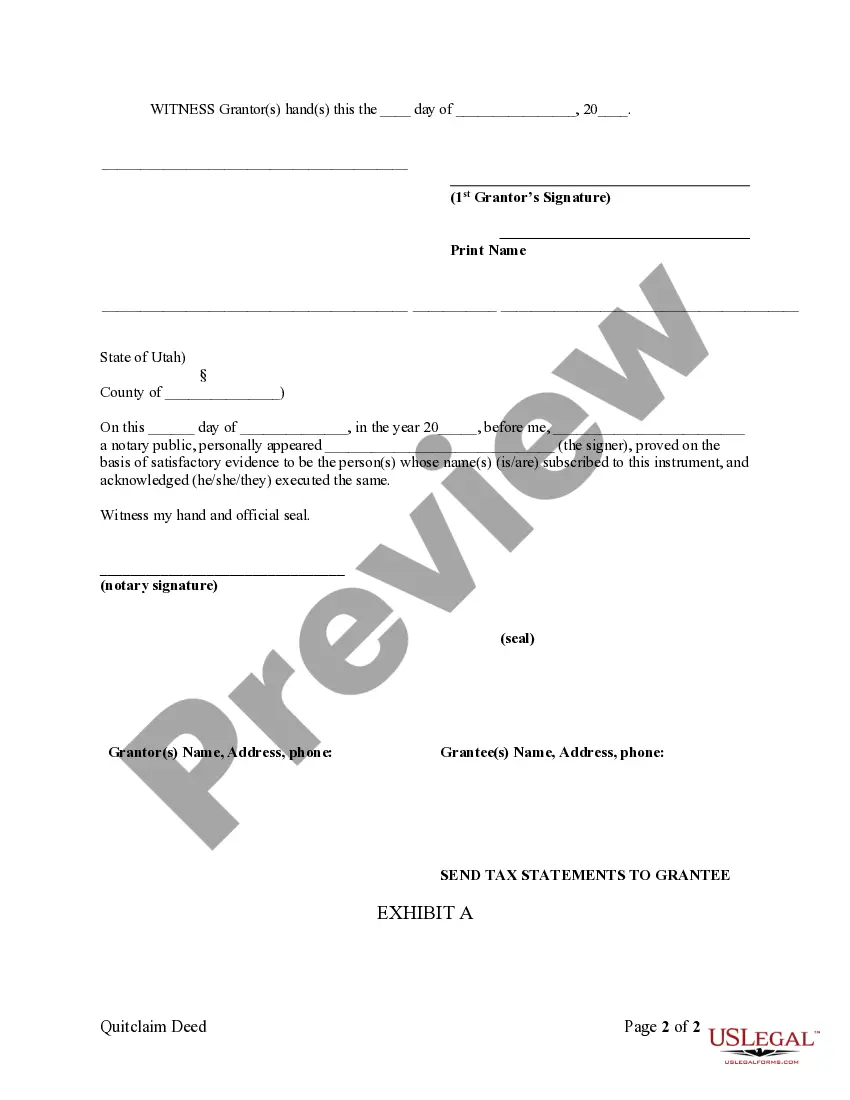

How to fill out Utah Quitclaim Deed From Individual To LLC?

- If you're a returning user, log into your account and ensure your subscription is active. Click the Download button to save your desired form template.

- For new users, begin by reviewing the Preview mode and the form description carefully. Confirm that the selected document meets your specific needs and complies with local regulations.

- If the form does not align with your requirements, utilize the Search tab above to find a more suitable one that fits your specifications before proceeding.

- Select the document by clicking the Buy Now button, choosing the subscription plan that works best for you. Be sure to set up your account to access the extensive library of forms.

- Complete your transaction by entering your payment details via credit card or PayPal to finalize your subscription.

- After purchase, download the template to your device. Access it anytime via the My Forms section in your profile.

US Legal Forms offers a robust collection of over 85,000 legal forms, ensuring that individuals and attorneys can quickly find and execute documents necessary for their LLC formation. The service stands out with its affordable pricing and access to premium experts for assistance, guaranteeing the completion of legally sound documents.

Overall, utilizing US Legal Forms simplifies the process of setting up your LLC. Don't let the legal complexities overwhelm you – start your journey towards business ownership today!

Form popularity

FAQ

The best program to start an LLC often includes online services that provide step-by-step guidance and legal documentation assistance, like US Legal Forms. These programs simplify the filing process, making them particularly suitable for beginners navigating the world of limited liability companies. Choosing a reliable program ensures that you meet all legal requirements effectively.

Yes, you can file your LLC by yourself, but it requires a thorough understanding of the process. Preparing the necessary forms and ensuring compliance with state regulations is crucial. However, using a service like US Legal Forms can provide the necessary support and resources, making it easier for anyone interested in a limited liability company for dummies.

One significant disadvantage of a limited liability company is the potential for self-employment taxes on earnings. If your LLC is treated as a disregarded entity, all profits will be subject to these taxes. Understanding this downside is key for anyone looking to form an LLC, so you can plan accordingly.

The most effective way to file for an LLC is to utilize online platforms that help streamline the process, like US Legal Forms. You should prepare the necessary documentation, including the Articles of Organization, and follow your state’s specific filing procedures. This method is particularly beneficial for those unfamiliar with legal jargon.

Choosing the best filing status for your limited liability company depends on your business structure and number of members. For single-member LLCs, you typically file as a sole proprietorship, while multi-member LLCs often file as partnerships. Each option has distinct tax implications, so ensure you understand them well.

Filing taxes for a limited liability company can seem complicated, but it doesn't have to be. An LLC usually files taxes as a pass-through entity, meaning profits pass directly to the owners and are reported on their individual tax returns. For those learning about this, it’s crucial to consult resources or services that can clarify these tax obligations.

To file for an LLC, you should first choose a unique name for your business and ensure it complies with state rules. Next, you must prepare and submit your Articles of Organization to your state’s business filing agency. Using a trusted platform like US Legal Forms can simplify this process, providing guidance tailored for those interested in a limited liability company for dummies.

An LLC can be worth it for a small business, especially if you want to protect your personal assets and limit your financial risks. The structure offers flexibility in management and tax options, which can benefit many small business owners. Protecting your personal wealth is crucial, and a limited liability company for dummies can provide that security. Ultimately, evaluating your specific needs will help you determine the value of forming an LLC.

Choosing not to form a limited liability company for dummies can be due to various reasons. Some individuals may prefer simpler structures like sole proprietorships, which have fewer formalities and costs. Others may worry about the regulatory requirements or are unfamiliar with the limited liability concept. Therefore, understanding the alternatives can help you make the best choice for your situation.

Yes, owning a limited liability company for dummies can significantly affect your taxes. Generally, LLCs are pass-through entities, meaning profits and losses are reported on your personal tax return, avoiding double taxation. However, specific tax responsibilities can vary depending on your state and the number of members in your LLC. Consulting a tax professional can help clarify how an LLC will impact your overall tax obligations.