Llc Formation Form California

Description

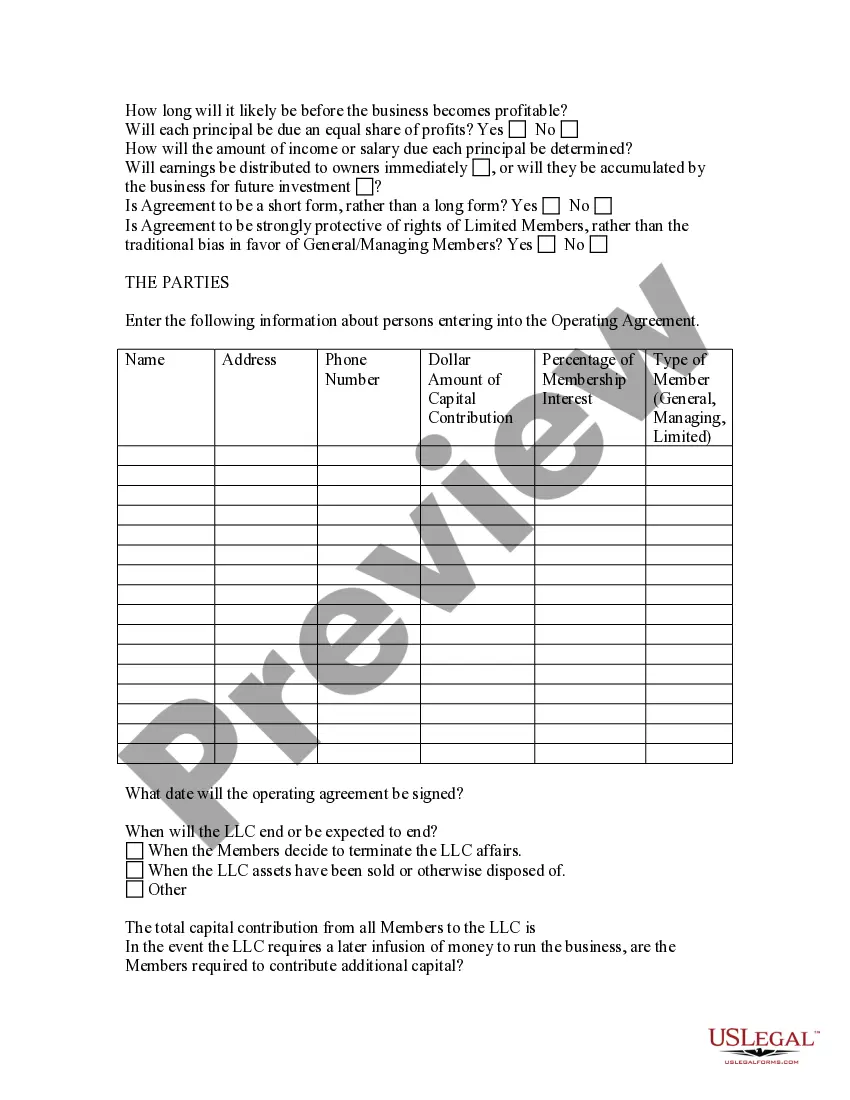

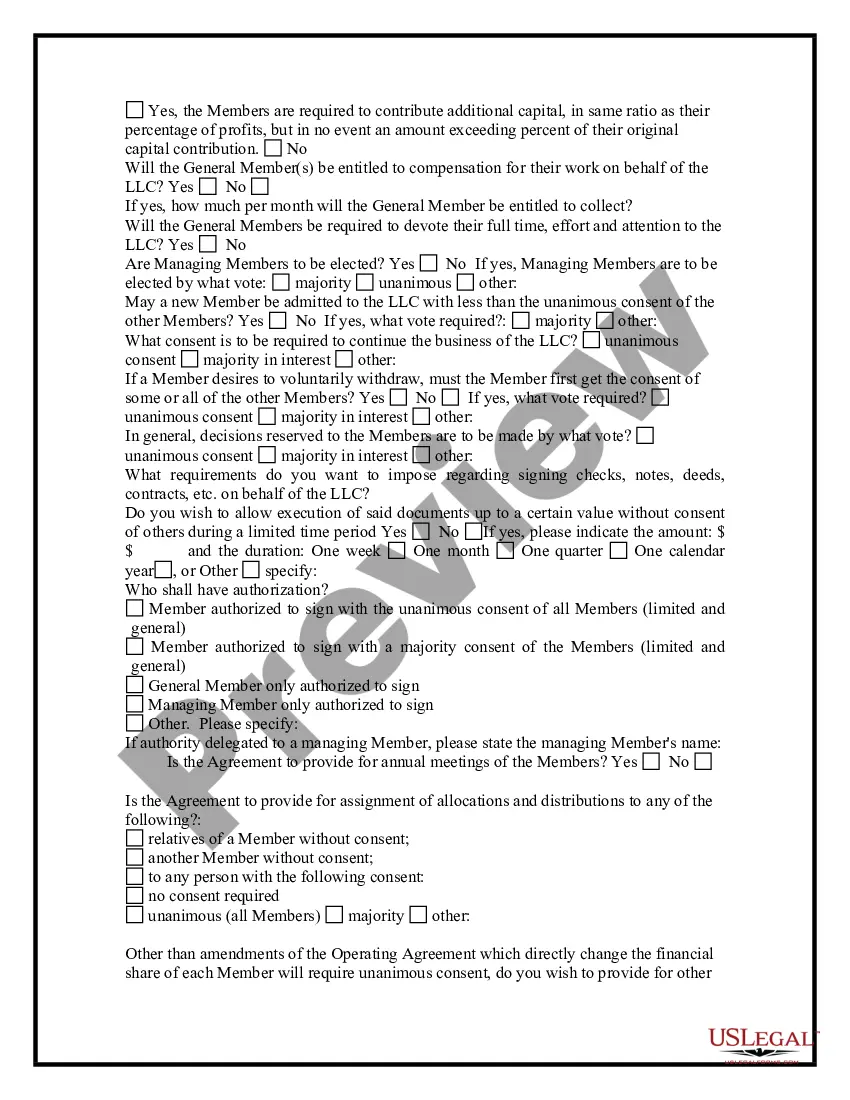

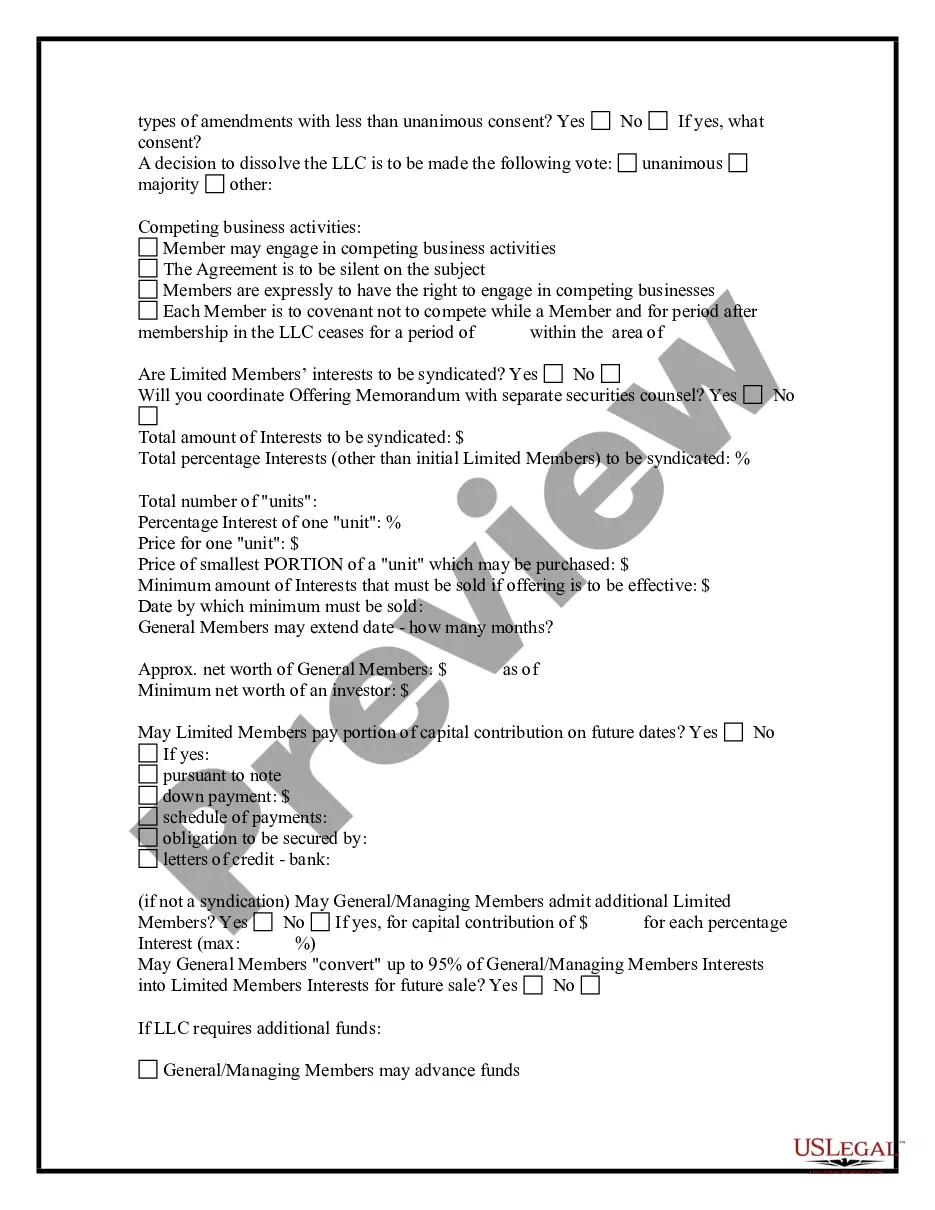

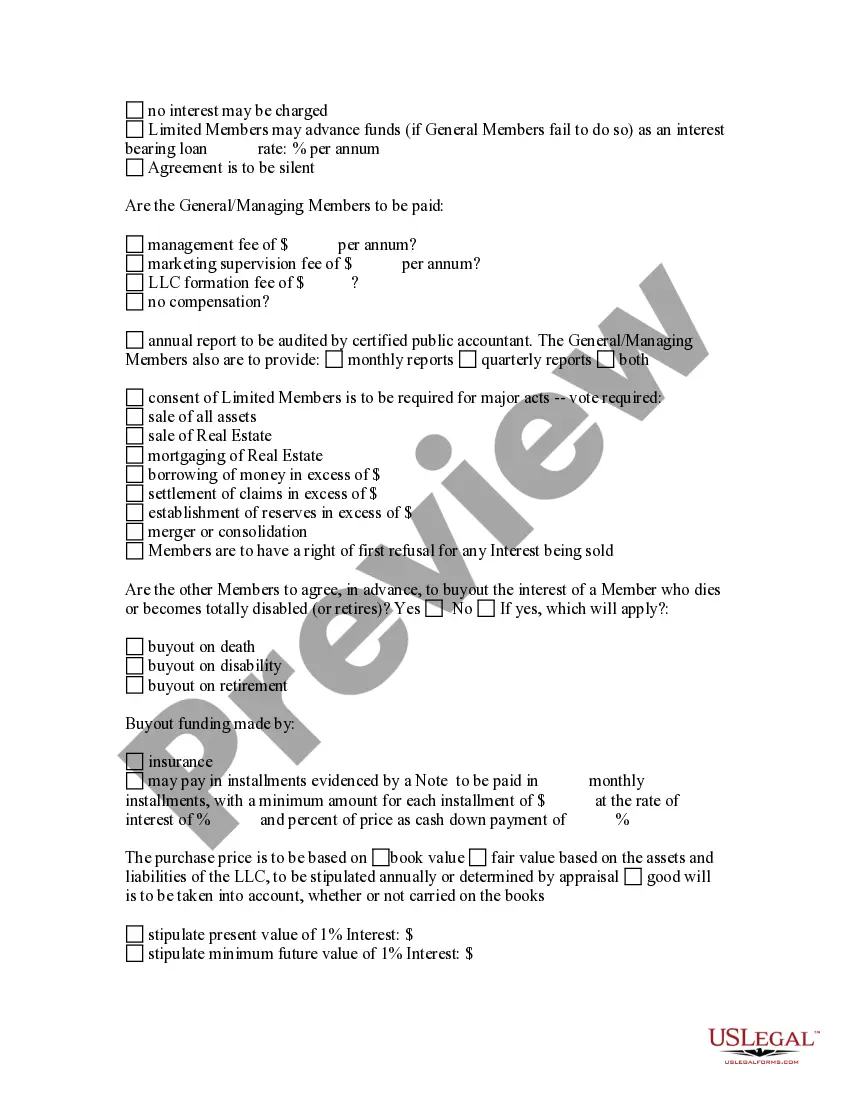

How to fill out Limited Liability Company - LLC - Formation Questionnaire?

Engaging with legal paperwork and processes can be a lengthy addition to your schedule.

Llc Formation Form California and similar forms typically necessitate that you locate them and figure out how to fill them out accurately.

Thus, whether you are managing financial, legal, or personal affairs, possessing a comprehensive and user-friendly online repository of forms readily available will be extremely beneficial.

US Legal Forms is the premier online source for legal templates, featuring over 85,000 state-specific documents and countless resources to assist you in completing your paperwork swiftly.

If it's your first time using US Legal Forms, register and create an account in a matter of minutes to gain access to the form library and Llc Formation Form California. Then, follow the steps below to fill out your form: Ensure you have located the right form using the Preview feature and reviewing the form details. Select Buy Now when you're prepared, and choose the subscription plan that suits you best. Click Download, then fill in, sign, and print the form. With 25 years of experience in helping users with their legal forms, US Legal Forms enables you to find the form you need today and simplify any procedure effortlessly.

- Browse the repository of relevant documents accessible to you with just a single click.

- US Legal Forms provides you with state- and county-specific forms available for download at any time.

- Protect your document management operations with a superior service that enables you to create any form in just minutes without extra or hidden charges.

Form popularity

FAQ

Name your California LLC. ... Choose your registered agent. ... Prepare and file articles of organization. ... Receive a certificate from the state. ... Create an operating agreement. ... File a statement of information. ... Get an employer identification number. ... Pay the annual franchise tax.

Name your California LLC. ... Choose your registered agent. ... Prepare and file articles of organization. ... Receive a certificate from the state. ... Create an operating agreement. ... File a statement of information. ... Get an employer identification number. ... Pay the annual franchise tax.

Step 1: Choose a business type. ... Step 2: Register your LLC with the Secretary of State. ... Step 3: File a Statement of Information. ... Step 4: Apply for an EIN. ... Step 5: Create an Operating Agreement. ... Step 6: Open a bank account for your LLC. ... Step 7: Register with the Franchise Tax Board. ... Step 8: Hiring employees?

Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

Just go to California's Franchise Tax Board website, and under 'Business,' select 'Use Web Pay Business. ' Select 'LLC' as entity type and enter your CA LLC entity ID. Pay the annual fee for the full calendar year (1/1 to 12/31) using your business bank account.