Estate Planning Form Printable With Holidays

Description

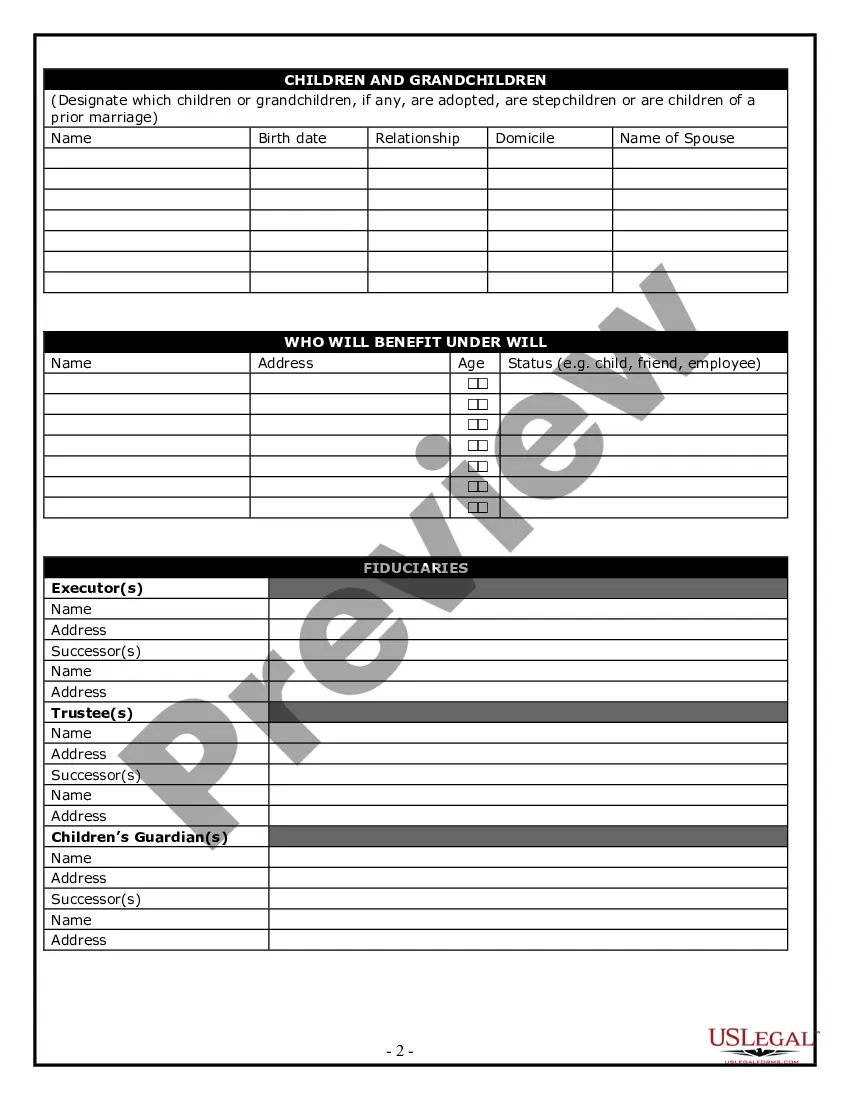

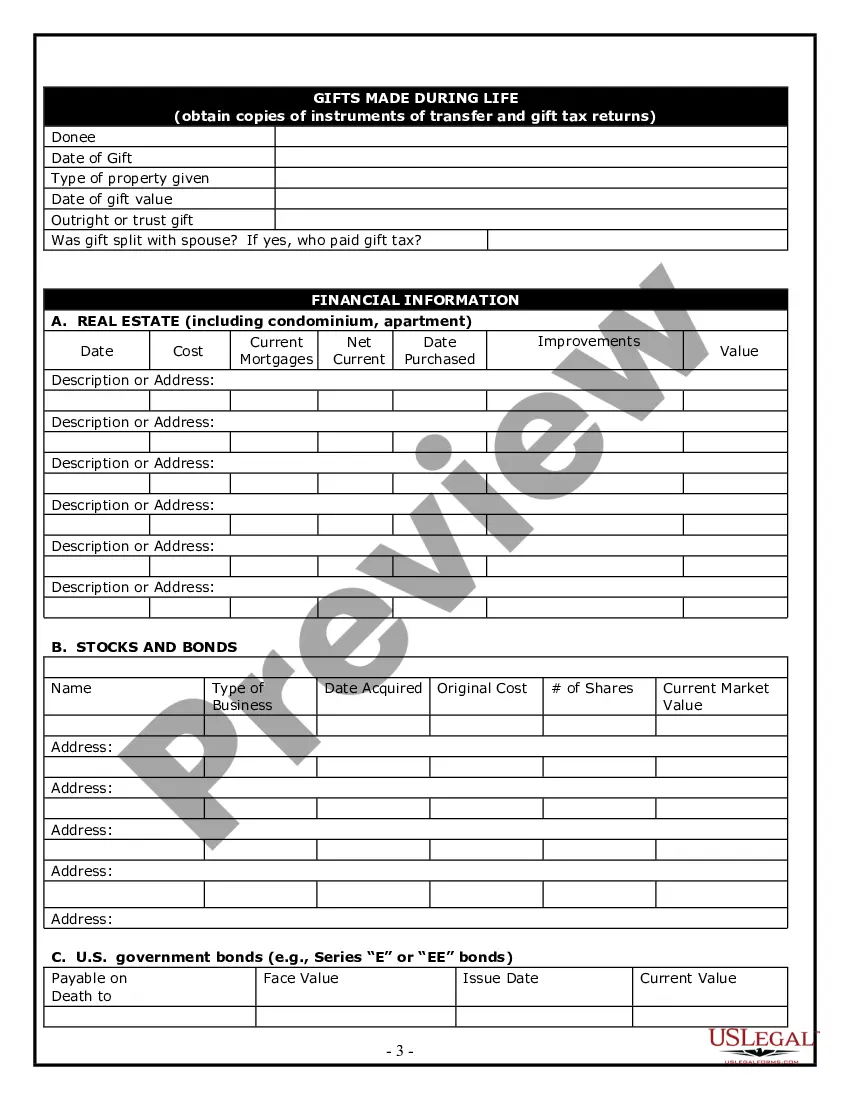

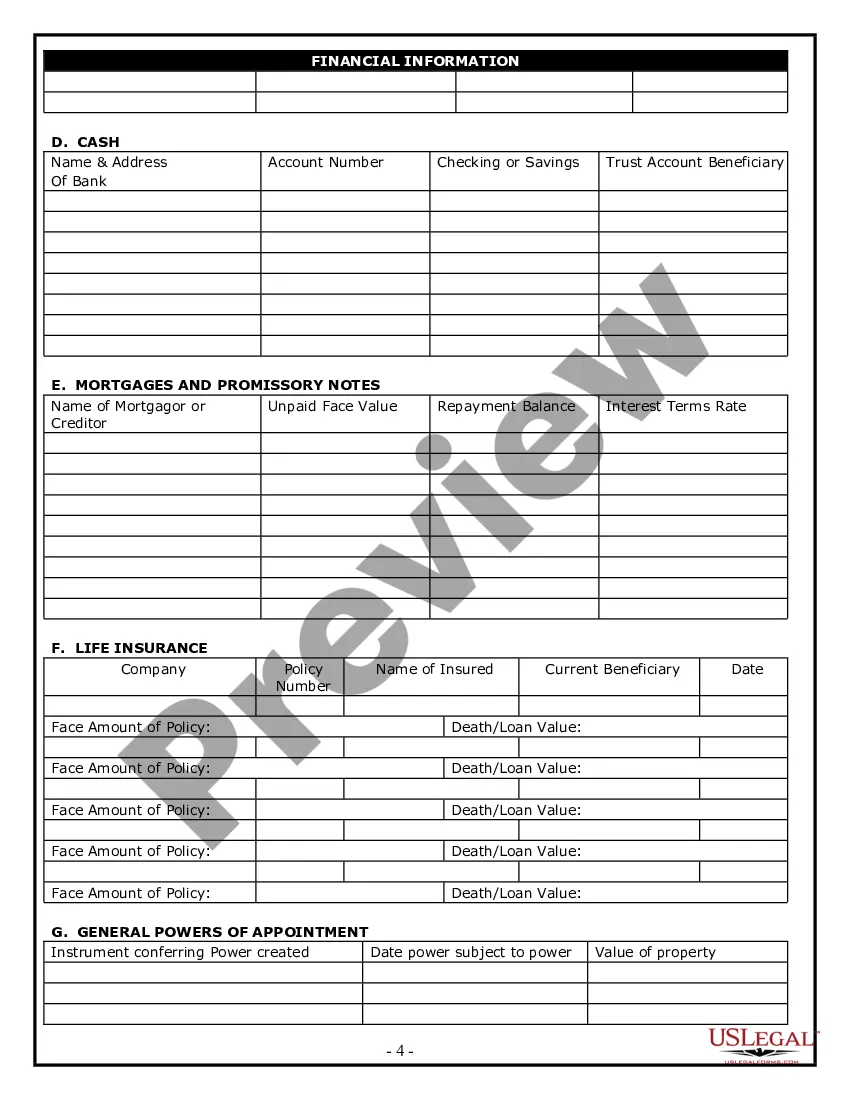

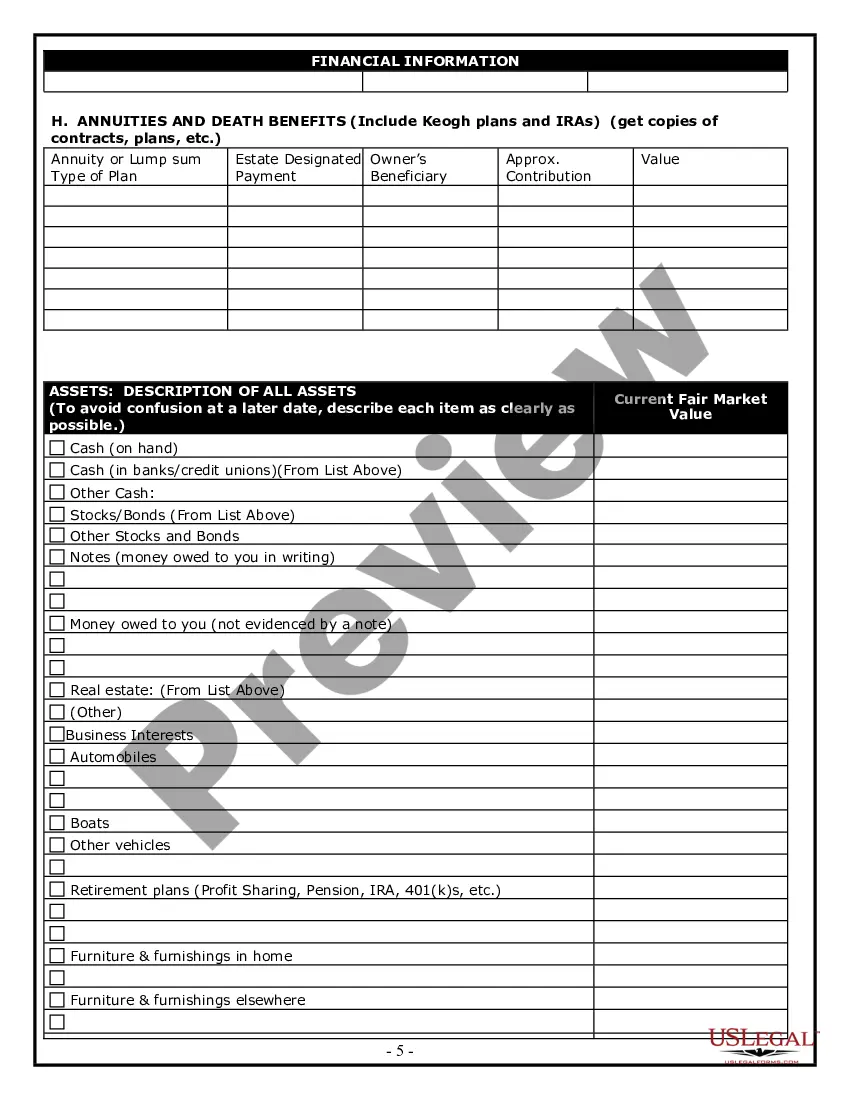

How to fill out Estate Planning Questionnaire?

The Estate Planning Document Printable With Holidays presented on this page is a reusable official template created by experienced attorneys in compliance with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, entities, and lawyers with more than 85,000 authenticated, state-specific documents for any business and personal event. It’s the fastest, simplest, and most dependable method to acquire the forms you require, as the service ensures bank-level data protection and anti-malware safeguards.

Select the format you want for your Estate Planning Document Printable With Holidays (PDF, DOCX, RTF) and save the sample on your device. Fill out and sign the documents. Print the template to complete it by hand. Alternatively, use an online multifunctional PDF editor to quickly and accurately fill out and sign your form with a legally binding electronic signature. Download your documents again. Utilize the same document again whenever needed. Access the My documents tab in your profile to redownload any previously obtained forms. Subscribe to US Legal Forms for verified legal templates for all of life’s circumstances at your fingertips.

- Search for the document you need and review it.

- Browse the file you searched and preview it or read the form description to make sure it meets your requirements. If it doesn’t, use the search bar to find the correct one. Click Buy Now once you have found the template you need.

- Register and Log In.

- Choose the pricing option that fits you and set up an account. Use PayPal or a credit card to make a quick payment. If you already have an account, Log In and check your subscription to continue.

- Obtain the editable template.

Form popularity

FAQ

The 5 by 5 rule allows beneficiaries of a trust to withdraw amounts up to $5,000 or 5% of the trust's value annually, encouraging some level of access to funds while preserving the trust. This provision can help beneficiaries manage their needs without completely depleting the trust. Knowing how this rule works can enhance your estate planning strategy. Use our estate planning form printable with holidays to stay organized and informed.

One major mistake parents make is failing to communicate their intentions to their children. Without clear guidance, beneficiaries may misunderstand the trust's purpose or misuse the funds. Open conversations about the trust can lead to better understanding and responsible management. You can start this process effectively with our estate planning form printable with holidays.

In most cases, a beneficiary designation will take precedence over the terms of a trust. This means that if you name someone as a beneficiary on an account, that designation generally overrides any instructions in your trust. It's vital to keep your beneficiary designations updated to align with your estate planning goals. To ensure clarity, consider utilizing our estate planning form printable with holidays.

The 5 and 5 rule refers to a provision that allows a trust beneficiary to withdraw up to $5,000 or 5% of the trust's value each year, whichever is greater. This rule provides flexibility while ensuring that the trust's principal remains intact for future beneficiaries. Understanding this rule can be crucial for effective estate management. Our estate planning form printable with holidays can help you navigate these complexities easily.

Using a trust can help minimize or avoid inheritance tax in certain situations. Trusts allow you to transfer assets out of your estate, which can lower the value of your taxable estate. However, it's essential to create the right type of trust based on your specific needs. For more guidance, consider using our estate planning form printable with holidays to simplify the process.

The Estate Planning Must-Haves. Wills and Trusts. Durable Power of Attorney. Beneficiary Designations. Letter of Intent. Healthcare Power of Attorney. Guardianship Designations. Estate Planning FAQs.

An estate planning checklist is a guide on how to plan an individual's assets and end-of-life health care if they should die or become incapacitated.

5 Steps to Organize Estate Documents for Your Executor 5 Steps to Organize. ... Step 1: Create a checklist of important documents (and their locations) ... Step 2: List the names and contact information of key associates. ... Step 3: Catalog your digital asset inventory. ... Step 4: Ensure all documents are organized and accessible.

Common estate planning documents are wills, trusts, powers of attorney, and living wills. Everyone can benefit from having a will, no matter how small their estate or simple their wishes. Online estate planning services offer basic packages for less than $200.

These documents include a financial power of attorney, an advance care directive, and a living trust or a last will.