Form 1c Financing Statement/claim For Lien

Description

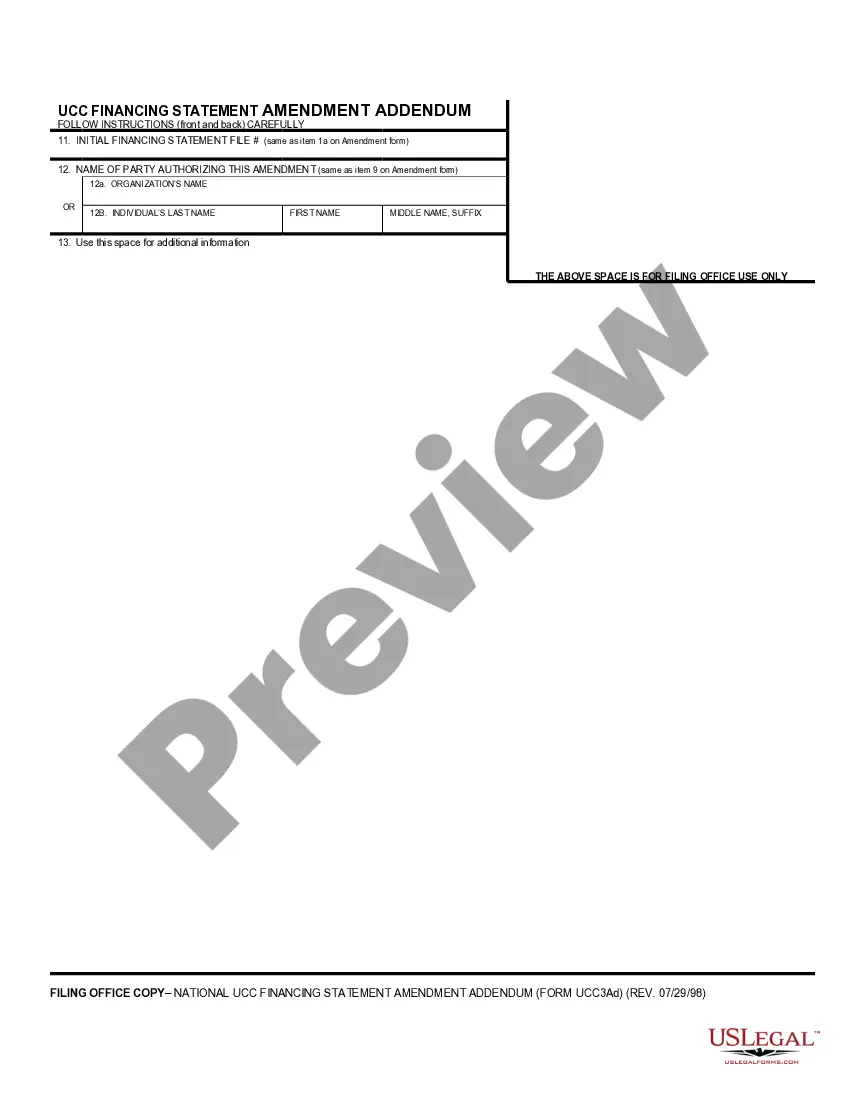

How to fill out UCC1-AD Financing Statement Addendum?

Creating legal documents from nothing can frequently be intimidating.

Certain situations may entail extensive investigation and significant amounts of money spent.

If you’re looking for a simpler and more cost-effective method of preparing Form 1c Financing Statement/claim For Lien or any other paperwork without unnecessary complications, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can swiftly find state- and county-compliant templates carefully assembled for you by our legal professionals.

Examine the form preview and descriptions to make sure that you have located the form you desire.

- Utilize our website whenever you require a dependable service through which you can effortlessly find and download the Form 1c Financing Statement/claim For Lien.

- If you’re already familiar with our services and have previously registered an account with us, simply Log In to your account, find the template, and download it immediately or re-download it at any time in the My documents section.

- Not signed up yet? No worries. It requires minimal time to set it up and navigate the catalog.

- However, before directly downloading Form 1c Financing Statement/claim For Lien, follow these suggestions.

Form popularity

FAQ

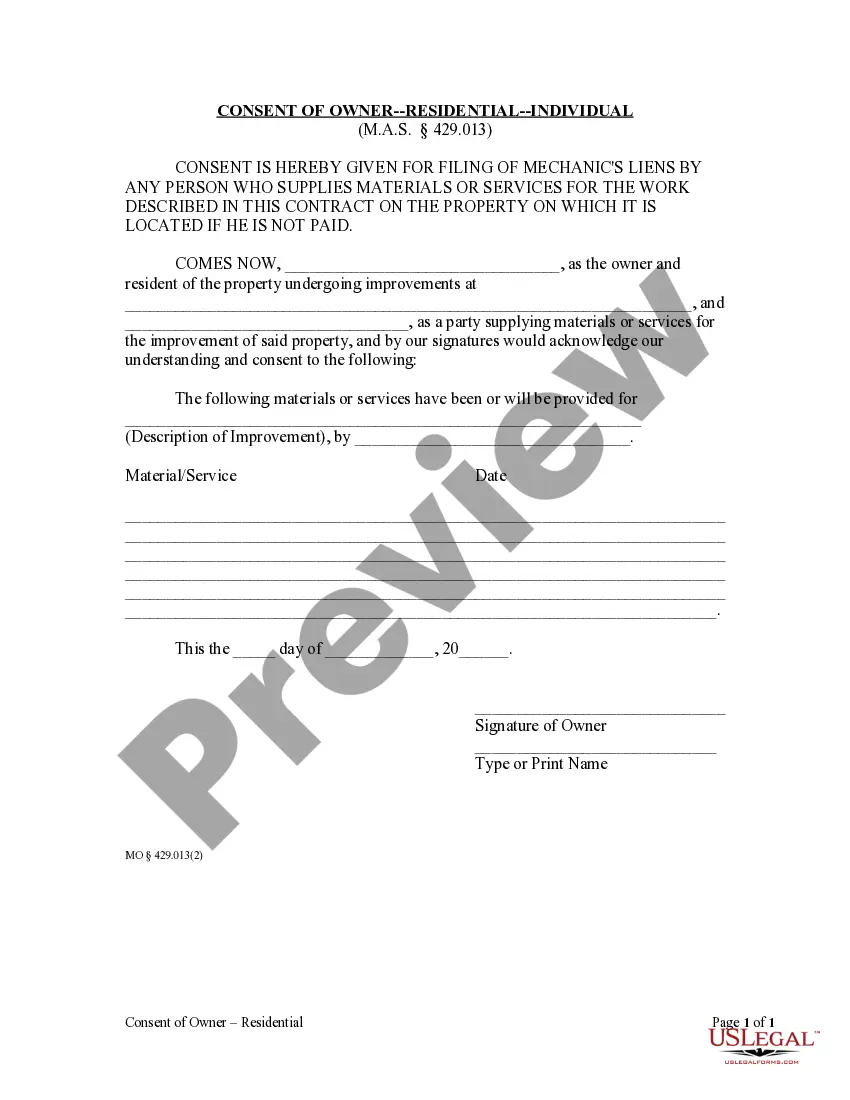

1 or Form 1c financing statement/claim for lien gets filed at the Secretary of State office in the relevant state. Filing here is crucial as it establishes your security interest against the debtor’s assets. To streamline this process, consider using uslegalforms to ensure that your Form 1c is filed correctly and efficiently.

You can find UCC-1 filings by checking the Secretary of State’s website for the state where the filing occurred. Many states have online databases, making it simple to review and obtain these records. Uslegalforms also offers easy access to UCC-1 filing records, providing a user-friendly platform for your research needs.

1 financing statement, also known as a Form 1c financing statement/claim for lien, is typically filed with the Secretary of State in the state where the debtor resides or conducts business. This filing process helps establish a legal claim on assets. To ensure your claim is properly recorded, utilize the services provided by uslegalforms, which guide you through the filing process seamlessly.

Common mistakes in filing the Form 1c financing statement/claim for lien include omitting debtor information or failing to provide a clear collateral description. Additionally, incorrect dates or signatures can lead to delays or rejection of the filing. Taking the time to double-check your document can prevent these issues. Tools like US Legal Forms can help you avoid these pitfalls by providing accurate examples and checklists.

To satisfy a UCC lien, you must file a UCC-3 form, which officially releases the lien from public records. This process confirms that the obligation tied to the Form 1c financing statement/claim for lien has been fulfilled. Ensure you provide accurate details on the UCC-3 to avoid any future disputes. Using services like US Legal Forms can streamline this process, ensuring your forms are correctly completed.

To complete the Form 1c financing statement/claim for lien, start by providing the correct name and address of the debtor. Next, include the secured party's information and a description of the collateral. It is essential to ensure accuracy, as errors can lead to complications. Utilizing platforms like US Legal Forms can simplify this process, offering guidance and templates to accurately file your UCC-1.

Ask the lender to terminate the lien upon payoff. A good rule of thumb is to request that your lender file a UCC-3 form with your secretary of state as soon as possible after you pay off your loan. The UCC-3 will terminate the lien on your company's assets (or assets) and remove the UCC-1 filing.

Fill in the debtor's name and mailing address. It may be an individual, or it may be in the name of a business or organization. If the loan is in the name of the business, include the business mailing address. There is space for additional debtors. Include them exactly as they appeared on the loan agreement.

The UCC filing establishes a lien against the collateral the borrower uses to secure the loan ? giving the lender the right to claim that collateral as repayment in the case of default. However, in many cases, the terms UCC lien and UCC filing are used interchangeably.

Ask the lender to terminate the lien upon payoff. It is important to note that removing the UCC filing from your business credit report may or may not occur. It will not remove a closed UCC filing unless it receives a request from a customer or the lien has been inactive for 11 years. You should always verify.