Estate Planning Checklist With Example

Description

How to fill out Estate Planning Questionnaire?

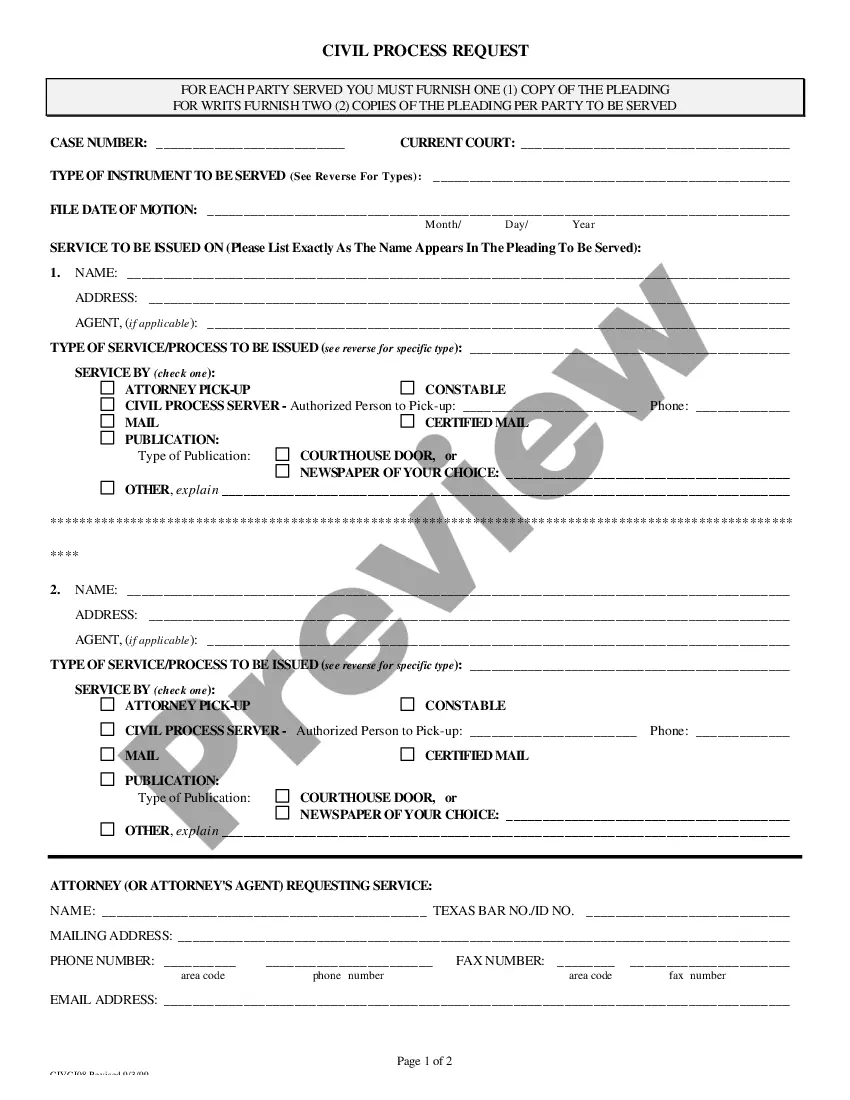

- Access your US Legal Forms account. If you've used the service previously, log in and verify your subscription is active. If it’s expired, renew it according to your payment plan.

- Explore the available forms. Check the Preview mode and form descriptions to ensure you select the right template that complies with your local jurisdiction.

- Search for alternatives, if needed. Use the Search tab to find other templates that may be more suitable. Confirm it’s the right fit before proceeding.

- Make a purchase. Click the Buy Now button, choose your subscription plan, and create an account for full access to the legal library.

- Complete the payment. Provide your credit card information or utilize your PayPal account.

- Download your chosen form. Save the template to your device and find it later in the My Forms section of your account.

In conclusion, US Legal Forms simplifies the estate planning process by offering a wide selection of customizable legal documents and easy access to expert assistance, helping you create legally sound documents in no time.

Start your estate planning journey today by visiting US Legal Forms and finding the resources you need!

Form popularity

FAQ

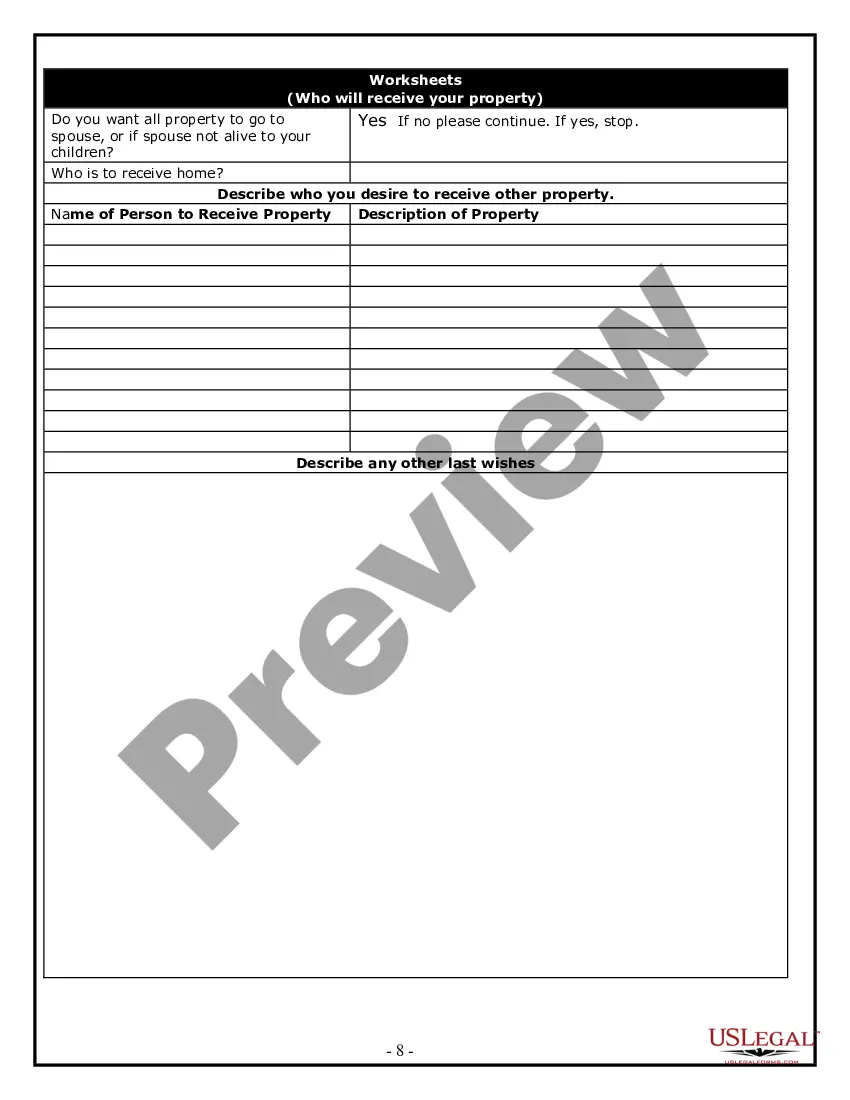

One of the most significant mistakes parents make when establishing a trust fund is failing to communicate their intentions clearly to their children. This can lead to misunderstandings about the trust’s purpose and the responsibilities of the beneficiaries. Additionally, parents might overlook the importance of reviewing and updating the trust as circumstances change. Using an estate planning checklist with example can help parents avoid these pitfalls by ensuring that they address all crucial aspects.

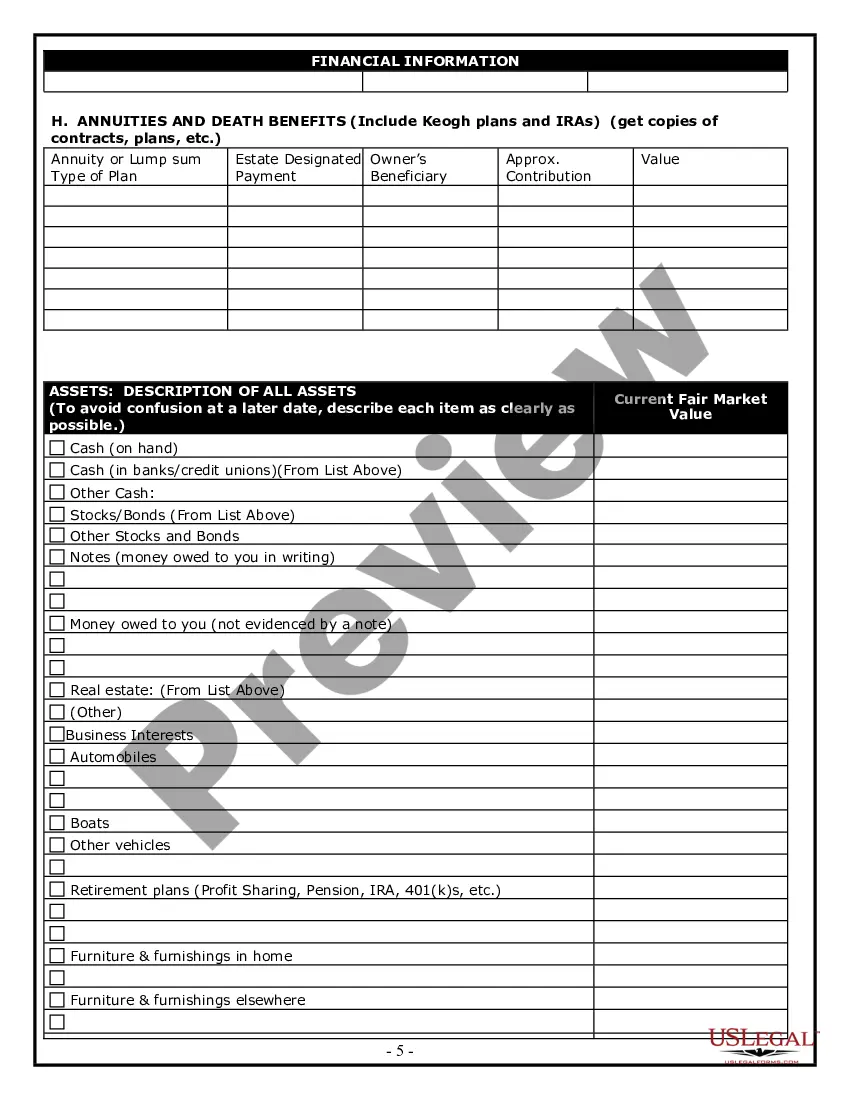

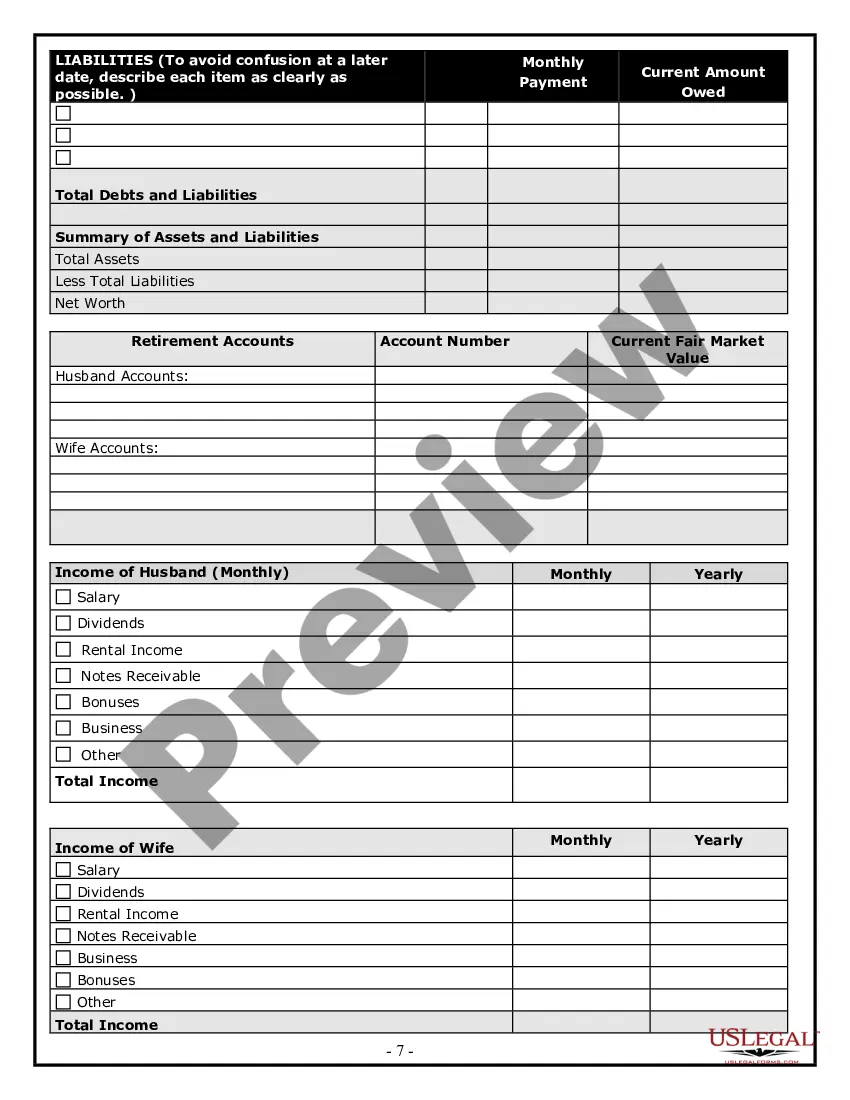

The estate planning process typically includes seven key steps. First, gather your financial information. Next, identify your assets and establish your goals. After that, select your beneficiaries, choose an executor, and decide on guardianship for minors. Then, create and review your estate documents, such as wills and trusts, while also considering healthcare directives. Lastly, implement and regularly update your estate planning checklist with example to ensure that it meets your wishes.

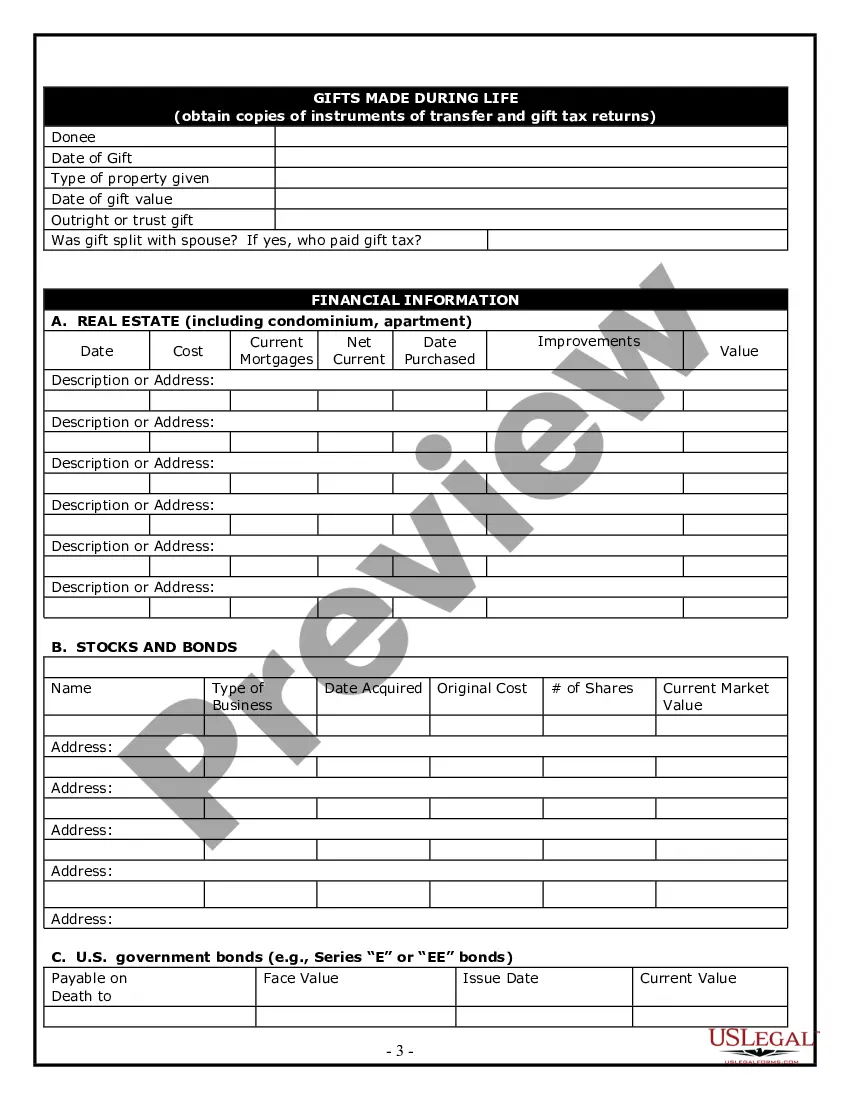

The 5 and 5 rule pertains to gift tax exclusions in estate planning. Under this rule, you can give a certain amount annually to as many individuals as you like without incurring gift taxes, up to a limit of $15,000. Additionally, if you leave a trust, beneficiaries can receive up to $5,000 a year from the trust without facing tax implications. To make the most of your estate planning checklist with example, consider consulting with a professional.

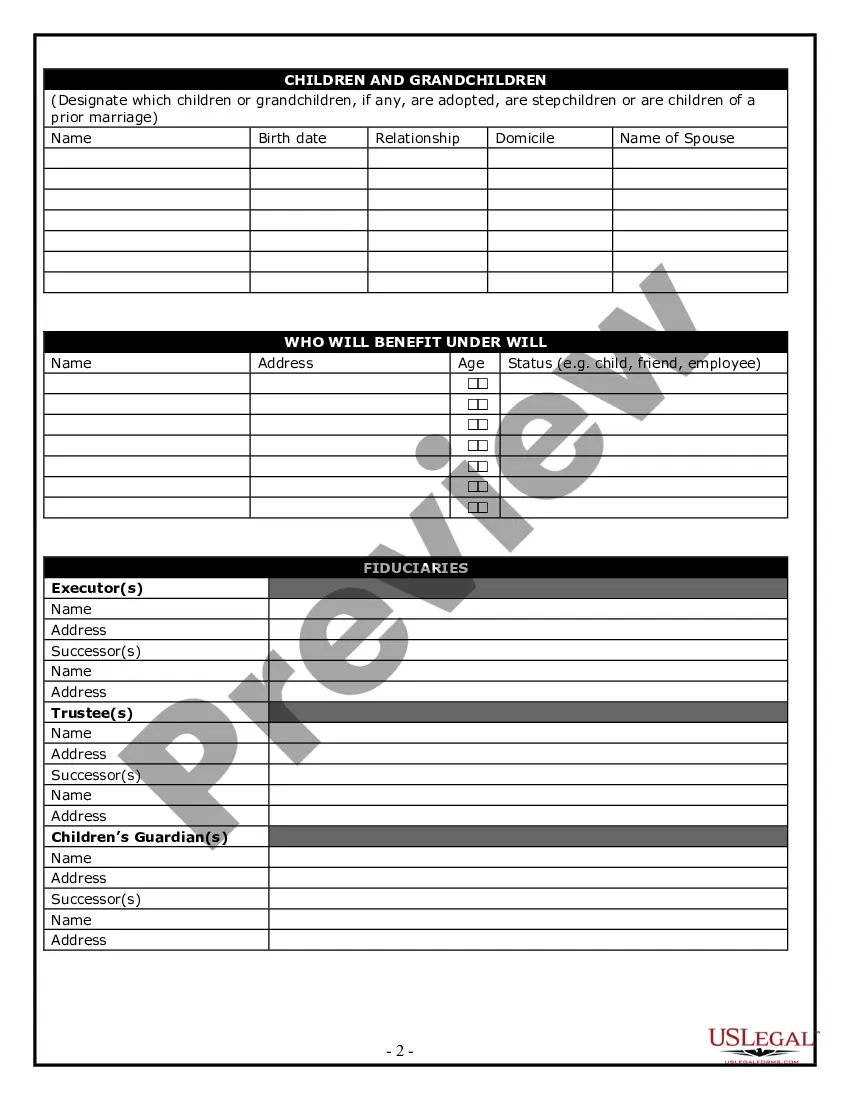

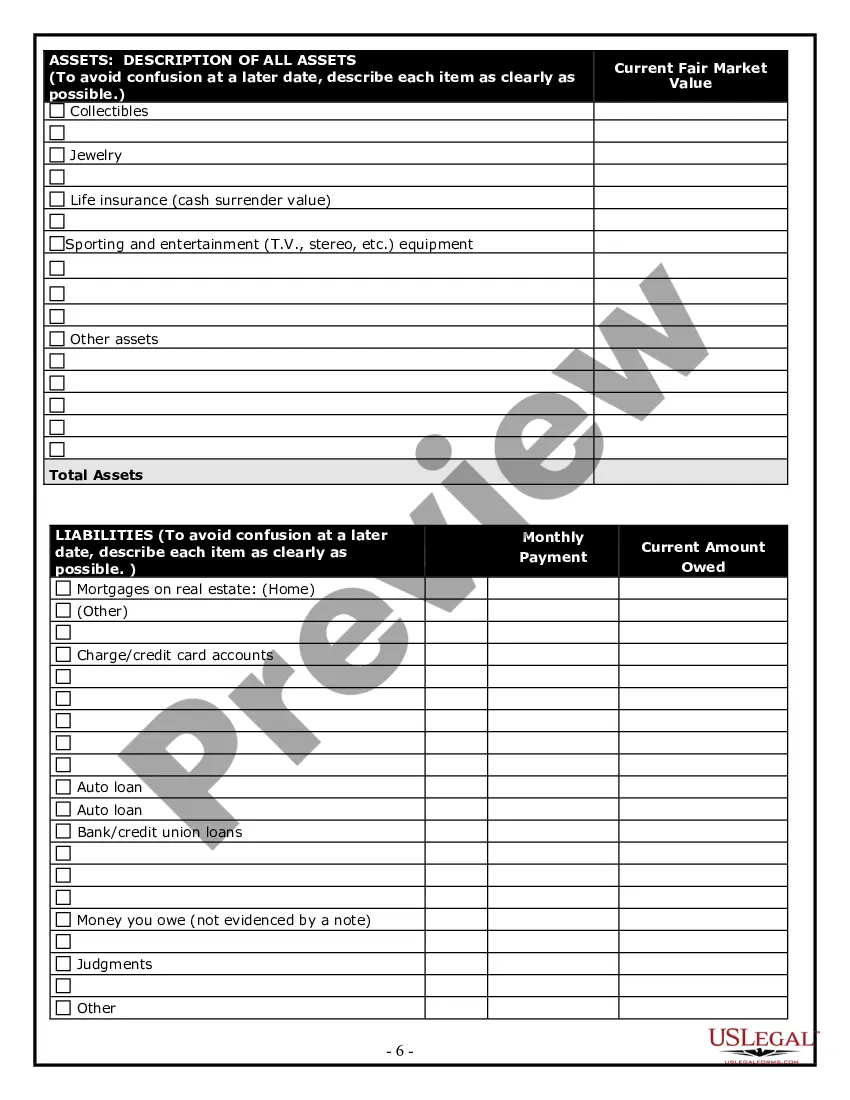

To create a comprehensive before death checklist, include items such as a will, power of attorney, and health care directives in your estate planning checklist with examples. Additionally, gather financial documents, titles to properties, and any insurance policies. Organizing these important papers not only eases the burden on your loved ones but also ensures your wishes are fulfilled. Consider using US Legal Forms to access customizable checklists that meet your specific needs.

You can start estate planning yourself by creating an estate planning checklist with examples specific to your situation. Begin by listing your assets, deciding who will inherit them, and considering guardianship for dependents if necessary. Next, draft essential documents, such as a will or a trust, and ensure they are legally binding. US Legal Forms provides templates and resources that simplify the entire process and help you avoid common pitfalls.

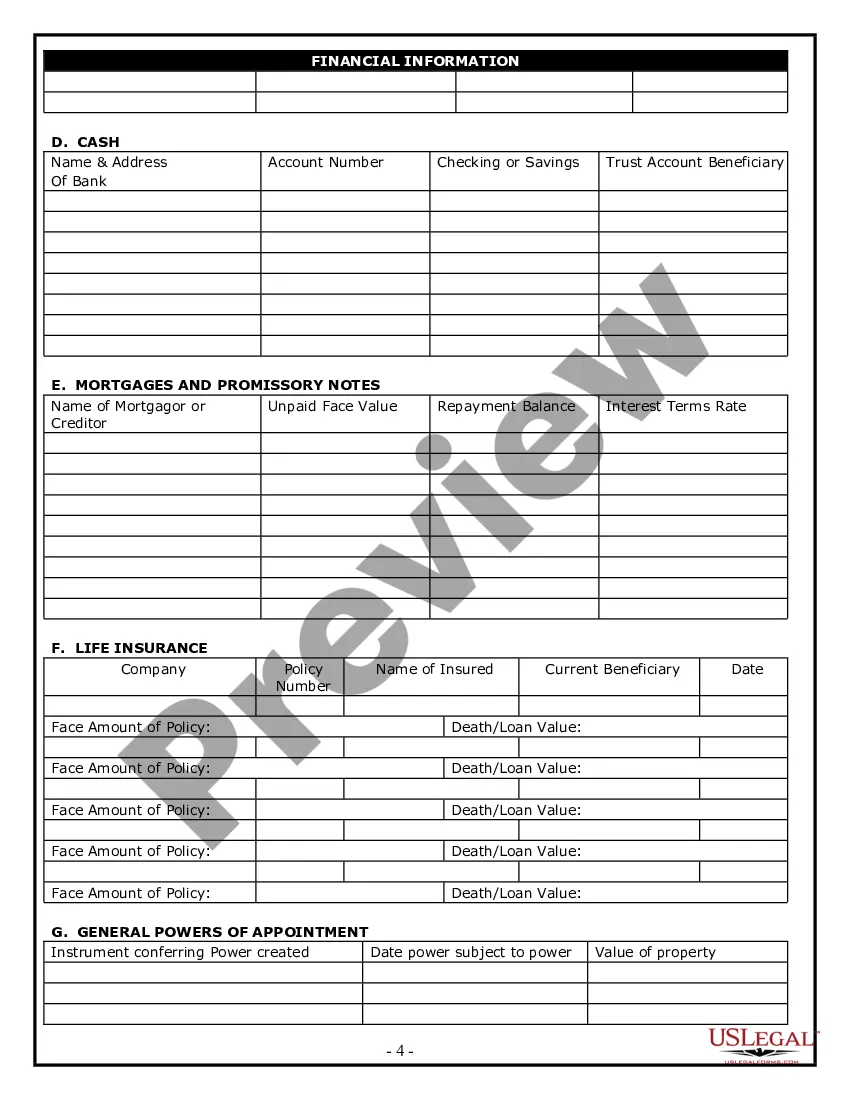

Suze Orman emphasizes the importance of having a will, a durable power of attorney, a healthcare proxy, and a living trust. These four documents provide a robust framework for your estate plan, ensuring that your wishes are honored. You can create your own estate planning checklist with example documents to help you track these essentials. US Legal Forms offers valuable resources to aid you in preparing and understanding these key documents.

Maintaining estate plan documents requires regular reviews and updates, particularly after significant life events or changes in laws. Use your estate planning checklist with example updates for tracking which documents need review. Ensure that all copies are kept in a safe place, and consider sharing their locations and purposes with trusted family members or a legal advisor. Regularly using a service like US Legal Forms can also help you stay informed about potential changes you need to make.

To organize documents for estate planning, begin by creating an estate planning checklist with example categories such as wills, trusts, and financial accounts. Gather all essential paperwork including property deeds, insurance policies, and bank statements. Once you have everything, store these documents in a secure location, like a locked file cabinet or a safe. Utilizing platforms like US Legal Forms can help you streamline this process by providing templates and guidance.

The 5 D's of real estate are similar to those of estate planning and include Desire, Determination, Development, Demand, and Diversification. Embracing these principles can strengthen your investment strategy and guide your estate planning decisions. Incorporating these factors into your estate planning checklist with example can lead to more informed choices and a sustainable financial future.

The 4 D's of real estate involve Location, Demand, Development, and Diversification. Each factor plays a crucial role in property valuation and investment potential. Understanding these elements is essential for effective estate planning, particularly when real estate assets are involved, as they should be included in your estate planning checklist with example.