Form Modification Loan For Car

Description

How to fill out HAMP Loan Modification Package?

Drafting legal paperwork from scratch can often be daunting. Certain scenarios might involve hours of research and hundreds of dollars invested. If you’re searching for an easier and more affordable way of creating Form Modification Loan For Car or any other paperwork without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our online catalog of over 85,000 up-to-date legal documents covers virtually every element of your financial, legal, and personal matters. With just a few clicks, you can instantly get state- and county-compliant templates carefully prepared for you by our legal experts.

Use our website whenever you need a trusted and reliable services through which you can easily locate and download the Form Modification Loan For Car. If you’re not new to our website and have previously created an account with us, simply log in to your account, select the form and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No problem. It takes little to no time to register it and explore the library. But before jumping directly to downloading Form Modification Loan For Car, follow these tips:

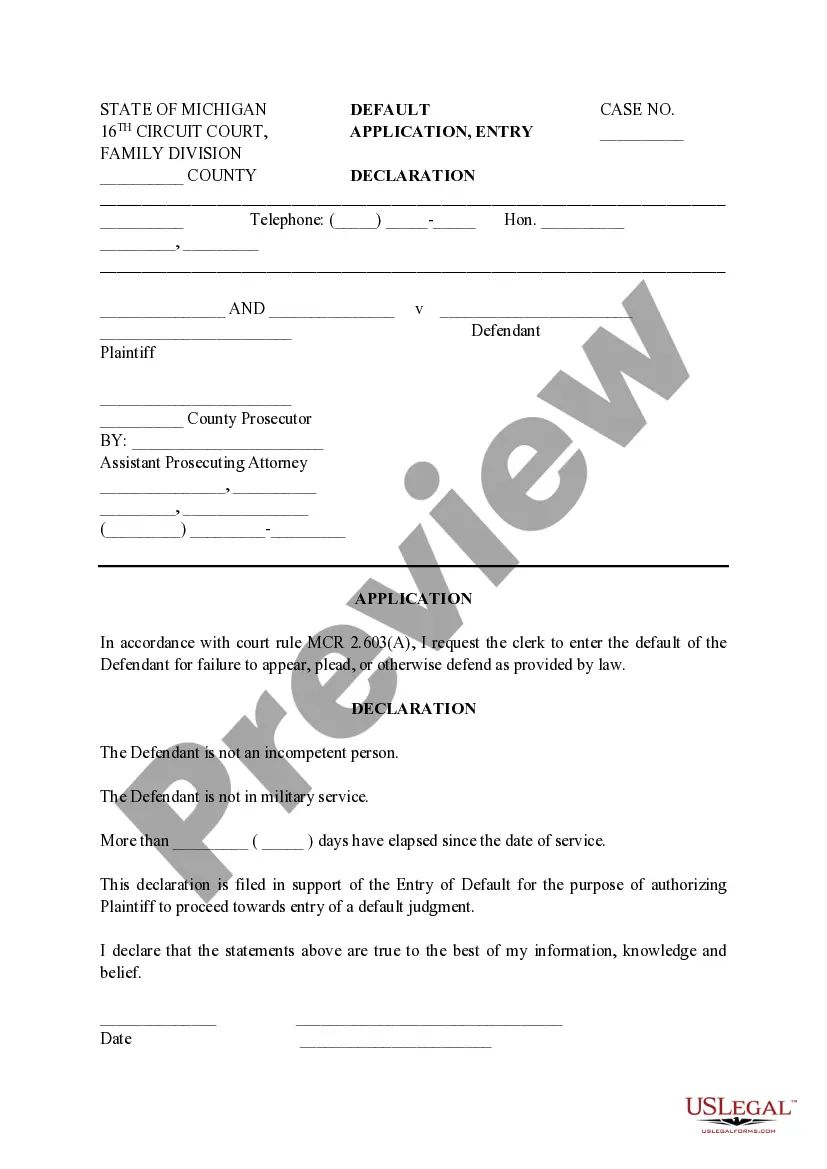

- Review the document preview and descriptions to make sure you are on the the form you are searching for.

- Make sure the form you select complies with the regulations and laws of your state and county.

- Choose the right subscription option to buy the Form Modification Loan For Car.

- Download the file. Then complete, sign, and print it out.

US Legal Forms has a good reputation and over 25 years of expertise. Join us today and transform document execution into something simple and streamlined!

Form popularity

FAQ

How to Get a Mortgage Modification Gather Initial Paperwork. ... Get in Touch With Your Loan Servicer. ... Complete and Submit a Formal Application. ... Complete Trial Payments. ... Await a Final Mortgage Modification Decision.

What car loan modification is. As the name implies, a car loan modification entails changing the terms of your loan. The lender may agree to lower your interest rate, defer your payments in the short term or change your payment due date so it works better for your budget.

How to Get a Mortgage Modification Gather Initial Paperwork. ... Get in Touch With Your Loan Servicer. ... Complete and Submit a Formal Application. ... Complete Trial Payments. ... Await a Final Mortgage Modification Decision.

-The borrower's income was not sufficient to support the modified payment amount. -The borrower had already missed too many payments before applying for the modification. -The property value had declined, making it worth less than the outstanding loan balance.

Modifications may involve extending the number of years you have to repay the loan, reducing your interest rate, and/or forbearing or reducing your principal balance.