Utah Business Corporation With The Following Investments

Description

How to fill out Utah Business Incorporation Package To Incorporate Corporation?

Legal document managing may be overpowering, even for the most skilled experts. When you are looking for a Utah Business Corporation With The Following Investments and do not get the time to devote searching for the correct and up-to-date version, the processes might be stress filled. A strong web form library can be a gamechanger for everyone who wants to manage these situations efficiently. US Legal Forms is a market leader in online legal forms, with over 85,000 state-specific legal forms available at any moment.

With US Legal Forms, you can:

- Access state- or county-specific legal and business forms. US Legal Forms handles any demands you might have, from individual to business papers, all-in-one location.

- Utilize advanced resources to complete and control your Utah Business Corporation With The Following Investments

- Access a useful resource base of articles, instructions and handbooks and resources relevant to your situation and needs

Save effort and time searching for the papers you need, and make use of US Legal Forms’ advanced search and Review feature to find Utah Business Corporation With The Following Investments and download it. In case you have a monthly subscription, log in to the US Legal Forms profile, look for the form, and download it. Take a look at My Forms tab to view the papers you previously downloaded as well as control your folders as you see fit.

If it is the first time with US Legal Forms, register a free account and acquire unlimited usage of all advantages of the platform. Listed below are the steps for taking after accessing the form you want:

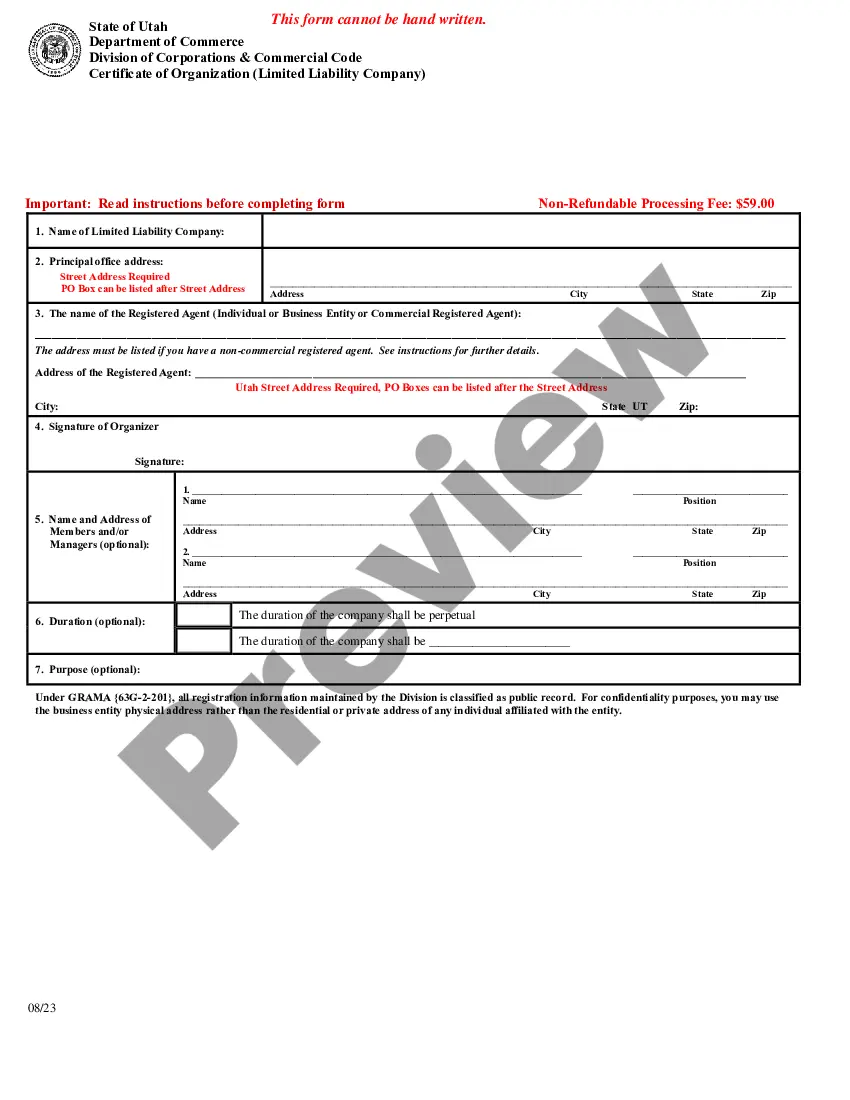

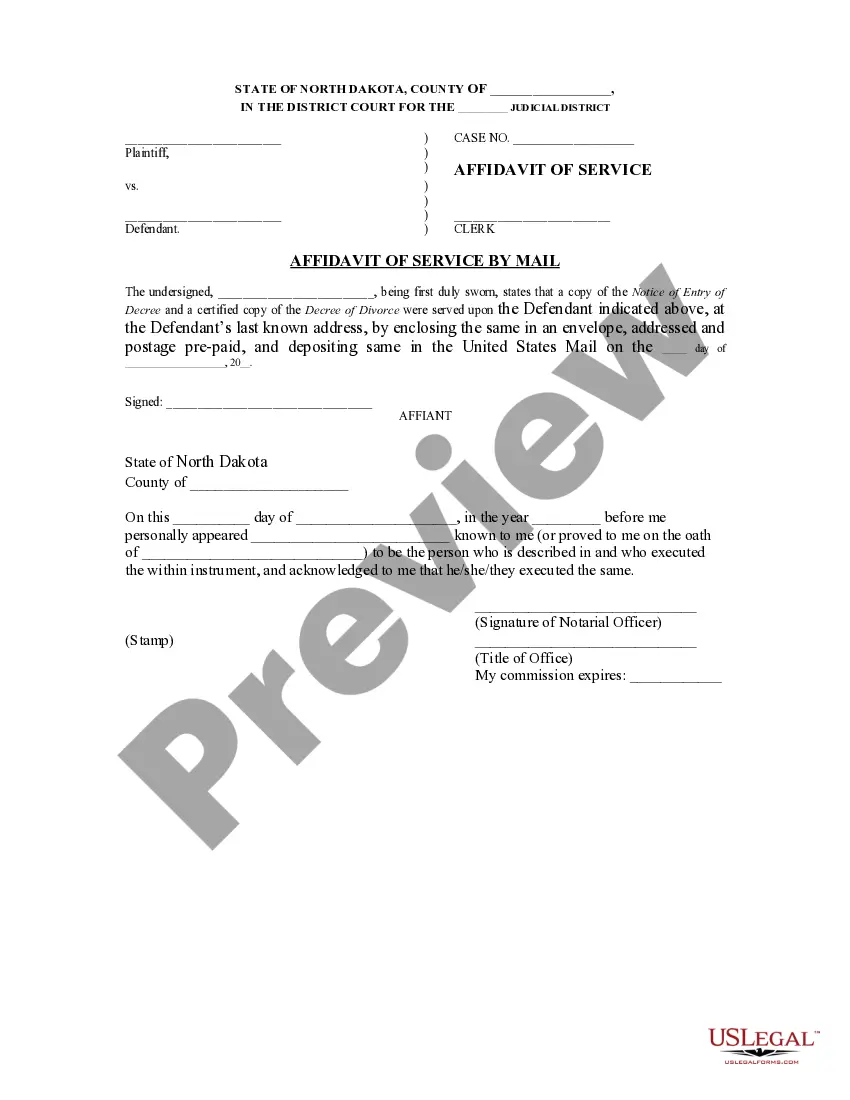

- Validate it is the right form by previewing it and looking at its description.

- Ensure that the sample is recognized in your state or county.

- Choose Buy Now when you are all set.

- Select a monthly subscription plan.

- Pick the formatting you want, and Download, complete, sign, print out and send out your document.

Benefit from the US Legal Forms web library, supported with 25 years of experience and trustworthiness. Change your daily document managing in to a easy and user-friendly process today.

Form popularity

FAQ

Corporations file Schedule M-3 (Form 1120) to answer questions about their financial statements and reconcile financial statement net income (loss) for the corporation to net and taxable income on Form 1120.

Below are common steps to forming a Utah corporation: File Utah Articles of Incorporation. Pay the filing fee: $54. Hold an organizational meeting and create bylaws. Get an EIN from the IRS. File mandatory Beneficial Ownership Information report. Apply for licenses. Open a Utah corporate bank account.

Use Form 1120-S to report the income, gains, losses, deductions, credits, etc., of a domestic corporation or other entity for any tax year covered by an election to be an S corporation.

Items that must be separately stated include, but are not limited to: net income or loss from rental activities, including rental real estate activities; portfolio income or loss and related expenses; Code Sec.

File Form 1040 Both get reported on your personal tax return. Your W-2 income goes on line one of Form 1040. Then report your portion of S corp earnings on part two of Form 1040 Schedule E, a catch-all form for supplemental income, and Form 1040 Schedule 1, a summary of Schedule E and other adjustments to income.