Utah Trust Form

Description

Form popularity

FAQ

The most common mistake parents make is failing to clearly specify how the funds should be used in the trust documentation. Without clear guidelines in the Utah trust form, beneficiaries may misuse the assets or be unprepared for financial responsibilities. Additionally, parents often overlook updating the trust as family circumstances change, leading to potential conflicts or unmet intentions. Ensuring clarity and regular updates can significantly enhance the effectiveness of the trust fund.

One major disadvantage of a trust is the associated costs and complexity in setting it up and maintaining it. Creating a trust requires careful planning and may involve legal fees, which can be higher compared to simpler estate planning options. In some cases, individuals may feel overwhelmed by the paperwork and responsibilities tied to managing the trust. However, using a user-friendly Utah trust form can simplify the process and reduce these burdens.

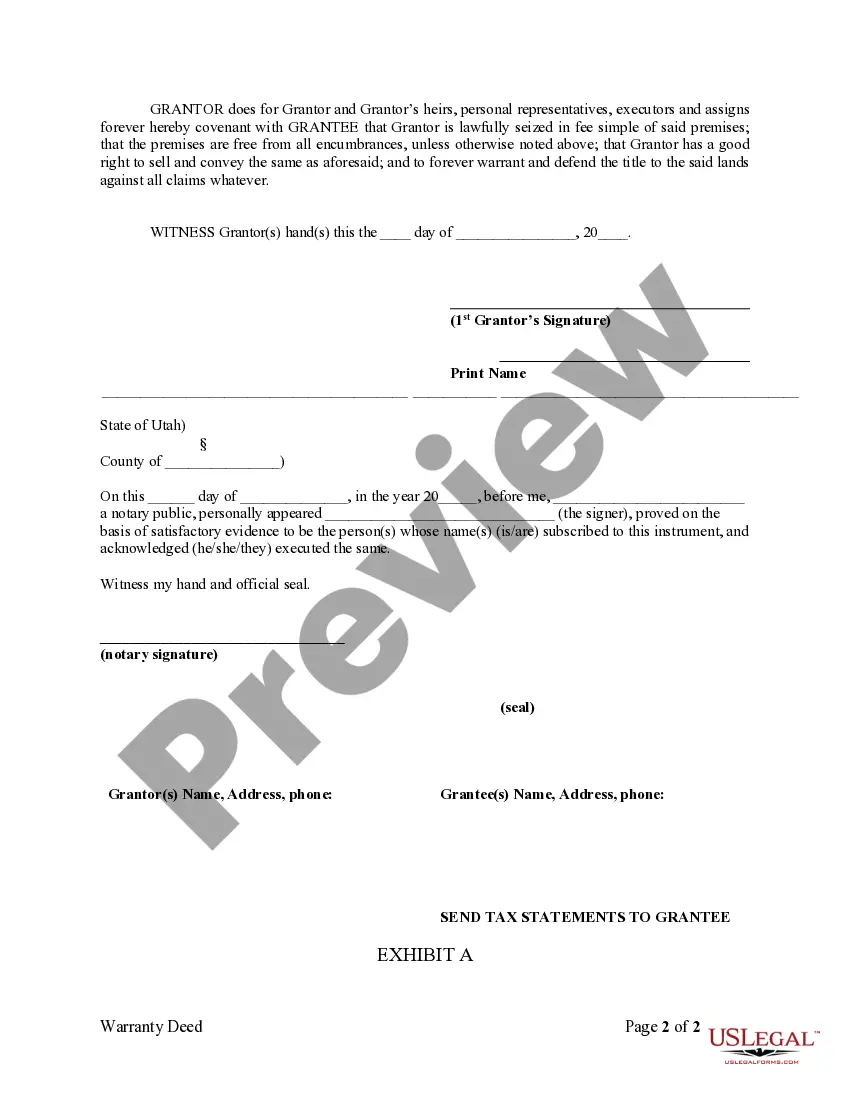

Yes, trusts in Utah are generally required to file a trust tax return depending on their classification. If the trust generates income, it must file a federal tax return, which may include state taxes as well. The specific requirements can be complex, so it is beneficial to consult with a tax professional familiar with the Utah trust form. This ensures compliance and proper handling of tax obligations for the trust.

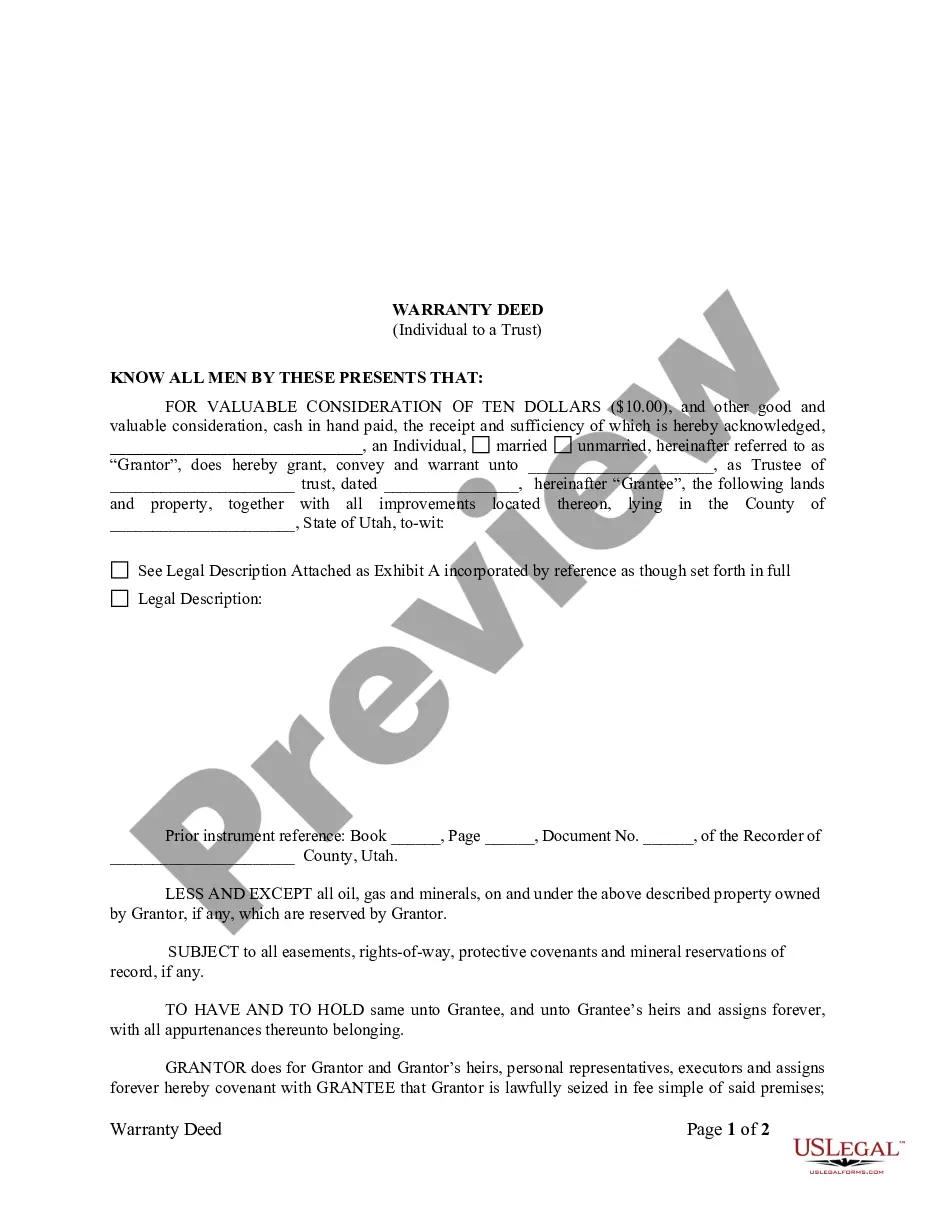

A trust in Utah serves as a legal arrangement where a person, known as the grantor, gives control of assets to a trustee for the benefit of beneficiaries. The grantor outlines specific terms in the Utah trust form, detailing how and when assets should be distributed. This setup ensures a smooth transition of assets, avoids probate, and maintains privacy for those involved. Utilizing the correct Utah trust form can streamline this process significantly.

To transfer your property into a trust in Utah, you will need to change the title of the property to the name of the trust. This process typically involves filling out a Utah trust form and recording it with your county clerk. Properly completing this transfer ensures your assets are managed according to your wishes. USLegalForms can guide you through the necessary steps and documentation.

One downside of a trust is the complexity involved in setting it up and maintaining it. Your Utah trust form requires careful drafting to ensure it meets your needs and state regulations. Additionally, there may be costs associated with creating and managing the trust over time. Exploring resources like USLegalForms can help simplify this process.

In Utah, a trust does not generally need to be notarized. However, having your Utah trust form notarized can add an extra layer of authenticity. It can also help in preventing disputes among beneficiaries. Using USLegalForms can assist you in obtaining a notarized document easily.

Yes, you can write your own trust in Utah. However, it is important to ensure that your Utah trust form complies with state laws. A well-drafted trust can help you avoid legal issues later. If you are unsure, consider using a reliable platform like USLegalForms, which simplifies the process and provides guidance.

Trusts might need to file Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return, under certain conditions. This typically occurs if the trust makes significant taxable gifts. By understanding when and how to use Form 709 alongside your Utah trust form, you can ensure proper compliance with tax laws.

The primary IRS form to file for a trust is Form 1041, which is the federal income tax return for estates and trusts. If your trust has a taxable income, this form must be filed annually. Additionally, any distributions made to beneficiaries should be reported on the K-1 form issued by the trust.