Estate Planning Checklist Form

Description

How to fill out Estate Planning Questionnaire?

Finding your way through the red tape of official documents and templates can be challenging, particularly when you aren't familiar with it professionally.

Selecting the appropriate template for an Estate Planning Checklist Form can take considerable time, as it must be accurate and valid down to the last detail.

However, you will spend significantly less time locating a suitable template if it originates from a trustworthy source.

Obtain the correct form in a few simple steps: Enter the document name in the search box, locate the right Estate Planning Checklist Form from the results, review the sample description or open its preview, if the template meets your needs, click Buy Now, choose your subscription plan, register an account using your email and create a password, select a credit card or PayPal payment method, and save the document in your preferred format on your device. US Legal Forms will help you save time and effort in determining if the form you found online suits your requirements. Create an account to gain unlimited access to all the templates you need.

- US Legal Forms is a service that streamlines the process of locating the correct forms online.

- US Legal Forms serves as a centralized hub for accessing the latest document samples, understanding their usage, and downloading them for completion.

- This platform boasts a collection of over 85,000 forms relevant to various professional sectors.

- When searching for an Estate Planning Checklist Form, there will be no need to question its reliability as all forms are validated.

- Creating an account on US Legal Forms will guarantee you have all necessary samples readily available.

- You can store them in your history or add them to the My documents section.

- Your saved forms can be accessed from any device by selecting Log In on the library site.

- If you do not possess an account yet, you can always seek anew for the template you need.

Form popularity

FAQ

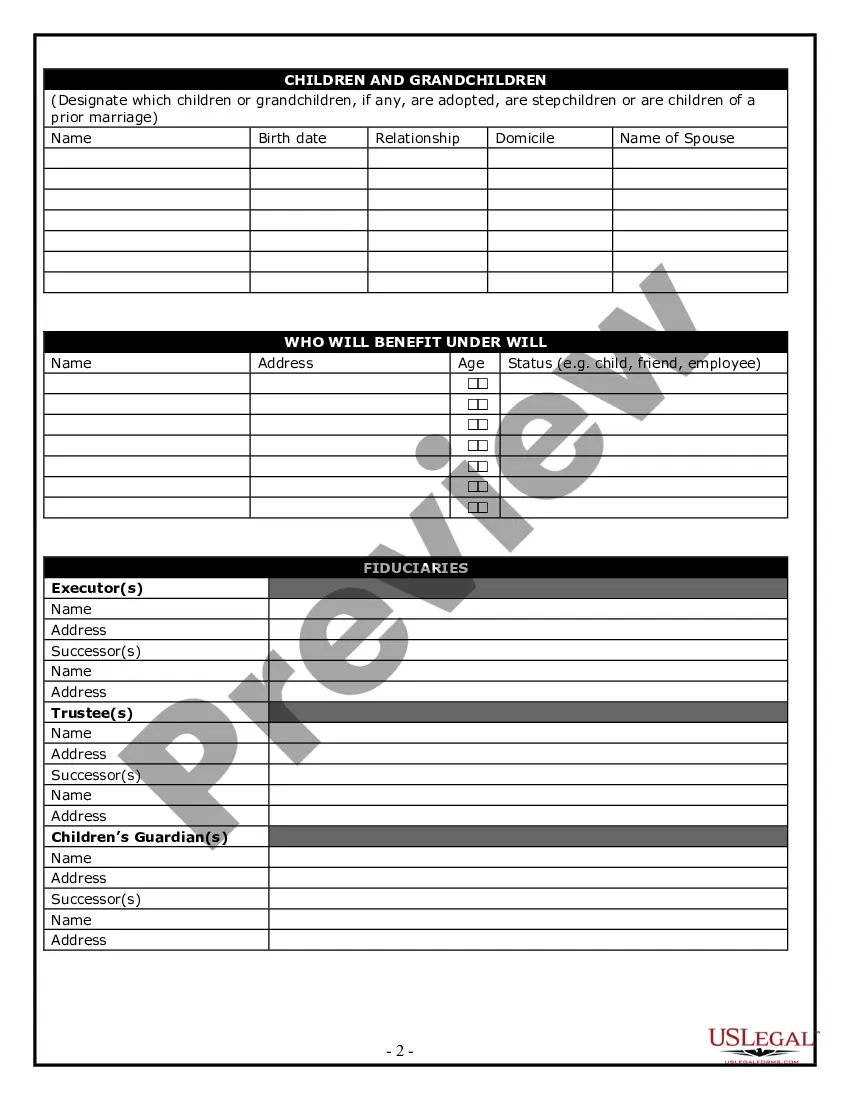

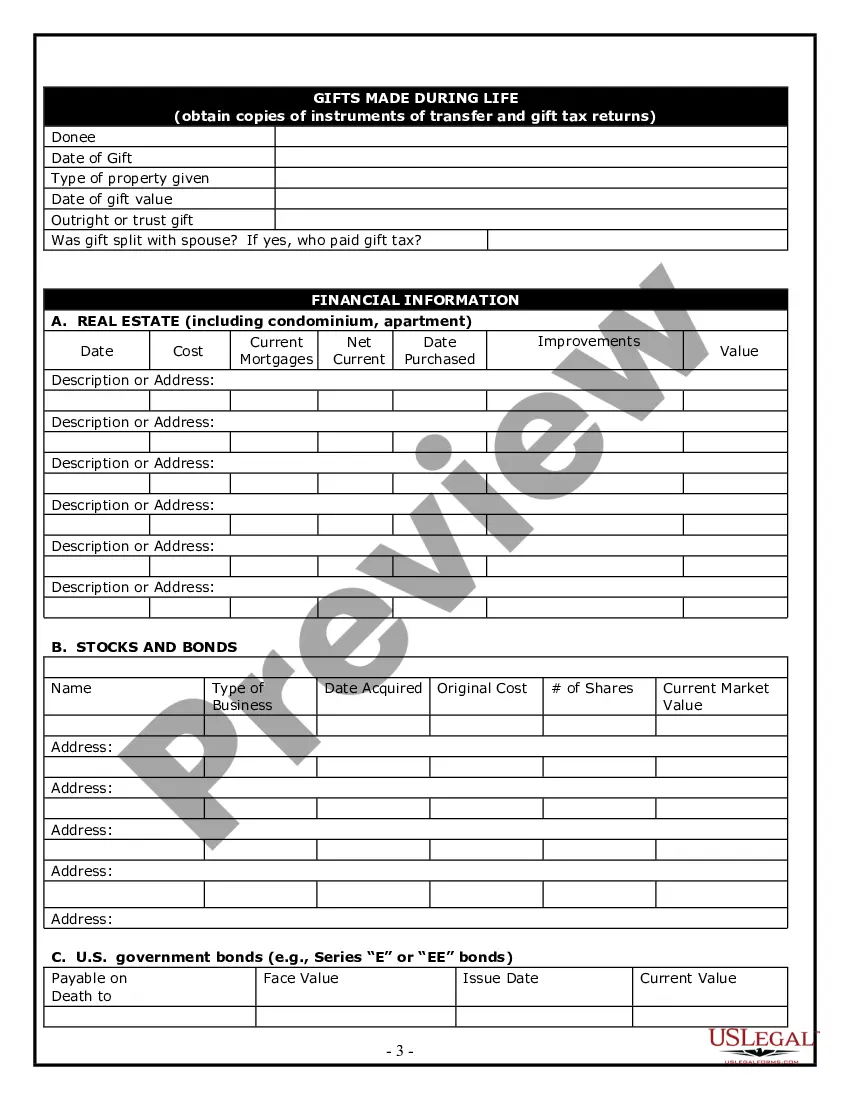

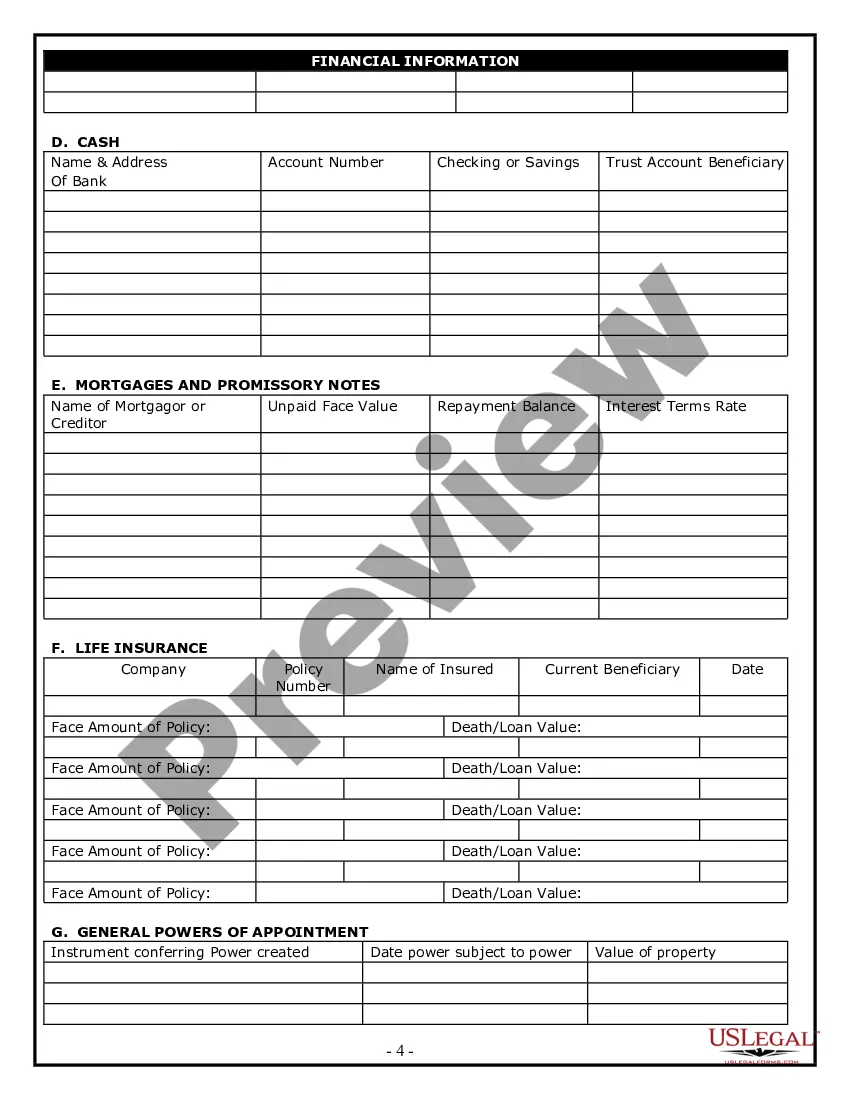

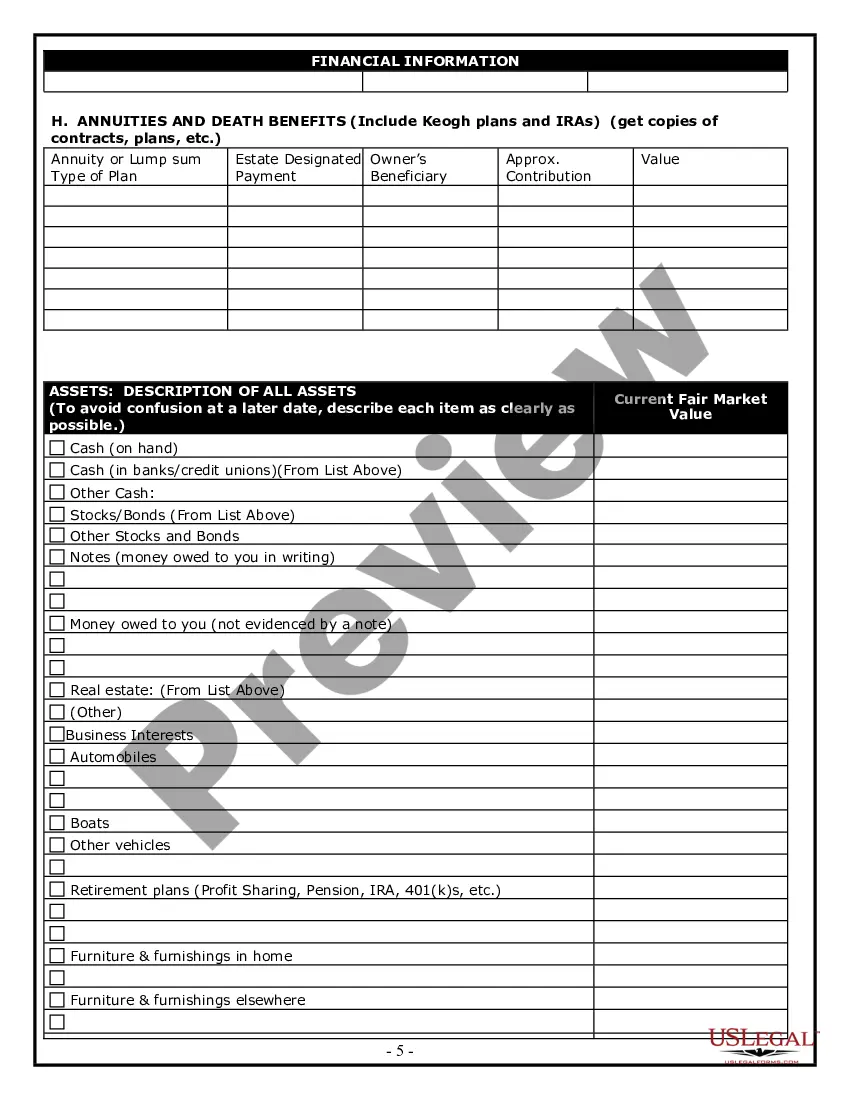

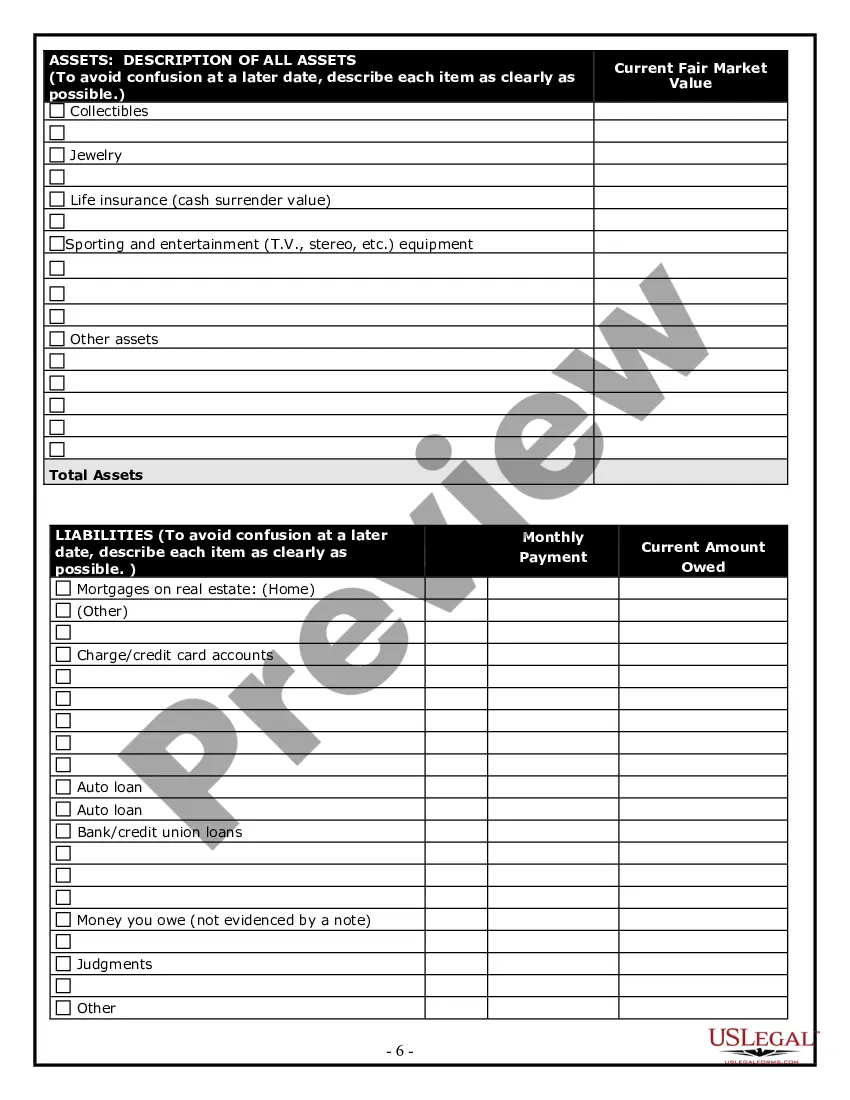

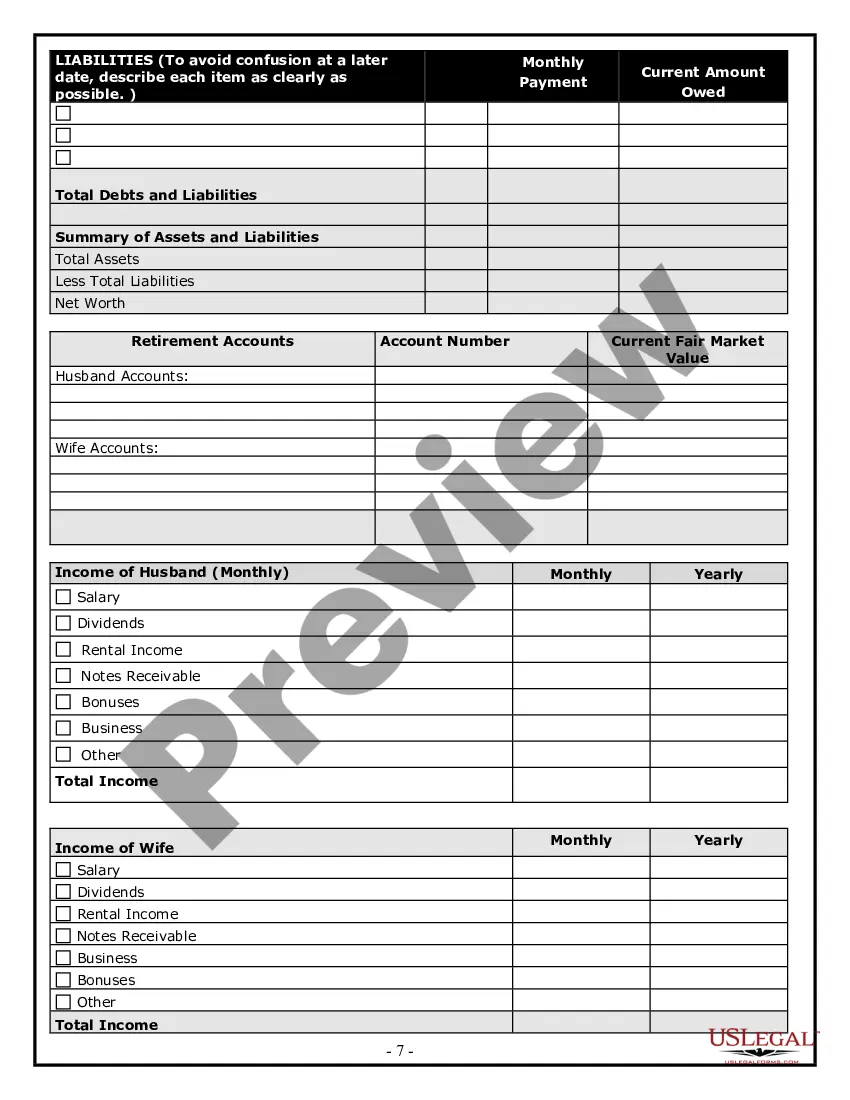

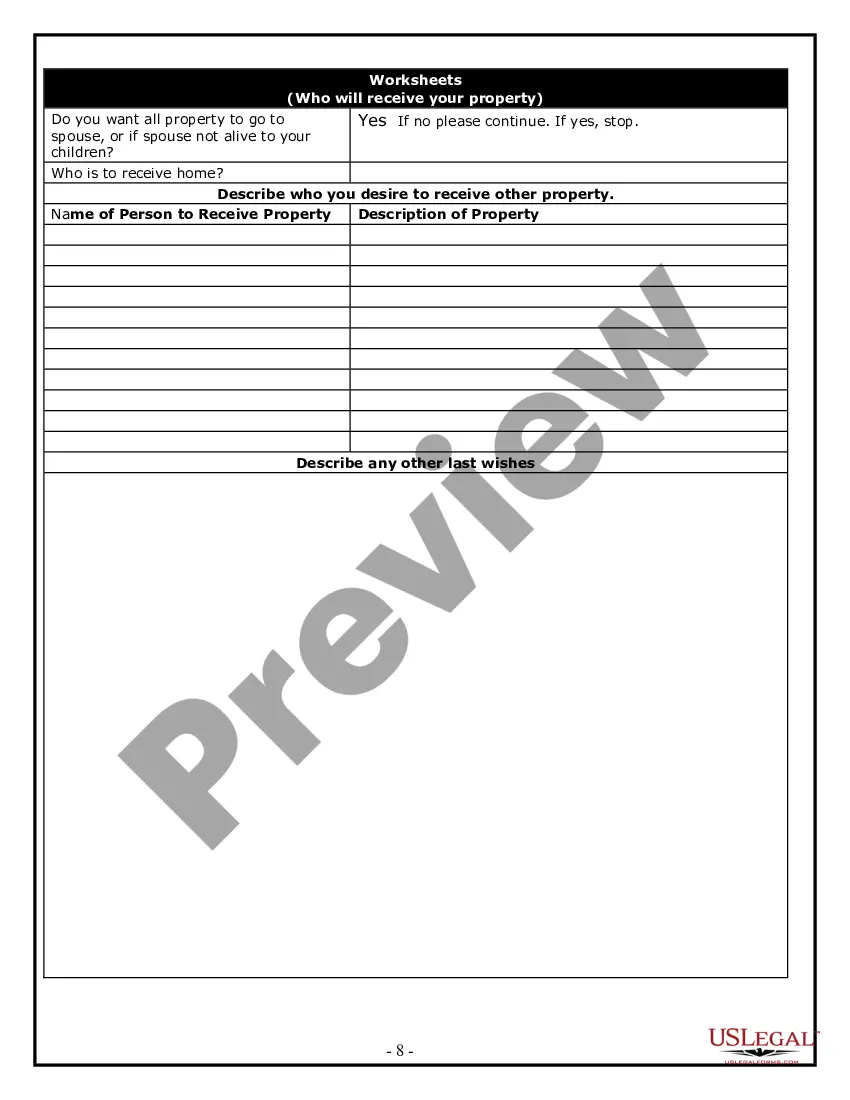

Organizing your estate planning documents begins with listing all your assets, including real estate, bank accounts, and investments. Next, categorize documents such as wills, trusts, powers of attorney, and health care directives. By using an estate planning checklist form, you can ensure that all necessary documents are in place and easy to locate. This method simplifies the process for your loved ones when the time comes.

The 5 and 5 rule allows a beneficiary of an irrevocable trust to withdraw up to $5,000 or 5% of the trust's value each year, whichever is greater, without incurring gift tax. This rule provides flexibility while ensuring that the trust retains its tax benefits. When planning your estate, it's vital to consider how this rule affects your assets. An estate planning checklist form can help you navigate these nuances.

The best way to do estate planning is to start early and be thorough. Utilize an estate planning checklist form to ensure you don’t overlook important details, such as beneficiaries and asset distribution. Consider your unique financial situation and the needs of your family as you develop your plan. Platforms like US Legal Forms can support you by offering reliable templates and expert guidance.

Yes, estate planning can be effectively done online. Many services offer tools and resources that make it easier to create essential documents from the comfort of your home. By using an estate planning checklist form, you can ensure that all your bases are covered. US Legal Forms offers a comprehensive platform that simplifies the online estate planning process.

Online wills can hold up in court if they meet the legal requirements of your state. It is crucial to ensure that the estate planning checklist form is filled out correctly and that you follow any necessary signing and witnessing procedures. Platforms like US Legal Forms provide templates that comply with legal standards, giving you peace of mind that your estate is well managed.

The most common form of estate planning is creating a will. A will outlines your wishes regarding the distribution of your assets after you pass away. Additionally, incorporating other documents, such as trusts or healthcare directives, can further specify your intentions. Utilizing an estate planning checklist form can help you ensure that you cover all necessary components.

Creating a before-death checklist is essential for ensuring that your wishes are respected. Begin by gathering important documents, such as your estate planning checklist form, financial information, and details about your assets. Additionally, you should identify your beneficiaries and assign a power of attorney. This preparation helps your loved ones handle your affairs more easily when the time comes.

The 5 or 5 rule is a principle applicable in certain trust arrangements, particularly for beneficiaries who can access a specified amount without tax implications. In essence, this rule allows beneficiaries to withdraw the greater of $5,000 or 5% of the trust's total value during a given year. This system provides both flexibility and strategic tax advantages, as it enables beneficiaries to manage their resources while keeping the estate intact. Incorporating this understanding into your estate planning checklist form can greatly enhance your ability to meet your beneficiaries' needs while ensuring your wishes are honored.

The 5 and 5 rule is a helpful guideline used in estate planning to determine the permissible gifts that can be made without incurring gift taxes. According to this rule, individuals can give away up to $15,000 per year to each recipient without triggering any taxation. Additionally, the recipient can access a five-year period in which the donor can withdraw this amount without affecting their estate tax exemption. By understanding this rule, you can strategically utilize an estate planning checklist form to optimize your gifting strategy and maximize your estate's value.

Parents often overlook the importance of funding the trust, which may endanger their estate planning goals. Creating a trust is one part of the process, but you must also transfer your assets into that trust properly. Without proper funding, your trust will fail to serve its intended purpose, leading to complications in asset management and distribution. To ensure a smooth transition, utilize an estate planning checklist form to track assets designated for your trust, helping you avoid this common pitfall.