Financial Planning Checklist For Death

Description

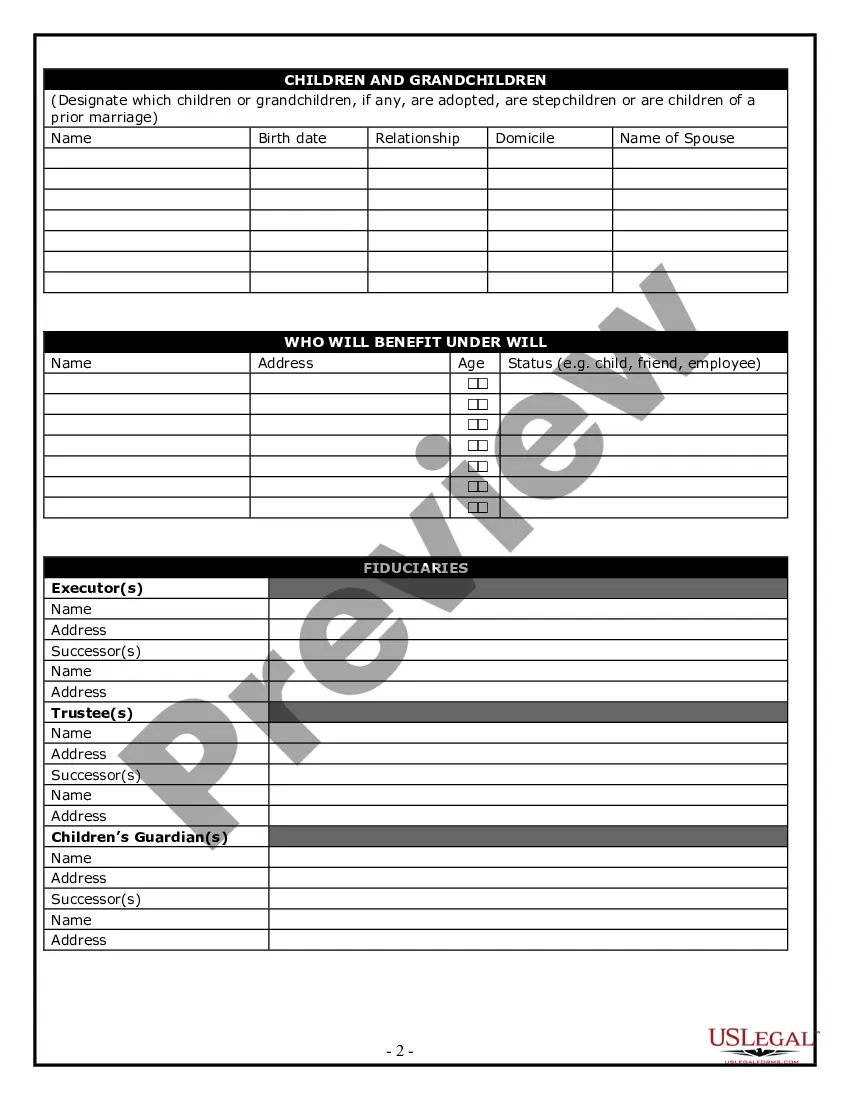

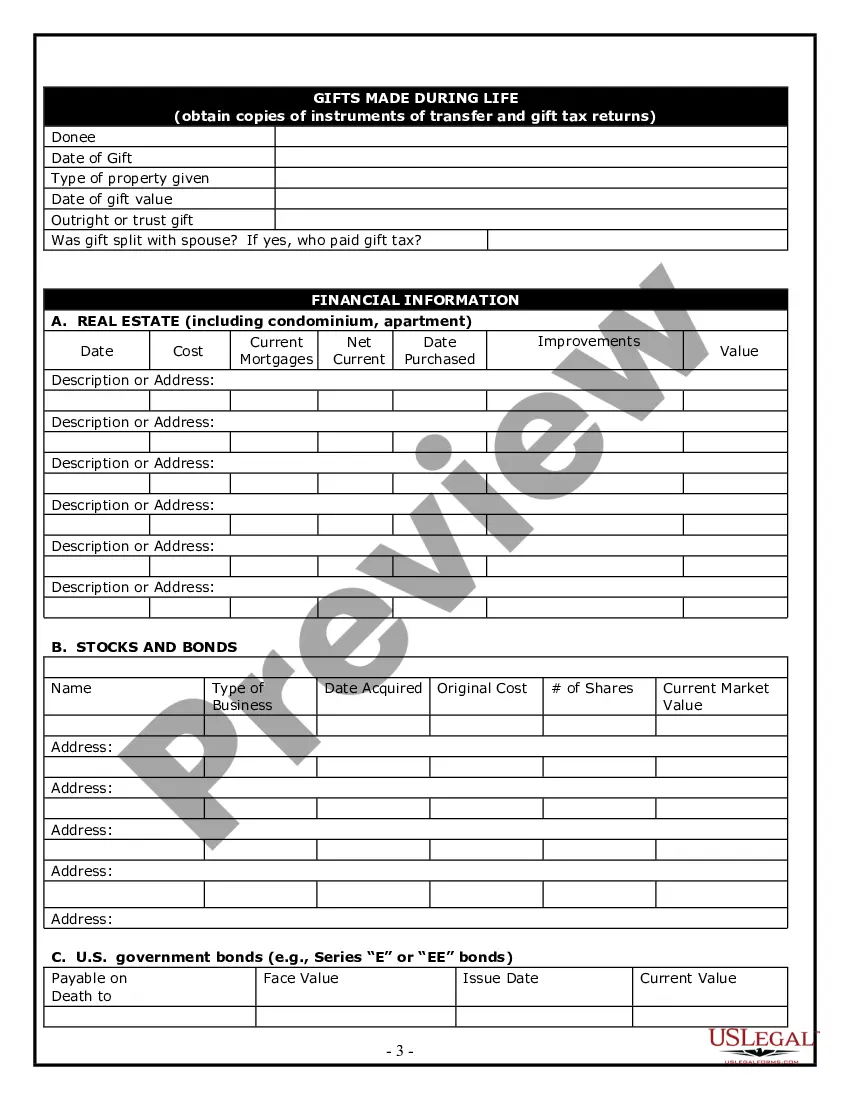

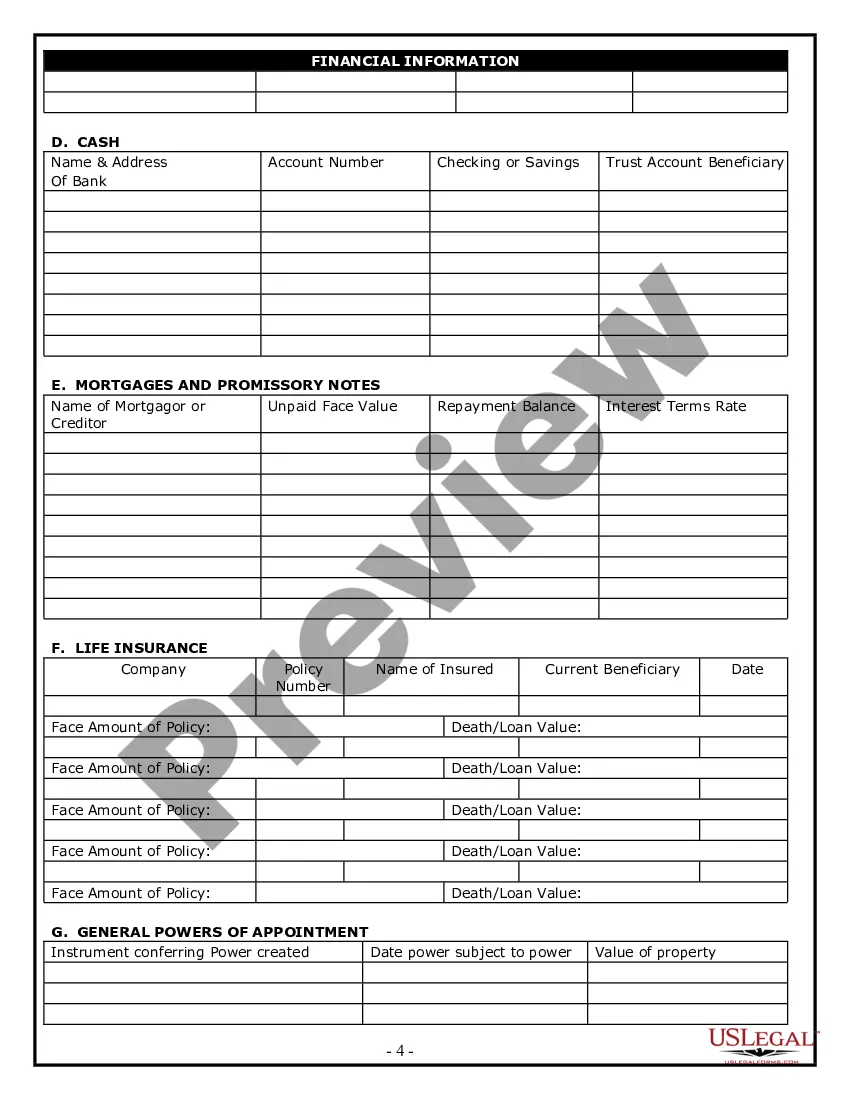

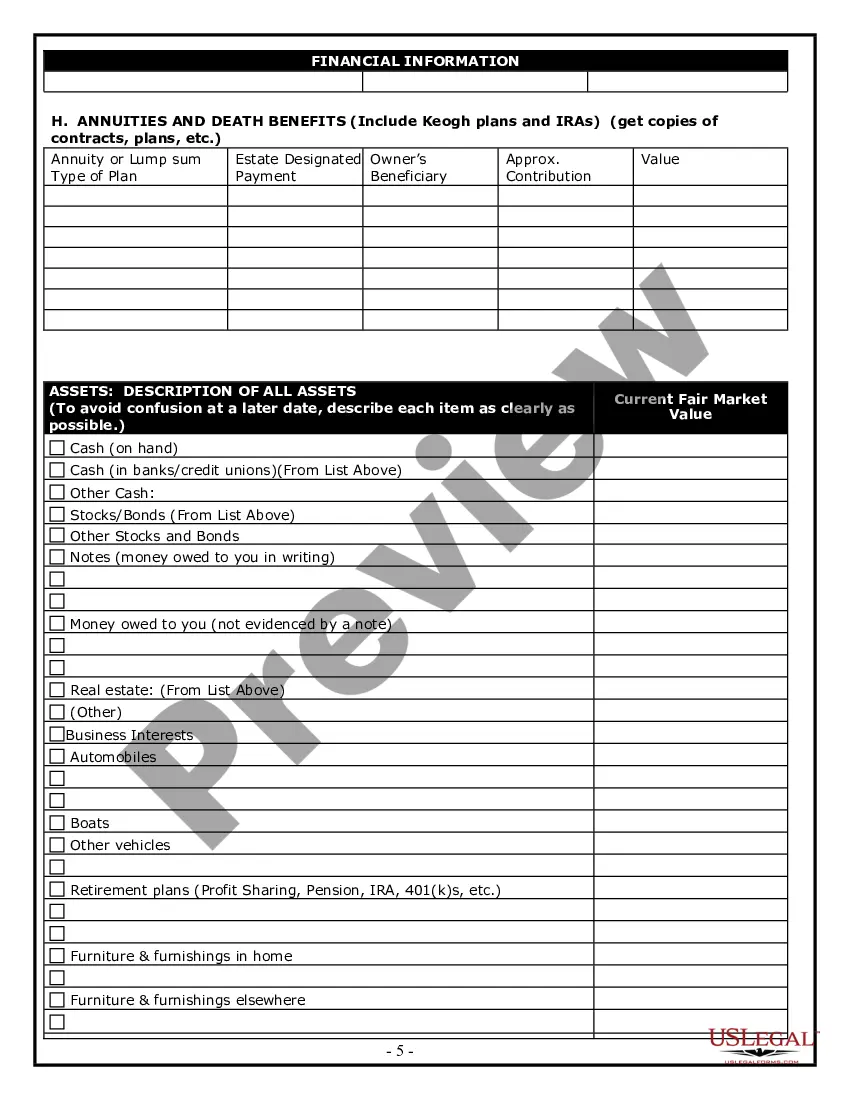

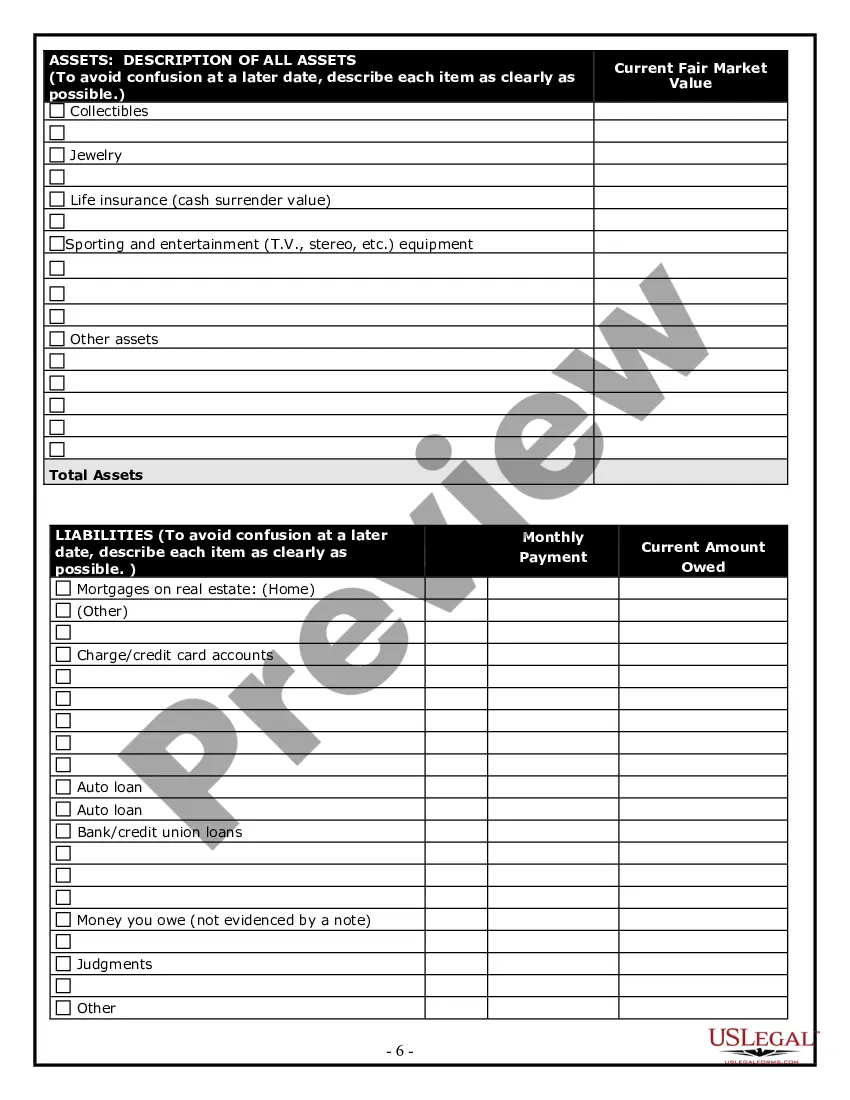

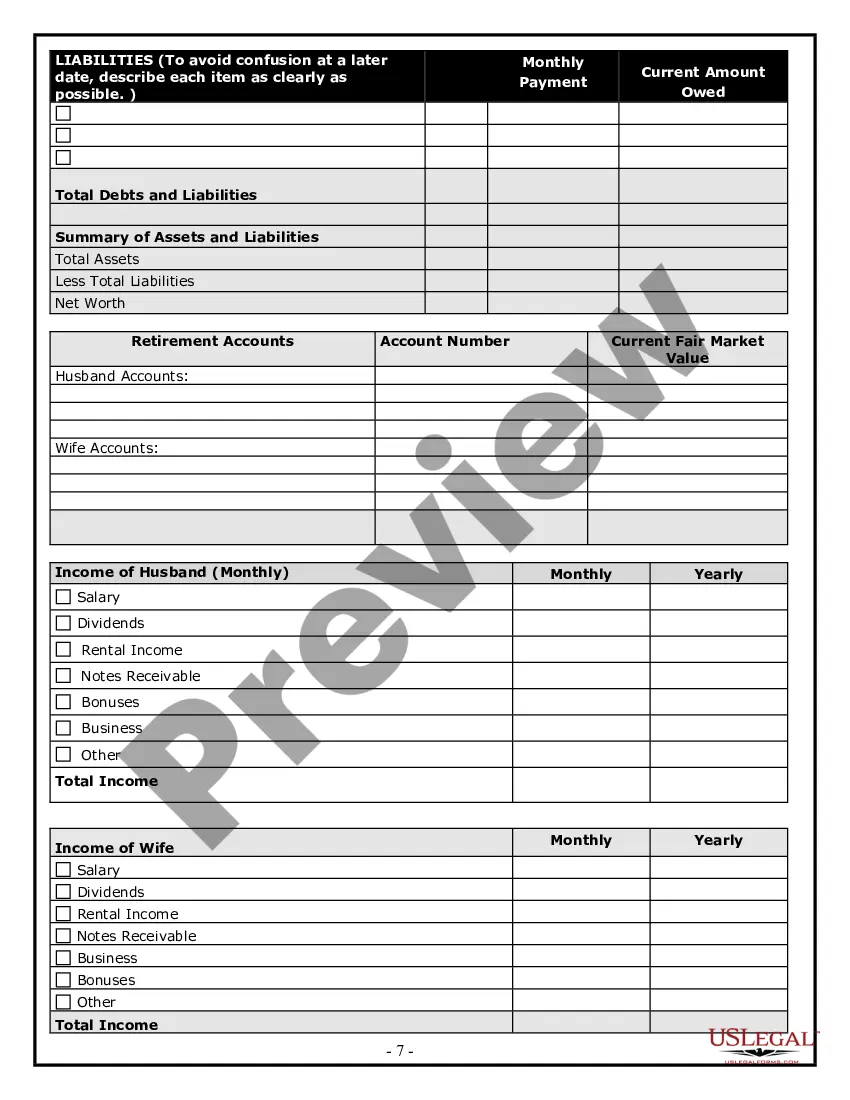

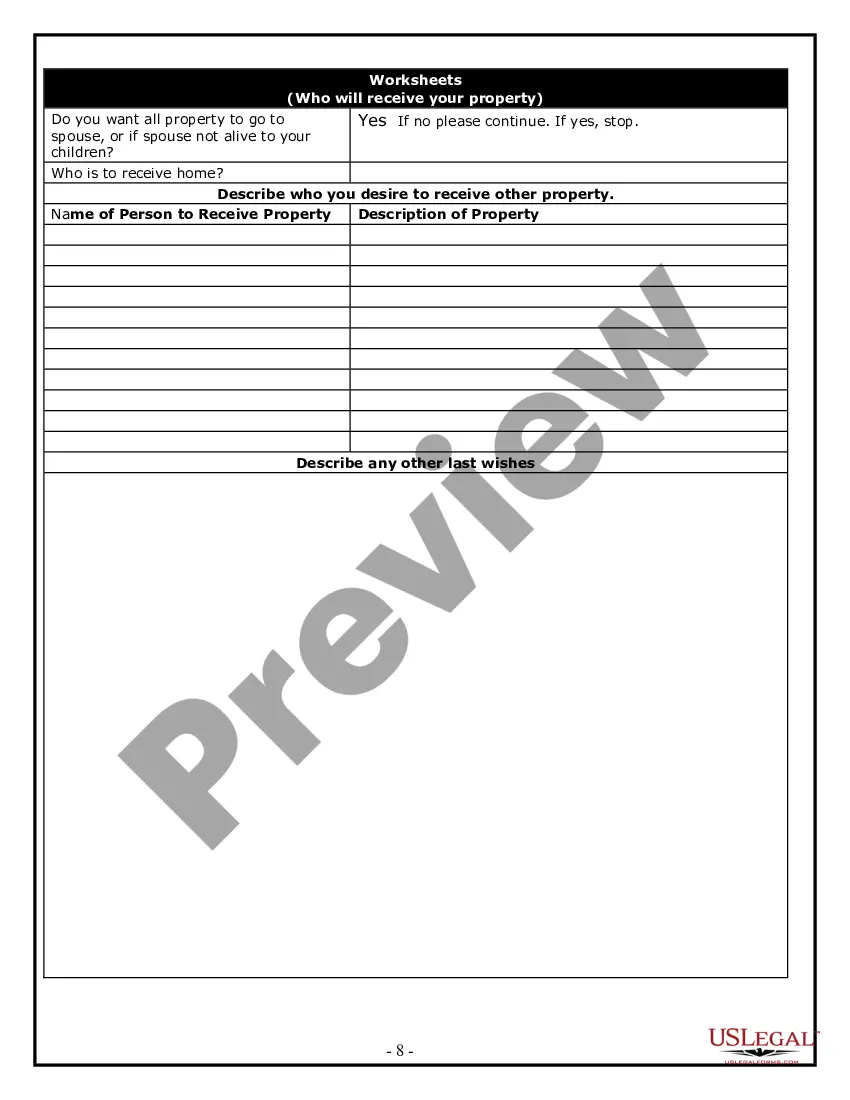

How to fill out Estate Planning Questionnaire?

Creating legal documents from the ground up can occasionally feel a bit daunting. Certain instances may require extensive research and significant financial investment.

If you’re looking for a simpler and cost-effective approach to generating a Financial Planning Checklist For Death or any other documents without unnecessary complications, US Legal Forms is readily available for you.

Our online repository of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can swiftly acquire state- and county-specific templates meticulously assembled for you by our legal professionals.

Utilize our website whenever you require a dependable and trustworthy service through which you can quickly locate and download the Financial Planning Checklist For Death. If you’re familiar with our services and have established an account with us previously, just Log In to your account, find the form, and download it or re-download it anytime from the My documents section.

Download the form. Then complete, certify, and print it. US Legal Forms has a solid reputation and over 25 years of experience. Join us now and make form completion a seamless and efficient process!

- Not registered yet? No problem. It takes very little time to register and explore the library.

- But before you jump straight to downloading the Financial Planning Checklist For Death, follow these guidelines.

- Examine the form preview and descriptions to ensure you are on the correct form.

- Verify if the form you select meets the requirements of your specific state and county.

- Choose the most appropriate subscription option to purchase the Financial Planning Checklist For Death.

Form popularity

FAQ

Alabama Annual Registration Filing Fees & Instructions. While all businesses in Alabama are required to pay the Alabama Business Privilege Tax, only LLCs, LLPs, and corporations are required by law to file annual reports. These reports must be filed by March 15th or April 15th depending upon the type of company.

Alabama LLC Formation Filing Fee: $200 Once your name reservation has been accepted, you can file the Alabama Certificate of Formation, which costs $200 ($208 online). (The cost is the same for Alabama series LLCs.) Filing this certificate officially brings your LLC into existence.

PURPOSE: In order to form a Limited Liability Company (LLC) under Section 10A-5A-2.01 of the Code of Alabama 1975, this Certificate of Formation and the appropriate filing fees must be filed with the Office of the Secretary of State.

Alabama. To obtain copies of your company's articles of incorporation or articles of organization online, visit Alabama's Secretary of State website. To request paper copies, complete this form and follow the instructions.

All Alabama LLCs need to pay $50 per year for the Annual Report and Alabama Business Privilege Tax. These state fees are paid to the Department of Revenue. And this is the only state-required annual fee. You have to pay this to keep your LLC in good standing.

You may mail your request to the Office of the Alabama Secretary of State, Business Services Division/Business Entities at PO Box 5616, Montgomery, Alabama 36103-5616. You may use this form to use your Credit Card or prepaid account, or enclose a check or money order for payment of the fees.

How do I check if an LLC name is taken in Alabama? You can use the Alabama Business Entity Search tool to see if your business name is available. Learn more about business entity name availability in the How to Search Available LLC Names section.

Immediate Processing: You may acquire copies and certified copies online at .sos.alabama.gov. Click on Business Services (below the picture, Business Entity Record Copies.