Transfer Real Estate Property Form Maine

Description

How to fill out Deed Transfer Questionnaire?

Legal managing might be mind-boggling, even for skilled specialists. When you are looking for a Transfer Real Estate Property Form Maine and don’t get the a chance to devote searching for the correct and up-to-date version, the processes might be nerve-racking. A robust web form catalogue could be a gamechanger for anybody who wants to take care of these situations efficiently. US Legal Forms is a market leader in online legal forms, with more than 85,000 state-specific legal forms available anytime.

With US Legal Forms, you are able to:

- Access state- or county-specific legal and organization forms. US Legal Forms covers any demands you might have, from individual to business papers, all in one spot.

- Make use of advanced resources to complete and handle your Transfer Real Estate Property Form Maine

- Access a useful resource base of articles, instructions and handbooks and materials highly relevant to your situation and needs

Help save time and effort searching for the papers you need, and make use of US Legal Forms’ advanced search and Review tool to discover Transfer Real Estate Property Form Maine and get it. In case you have a monthly subscription, log in for your US Legal Forms account, search for the form, and get it. Review your My Forms tab to see the papers you previously saved as well as to handle your folders as you can see fit.

Should it be the first time with US Legal Forms, make a free account and get unlimited usage of all advantages of the library. Listed below are the steps to take after accessing the form you need:

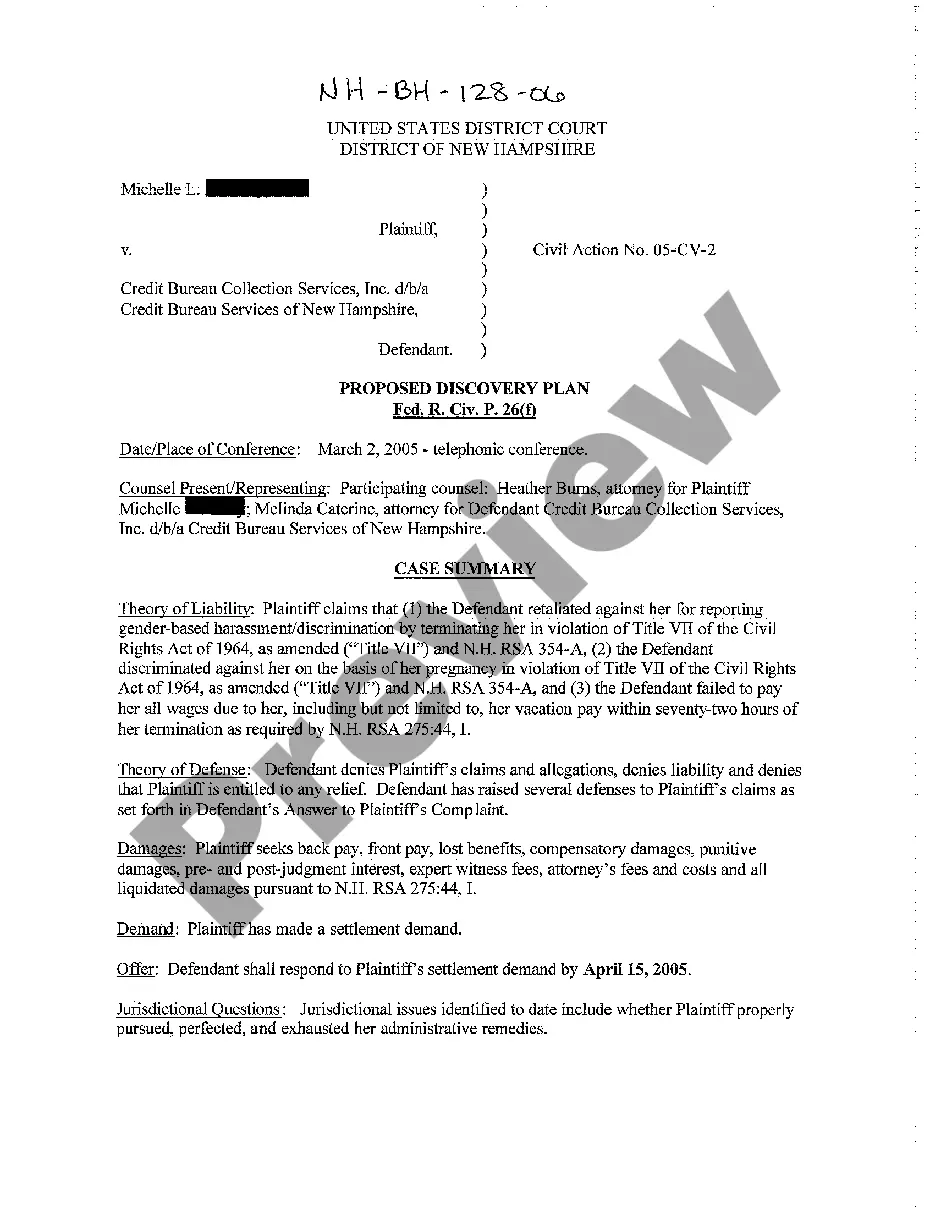

- Confirm it is the right form by previewing it and reading its description.

- Be sure that the sample is recognized in your state or county.

- Choose Buy Now once you are ready.

- Select a monthly subscription plan.

- Find the formatting you need, and Download, complete, eSign, print out and deliver your document.

Benefit from the US Legal Forms web catalogue, backed with 25 years of experience and trustworthiness. Change your day-to-day document management in a smooth and user-friendly process today.

Form popularity

FAQ

The tax is imposed ½ on the grantor, ½ on the grantee. Controlling Interest - A separate Return/Declaration must be filed for each transfer of a controlling interest in the county where real property is located.

A tax of $2.20 per $500 in value (rounded up) imposed upon the sale, granting or transfer of real estate and any interest therein. The transfer tax is equally divided between the buyer and the seller, unless exempt pursuant to Title 36, §4641-C.

Maine deed transfer tax rate The tax rate is $2.20 per $500 or a fractional part of $500 of the property's value being transferred. The tax is levied at 1/2 on the grantor and 1/2 on the grantee.

To be able to record the deed, it must be accompanied by a transfer tax form and payment of transfer tax. Transfer tax rate in Maine is ?$2.20 per $500 or fractional part of $500 of the value of the property being transferred.? Further, transfer tax is imposed 50/50 on both the grantor and grantee.