Blood Test For Dui In California

Description

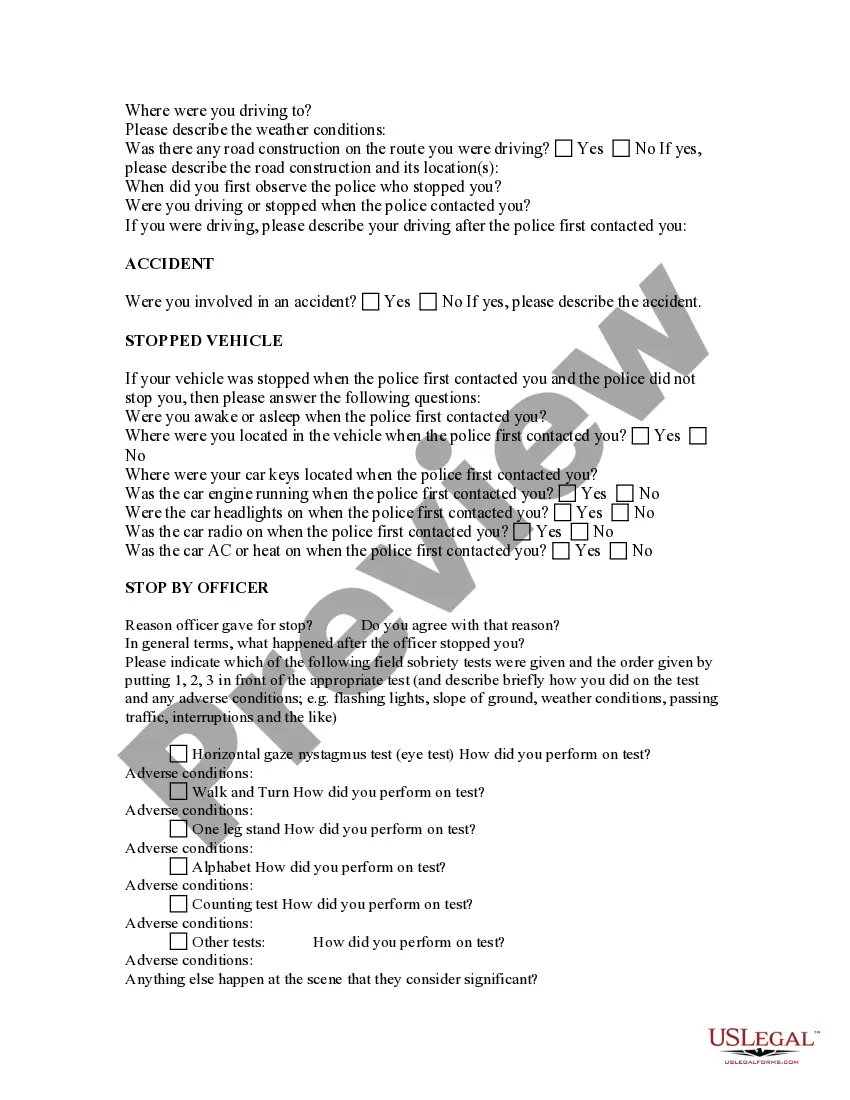

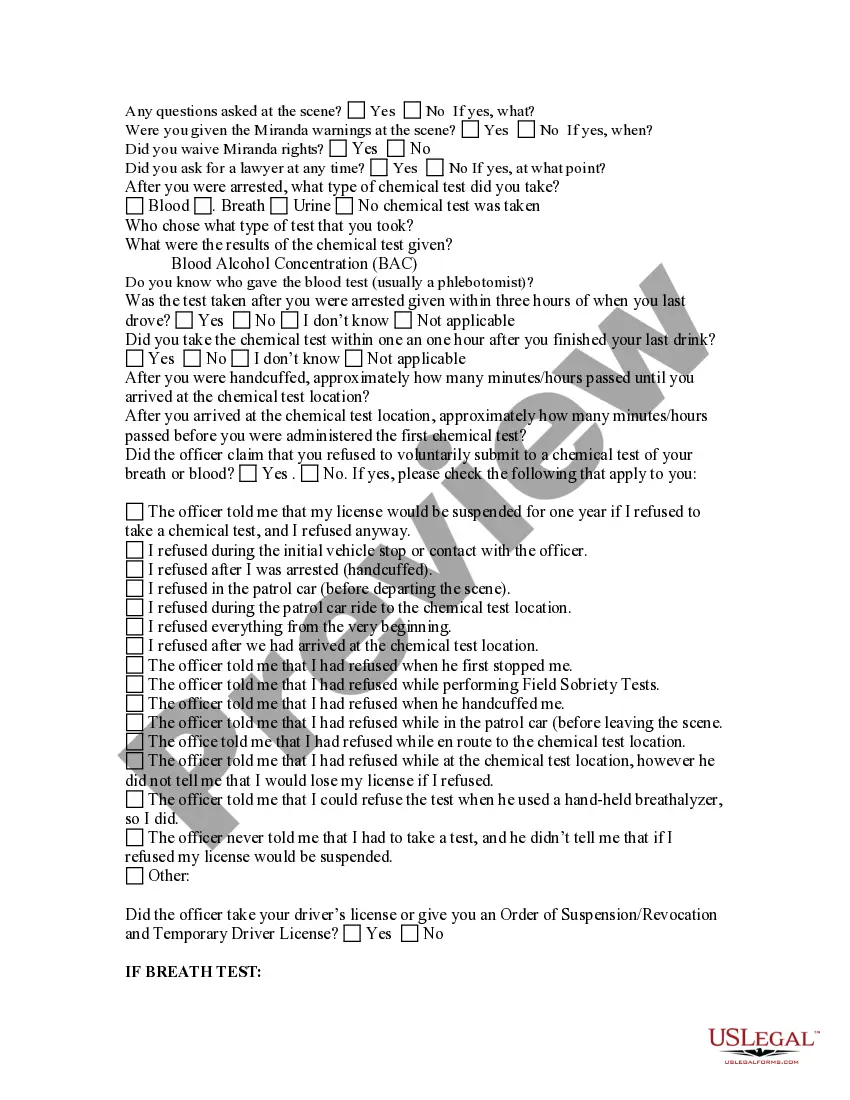

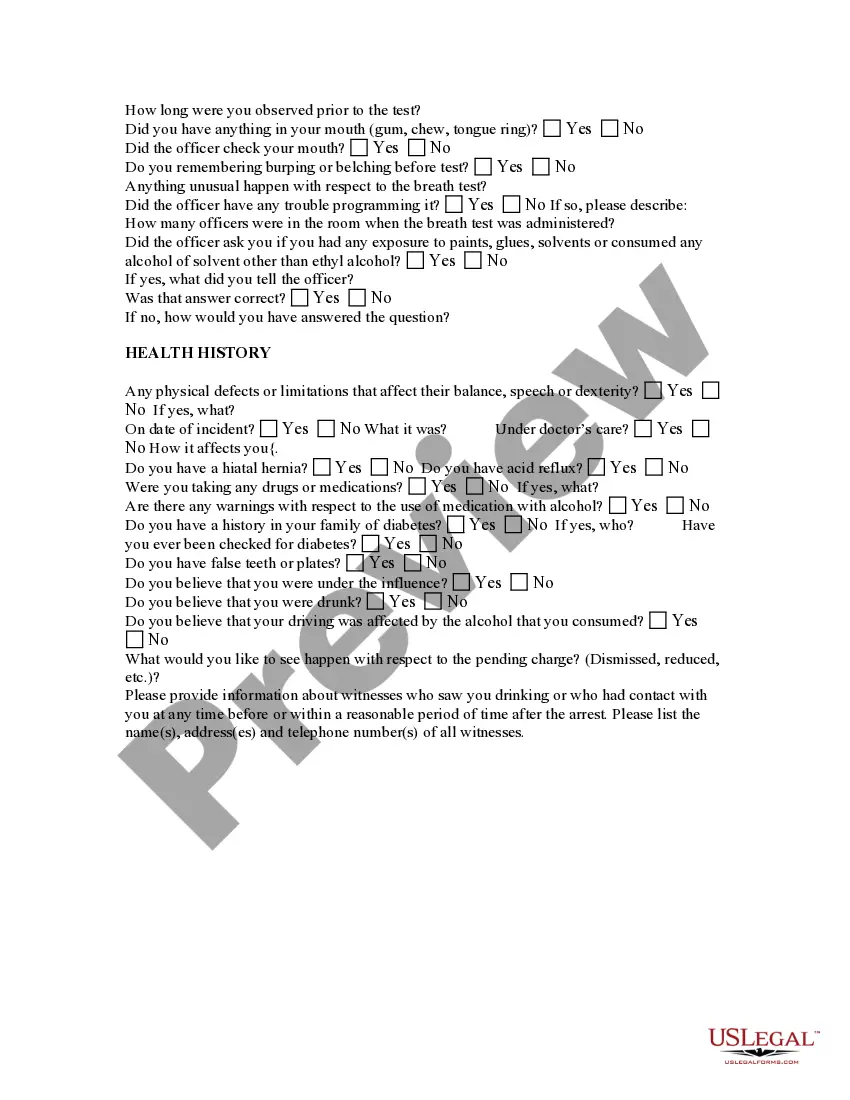

How to fill out Driving Under The Influence - DUI - Questionnaire?

Acquiring legal document examples that comply with federal and state regulations is essential, and the internet provides numerous alternatives to choose from.

However, what is the benefit of spending time hunting for the properly drafted Blood Test For Dui In California sample online if the US Legal Forms digital library already has such templates assembled in one location.

US Legal Forms is the most comprehensive online legal repository with more than 85,000 fillable templates created by lawyers for various professional and personal scenarios. They are easy to navigate, with all documents organized by state and intended use.

Utilize the most expansive and user-friendly legal document service!

- Our experts stay updated with legislative changes, ensuring that your paperwork is always current and compliant when acquiring a Blood Test For Dui In California from our site.

- Obtaining a Blood Test For Dui In California is straightforward and quick for both existing and new users.

- If you already possess an account with a valid subscription, Log In and save the document sample you require in the appropriate format.

- If you are a new visitor to our website, follow the steps outlined below.

- Review the template using the Preview tool or through the text description to ensure it meets your needs.

Form popularity

FAQ

Yes, in California, you can request a blood test instead of taking a breathalyzer. However, the officer must agree to your request, and the situation will generally dictate the available options. If you prefer a blood test for DUI in California, make sure to express your choice clearly to the officer. Doing so may help protect your rights and provide more accurate results.

Most states impose a sales and use taxes of between 3% and 10% on aircraft purchase transactions, but there are exceptions. The tax rate for the use tax in any specific state will be identical to such state's sales tax rate. Sales taxes and use taxes are mutually exclusive.

Tennessee applies a 7% state tax on the total amount of consideration, a local tax on the first $1,600, and a State single article tax rate of 2.75% on the following $1,600.

Notwithstanding other provisions of this chapter, tax imposed with respect to the sale, the use, the consumption, the distribution and the storage of aviation fuel that is actually used in the operation of airplane or aircraft motors, shall be at the rate of four and one-half percent (4.5%).

States typically impose sales and use tax for the sale, purchase, and use of aircraft. However, the amount of imposed sales and use taxes vary from state to state. Each state enforces specific tax laws that aircraft owners must adhere to.

For example, as shown in Table 5-4, Kentucky imposes a 6 percent tax on aircraft parts, while Ohio exempts aircraft parts from sales tax.