Bridge Financing Agreement Without Firm Offer

Description

How to fill out Security Agreement For Bridge Financing?

Individuals generally connect legal documentation with something intricate that only an expert can manage.

In a certain sense, that is accurate, as creating a Bridge Financing Agreement Without Firm Offer requires significant knowledge in relevant criteria, including state and county laws.

Nevertheless, with US Legal Forms, the process has become more user-friendly: pre-made legal documents for any personal and business situation tailored to state regulations are compiled in a comprehensive online library and are now accessible to all.

Print your document or upload it to an online editor for more efficient completion. All templates in our collection are reusable: once obtained, they remain stored in your profile, allowing you access whenever needed through the My documents tab. Discover all the benefits of using the US Legal Forms platform. Sign up today!

- US Legal Forms provides over 85k current forms categorized by state and area of application, allowing you to search for the Bridge Financing Agreement Without Firm Offer or any specific document in just a few minutes.

- Existing users with a valid subscription must Log In to their account and select Download to obtain the document.

- New users will need to create an account and subscribe prior to downloading any legal documentation.

- Follow these steps to get the Bridge Financing Agreement Without Firm Offer.

- Review the page content meticulously to ensure it meets your requirements.

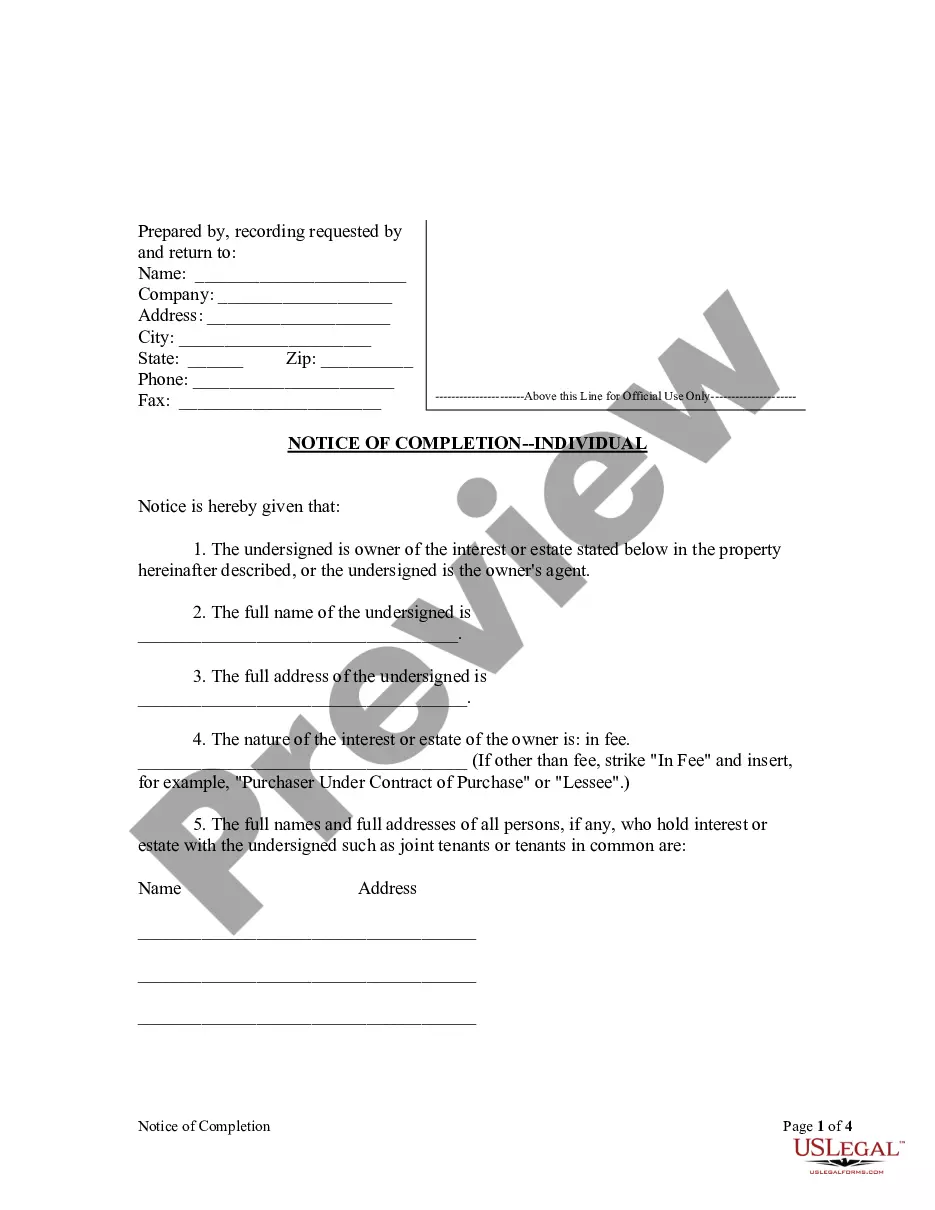

- Examine the form description or utilize the Preview feature.

- If the previous document is not suitable, search for another sample using the Search field above.

- Once you find the appropriate Bridge Financing Agreement Without Firm Offer, click Buy Now.

- Select a pricing plan that accommodates your needs and budget.

- Create an account or Log In to access the payment page.

- Complete your payment via PayPal or by using your credit card.

- Choose the format for your document and click Download.

Form popularity

FAQ

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties. You may choose to keep a copy in your county recorder's office if you wish, though it's not legally necessary. It's sufficient for both parties to store their own copy, ideally in a safe place.

However, bridge loans also come with higher interest rates than traditional mortgages and several fees, such as origination charges and a home appraisal.

To qualify for the bridging loan, you need 20% of the peak debt or $187,000 in cash or equity. You have $300,000 available in equity in your existing property so, in this example, you have enough to cover the 20% deposit to meet the requirements of the bridging loan.

Bridge loans typically have interest rates between 8.5% and 10.5%, making them more expensive than traditional, long-term financing options. However, the application and underwriting process for bridge loans is generally faster than for traditional loans.