Small Business Loan Without Llc

Description

How to fill out Small Business Startup Package For LLC?

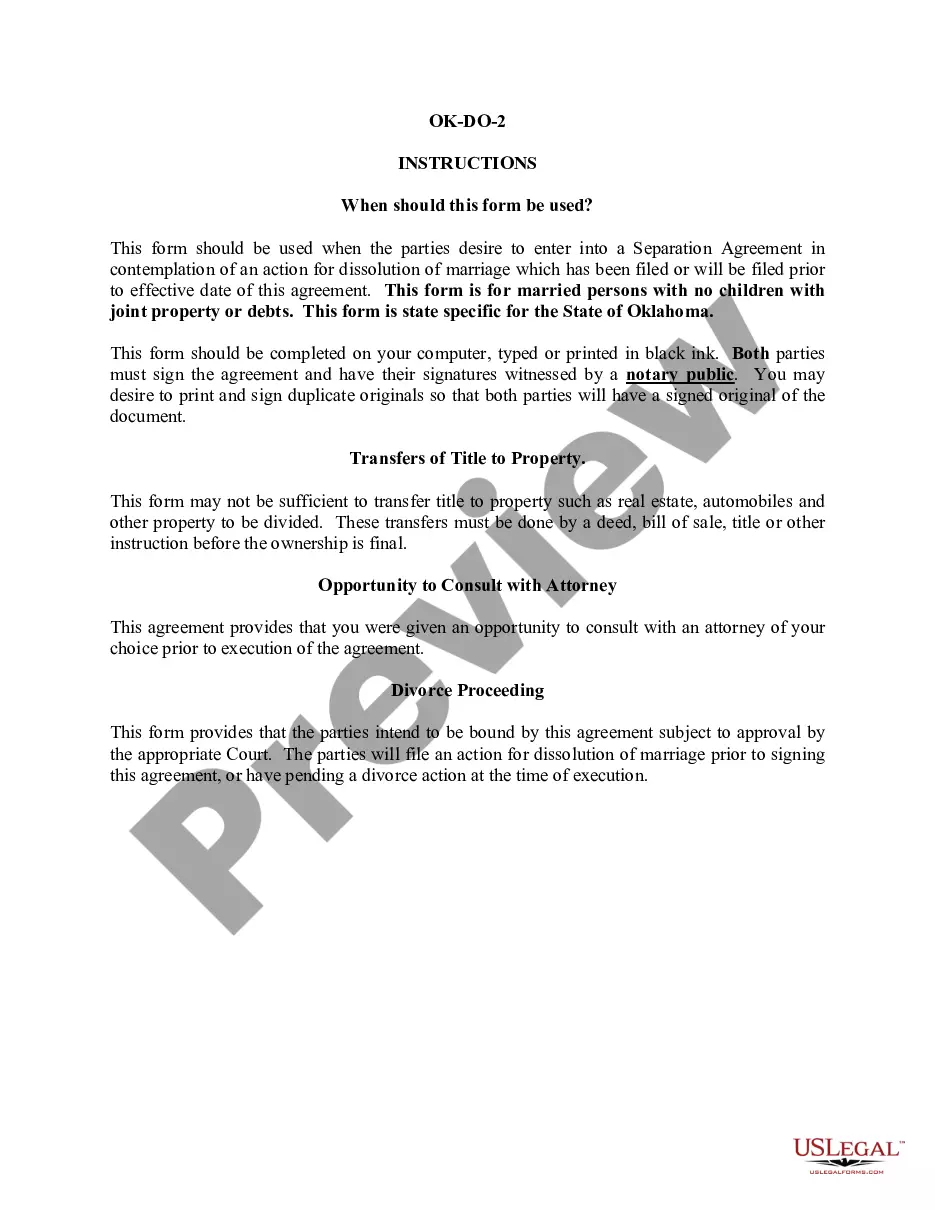

The Small Business Loan Without Llc you see on this page is a reusable formal template drafted by professional lawyers in line with federal and regional laws and regulations. For more than 25 years, US Legal Forms has provided people, companies, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the fastest, simplest and most trustworthy way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Getting this Small Business Loan Without Llc will take you only a few simple steps:

- Look for the document you need and review it. Look through the file you searched and preview it or check the form description to verify it satisfies your requirements. If it does not, use the search option to get the correct one. Click Buy Now once you have located the template you need.

- Sign up and log in. Select the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Obtain the fillable template. Choose the format you want for your Small Business Loan Without Llc (PDF, DOCX, RTF) and save the sample on your device.

- Fill out and sign the document. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork one more time. Use the same document once again anytime needed. Open the My Forms tab in your profile to redownload any earlier saved forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

No-doc business loans are pretty much what they sound like! You don't need to provide any financial statements or documentation to receive financing. Funding is provided based on credit standing and whatever information you provide in your loan application.

You have several options for EIN-only loans: Invoice Factoring. Accounts Receivable Financing. Merchant Cash Advances. Other types of loans.

It is possible to get a startup business loan with no revenue or no money. But if you need to find financing that doesn't depend on cash flow, your best choice may actually be to wait ? if you can afford to. You'll likely qualify for better rates and terms once your business's finances are stronger.

Essential Small Business Loan Requirements Personal/business credit score. Before applying for any loan, review your personal credit score. ... Business plan. ... Bank statement & ratings. ... Balance sheet. ... Business cash flow. ... Collateral or assets.

You can apply for a business loan with your EIN if you're a new business owner without established credit. However, you may also need to include your SSN and details about your personal finances because you'll likely have to provide a personal guarantee.