Utah Business Corporation Form 2553

Description

How to fill out Utah Business Incorporation Package To Incorporate Corporation?

Legal papers managing may be overpowering, even for knowledgeable experts. When you are looking for a Utah Business Corporation Form 2553 and do not get the time to commit looking for the appropriate and updated version, the processes can be stress filled. A robust web form catalogue could be a gamechanger for anybody who wants to deal with these situations successfully. US Legal Forms is a industry leader in web legal forms, with over 85,000 state-specific legal forms accessible to you at any time.

With US Legal Forms, it is possible to:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms handles any requirements you may have, from individual to enterprise documents, all-in-one spot.

- Use advanced tools to complete and deal with your Utah Business Corporation Form 2553

- Gain access to a useful resource base of articles, guides and handbooks and materials highly relevant to your situation and needs

Save effort and time looking for the documents you will need, and use US Legal Forms’ advanced search and Review tool to get Utah Business Corporation Form 2553 and download it. For those who have a monthly subscription, log in for your US Legal Forms profile, look for the form, and download it. Review your My Forms tab to find out the documents you previously saved and also to deal with your folders as you can see fit.

If it is your first time with US Legal Forms, create an account and get limitless use of all advantages of the library. Listed below are the steps to take after getting the form you need:

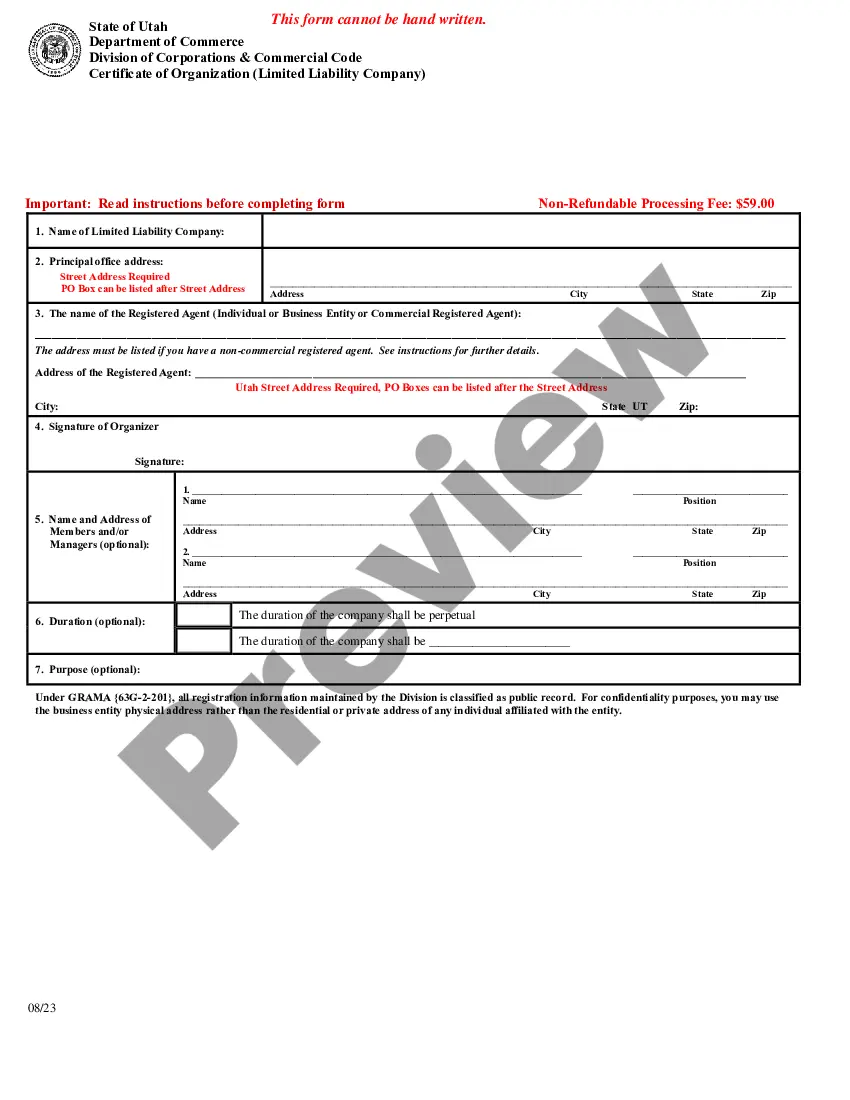

- Verify it is the correct form by previewing it and looking at its information.

- Ensure that the sample is approved in your state or county.

- Select Buy Now once you are ready.

- Choose a subscription plan.

- Find the formatting you need, and Download, complete, eSign, print out and deliver your papers.

Benefit from the US Legal Forms web catalogue, backed with 25 years of experience and trustworthiness. Enhance your everyday papers managing in a easy and intuitive process right now.

Form popularity

FAQ

Follow these five steps to start a Utah LLC and elect Utah S corp designation: Name Your Business. Choose a Registered Agent. File the Utah Certificate of Organization. Create an Operating Agreement. File Form 2553 to Elect Utah S Corp Tax Designation.

Form 2553, Election by a Small Business Corporation, can't be filed electronically. The form instructions state that the corporation needs to mail or fax the original copy of the form to the IRS. Refer to the IRS Instructions for Form 2553 for more information.

As an SMLLC (single-member limited liability company), taxes can be burdensome if one is paying taxes on all the profits that they receive from their company. However, IRS form 2553 can be filed, which would allow the SMLLC to reap the tax benefits of an S-Corp.

A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to be an S corporation.