Estate-planning

Description

How to fill out Estate Planning Questionnaire?

- If you're a returning user, log in to your account and navigate to the form template you need. Ensure your subscription is active; renew if necessary.

- For first-time users, start by reviewing the Preview mode and form descriptions. Confirm you select a document that aligns with your local jurisdiction's requirements.

- If you need a different template, utilize the Search tab to locate the correct document that suits your needs.

- Proceed to purchase the document by clicking the Buy Now button and select your preferred subscription plan. Create an account for full access to the resources.

- Complete your transaction by entering your payment details through credit card or PayPal.

- Once purchased, download your estate-planning form to your device for filling out, and you'll have access to it anytime through the My Forms section of your profile.

Using US Legal Forms not only simplifies the estate-planning process but also assures you have access to premium experts for assistance, ensuring your documents are done correctly.

Take control of your estate today—get started with US Legal Forms for a hassle-free legal document experience!

Form popularity

FAQ

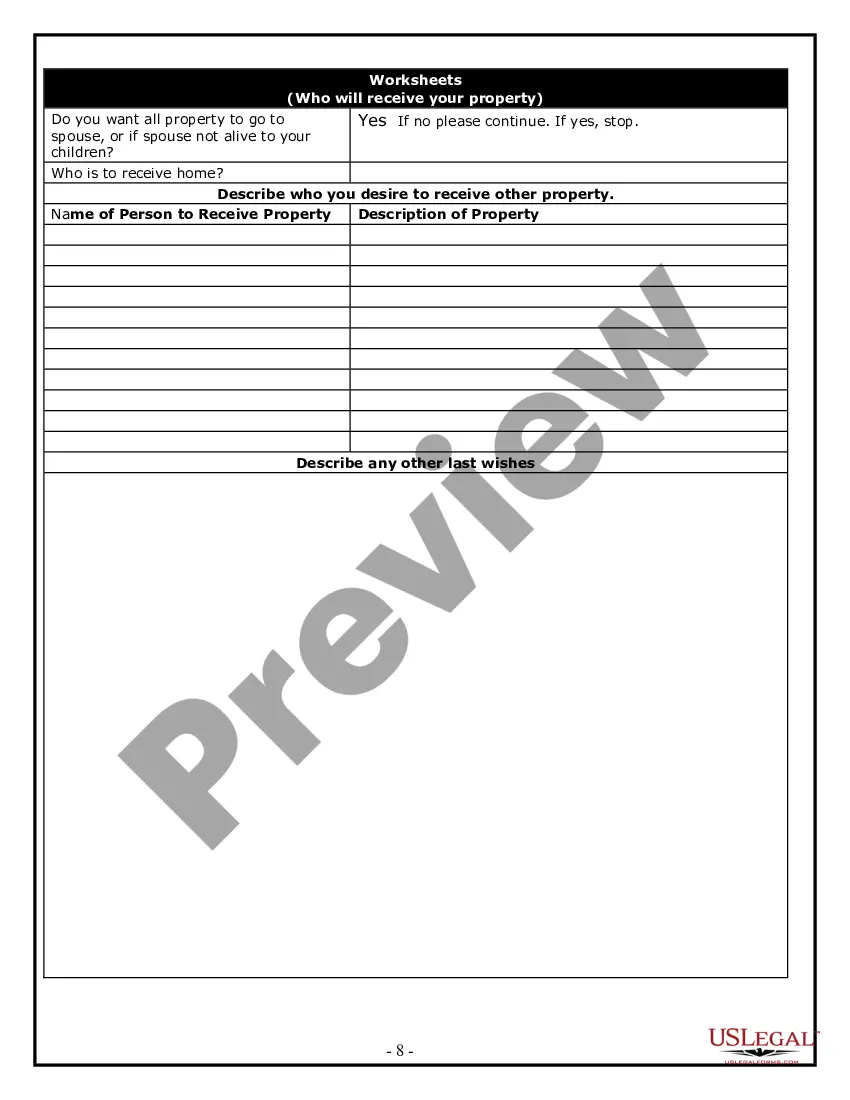

To create your own estate plan, start by defining your goals for asset distribution. Next, draft key documents like your will, trust, and healthcare directives. It's important to stay informed about state-specific legal requirements and ensure your documents are valid. Utilizing services from US Legal Forms can provide you with templates and guidance tailored to your estate-planning needs.

In the United States, you do not need a specific license to create a basic estate plan, such as a will or a power of attorney. However, if you are providing estate-planning services for others, you may need to consult legal professionals to ensure compliance with local laws. It is wise to seek assistance from knowledgeable platforms like US Legal Forms for accurate resources when entering the estate-planning field.

The 5 and 5 rule in estate planning refers to the annual gift tax exclusion. It allows individuals to give up to $15,000 per recipient each year without incurring gift taxes. Additionally, a spouse can gift $15,000 to the same recipient, effectively doubling the amount. Understanding this rule can help you effectively plan your estate and minimize tax implications, and resources from US Legal Forms can clarify its application.

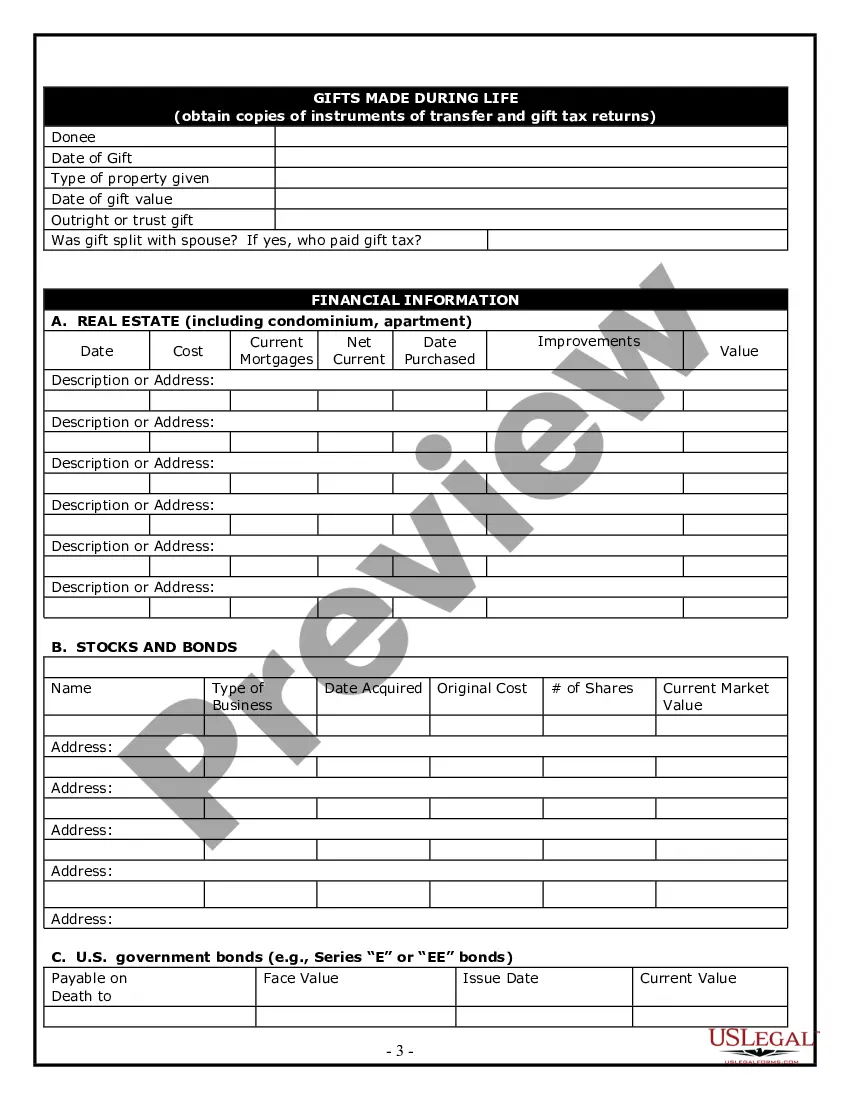

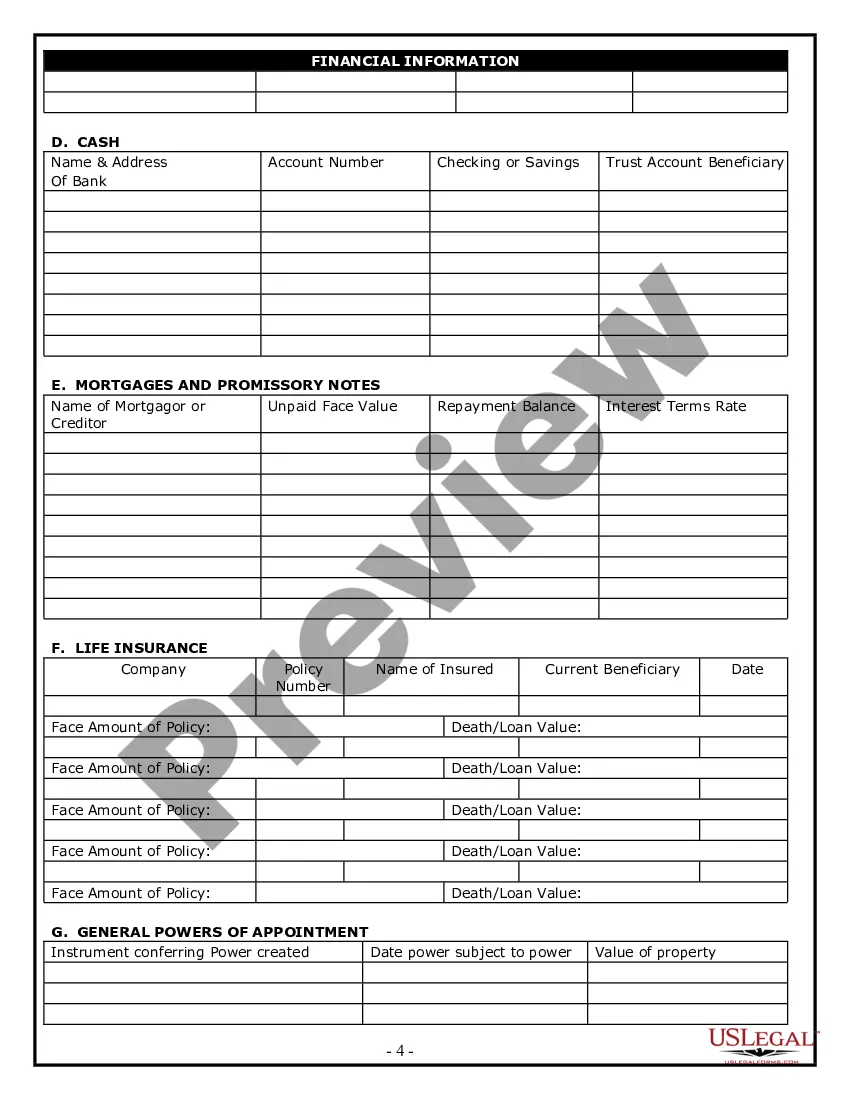

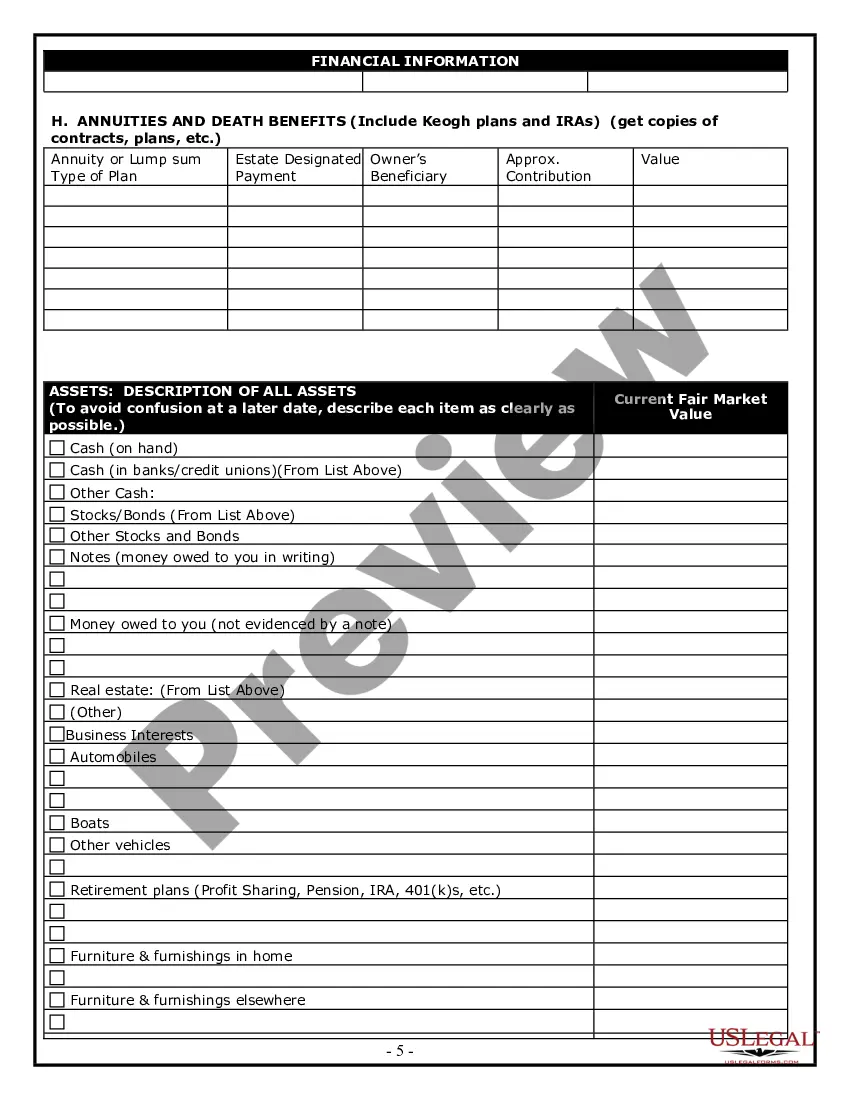

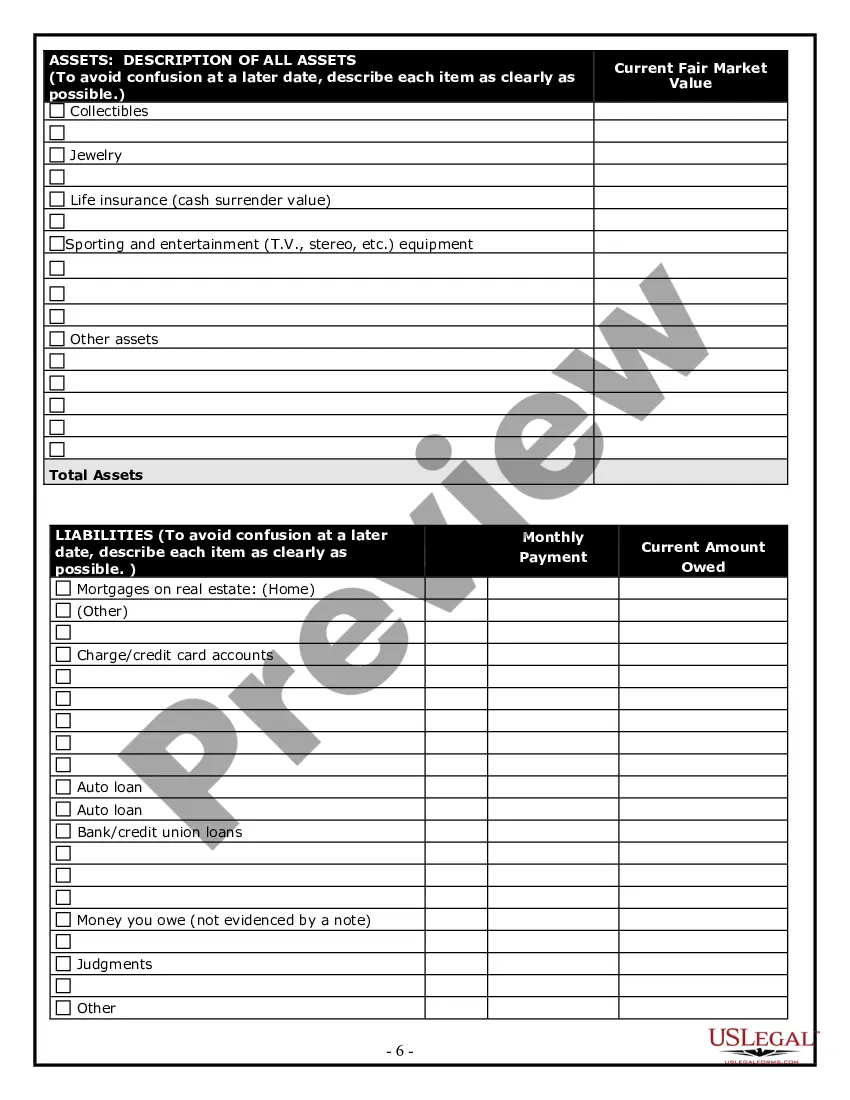

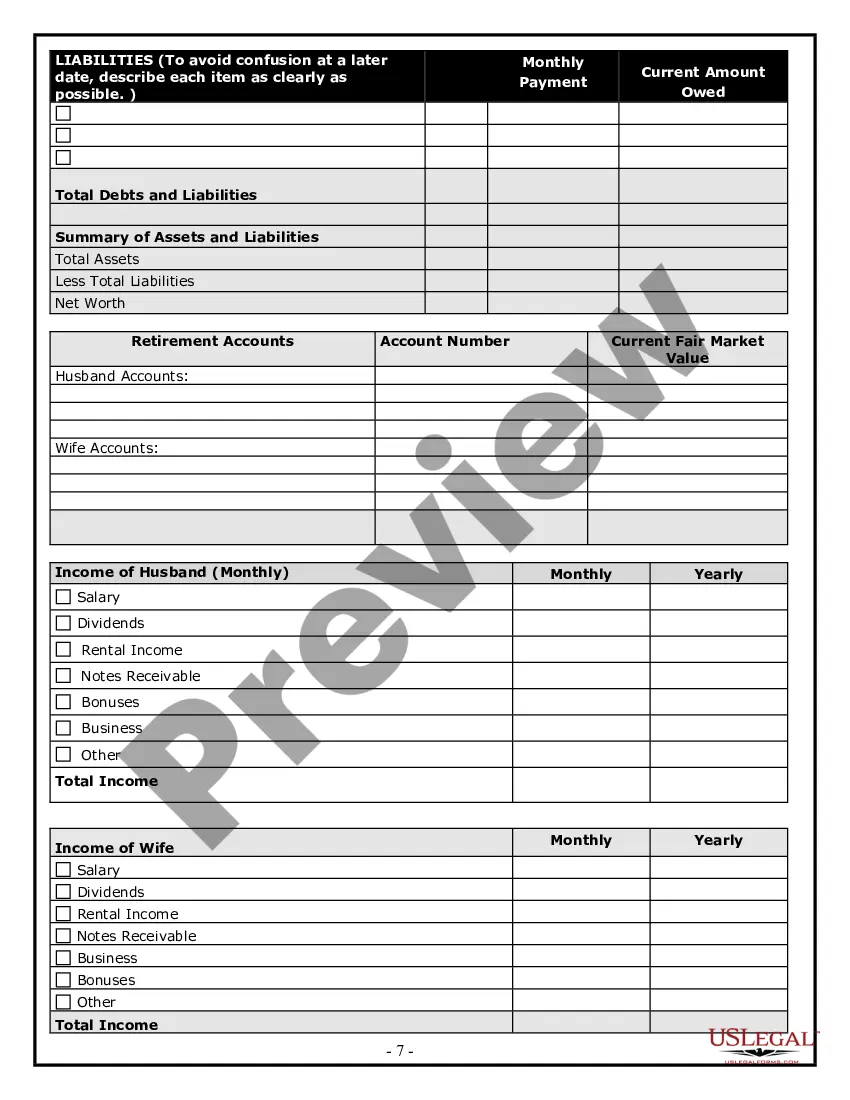

The first step in estate planning is assessing your financial situation. This involves gathering information about all your assets, such as property, bank accounts, and investments. It is essential to determine how you would like these assets distributed after your passing. Starting this process with tools from US Legal Forms can streamline your estate-planning journey and ensure you cover every necessary detail.

To get into estate planning, begin by researching the basics of wills, trusts, and other relevant documents. Consider taking a course or reading books focused on estate law to deepen your understanding. Networking with professionals in the field can also provide valuable insights. Platforms like US Legal Forms can offer practical resources and templates for someone new to estate-planning.

Creating your own estate plan involves several steps. Start by listing your assets and deciding how you want to distribute them. Next, choose a trusted individual to serve as your executor, and prepare essential documents such as a will and a power of attorney. You can utilize platforms like US Legal Forms to access templates and guides that simplify the estate-planning process.

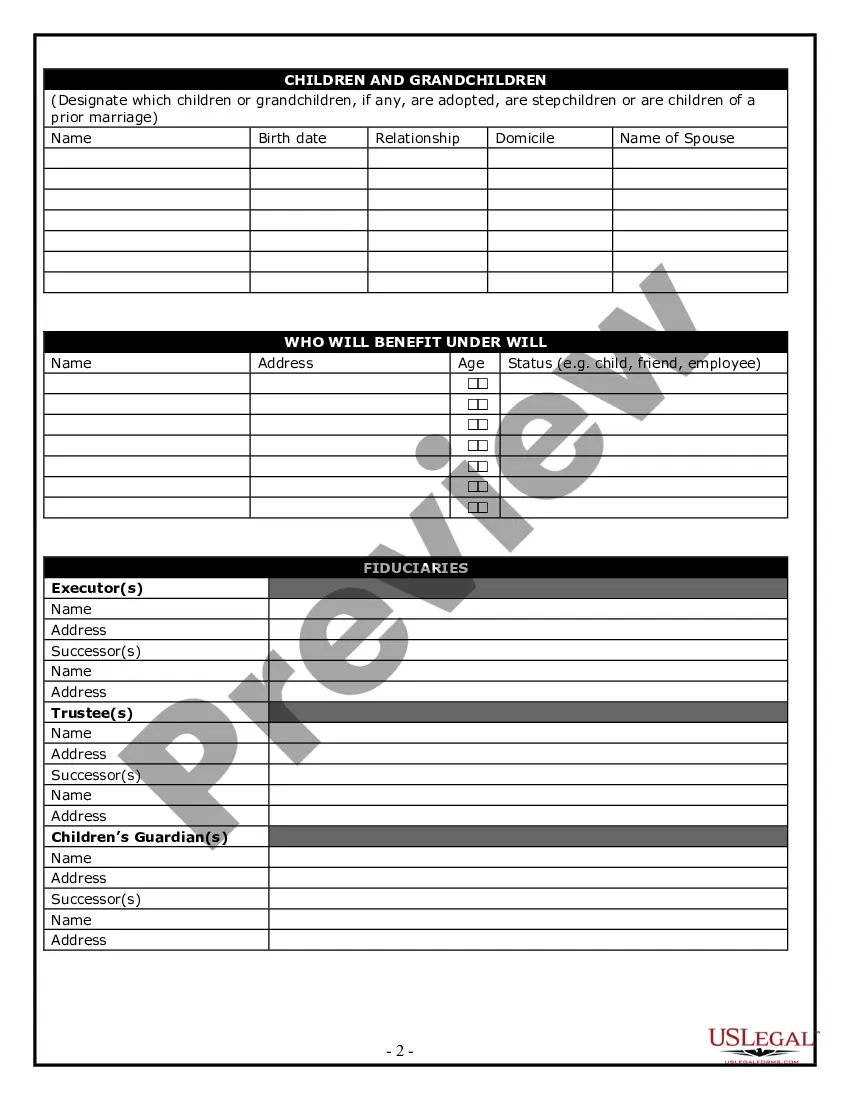

When you embark on the estate-planning process, there are seven essential steps to follow for a sound plan. Start by gathering all relevant financial documents and making a list of your assets. After that, identify your family needs and any special circumstances. Creating a comprehensive will, setting up trusts, and designating power of attorney are crucial parts of this process. Remember, reviewing your plan regularly can help you adapt to changes, making estate-planning a dynamic part of your life.

The estate-planning journey consists of seven significant steps that help you secure your legacy. Begin by evaluating your financial situation and understanding your complete asset portfolio. Next, set clear objectives on how you desire your assets to be allocated. Additionally, choose the right legal tools, such as trusts or wills, to protect your wishes. Don’t forget to periodically review and update your plan as your life circumstances change.

The estate-planning process involves several crucial steps to ensure that your assets are distributed according to your wishes. First, you must assess your assets and liabilities. Next, consider your family dynamics and future needs. Then, establish your goals for distribution, choose beneficiaries, and decide on executors. Finally, create and review documents such as wills and trusts, and ensure they comply with legal requirements.

A will is a legal document that specifies how your assets should be distributed after your death, whereas estate-planning encompasses a broader strategy for managing your assets during your life and after. Estate-planning includes the creation of a will, but also involves trusts, healthcare directives, and tax considerations. By focusing on comprehensive estate-planning, you can prevent disputes and ensure your wishes are fulfilled. US Legal Forms offers a variety of tools to assist you in creating a complete estate plan tailored to your needs.