Power Attorney Form Template With Irs

Description

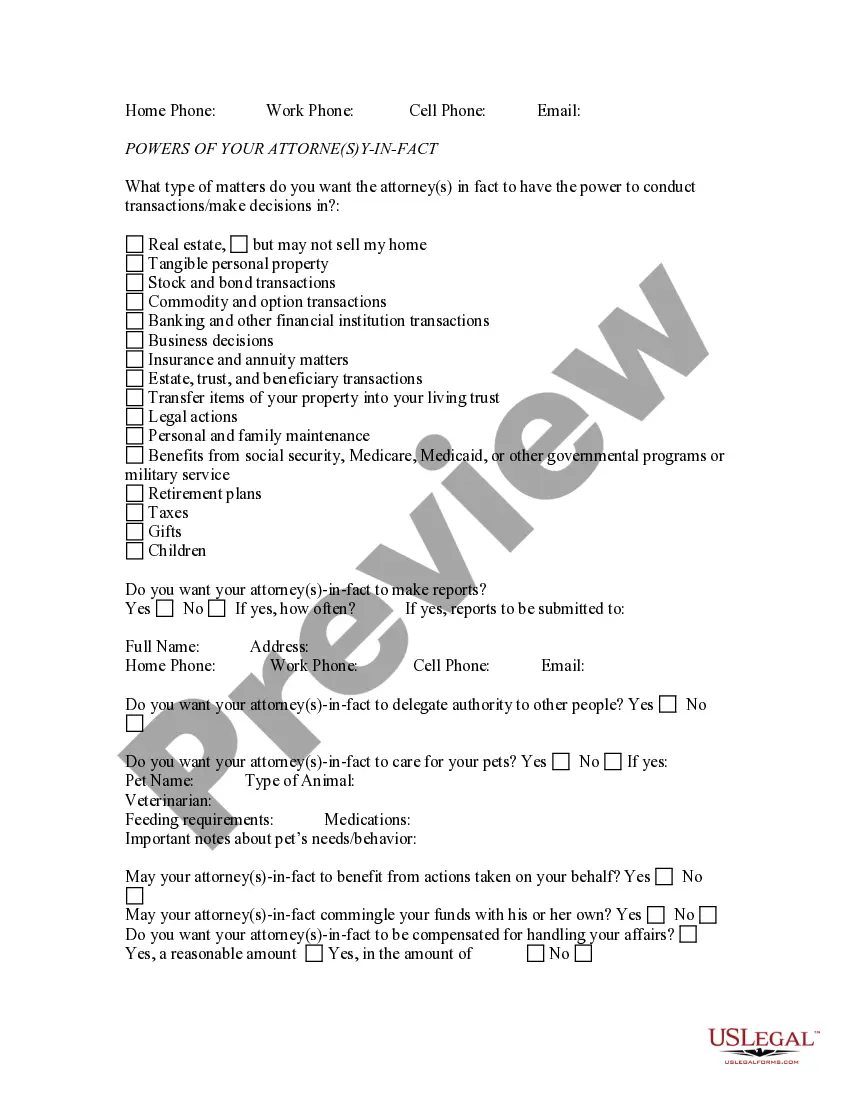

How to fill out Limited Power Of Attorney Questionnaire?

Managing legal documents can be perplexing, even for seasoned professionals.

When you are looking for a Power of Attorney Form Template with IRS and lack the opportunity to dedicate time to find the correct and current version, the process can be stressful.

Utilize a comprehensive resource of articles, guides, and materials pertinent to your circumstances and requirements.

Save effort and time searching for the documents you require, and use US Legal Forms' sophisticated search and Review tool to locate the Power of Attorney Form Template with IRS and download it.

Select Buy Now once you are prepared, choose a subscription plan, pick the file format you need, and Download, complete, sign, print, and send your document. Take advantage of the US Legal Forms library, backed by 25 years of experience and trustworthiness. Transform your routine document management into a smooth and user-friendly experience today.

- If you have a monthly subscription, Log In to your US Legal Forms account, find the form, and download it.

- Check your My documents tab to see the documents you've previously downloaded and manage your folders as you wish.

- If it's your first experience with US Legal Forms, create an account and gain unrestricted access to all the benefits of the library.

- After finding the form you need, confirm it is the correct version by previewing it and reviewing its description.

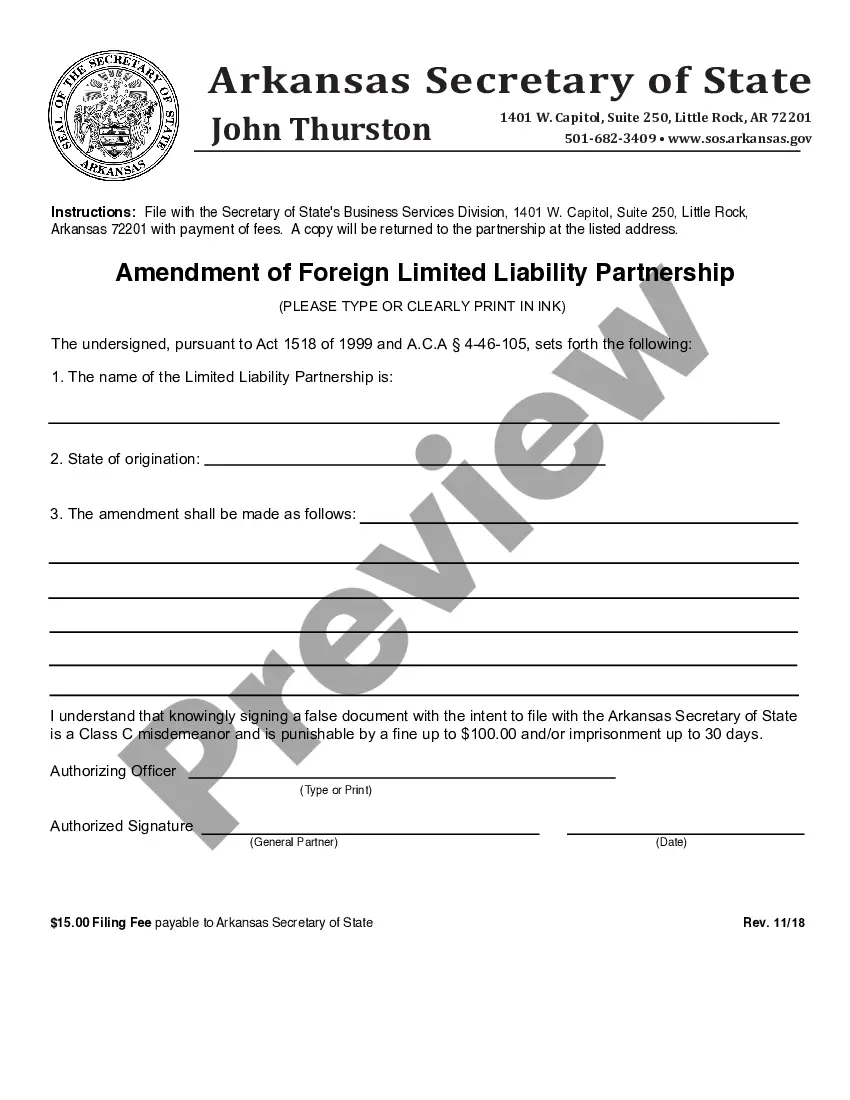

- Make sure the sample is recognized in your state or county.

- Access state- or region-specific legal and business documentation.

- US Legal Forms addresses any needs you may have, from personal to business records, all in one place.

- Use advanced tools to complete and handle your Power of Attorney Form Template with IRS.

Form popularity

FAQ

You may use Form 56 to: Provide notification to the IRS of the creation or termination of a fiduciary relationship under section 6903. Give notice of qualification under section 6036.

Use Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be a person eligible to practice before the IRS.

You can use Form 2848, Power of Attorney and Declaration of Representative for this purpose. Your signature on the Form 2848 allows the individual or individuals named to represent you before the IRS and to receive your tax information for the matter(s) and tax year(s)/period(s) specified on the Form 2848.

If you can't use an online option, you can fax or mail authorization forms to us. Use for: Individual or business taxpayer. Any tax matter or period.

A fiduciary is treated as if they were the taxpayer and have all the powers and abilities of the Taxpayer once the IRS is notified of this relationship via Form 56. A representative is treated as an agent of the taxpayer and is only permitted to perform the actions explicitly authorized in Form 2848.