Utah Foreign Corporation Registration

Description

How to fill out Utah Business Incorporation Package To Incorporate Corporation?

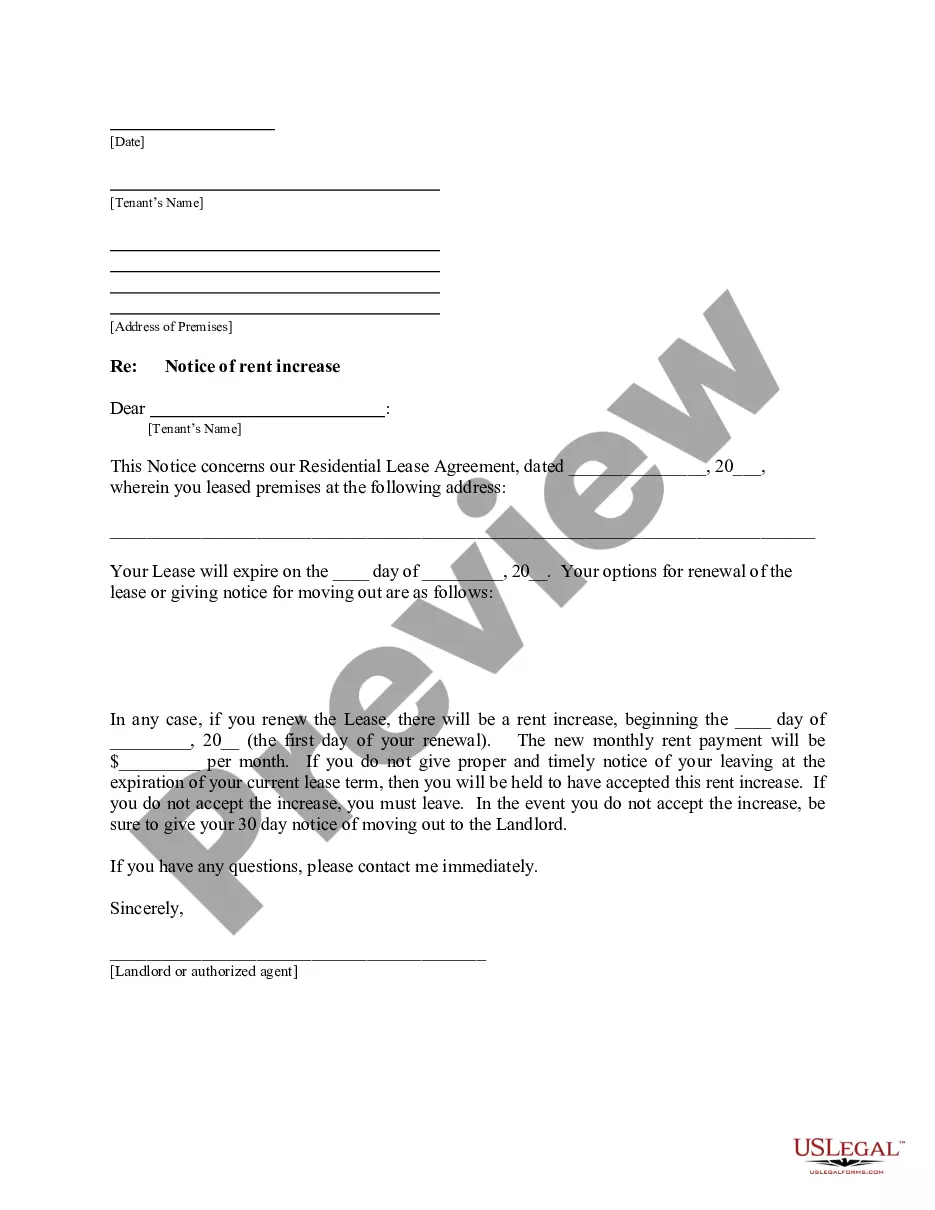

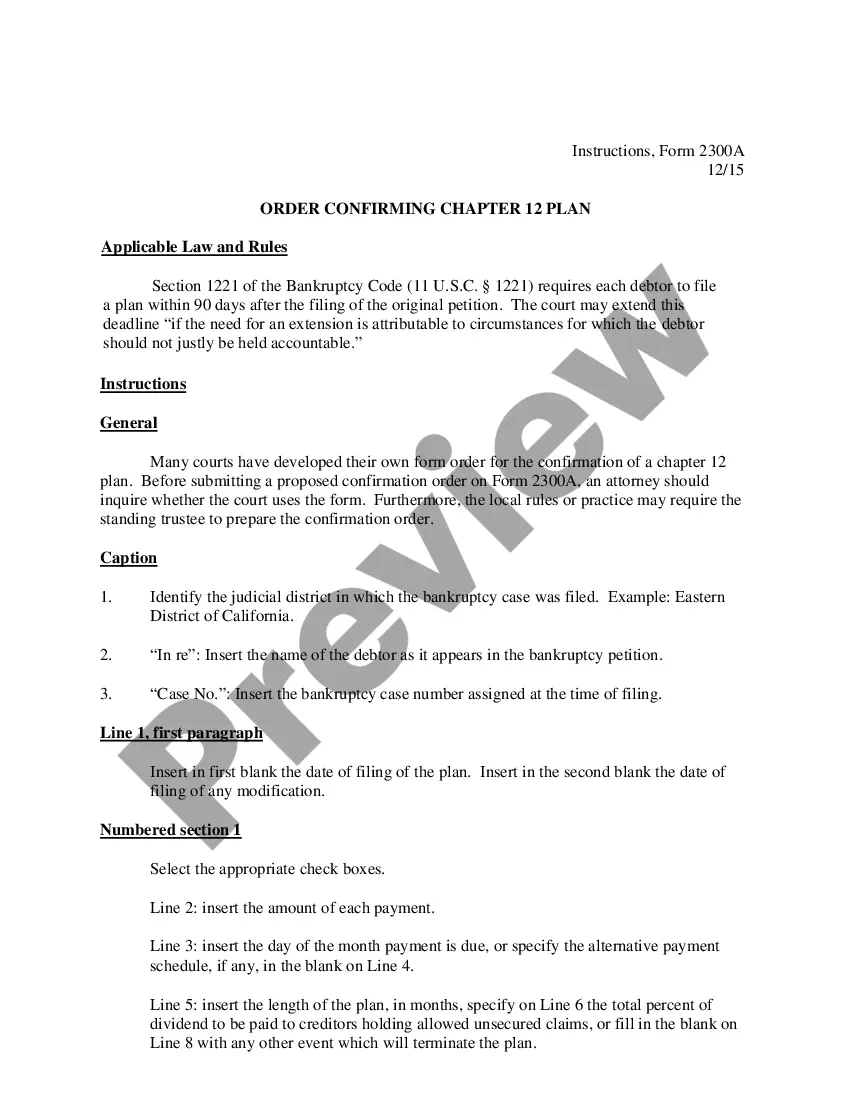

The Utah Foreign Corporation Registration displayed on this page is a versatile official template created by experienced attorneys in alignment with national and regional laws.

For over 25 years, US Legal Forms has offered individuals, businesses, and legal experts more than 85,000 validated, state-specific documents for various commercial and personal scenarios. It is the quickest, easiest, and most dependable method to obtain the documents you require, as the service ensures bank-level data security and anti-malware safeguards.

Subscribe to US Legal Forms to have authenticated legal templates for every life situation within your reach.

- Explore for the document you require and assess it.

- Investigate the file you searched and preview it or examine the form description to confirm it meets your requirements. If it doesn't, utilize the search bar to find the correct one. Click Buy Now once you have found the template you need.

- Choose and Log In to your account.

- Select the pricing option that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and check your subscription to continue.

- Obtain the fillable template.

- Choose the format you prefer for your Utah Foreign Corporation Registration (PDF, Word, RTF) and save the template on your device.

- Fill out and sign the document.

- Print the template to complete it manually. Alternatively, utilize an online multifunctional PDF editor to quickly and accurately fill out and sign your form with an eSignature.

- Download your documents again.

- Reuse the same document whenever necessary. Access the My documents tab in your profile to redownload any previously obtained forms.

Form popularity

FAQ

To qualify or register a foreign entity in California, you must submit an application to the California Secretary of State. This includes details about your business and a certificate of good standing from your original state or country. Be aware that each state has different requirements, so understanding these differences is important for effective management.

Starting an LLC in California ? fees to file You'll pay two filing fees with your LLC application in California: $70 fee to file articles of organization with the California Secretary of State's office. $20 fee to file a Statement of Information, Form LLC-12, with the California Secretary of State.

Note: California LLCs don't have to pay $800 franchise tax for the 1st year. Every California LLC must file the Annual Franchise Tax every year.

Note that while the normal LLC filing fee in California is $70, the state has temporarily waived this fee for applications submitted between July 1, 2022, and June 30, 2023. You will still need to pay the $5 certification fee, however, if you want a certified copy of your registration.

California LLC Fees and Taxes The CA LLC fee is $85, payable to the secretary of state. In addition, a California LLC fee is also due for the statement of information, a document that must be submitted within 90 days of LLC formation and carries a filing cost of $20.

The cheapest way to start Limited Liability Companies is to file the formation documents yourself. You'll also save money by being your own Registered Agent, and using our free LLC Operating Agreement template.

Each year, LLCs must pay an annual LLC franchise fee which is the greater of $800 or 1.5% of net taxable business income paid each taxable year until your LLC is dissolved, regardless of whether it is active or inactive.

Limited Liability Companies (LLC) - California Formation - Articles of Organization. Form LLC-1 (PDF) $70.00. Statement of Information: Due within 90 days of initial registration and every two years thereafter. Form LLC-12 (PDF) $20.00. ... Termination. Certificate of Dissolution. Certificate of Cancellation.

You can file your Articles of Organization with the California Secretary of State for $70. To do business in California, an LLC must pay an $800 franchise tax fee. This fee must be paid regardless of whether the business makes any income and is due every year.