Incorporation Questionnaire Within 30 Days

Description

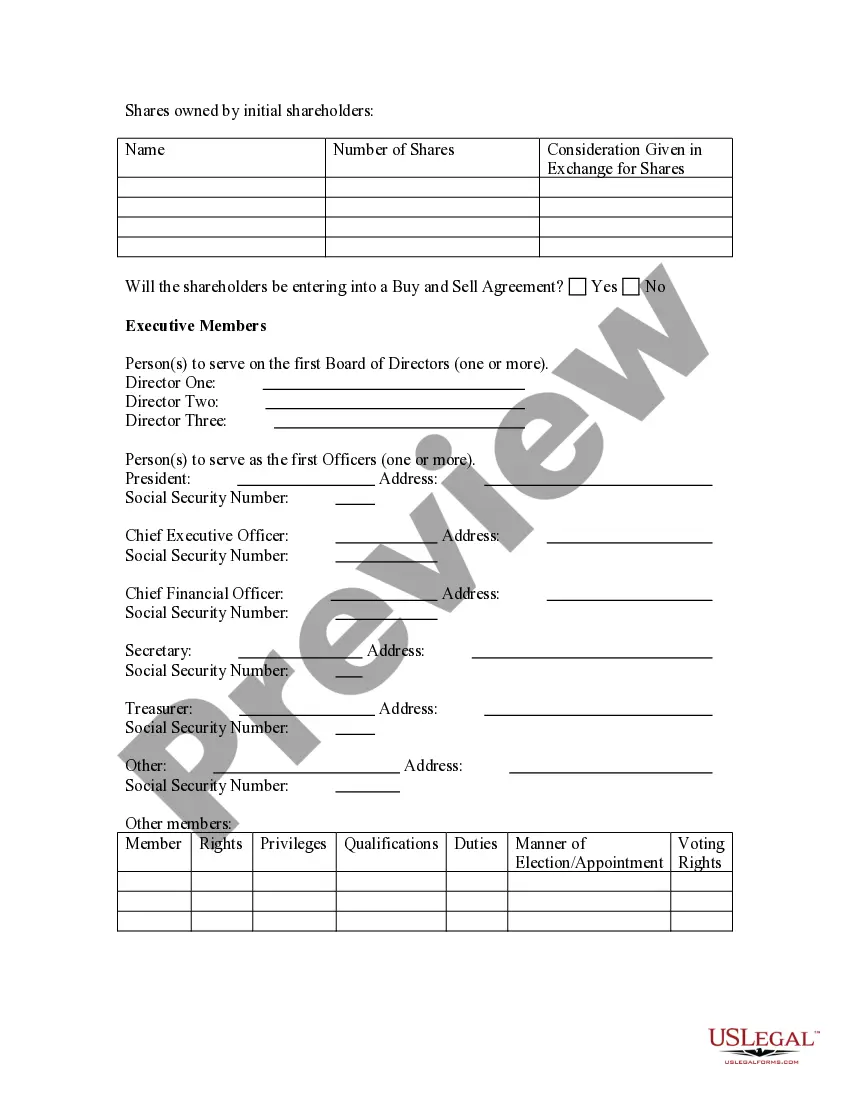

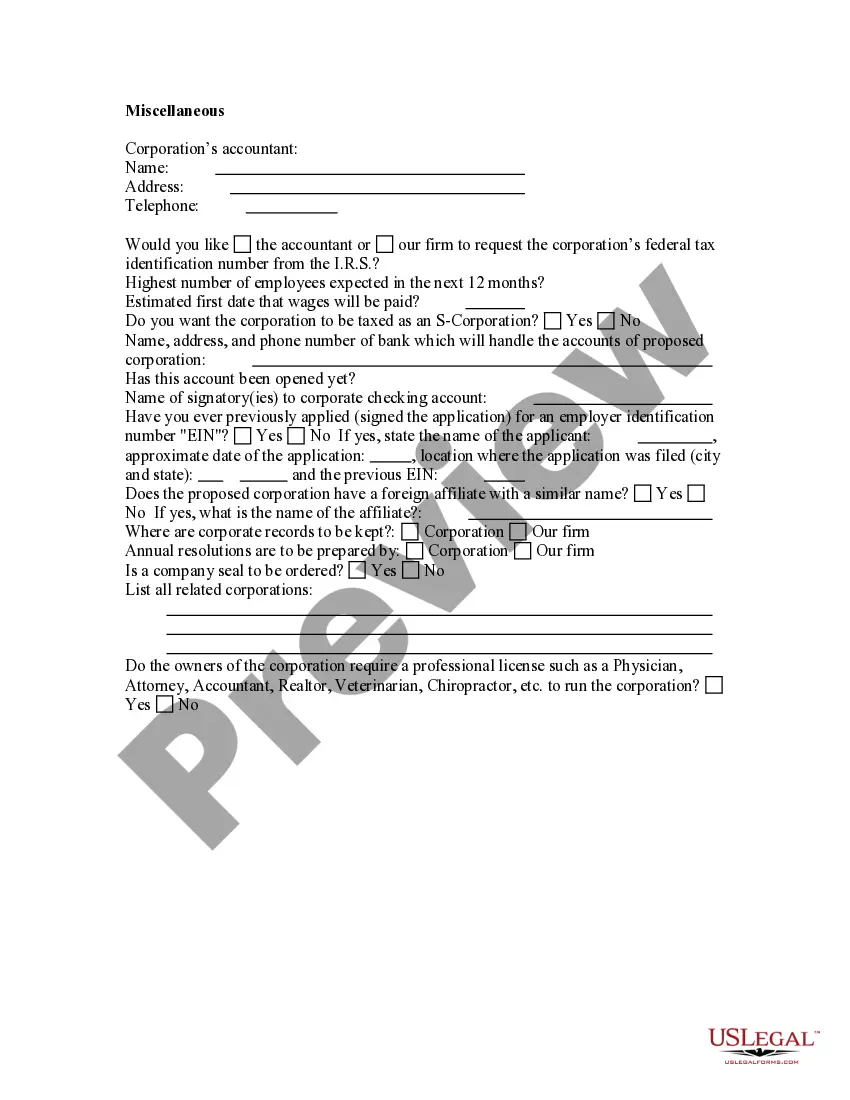

How to fill out Business Incorporation Questionnaire?

Managing legal documents and processes can be a lengthy addition to your entire day.

Incorporation Questionnaire Within 30 Days and similar forms typically require you to locate them and comprehend how to fill them out correctly.

Thus, whether you are handling financial, legal, or personal issues, having a comprehensive and straightforward online database of forms at your disposal will significantly help.

US Legal Forms is the leading online platform for legal documents, featuring over 85,000 state-specific templates and various resources to help you complete your documents effortlessly.

Is this your first experience with US Legal Forms? Register and set up a no-cost account in just a few minutes, and you will gain entry to the forms database and Incorporation Questionnaire Within 30 Days. After that, follow the instructions below to fill out your form: Make sure you are using the correct form by utilizing the Review feature and examining the form details. Click Buy Now when ready, and choose the monthly subscription plan that suits your needs. Click Download, then complete, eSign, and print the form. US Legal Forms has twenty-five years of experience assisting users with their legal documents. Acquire the form you need today and streamline any process with ease.

- Explore the collection of relevant documents available to you with just a click.

- US Legal Forms provides state- and county-specific forms that can be downloaded anytime.

- Safeguard your document management processes with premium services that allow you to create any form in minutes without additional or hidden charges.

- Simply Log In to your account, find Incorporation Questionnaire Within 30 Days, and download it immediately from the My documents section.

- You can also access previously downloaded documents.

Form popularity

FAQ

The approval timeframe for articles of incorporation varies but usually falls between 1 to 6 weeks. By effectively completing our incorporation questionnaire within 30 days, you can optimize your submission to speed up this process and reduce waiting times.

Setting up a corporation can take anywhere from a few days to several weeks, depending on the state’s processing times. To avoid delays and facilitate a quicker approval, consider using our incorporation questionnaire within 30 days to ensure all your paperwork is in order.

You will receive official notification from your state once your LLC is approved, typically via mail or email. Monitoring your status can be effortless if you complete our incorporation questionnaire within 30 days, as it keeps your information organized and accessible.

You can obtain Articles of Incorporation from your state’s business filing office, usually by applying online or submitting a paper form. To make this process smoother, consider using our incorporation questionnaire within 30 days to ensure you have all necessary documents ready for submission.

The date of incorporation is typically noted on the articles of incorporation that your state provides upon approval. For a streamlined incorporation process, utilize our incorporation questionnaire within 30 days to track important milestones effectively.

The requirement for BOI (Beneficial Ownership Information) filing varies by state and the type of LLC. Generally, not all LLCs need to file this report, but checking your state’s regulations is crucial. You can find accurate information by using our incorporation questionnaire within 30 days.

Incorporating yourself can take as little as a few hours if you fill out the necessary forms correctly and file them online. However, processing times at the state level can add several weeks. To streamline your experience, complete our incorporation questionnaire within 30 days for precise guidance.

The approval time for articles of organization varies by state, but you can typically expect it to take between 1 to 4 weeks. By completing our incorporation questionnaire within 30 days, you can ensure that your submission is well-organized, which may help speed up the process.

Yes, single-member LLCs are also required to file a BOI report in most cases. The regulations apply to various business structures to promote transparency. If you're a single-member LLC, ensure you complete the incorporation questionnaire within 30 days to meet your reporting obligations without hassle.

The deadline for BOI reporting varies depending on your business type and jurisdiction. Generally, businesses are required to file within a certain timeframe after registration or as regulations change. To avoid missing deadlines, use our incorporation questionnaire within 30 days for clear guidance on your filing requirements.