Checklist Up Business With Ein

Description

How to fill out Checklist For Starting Up A New Business?

Finding a go-to place to access the most current and relevant legal templates is half the struggle of dealing with bureaucracy. Choosing the right legal papers demands accuracy and attention to detail, which explains why it is crucial to take samples of Checklist Up Business With Ein only from trustworthy sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to be concerned about. You may access and see all the details concerning the document’s use and relevance for the circumstances and in your state or county.

Take the listed steps to complete your Checklist Up Business With Ein:

- Make use of the catalog navigation or search field to locate your sample.

- View the form’s description to see if it fits the requirements of your state and county.

- View the form preview, if there is one, to ensure the template is the one you are searching for.

- Resume the search and look for the right document if the Checklist Up Business With Ein does not fit your needs.

- When you are positive regarding the form’s relevance, download it.

- When you are a registered user, click Log in to authenticate and gain access to your selected forms in My Forms.

- If you do not have an account yet, click Buy now to get the form.

- Select the pricing plan that fits your requirements.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by selecting a transaction method (bank card or PayPal).

- Select the document format for downloading Checklist Up Business With Ein.

- When you have the form on your gadget, you may alter it with the editor or print it and complete it manually.

Eliminate the headache that comes with your legal documentation. Check out the extensive US Legal Forms catalog to find legal templates, check their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

Once an EIN has been assigned to a business entity, it becomes the permanent Federal taxpayer identification number for that entity. Regardless of whether the EIN is ever used to file Federal tax returns, the EIN is never reused or reassigned to another business entity.

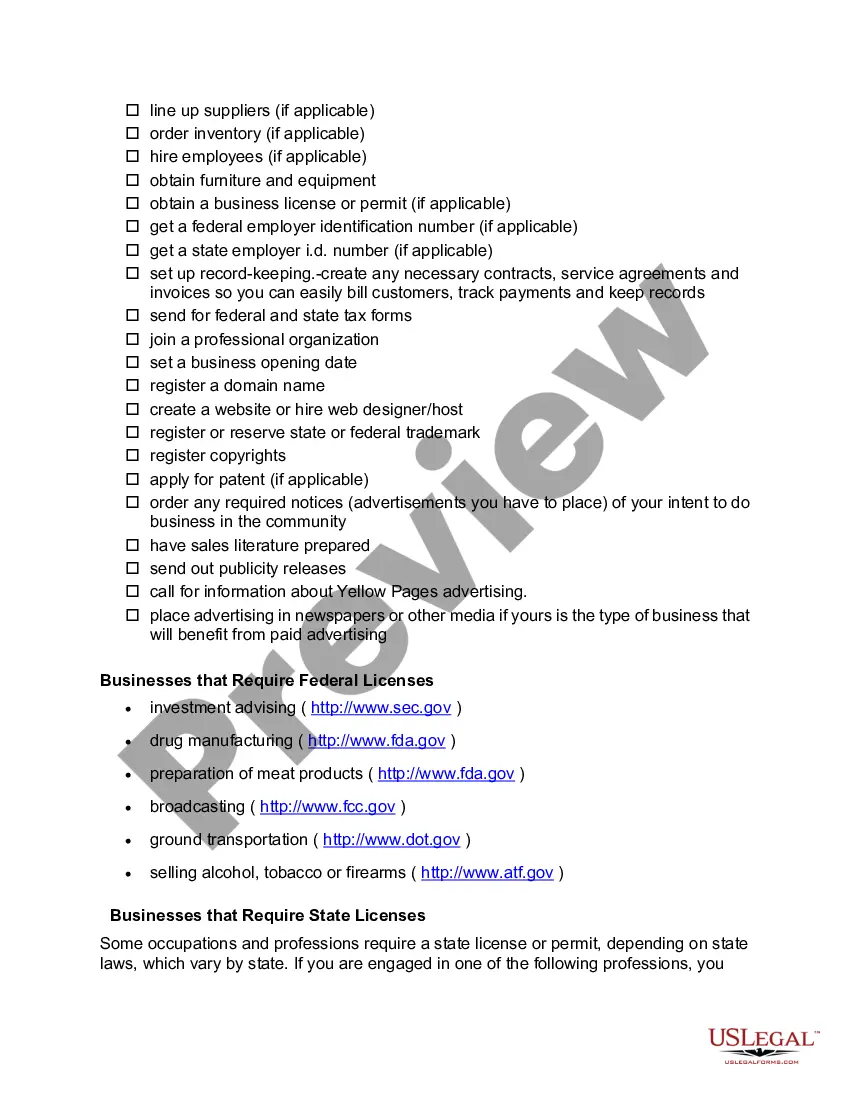

Starting a business checklist 1 Make key decisions. Get help to start. ... 2 Plan your business. Develop your business plan. ... 3 Set up your business finances. Get resources to help with business finances. ... 4 Protect your business. Meet work health and safety requirements. ... 5 Know the law. ... 6 Hiring people. ... 7 Keep required records.

7 Home Business Ideas with Awesome Small Business Tax Deductions Retail Arbitrage. ... Flipping Secondhand Items. ... Consulting. ... Training, Teaching and Coaching. ... Creating Handmade Items. ... Freelance Writing, Editing or Designing. ... Becoming a Social Media Pro.

Agricultural Income is completely non-taxable as per Section 10(1) of the Income Tax Act. Agricultural income refers to the income earned from: A) Production, Processing & Sale of agricultural crops like Grains, Pulses, Vegetables, Fruits, Spices, etc.

Business owners should notify the IRS so they can close the IRS business account. Keep business records. How long a business needs to keep records depends on what's recorded in each document.