Utah Property Laws

Description

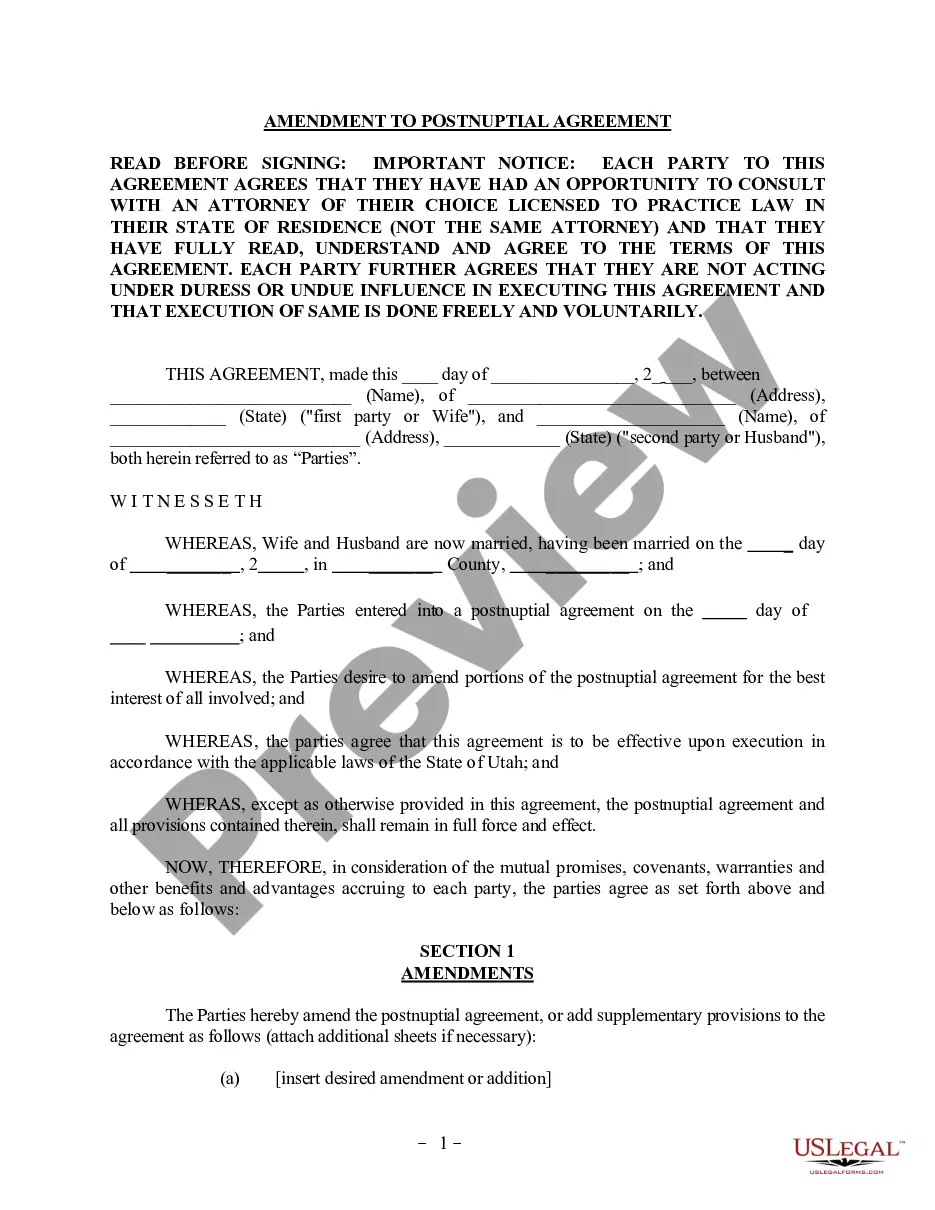

How to fill out Utah Postnuptial Property Agreement?

Legal document managing can be overwhelming, even for the most knowledgeable experts. When you are searching for a Utah Property Laws and do not have the time to spend searching for the appropriate and up-to-date version, the operations might be nerve-racking. A strong web form catalogue might be a gamechanger for anyone who wants to deal with these situations efficiently. US Legal Forms is a market leader in online legal forms, with more than 85,000 state-specific legal forms accessible to you at any moment.

With US Legal Forms, you are able to:

- Access state- or county-specific legal and business forms. US Legal Forms handles any demands you might have, from personal to business documents, all-in-one spot.

- Utilize innovative tools to accomplish and manage your Utah Property Laws

- Access a useful resource base of articles, guides and handbooks and resources highly relevant to your situation and requirements

Help save time and effort searching for the documents you will need, and employ US Legal Forms’ advanced search and Review feature to locate Utah Property Laws and download it. If you have a membership, log in for your US Legal Forms account, look for the form, and download it. Take a look at My Forms tab to view the documents you previously downloaded as well as manage your folders as you can see fit.

Should it be the first time with US Legal Forms, register a free account and have unrestricted access to all advantages of the library. Listed below are the steps to consider after getting the form you need:

- Confirm it is the correct form by previewing it and looking at its information.

- Be sure that the sample is approved in your state or county.

- Select Buy Now once you are ready.

- Choose a monthly subscription plan.

- Find the formatting you need, and Download, complete, eSign, print out and deliver your document.

Enjoy the US Legal Forms web catalogue, backed with 25 years of expertise and trustworthiness. Change your everyday document management in a easy and user-friendly process today.

Form popularity

FAQ

Residential properties that serve as the primary residence of any household receive an exemption of 45% of fair market value. Therefore, the taxable value is only 55% of fair market value. Tax rates are applied to the taxable value to determine the property tax due.

Property is divided by the Utah courts during a divorce. Divorce laws in Utah state that marital property should be divided equitably. This means that a Utah court could decide that it is fair to split the marital property 50-50 or they may decide that one party deserves more than 50% of the property.

The primary residential exemption is a 45% property tax exemption on most homes in Utah. This means you only pay property taxes on 55% of your home's fair market value. You may be eligible for the primary residential exemption if you occupy your home for 183 consecutive days or more in a calendar year.

With that said, the general rule, even for short-term marriages, is 50/50 division. However, in some very short-term marriages, the courts may put spouses back into the financial position they were in before the marriage ? that is, each spouse gets the asset that belonged to him/her at the beginning of the marriage.

The Utah State Tax Commission defines tangible personal property as material items such as watercraft, aircraft, motor vehicles, furniture and fixtures, machinery and equipment, tools, dies, patterns, outdoor advertising structures, and manufactured homes.